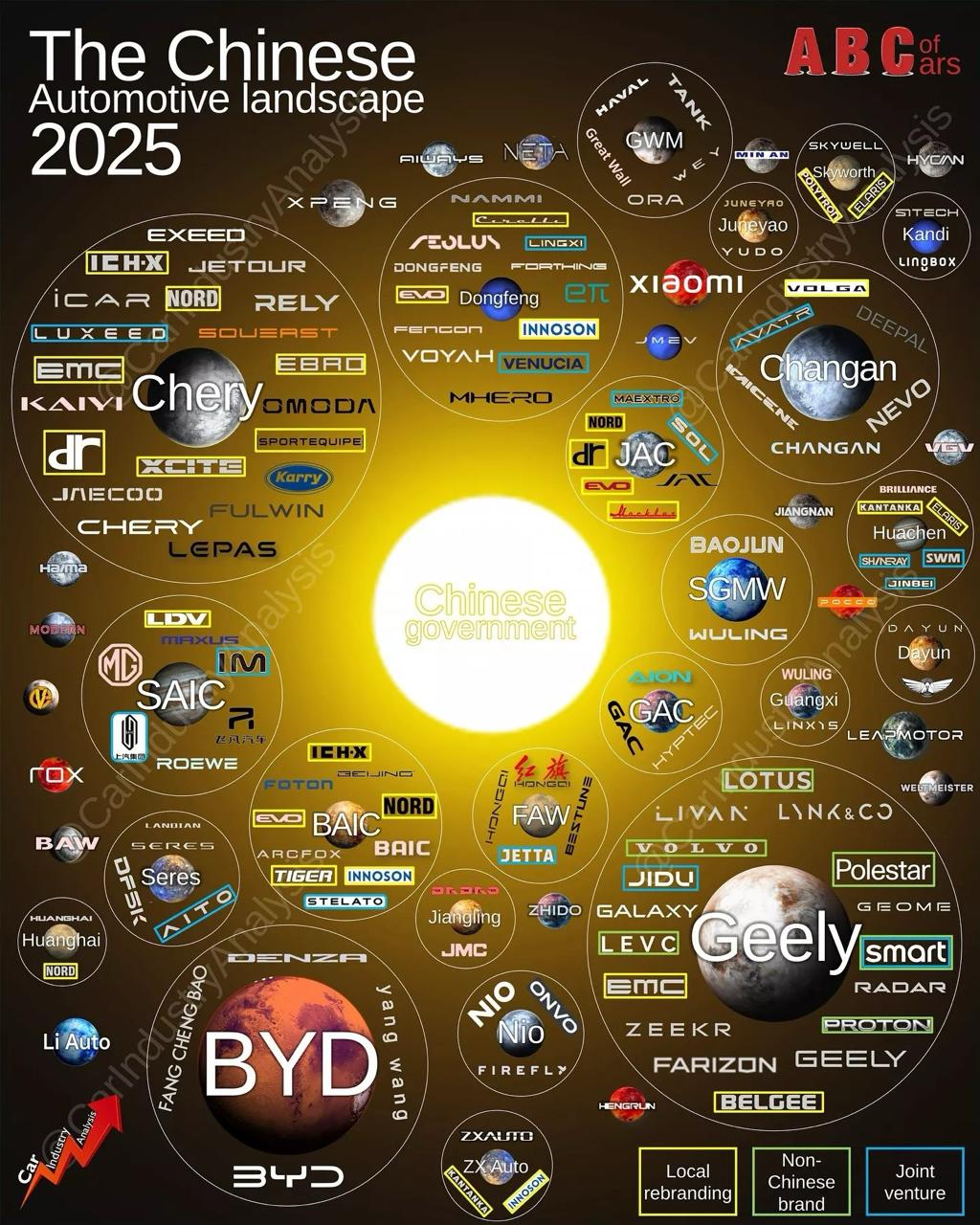

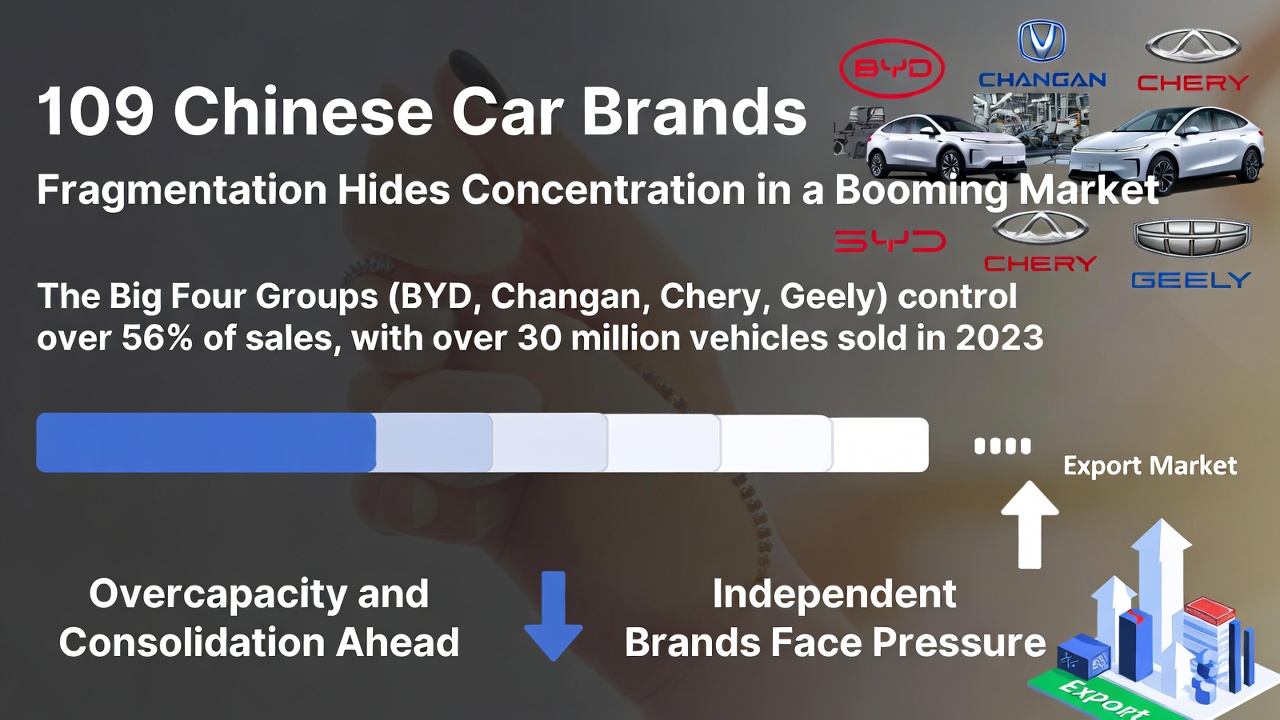

The Chinese automotive industry is a paradox of scale and sprawl. With an astonishing 109 active car brands as of early 2026, it appears highly fragmented — a bustling ecosystem where startups, state-backed giants, and niche players vie for dominance. Yet beneath this diversity lies intense concentration: just four major groups — BYD, Changan, Chery, and Geely — control over half of all sales, wielding dozens of sub-brands and benefiting from substantial government support.

These conglomerates dominate production, exports, and innovation, particularly in electric vehicles (EVs), while independent startups face mounting pressure. As analyst Felipe Munoz classifies brands from ultra-premium to budget segments, the market edges toward inevitable consolidation, with closures and mergers on the horizon.

The Big Four: Pillars of Power

China's auto sector produced over 30 million vehicles in 2025, making it the world's largest by far. But volume tells only part of the story. Domestic brands captured a record 65% share of passenger car sales last year, up from previous highs, driven by the top players.

China's auto sector produced over 30 million vehicles in 2025, making it the world's largest by far. But volume tells only part of the story. Domestic brands captured a record 65% share of passenger car sales last year, up from previous highs, driven by the top players.

