The future of the global economy is being etched in silicon, and the map is being redrawn faster than anyone predicted just five years ago.

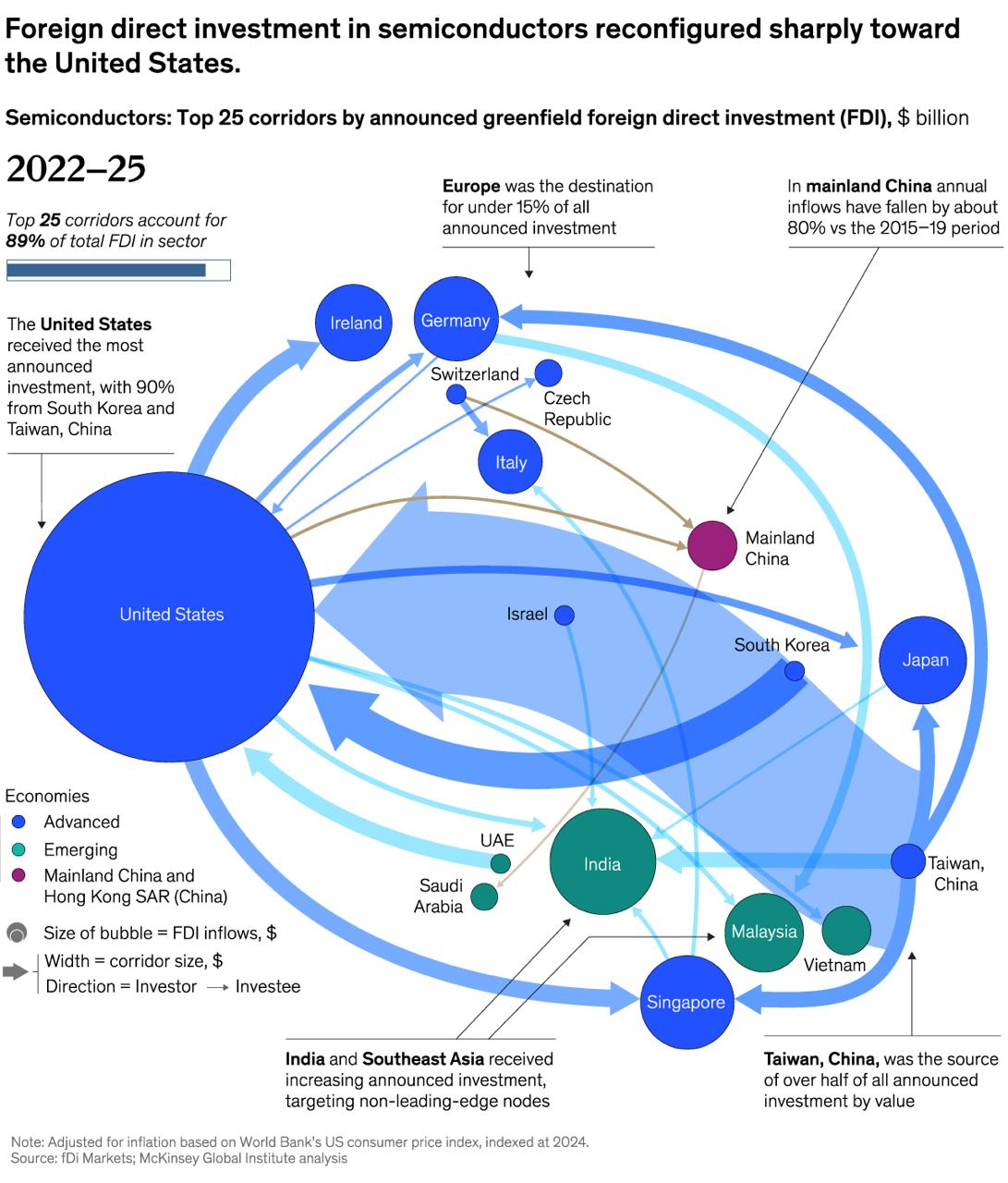

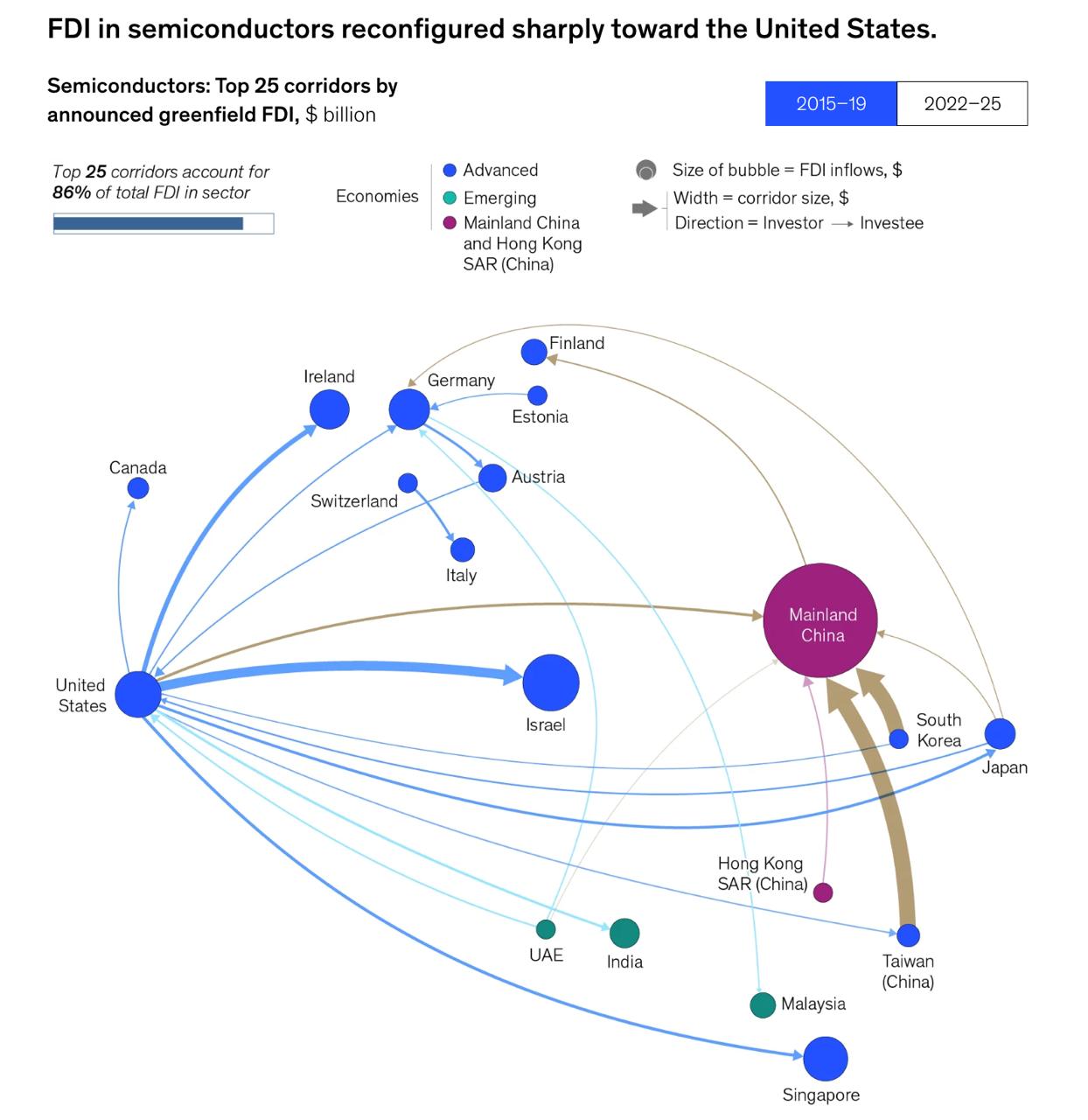

Two new visualizations from the McKinsey Global Institute and fDi Markets tell the story with brutal clarity: between 2022 and 2025, announced greenfield foreign direct investment (FDI) into the semiconductor industry has undergone a historic pivot. Money that once flowed overwhelmingly into mainland China and the Taiwan – South Korea axis is now rushing toward the United States and, to a lesser extent, Europe and Japan. The result is nothing less than the most rapid reconfiguration of a critical industry in modern history.

The United States Becomes the New Magnet

In the 2015–2019 period, the United States was just one of many destinations. By 2022–2025, it has become the undisputed center of gravity.

In the 2015–2019 period, the United States was just one of many destinations. By 2022–2025, it has become the undisputed center of gravity.

