In an increasingly interconnected global economy, international trade serves as the lifeblood for many nations, fueling growth, innovation, and prosperity. However, the degree to which economies rely on cross-border flows varies dramatically, with some thriving on exports and imports while others maintain more self-sufficient models.

A key metric for gauging this dependence is the trade-to-GDP ratio, calculated as the sum of a country's exports and imports of goods and services divided by its gross domestic product (GDP).

A key metric for gauging this dependence is the trade-to-GDP ratio, calculated as the sum of a country's exports and imports of goods and services divided by its gross domestic product (GDP).

This ratio reveals how much an economy's output is intertwined with global markets: a higher percentage signals greater vulnerability to external shocks, such as tariffs or geopolitical tensions, but also highlights opportunities for expansion through international partnerships.

According to recent World Bank data, economies with trade-to-GDP ratios exceeding 100% are particularly exposed, as trade volumes can surpass domestic production. This is common in small, open economies that specialize in logistics, finance, or niche manufacturing.

For instance, ratios above 300% underscore a profound reliance on trade, where disruptions can ripple through supply chains and employment. As global trade policies evolve — exemplified by escalating U.S.-China tensions and recent tariff hikes — these metrics are more critical than ever for policymakers and businesses plotting resilience strategies.

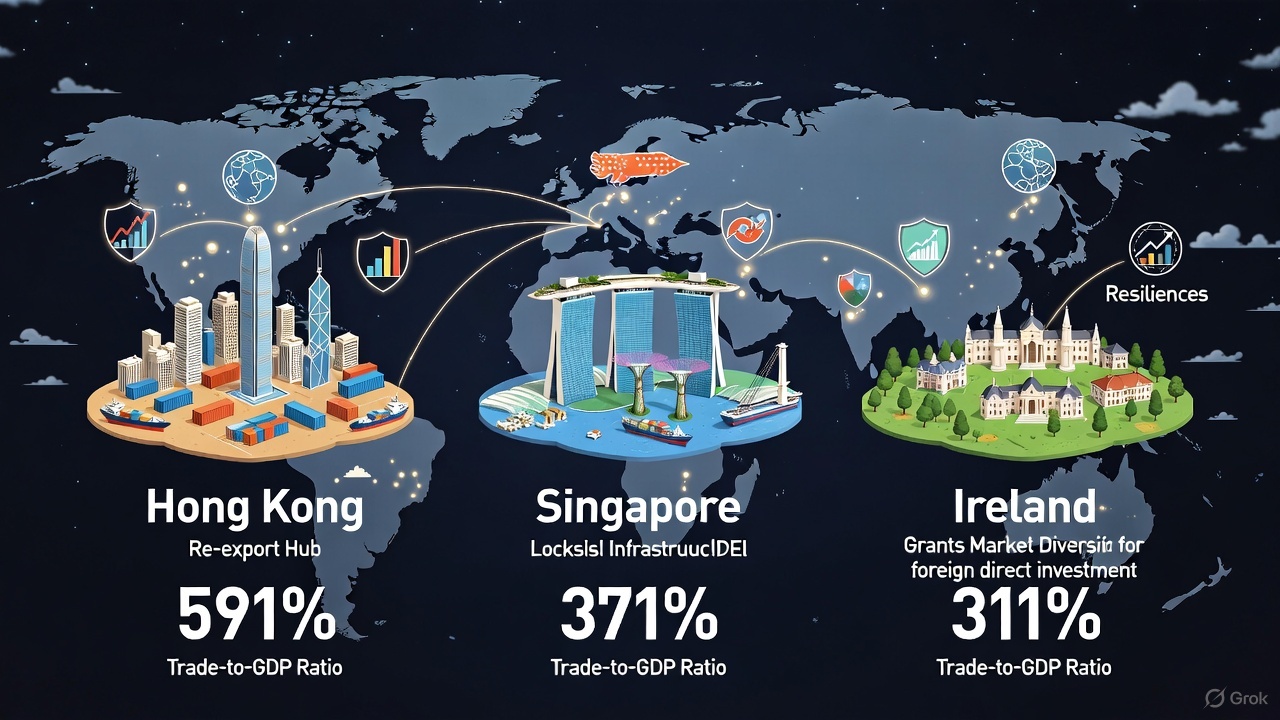

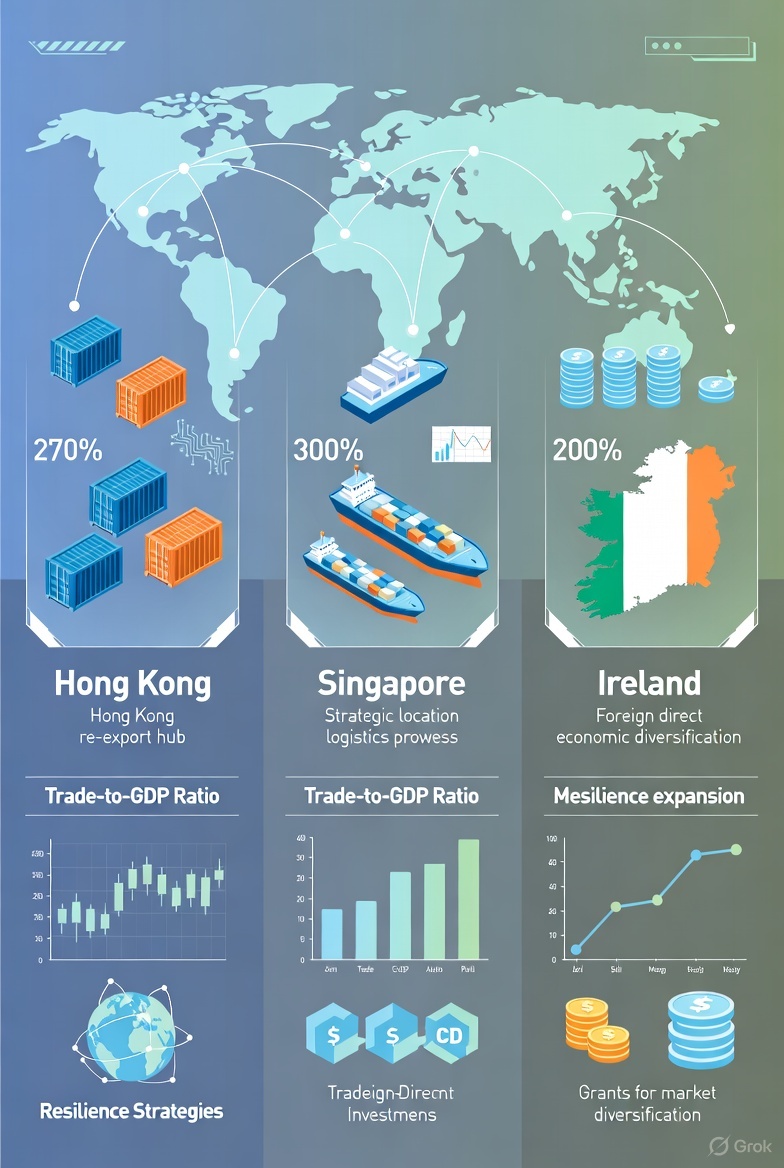

Hong Kong: The Re-Export Powerhouse at Over 350%

At the pinnacle of trade dependence stands Hong Kong, boasting a staggering trade-to-GDP ratio of approximately 355% in 2023, with projections holding steady around 385% for 2022 based on Macrotrends data. This figure means that the value of goods and services flowing through Hong Kong's borders is more than three times its annual GDP, positioning it as a quintessential global trading nexus.