- BYD: As China's EV powerhouse, BYD sold 4,602,436 vehicles in 2025, securing a 27.2% market share in new energy vehicles (NEVs) alone. Its portfolio is relatively streamlined, focusing on core brands like BYD Auto and sub-lines for hybrids and EVs. Backed by state incentives and vertical integration (from batteries to assembly), BYD has expanded globally, with exports surging.

- Geely: Geely achieved 3,024,567 sales in 2025, exceeding its revised target and claiming a 12.2% NEV share. This private conglomerate owns a complex web of brands, including Geely Auto, Zeekr (premium EVs), Lynk & Co (youth-oriented), and international assets like Volvo, Polestar, and Lotus. Geely's foreign holdings — acquired through strategic deals — give it a global edge, with stakes in Mercedes-Benz's parent company.

- Chery: With 2,631,381 units sold, Chery holds a 3.1% NEV share and focuses on affordable exports to emerging markets. As a state-owned entity, it manages sub-brands like Omoda and Jaecoo for international appeal, emphasizing SUVs and crossovers.

- Changan: Changan's NEV sales reached 789,141 in 2025, capturing a 6.2% share in that segment. Another state-backed giant, it oversees brands like UNI (premium) and partners with Ford and Mazda, blending domestic strength with joint ventures.

Together, these four accounted for 56% of Chinese manufacturers' sales in recent data, underscoring how government subsidies, R&D incentives, and policy support propel them ahead.

Independent Startups Under Siege

Beyond the big four, a slew of midsize state-owned groups (e.g., SAIC, Dongfeng, GAC) and emerging startups (e.g., NIO, XPeng, Li Auto, Xiaomi) add to the 109-brand count. These independents innovate in EVs and smart tech but operate under immense pressure.

For instance, startups like Seres and Leapmotor focus on high-tech features but face "price wars" and overcapacity, with combined sales around 1.05 million in the first half of 2025. Many are not yet absorbed into larger conglomerates, but survival is tough amid domestic saturation and export hurdles like tariffs.

Classification: From Ultra-Premium to Budget

Analyst Felipe Munoz's framework, echoed in industry tier lists, categorizes brands by positioning:

Analyst Felipe Munoz's framework, echoed in industry tier lists, categorizes brands by positioning:

- Ultra-Premium/Tech-Focused: NIO, XPeng, Zeekr (Geely) — Emphasizing luxury EVs with advanced autonomy and battery tech.

- Premium/Mainstream: Hongqi (FAW), UNI (Changan), Lynk & Co (Geely) — Blending sophistication with affordability.

- Mid-Range/Affordable: Chery, Great Wall Motors (GWM) — SUVs and crossovers for global markets.

- Budget/Old-Tech: Smaller locals like Lifan, Hawtai — Struggling with outdated designs and minimal share.

This spectrum highlights China's shift from copycat production to innovation, with premiums leading exports.

Also read:

- France's Debt Dilemma: A Grand Nation Teetering on Financial Ruin

- The Global Investment Landscape: How $261 Trillion in Assets Are Distributed Worldwide

- Dystopian Symbiosis: How Passive Investing and Platform Capitalism Are Stifling Competition

- The Year Nostalgia Went Mainstream: Build-A-Bear, Gap, and the Power of Looking Back

The Inevitable Consolidation

China's market is overbuilt: production capacity hit 55.6 million units against 27.6 million sales in 2024, fueling vicious price competition. In 2024, more EV makers exited (16) than entered, signaling the start of shakeouts. Brands like Mitsubishi have fled, while others like Dongfeng pivot to EVs amid sales drops.

China's market is overbuilt: production capacity hit 55.6 million units against 27.6 million sales in 2024, fueling vicious price competition. In 2024, more EV makers exited (16) than entered, signaling the start of shakeouts. Brands like Mitsubishi have fled, while others like Dongfeng pivot to EVs amid sales drops.

Experts predict bankruptcies, mergers, and job losses as demand cools and exports face tariffs. By 2030, consolidation could reduce the 109 brands significantly, favoring survivors like the big four.

China's auto industry exemplifies rapid ascent — from zero to global leader in EVs — but its fragmentation masks vulnerabilities. As consolidation looms, the survivors will likely dominate not just domestically but worldwide, reshaping the global automotive order.