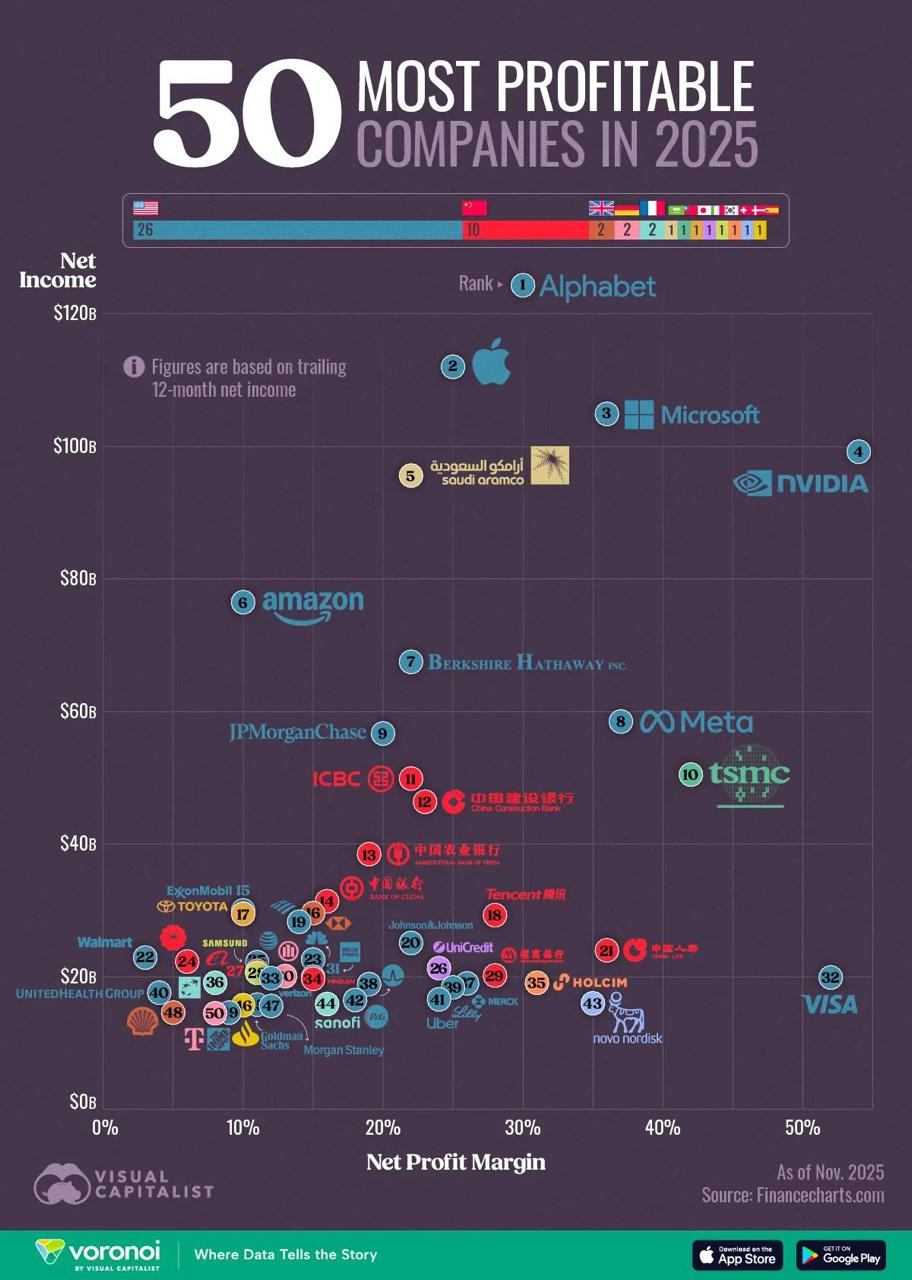

As of November 2025, the global corporate profit landscape remains dominated by a familiar trio: technology, finance, and energy. Data compiled by FinanceCharts.com and visualized by Visual Capitalist reveals the top 50 firms collectively generating hundreds of billions in trailing 12-month net income, underscoring how scale, digital leverage, and commodity cycles concentrate wealth.

Tech's Unassailable Lead

The podium belongs unequivocally to Big Tech:

The podium belongs unequivocally to Big Tech:

- Alphabet** (#1) leads with ~$124 billion in profits, fueled by advertising dominance and cloud growth.

- Apple (#2) and Microsoft (#3) follow closely, benefiting from ecosystem lock-in, services subscriptions, and AI infrastructure demand.

- NVIDIA (#4), Meta (#8), and TSMC (#10) round out the tech heavyweights, with NVIDIA's AI chip boom and Meta's ad recovery driving outsized margins.

These firms exemplify scalability: Low marginal costs for digital products yield profit margins often exceeding 25-40%, far above traditional industries.

Banking's Resilient Profit Machine

Financial services claim a massive chunk of the list, with nine U.S. and European banks plus China's "Big Four" in the top 50:

- JPMorgan Chase (#9), Bank of America, Wells Fargo, and others thrive on net interest margins amid elevated rates.

- China's quartet - ICBC (#11), China Construction Bank (#12), Agricultural Bank of China, and Bank of China - leverage the world's largest deposit base.

- Europeans like HSBC, BNP Paribas, and Santander demonstrate global reach.

Banks' high rankings reflect interest income windfalls post-rate hikes and fee-based businesses.

Energy and Pharma: Margin Kings

Saudi Aramco (#5) stands alone in energy with $95.6 billion in profits, thanks to oil prices and low production costs yielding ~50% margins - the highest on the list.

Pharma shines on innovation premiums:

- Novo Nordisk, Eli Lilly, and Merck ride blockbuster drugs (Ozempic/Wegovy for weight loss, Keytruda for oncology).

- Margins routinely top 30-40%, driven by patent protection.

Broader Trends and Surprises

- U.S. firms claim ~26 spots, China ~10, reflecting market size and policy environments.

- Consumer giants like Walmart, Amazon (retail side), and Toyota appear lower due to thinner margins.

- - Emerging standouts: Visa (#32) on transaction fees, UnitedHealth on healthcare scale.

In a year of AI hype and rate normalization, profits highlight enduring truths: Digital moats, financial leverage, and resource control generate wealth like few others. As 2025 closes, these 50 companies - representing <0.001% of global firms - pocket trillions, shaping economies and markets alike.

Also read:

- Soldiers of Fortune: How U.S. Military Personnel Became a Potent Force in Stock and Crypto Markets

- MetaMask Breaks Barriers: Native Bitcoin Support Arrives, Unifying Crypto's Biggest Ecosystems

- Tether Eyes Up to $20 Billion Raise at $500 Billion Valuation, Explores Share Buybacks and Tokenization for Liquidity

Author: Slava Vasipenok

Founder and CEO of QUASA (quasa.io) - Daily insights on Web3, AI, Crypto, and Freelance. Stay updated on finance, technology trends, and creator tools - with sources and real value.

Innovative entrepreneur with over 20 years of experience in IT, fintech, and blockchain. Specializes in decentralized solutions for freelancing, helping to overcome the barriers of traditional finance, especially in developing regions.

This is not financial or investment advice. Always do your own research (DYOR).