The honeymoon period for VC-backed startups has officially ended. While early-stage ventures seem to be holding their ground, the "middle class" of the startup world is facing a brutal reckoning.

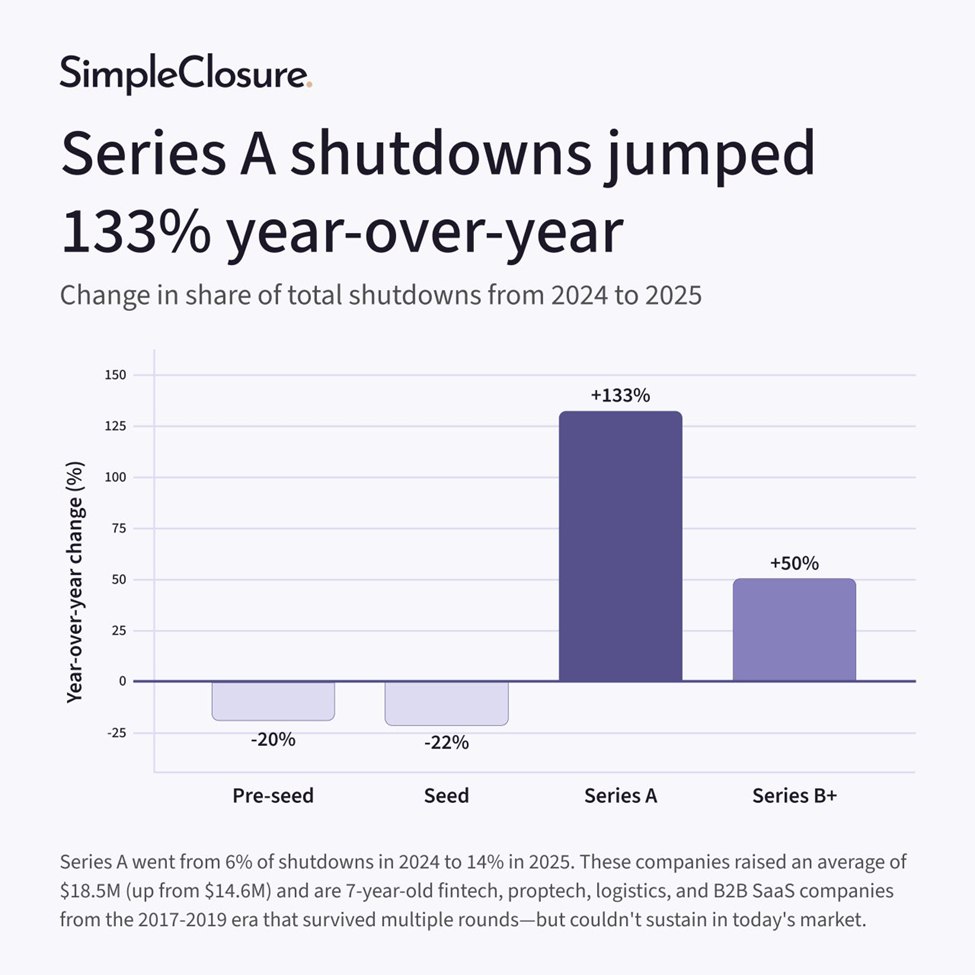

According to new data from SimpleClosure — a platform specializing in the legal and financial dissolution of companies — the share of Series A startups shutting down has surged by a staggering 133% in 2025.

According to new data from SimpleClosure — a platform specializing in the legal and financial dissolution of companies — the share of Series A startups shutting down has surged by a staggering 133% in 2025.

This data offers a sobering counterpoint to the hype surrounding AI and the perceived recovery of the venture market. It suggests that while the "dreaming" stage (Pre-seed and Seed) remains relatively stable, the "execution" stage (Series A) is where reality is hitting the hardest.

The Death of the "Bridge to Nowhere"

The shift in shutdown distribution across funding rounds tells a clear story:

SimpleClosure notes that the share of Series A companies in the total "graveyard" rose from 6% in 2024 to 14% in 2025. These aren't just small experiments; these are companies that raised an average of $18.5 million (up from $14.6M the previous year) and have been operating for an average of seven years.

Many of these failing companies were launched between 2017 and 2019. They survived the pandemic and the 2022 market cooling by raising multiple bridge rounds, but in 2025, the "bridge to nowhere" has finally run out of tarmac.

Why Series A is the New "Danger Zone"

The "Series A Crunch" is driven by three primary factors:

The "Series A Crunch" is driven by three primary factors:

- The "ZIRP" Hangover: Companies that raised easily during the Zero Interest Rate Policy (ZIRP) era are now being judged by 2025 metrics — profitability, efficient unit economics, and high growth — which many simply cannot meet.

- Market Consolidation: Sectors like Fintech, Proptech, and B2B SaaS are oversaturated. With AI disrupting traditional software models, older SaaS companies are finding their "moats" evaporated overnight.

- The Capital Bar: Investors are no longer throwing good money after bad. A Series A company with a $15M burn and flat growth is no longer a "potential winner"; it's a liability.

5 Fast Facts: The 2025 Startup Reckoning

- The 7-Year Itch: The average age of a closing Series A company in 2025 is 7 years, meaning they are "Zombie Startups" that finally accepted they cannot reach the Series B milestone.

- Raising More to Fail Harder: The average capital raised by closing startups increased to $18.5M, indicating that founders are burning more cash in a desperate attempt to pivot before finally shutting down.

- Seed Stage Resilience: Pre-seed and Seed closures have actually decreased in share. This is likely because these startups are leaner, have lower burn rates, and are often building with "AI-native" efficiency from day one.

- B2B SaaS Fatigue: B2B SaaS represents the largest category of closures. The "death by a thousand subscriptions" in corporate budgets has led to massive churn for non-essential software.

- The "Clean-Up" Industry: SimpleClosure itself is a sign of the times. The business of "shutting down startups" is one of the few growth sectors in the current ecosystem, as founders look for professional ways to wind down without legal repercussions.

Analysis: A Healthy Pruning?

While a 133% increase in closures sounds catastrophic, many economists view this as a "healthy pruning" of the ecosystem. The capital that was trapped in underperforming 2018-era Fintechs is now being freed up — along with the talent — to move toward the next wave of technological innovation.

While a 133% increase in closures sounds catastrophic, many economists view this as a "healthy pruning" of the ecosystem. The capital that was trapped in underperforming 2018-era Fintechs is now being freed up — along with the talent — to move toward the next wave of technological innovation.

However, for founders and employees in that "Series A middle," 2025 remains the most challenging year in a decade.

Also read:

- The AI Tectonic Shift: Gavin Baker on Why OpenAI Lost the Lead to Google and xAI

- Beyond the Bento: How China’s High-Speed Rail Is Redefining Fast Food Delivery

- TikTok's Bold US Pivot: The Planned 'M2' App and the Massive User Migration Challenge

Author: Slava Vasipenok

Founder and CEO of QUASA (quasa.io) - Daily insights on Web3, AI, Crypto, and Freelance. Stay updated on finance, technology trends, and creator tools - with sources and real value.

Innovative entrepreneur with over 20 years of experience in IT, fintech, and blockchain. Specializes in decentralized solutions for freelancing, helping to overcome the barriers of traditional finance, especially in developing regions.