In an era dominated by streaming services like Spotify and Apple Music, where listeners can access millions of songs for a monthly fee, the concept of buying digital music might seem like a relic from the early 2000s. Yet, digital music sales, primarily through Apple's iTunes Store, continue to hold a surprising significance in the music industry.

Despite a sharp decline in revenue, these sales remain a key metric for record labels, influencing everything from chart rankings to artist strategies. This article explores the current state of digital music sales, their monopoly-like grip by Apple, and why they still matter in a streaming-saturated market.

Apple's Monopoly in a Shrinking Market

Apple's iTunes Store has long been the de facto monopolist in digital music sales. Launched in 2003, it revolutionized how people purchased music, shifting from physical CDs to downloadable tracks and albums.

Apple's iTunes Store has long been the de facto monopolist in digital music sales. Launched in 2003, it revolutionized how people purchased music, shifting from physical CDs to downloadable tracks and albums.

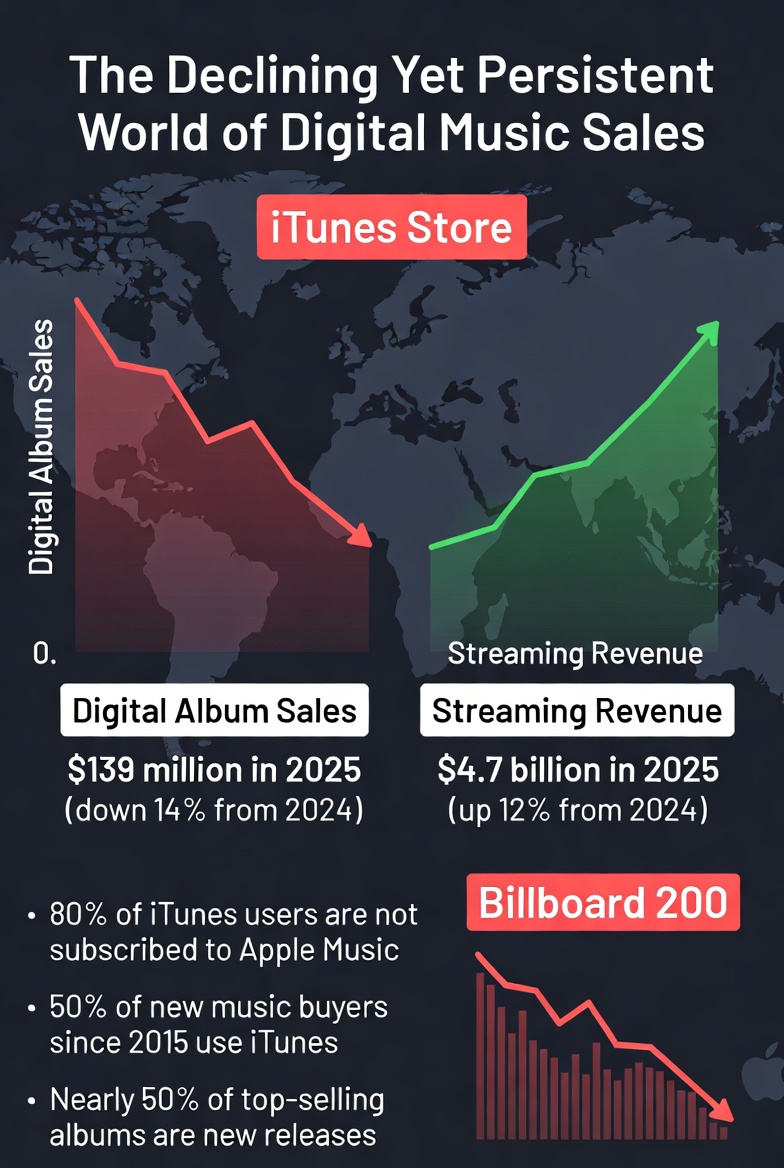

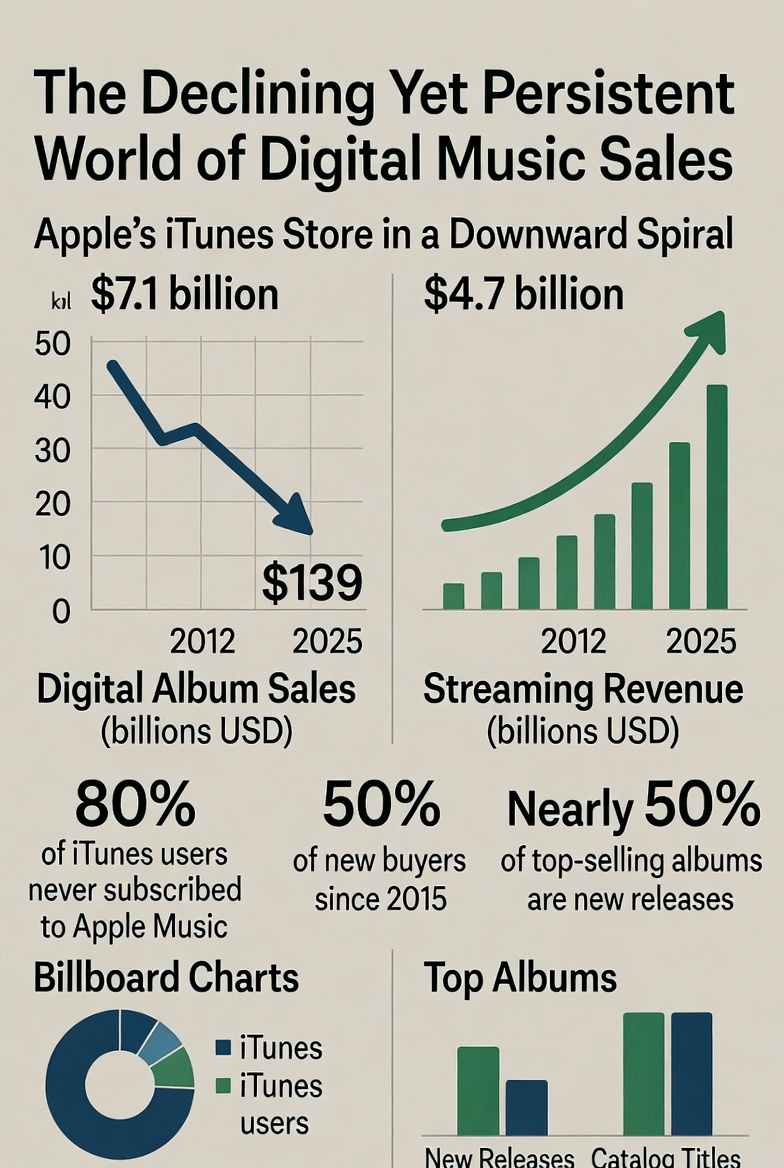

However, this segment of the market is in a perpetual downward spiral. In the first half of 2025, digital album sales plummeted by 14%, generating a mere $139 million in revenue.

This figure pales in comparison to the booming streaming industry, which raked in $4.7 billion during the same period — a colossal gap that underscores the shift in consumer preferences.

The decline isn't surprising. Streaming offers unlimited access, personalized playlists, and seamless integration across devices, making outright purchases less appealing for most users.

Why buy an album when you can stream it indefinitely for the cost of a coffee? Yet, despite the downturn, iTunes persists as a vital channel, particularly for certain demographics and industry insiders.

The Billboard Factor: Why Labels Still Care

One of the primary reasons record labels cling to digital sales is their outsized impact on Billboard charts, the music industry's gold standard for measuring popularity. In Billboard's methodology, a single digital album sale through iTunes carries far more weight than streams. Specifically, one direct sale is equivalent to approximately 1,250 paid streams or 3,750 ad-supported (free) streams. This disparity makes it easier for artists to climb the charts by selling a few thousand copies rather than amassing millions of streams.

For emerging artists or those targeting niche audiences, this can be a game-changer. Labels often encourage fans to buy digital copies during release weeks to boost chart positions, which in turn drives more streams, media attention, and tour bookings. In a sense, iTunes sales act as a force multiplier in the complex ecosystem of music metrics.

Surprising Insights into iTunes Users

Delving deeper into user behavior reveals some counterintuitive trends.

Delving deeper into user behavior reveals some counterintuitive trends.