For decades, Hong Kong has functioned as a re-export hub, facilitating the movement of mainland Chinese goods to the world and vice versa. Over 90% of its imports are re-exported, often with value added through logistics, quality checks, or repackaging, underscoring its role as a "super-connector" in Asia's supply chains.

For decades, Hong Kong has functioned as a re-export hub, facilitating the movement of mainland Chinese goods to the world and vice versa. Over 90% of its imports are re-exported, often with value added through logistics, quality checks, or repackaging, underscoring its role as a "super-connector" in Asia's supply chains.

This model has propelled Hong Kong's economy, contributing to a per capita GDP rivaling advanced Western nations. Yet, it also amplifies risks: geopolitical frictions, like U.S. tariffs on Chinese imports renewed in early 2025, directly threaten re-export volumes, as much of Hong Kong's trade originates from or passes through mainland China. Economic swings in major partners, such as slowdowns in Europe or the U.S., can cascade into local unemployment and reduced port activity.

Also read: First Chinese Bank Launches Cryptocurrency Trading in Hong Kong

Singapore: Strategic Location Fuels a 322% Trade Reliance

Close behind Hong Kong is Singapore, with a trade-to-GDP ratio of 322% in 2024, down slightly from 333% in 2022 but still among the world's highest.

Close behind Hong Kong is Singapore, with a trade-to-GDP ratio of 322% in 2024, down slightly from 333% in 2022 but still among the world's highest.

The city-state's ascent as a trade behemoth stems from its prime geographic position at the crossroads of major shipping lanes, coupled with world-class infrastructure and a business-friendly environment.

Singapore's port, the second-busiest globally by cargo tonnage, handles vast transshipment volumes, while its logistics sector — bolstered by free trade agreements with over 20 partners — ensures seamless global connectivity.

