The QUASA Rewards program is a reward mechanism that incentivizes user interaction with the Quasa partner ecosystem by offering QUA (Quasacoins) tokens for completing simple tasks (quests).

Here is the revised analysis of the program, incorporating the crucial information about the utility and liquidity of the QUA token.

The Essence and Mechanics of QUASA Rewards

The program operates on a "Play and Earn" model, where users complete quests from partners (mainly in the fields of AI, the Creator Economy, and Web3) and receive QUA tokens for their activity.

Prospects and the Financial Value of QUA

The QUASA Rewards program exhibits high potential, which is significantly enhanced by the financial model of the QUA token.

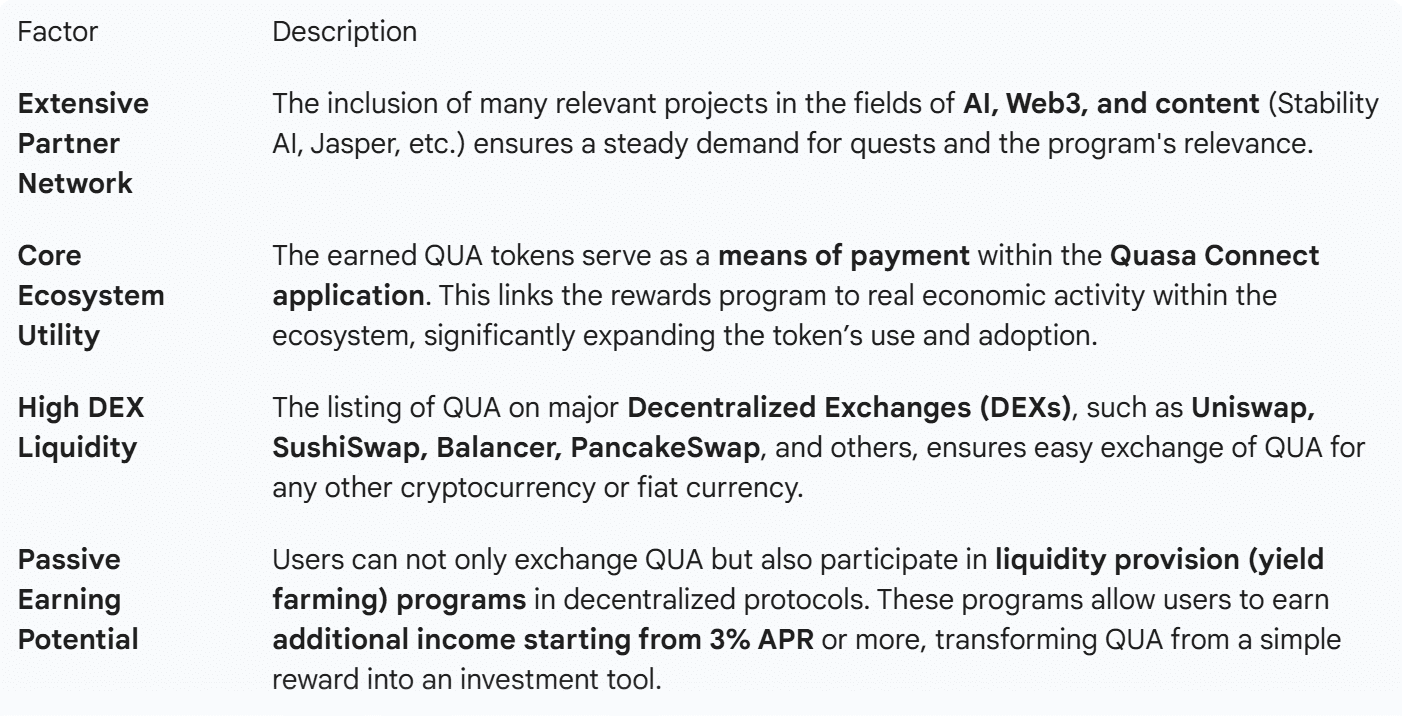

Positive Factors (Strengths)

Challenges and Risks

- QUA Token Volatility: The program's attractiveness to users remains dependent on the market value of QUA, which, like any cryptocurrency, can be volatile.

- Quality of Engagement: The risk of perfunctory task completion for the sake of the reward persists but is mitigated by the expanded utility of QUA.

Overall Conclusion

The QUASA Rewards program has exceptionally favorable prospects and moves beyond being just a marketing tool.

The QUASA Rewards program has exceptionally favorable prospects and moves beyond being just a marketing tool.