The U.S. captured the lion’s share of the top 25 FDI corridors, with roughly 90 % of announced investment coming from South Korea, Taiwan, Japan, Germany, and Israel — exactly the countries that possess leading-edge process technology.

Key projects driving this tsunami:

- TSMC’s $65 billion complex in Arizona (three fabs, with the first 4 nm production already online in 2025 and 2 nm slated for 2028–2029);

- Samsung’s $37 billion expansion in Taylor, Texas (including an upcoming 2 nm-capable line);

- Intel’s own $100+ billion U.S. megasite investments (Ohio, Arizona, New Mexico), partially funded by the CHIPS Act but amplified by joint-venture deals with Brookfield and Apollo;

- GlobalFoundries–GM strategic partnership in New York for automotive-grade chips;

- - Micron’s $100 billion “megafab” in Clay, New York — the largest single private investment in state history.

Taken together, these and dozens of smaller projects mean that the United States is on track to triple its share of global advanced logic capacity from ~0 % in 2022 (below 10 nm) to an estimated 28–30 % by 2032, according to SIA-BCG projections updated in September 2025. That would make America the second-largest producer of leading-edge chips after Taiwan — a position no analyst considered realistic even three years ago.

Europe: Steady but Modest Gains

Europe attracted only about 15 % of the new wave of announced FDI, concentrated in Germany (Infineon, Bosch, GlobalFoundries Dresden expansion), Ireland (Intel Leixlip), and Italy (ST-Ericsson–GlobalFoundries Agrate).

While the EU Chips Act has unlocked €43 billion in public and private money, most European projects remain domestic rather than foreign-driven, limiting the scale compared with the U.S.

China: An 80 % Collapse in Inbound FDI

The most dramatic shift is the near-total evaporation of foreign semiconductor investment into mainland China. Announced greenfield FDI for 2022–2025 is running at barely 20 % of the 2015–2019 average — an 80 % drop in dollar terms.

The most dramatic shift is the near-total evaporation of foreign semiconductor investment into mainland China. Announced greenfield FDI for 2022–2025 is running at barely 20 % of the 2015–2019 average — an 80 % drop in dollar terms.

This is not just about export controls. Companies are proactively “de-risking”:

- Applied Materials, Lam Research, and KLA have essentially halted new fab investments in China;

- Even Chinese firms are building new leading-edge capacity outside the mainland when possible (e.g., SMIC’s majority-owned fab in Italy via the STMicro joint venture).

The result: China’s share of global capacity above 10 nm is now expected to peak in 2026–2027 and then decline in relative terms as the U.S., Europe, Japan, and Southeast Asia surge ahead.

The Emerging “Friend-Shoring” Belt

A new arc is forming: Singapore → Malaysia → Vietnam → India → UAE → Saudi Arabia. These locations are receiving smaller but strategically important packaging, testing, and substrate investments (Amkor, ASE, Intel, Qualcomm, and Infineon all have major projects). While they will not produce 2 nm logic anytime soon, they are becoming indispensable nodes in the back-end supply chain.

Also read:

- Crypto's Hidden Liquidity Trap: Tom Lee's Bombshell on Market Makers and the Bitcoin Bloodbath

- China’s AI Startups Cut the Dollar Cord: From Silicon Valley Money to State Guidance

- Taiwan Firmly Rejects U.S. '50-50' Proposal for Semiconductor Production Split

- What Does An HR Manager Do?: A Guide

What This Means by 2030

McKinsey’s latest scenario (November 2025) now forecasts:

- U.S. + Europe + Japan combined share of global installed capacity: from 10 % in 2022 → 31–34 % by 2030;

- More than half of that increase is directly attributable to cross-border FDI;

- Taiwan remains #1 in absolute leading-edge output, but its share falls from ~65 % (sub-5 nm) today to ~45 % by 2032;

- Mainland China’s share of sub-10 nm capacity plateaus and begins shrinking after 2029.

In short, the world is no longer betting everything on a single island in the Taiwan Strait. The semiconductor industry is becoming genuinely multipolar for the first time since the 1980s — and foreign direct investment, turbocharged by government incentives and geopolitical reality, is the engine making it happen.

The silicon curtain is descending, but behind it the West and its closest allies are building what may soon be the most resilient chip-making ecosystem the world has ever seen.