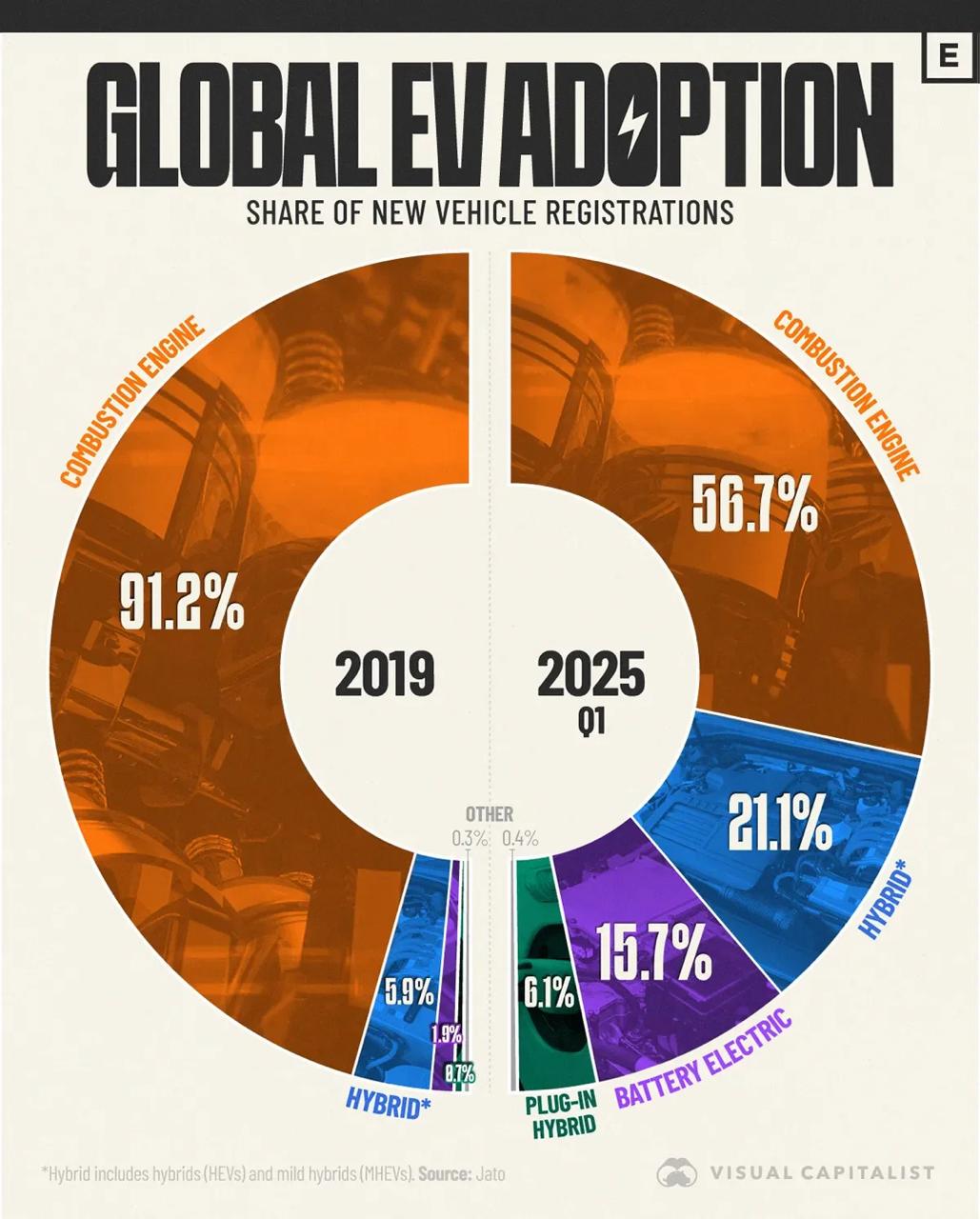

By the first quarter of 2025, electric vehicles (EVs), including hybrids, have captured an impressive 43% of the global automotive market—a dramatic leap from just 9% in 2019.

This rapid rise signals a transformative shift in the industry, driven by technological advancements, environmental concerns, and shifting consumer preferences. Over the past six years, traditional gasoline engines have lost 34.4 percentage points of market share, underscoring the accelerating transition to electrified transportation.

Regional Dominance in EV Production

China leads the charge in pure electric vehicle production, accounting for 57% of all global registrations. The country’s aggressive investment in EV infrastructure and manufacturing has solidified its position as a global powerhouse.

China leads the charge in pure electric vehicle production, accounting for 57% of all global registrations. The country’s aggressive investment in EV infrastructure and manufacturing has solidified its position as a global powerhouse.

Europe follows with 22% of registrations, bolstered by stringent emissions regulations and growing consumer demand. The United States trails with 12%, while the rest of the world lags significantly, contributing less than 2% to the total.

This concentration highlights the uneven global adoption of EVs, with major markets setting the pace while others struggle to keep up.

Price Dynamics Across Borders

Price differences between EVs and gasoline cars vary widely, reflecting diverse market strategies and economic conditions.

Price differences between EVs and gasoline cars vary widely, reflecting diverse market strategies and economic conditions.

In China, the gap has narrowed by 15% over six years, with EVs now often cheaper than their gasoline counterparts — a trend fueled by government subsidies and the widespread use of cost-effective lithium iron phosphate (LFP) batteries.

In contrast, Germany has seen both EV and gasoline car prices rise by 21%, maintaining the same price differential. In the United States, EVs were 44% more expensive than gasoline cars in 2019 — the highest premium globally — but this gap has decreased to 31% by 2025, driven by improved production scales and incentives.

Strategic Approaches

The varying price trends reflect distinct regional strategies. China’s reliance on affordable LFP batteries has lowered costs and made EVs accessible to a broader market, aligning with its mass-production model. Meanwhile, the United States and Europe prioritize range and fast-charging capabilities, catering to consumers who value long-distance travel and convenience. This divergence suggests that while China focuses on affordability and volume, Western markets are betting on performance and infrastructure to drive adoption.

Also read:

- ChatGPT Agent Masters Cloudflare Protection: Screenshots Reveal Human-Like Behavior

- The Mighty Are Changing Their Tune: A Shift on Bitcoin

- PayPal to Launch Crypto Payment Service for U.S. Businesses

The Bigger Picture

The 43% market share milestone in Q1 2025 is a testament to the EV revolution, but it also raises questions about sustainability and equity. China’s dominance could widen the technological gap with other regions, while the focus on range and charging in the U.S. and Europe may exclude lower-income buyers. As gasoline engines continue to lose ground, the industry’s future hinges on balancing innovation, affordability, and global accessibility—a challenge that will shape the automotive landscape for decades to come.

Author: Slava Vasipenok

Founder and CEO of QUASA (quasa.io) - Daily insights on Web3, AI, Crypto, and Freelance. Stay updated on finance, technology trends, and creator tools - with sources and real value.

Innovative entrepreneur with over 20 years of experience in IT, fintech, and blockchain. Specializes in decentralized solutions for freelancing, helping to overcome the barriers of traditional finance, especially in developing regions.

This is not financial or investment advice. Always do your own research (DYOR).