When a company is added to the S&P 500, its stock price often experiences a sharp increase—a phenomenon known as the "S&P 500 inclusion effect." The reason is straightforward: index-tracking funds, managing approximately $13 trillion in assets, are obligated to buy shares of newly included companies to align with the index. Recent examples highlight this trend vividly — Block’s stock jumped 10%, and Datadog’s rose 15% following news of their inclusion.

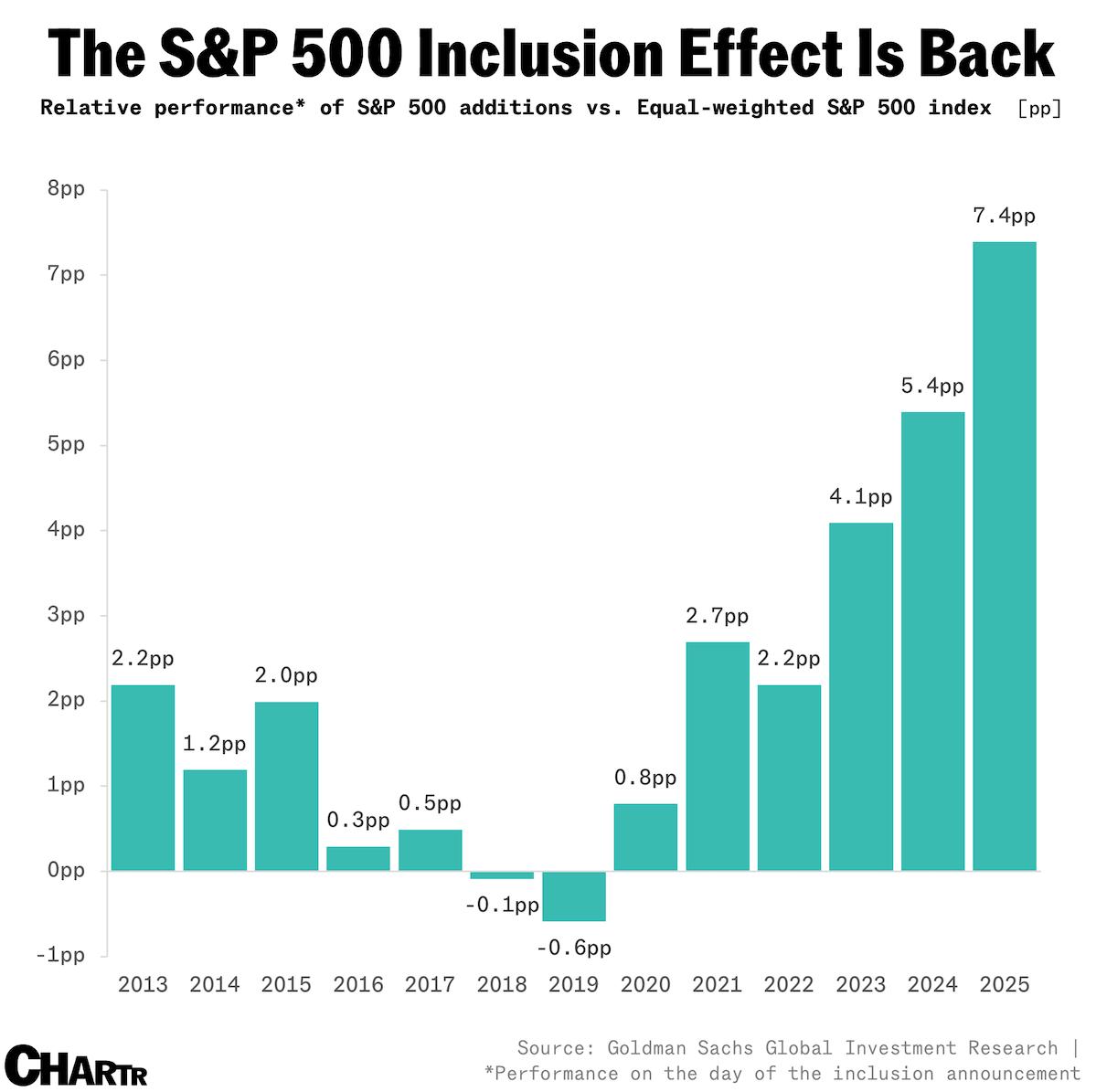

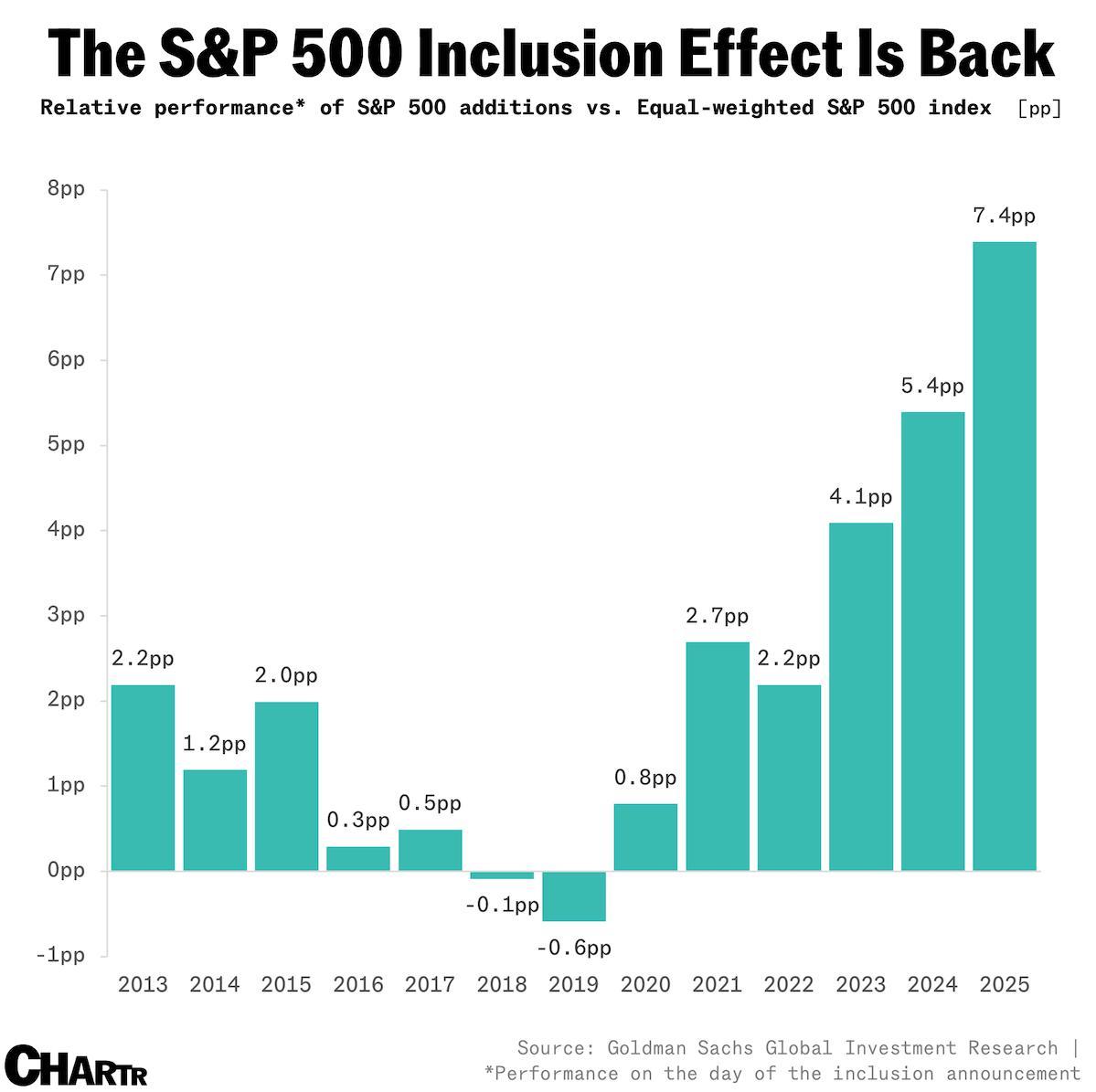

Historically, this effect has fluctuated. In the 1990s, stocks saw an average gain of around 9% on the announcement day, reflecting strong market enthusiasm. However, this impact waned in the 2010s, with gains dropping to a modest 0.8% on average.

Historically, this effect has fluctuated. In the 1990s, stocks saw an average gain of around 9% on the announcement day, reflecting strong market enthusiasm. However, this impact waned in the 2010s, with gains dropping to a modest 0.8% on average.

Yet, recent data suggests the effect is making a robust comeback.

According to Goldman Sachs, since 2021, newly added S&P 500 stocks have outperformed the market by an average of 4 percentage points on the announcement day, with nearly three-quarters beating the index.

So, what’s driving this resurgence? One key factor is the source of new inclusions. Unlike past trends where many companies graduated from the S&P MidCap 400, today’s additions increasingly come from outside this midcap index. Stocks entering directly from outside have averaged relative gains of 5.3 percentage points since 2013, while those transitioning from the midcap index have seen negligible or even negative returns (-0.4 percentage points). This shift reduces predictability, making it harder for traders and funds to "front-run" the move, thus amplifying the surprise effect.