The integration with current sectors (AI, Creator Economy) combined with the fundamental economic model of QUA creates a powerful incentive for users:

- QUA as a Payment Method (Utility): The token has practical value within Quasa Connect.

- QUA as an Earning Asset (Investment Value): Liquidity on leading DEXs and the option for staking/farming at interest (starting from 3% APR) allow users not just to cash out their reward, but to use it as a tool for passive income.

Thus, the program not only attracts new users to the ecosystem but also encourages them to hold the token for use and investment, which is a critical factor for the long-term stability and growth of the project.

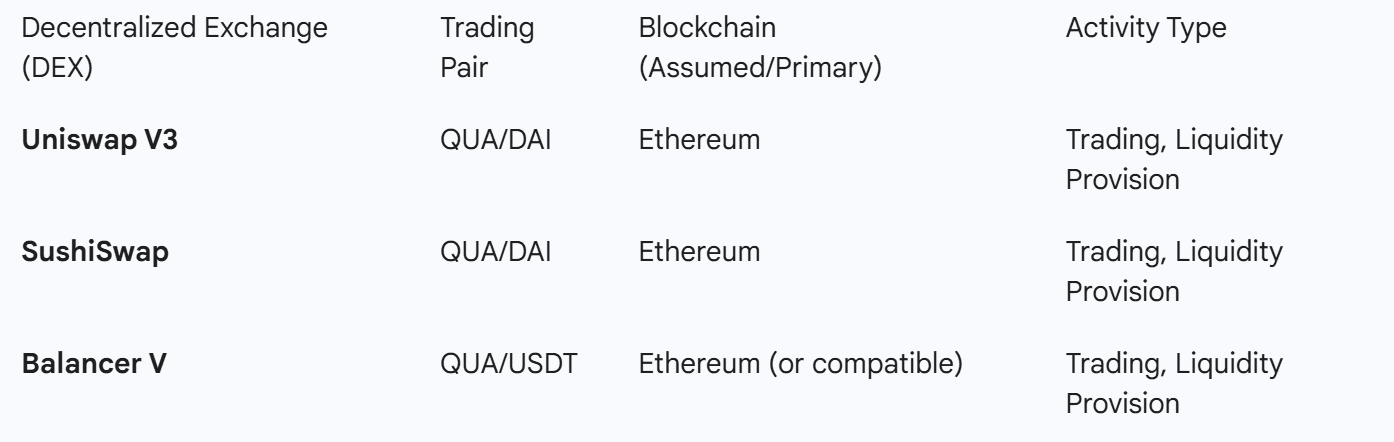

Based on current data, QUA (Quasacoin) is indeed actively traded on a number of the largest Decentralized Exchanges (DEXs).

Main Decentralized Exchanges (DEXs) and QUA Trading Pairs

The QUA token is primarily traded in pairs with stablecoins (DAI, USDT) on the Ethereum blockchain, ensuring liquidity and simplifying transactions.

Additional Liquidity Platforms

It is also confirmed that QUA is available on other well-known decentralized protocols that support exchange and liquidity mechanisms:

It is also confirmed that QUA is available on other well-known decentralized protocols that support exchange and liquidity mechanisms:

- DODO

- Curve

- ShibaSwap

- SmarDex

- Maverick Protocol

The Prospect of Earning via Liquidity (Yield Farming)

The presence of QUA in liquidity pools on platforms like Uniswap, SushiSwap, and Balancer directly supports your point about passive earning potential:

The presence of QUA in liquidity pools on platforms like Uniswap, SushiSwap, and Balancer directly supports your point about passive earning potential:

- Liquidity Provision (LP): Users can deposit an equal value of QUA and the second token (e.g., DAI or USDT) into a pool.

- Income: In return, they receive LP tokens, which entitle them to a share of the fees charged for every trade within that pair (the source of income - "starting from 3%").

- Expanded Adoption: This creates a strong incentive for the long-term holding of the QUA token, as it becomes an investment asset, not just a means of payment. This is a critical factor for the stability of its value.

In summary, QUA Rewards not only allows users to earn QUA for activity but also integrates those earnings into the broad and deep DeFi financial market, significantly increasing the token's attractiveness and economic value.

Author: Slava Vasipenok

Founder and CEO of QUASA (quasa.io) — the world's first remote work platform with payments in cryptocurrency.

Innovative entrepreneur with over 20 years of experience in IT, fintech, and blockchain. Specializes in decentralized solutions for freelancing, helping to overcome the barriers of traditional finance, especially in developing regions.

This is not financial or investment advice. Always do your own research (DYOR).