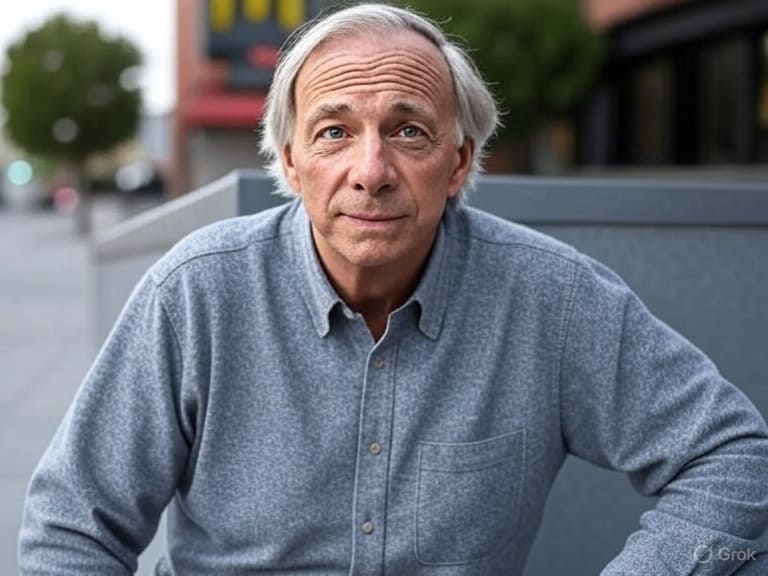

Renowned investor and founder of Bridgewater Associates, the world’s largest hedge fund, Ray Dalio has issued a stark warning about the future of the U.S. dollar amid the nation’s soaring debt levels.

In a detailed post on X, Dalio outlined how the escalating U.S. government debt — now exceeding $35 trillion — is driving a significant reallocation of capital toward gold and cryptocurrencies as viable alternatives to traditional fiat currencies burdened by massive liabilities.

The Dollar’s True Threat: Debt, Not Deregulation

Dalio argues that the primary risk to the dollar’s status as the world’s reserve currency does not stem from deregulation but from the deepening debt crisis affecting the U.S. and other reserve currency nations.

Dalio argues that the primary risk to the dollar’s status as the world’s reserve currency does not stem from deregulation but from the deepening debt crisis affecting the U.S. and other reserve currency nations.

He points out that the unchecked growth of public debt, coupled with rising interest payments — currently around $1 trillion annually —creates a precarious situation. This debt spiral, he suggests, undermines confidence in fiat currencies, pushing investors to seek safer havens.

Gold and Crypto Prices Surge as Alternatives

The rising prices of gold and cryptocurrencies, according to Dalio, are direct responses to this debt-induced vulnerability. With the supply of dollar-denominated debt outpacing demand, investors are turning to assets with limited supply and perceived stability. Gold, a traditional safe-haven asset, is seeing renewed interest, while cryptocurrencies with capped supplies — most notably Bitcoin — are emerging as modern equivalents. Dalio notes that this shift mirrors historical patterns where investors fled depreciating currencies during crisis cycles.

Stablecoins: Limited Risk with Proper Regulation

Addressing the role of stablecoins, Dalio acknowledges that these digital assets do not pose a systemic risk if properly regulated. However, he cautions that the value of the U.S. Treasuries backing many stablecoins is declining due to falling real purchasing power. This dynamic could erode trust in stablecoins over time unless their regulatory frameworks are robust, highlighting a potential weak link in the crypto ecosystem.

Crypto as a Growing Alternative to the Dollar

Dalio emphasizes that cryptocurrencies with limited supply are gradually positioning themselves as realistic alternatives to the dollar. He draws parallels to past economic cycles, such as the 1930s and 1970s, when fiat currencies lost value, and investors migrated to “hard” assets like gold and commodities. Today, he argues, cryptocurrencies are beginning to fulfill a similar role, offering a hedge against inflation and currency devaluation driven by excessive debt.

Also read:

- New Scam Scheme Emerges on Discord

- Venus Protocol User Loses $27M in Phishing Attack

- Will Smith’s Career May Be Derailed by Artificial Intelligence

- AI and Children: The Market is Massive

Historical Context and Future Implications

Reflecting on historical debt crises, Dalio suggests that the current trajectory of U.S. fiscal policy could lead to a “debt-induced economic heart attack” within the next few years, barring significant policy changes. This prediction has fueled discussions in financial circles, with many interpreting his endorsement of crypto and gold as a strategic call to diversify portfolios — potentially allocating up to 15% to Bitcoin and gold, as he has previously advised.

As the founder of Bridgewater Associates, Dalio’s insights carry significant weight, and his latest statements have reignited debates about the long-term viability of the dollar-dominated financial system. With the global economy at a crossroads, the shift toward gold and crypto may signal a transformative phase in how capital is preserved and allocated in an era of unprecedented debt.

Author: Slava Vasipenok

Founder and CEO of QUASA (quasa.io) - Daily insights on Web3, AI, Crypto, and Freelance. Stay updated on finance, technology trends, and creator tools - with sources and real value.

Innovative entrepreneur with over 20 years of experience in IT, fintech, and blockchain. Specializes in decentralized solutions for freelancing, helping to overcome the barriers of traditional finance, especially in developing regions.

This is not financial or investment advice. Always do your own research (DYOR).