Contrary to the assumption that iTunes buyers are mostly nostalgic holdouts from the pre-streaming era, the data tells a different story:

- Non-Subscribers Dominate: About 80% of iTunes users are not subscribed to Apple Music, Apple's own streaming service. This suggests that many prefer ownership over rental-like access, even in the digital realm.

- Newcomers in the Mix: Remarkably, 50% of current iTunes buyers started purchasing tracks after the launch of Apple Music in 2015. These aren't just "old-timers"; a significant portion are newer users who value the permanence of downloads.

- Focus on Fresh Releases: Nearly 50% of the top 10,000 best-selling albums each quarter are new releases, not timeless classics. This indicates that digital sales aren't solely driven by catalog music but play a role in promoting contemporary artists.

These statistics highlight that digital purchases appeal to a dedicated, albeit shrinking, audience that seeks control over their music libraries.

Also read:

- The Dynamics of Market Leadership: How New Companies Dominate in the US While Europe Clings to Legacy Giants

- 109 Chinese Car Brands: Fragmentation Hides Concentration in a Booming Market

- Love in the Age of AI: When ChatGPT Becomes Your Wingman — or Your Entire Relationship

- Wasting Life: How Digital Existence Accelerates Time and Erodes Our Humanity

Will Digital Music See a Vinyl-Like Renaissance?

The resurgence of vinyl records in recent years — fueled by collectors, audiophiles, and a desire for tangible experiences — raises an intriguing question: Could digital music sales experience a similar revival? Vinyl sales have surged, blending nostalgia with modern appeal, as buyers appreciate the physical ownership and ritual of playing records.

However, a digital renaissance seems unlikely. Streaming's convenience is unmatched: instant access, offline downloads (temporarily), and algorithmic recommendations tailored to individual tastes. Moreover, purchasing music on iTunes doesn't grant true ownership in the same way as a physical record. Digital files are licensed, not owned outright, and can be subject to platform changes or DRM restrictions. You can't resell, lend, or display a digital album like a vinyl LP on a shelf.

For the majority, the trade-offs simply aren't worth it. While a niche market for high-fidelity digital downloads (e.g., FLAC files from specialized stores) might persist, the broad appeal of iTunes-style sales is fading. Record labels may continue to leverage them for chart manipulation, but as streaming evolves — perhaps with better artist payouts or enhanced features — the digital sales era could quietly fade into obscurity.

In conclusion, digital music sales represent a fascinating holdover in an industry that's rapidly evolving. Apple's iTunes, despite its monopoly and declining revenues, remains a strategic tool for labels navigating the charts. Yet, as consumer habits solidify around streaming, the future of buying music digitally looks more like a footnote than a comeback story.