Another contributor is the nature of the companies being added. Recent entrants like Coinbase, Palantir, and Super Micro Computer are already popular with retail investors, often tied to trendy sectors like cryptocurrency and artificial intelligence. This pre-existing buzz fuels additional demand when inclusion is announced, boosting price surges beyond what might be expected from institutional buying alone.

Another contributor is the nature of the companies being added. Recent entrants like Coinbase, Palantir, and Super Micro Computer are already popular with retail investors, often tied to trendy sectors like cryptocurrency and artificial intelligence. This pre-existing buzz fuels additional demand when inclusion is announced, boosting price surges beyond what might be expected from institutional buying alone.

Also read:

- The Mighty Are Changing Their Tune: A Shift on Bitcoin

- ChatGPT Agent Masters Cloudflare Protection: Screenshots Reveal Human-Like Behavior

- Streaming Catastrophe in India: 25 Platforms Blocked Overnight

While the inclusion effect offers a short-term windfall, its long-term impact remains debated.

The immediate price jump is largely driven by mechanical buying from index funds, but sustained growth depends on a company’s fundamentals.

Still, the renewed vigor of the S&P 500 inclusion effect signals a market increasingly responsive to new, high-profile players — making it a critical factor for investors to watch.

Author: Slava Vasipenok

Founder and CEO of QUASA (quasa.io) - Daily insights on Web3, AI, Crypto, and Freelance. Stay updated on finance, technology trends, and creator tools - with sources and real value.

Innovative entrepreneur with over 20 years of experience in IT, fintech, and blockchain. Specializes in decentralized solutions for freelancing, helping to overcome the barriers of traditional finance, especially in developing regions.

This is not financial or investment advice. Always do your own research (DYOR).