Like Hong Kong, Singapore's economy is a re-export engine, with trade accounting for over three times its GDP. This openness has driven consistent growth, but it leaves the nation susceptible to the same external pressures: supply chain disruptions from events like the COVID-19 pandemic or rising protectionism.

In 2023, the ratio dipped by 21.7 percentage points amid global volatility, highlighting the need for adaptive measures.

Navigating Geopolitical Storms: Strategies for Resilience

Given their outsized trade exposure, economies like Hong Kong and Singapore — and others such as Ireland (253% ratio) — face acute challenges from geopolitical shifts and tariff barriers. U.S. policies, including the 15% tariffs on EU goods imposed in 2025, exemplify how protectionism can erode competitiveness overnight, inflating costs and squeezing margins for exporters. To counter this, these hubs are pivoting toward diversification, blending trade agility with domestic innovation to build buffers against uncertainty.

Hong Kong's Shift to High-Value Services and Infrastructure

Hong Kong is actively transitioning from pure re-export reliance to a multifaceted services powerhouse, aiming to leverage its strengths in finance, law, and insurance. This evolution traces back to the 1990s, when manufacturing hollowed out to mainland China, but has accelerated post-2010 with initiatives like the Closer Economic Partnership Arrangement (CEPA), granting tariff-free access for Hong Kong-origin services to the mainland.

Hong Kong is actively transitioning from pure re-export reliance to a multifaceted services powerhouse, aiming to leverage its strengths in finance, law, and insurance. This evolution traces back to the 1990s, when manufacturing hollowed out to mainland China, but has accelerated post-2010 with initiatives like the Closer Economic Partnership Arrangement (CEPA), granting tariff-free access for Hong Kong-origin services to the mainland.

Today, services comprise over 90% of GDP, with fintech and e-commerce startups surging — from 998 in 2014 to over 2,800 by 2018 — focusing on areas like digital payments and blockchain.

Key to this strategy is enhancing non-trade infrastructure. The government is investing heavily in the Hong Kong International Airport's three-runway expansion, set for full operation by 2024, to boost air cargo capacity by 100 million tons annually and solidify its role as an aviation-trade gateway.

Concurrently, policies promote professional services exports, such as legal arbitration and insurance underwriting, while fostering ties with Southeast Asia to diversify beyond China. These moves not only mitigate tariff risks but also position Hong Kong as a "supply chain hub" for regional FDI, with over two-thirds of China's inward and outward investments routing through it.

Ireland's Proactive Grants and Market Diversification

Further afield, Ireland exemplifies European responses to U.S. tariff pressures. With a trade-to-GDP ratio of 253%, the Emerald Isle's export-driven model — dominated by pharmaceuticals, tech, and agri-food — makes it highly sensitive to transatlantic frictions.

Further afield, Ireland exemplifies European responses to U.S. tariff pressures. With a trade-to-GDP ratio of 253%, the Emerald Isle's export-driven model — dominated by pharmaceuticals, tech, and agri-food — makes it highly sensitive to transatlantic frictions.

In August 2025, Enterprise Ireland launched targeted grants to shield its 950 U.S.-exporting clients, of which 450 face significant hits from the 15% duties, totaling €4 billion in affected trade.

The Market Research Grant provides up to €35,000 for firms to analyze tariff impacts, scout market insights, and craft mitigation plans, while the New Markets Validation Grant offers up to €150,000 for exploring entry into Asia-Pacific or other regions.

Backed by a €3.6 billion National Development Plan allocation — including €200 million annually for Enterprise Ireland — these initiatives align with the government's Action Plan on Market Diversification, featuring over 100 actions to target new horizons like India and ASEAN.

Minister Peter Burke emphasized that while tariffs harm consumers on both sides, these supports safeguard jobs and profitability, urging companies to contact advisors for tailored strategies.

Also read:

- The Panacea of the Bush: Russell Crowe on Joe Rogan, The Farm, and Finding Peace

- How AI is Building Super-Television: Infinite Feeds, Human Dreams, and the Echo of Old Habits

- How Gamma Hit a $2.1 Billion Unicorn Valuation by Focusing on Creators

Charting a Balanced Path Forward

The trade-to-GDP ratio illuminates the double-edged sword of globalization: profound opportunities laced with inherent risks. Hong Kong's service-led reinvention and airport upgrades, alongside Singapore's logistical prowess and Ireland's grant-fueled diversification, demonstrate proactive blueprints for resilience.

As tariffs and supply chain "de-risking" intensify — evident in 2025's U.S. policy shifts — these economies are not just weathering storms but reshaping their sails for sustainable voyages. For others eyeing high trade ratios, the lesson is clear: balance openness with agility, investing in people, infrastructure, and new frontiers to turn dependence into durable strength. In this dynamic landscape, adaptation isn't optional—it's the currency of enduring growth.