In today's rapidly evolving global economy, a market's dynamism is often measured by its ability to foster innovation and allow newcomers to challenge and surpass established players. This fluidity is a hallmark of competitive ecosystems, where technological breakthroughs and entrepreneurial energy can propel startups to the forefront.

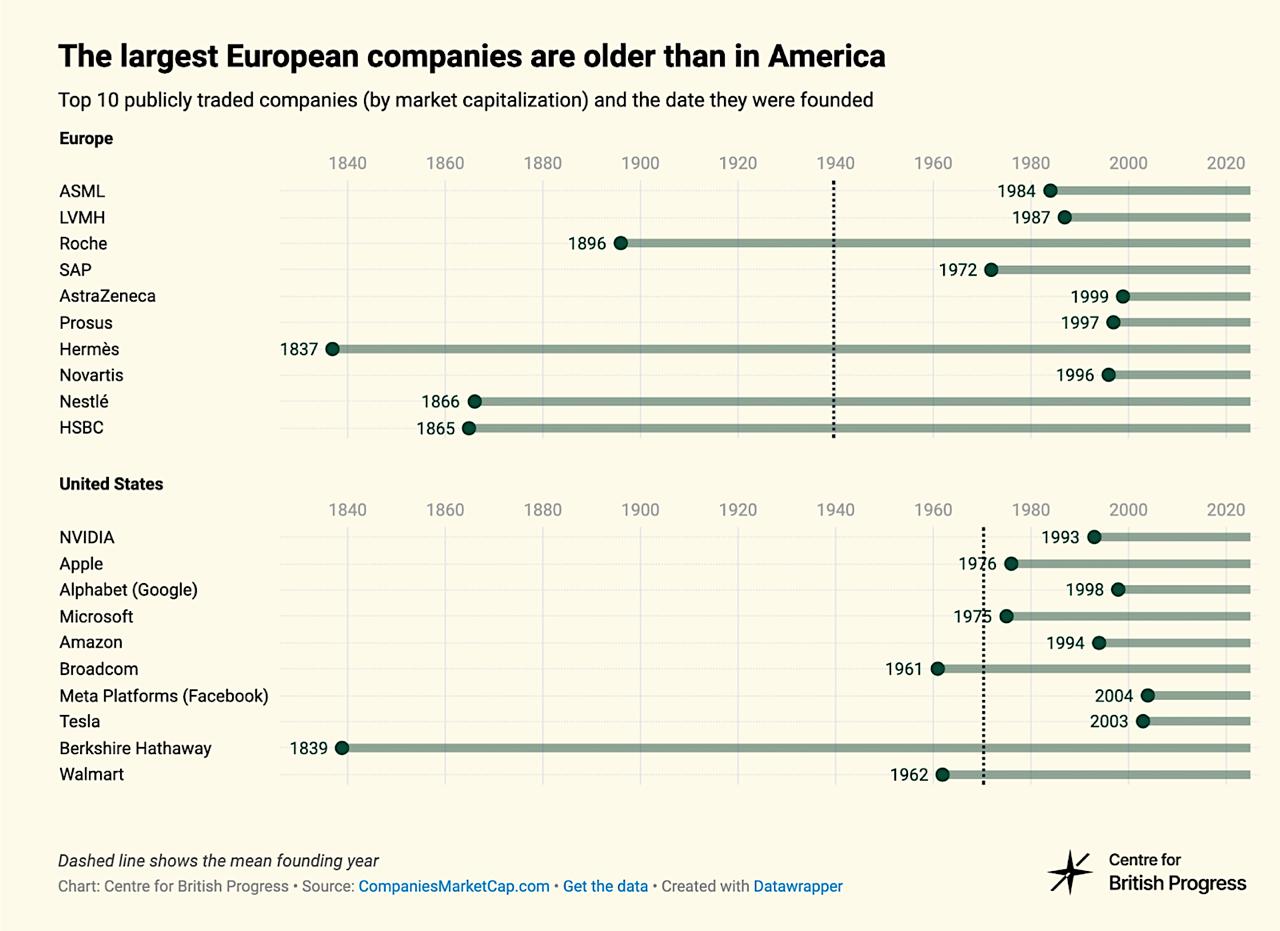

A striking contrast emerges when comparing the top companies in the United States and Europe. In the US, the largest firms are predominantly young tech innovators, many of which didn't exist just a few decades ago. In Europe, however, the corporate elite is dominated by centuries-old institutions, with wealth and power often persisting across generations in aristocratic or family-controlled entities. Yet, as we'll explore, removing a few legacy outliers from Europe's list reveals a more modern, albeit still conservative, landscape.

The US: A Playground for Rapid Ascent

The top 10 US companies by market capitalization as of early February 2026 exemplify this innovative churn.

According to data from FinanceCharts.com and The Motley Fool, the list is heavily skewed toward technology firms founded in the late 20th or early 21st century:

According to data from FinanceCharts.com and The Motley Fool, the list is heavily skewed toward technology firms founded in the late 20th or early 21st century:

- NVIDIA (NVDA): Market cap ~$4.18 trillion. Founded in 1993, NVIDIA has revolutionized graphics processing and AI computing.

- Alphabet (GOOGL): Market cap ~$4.09 trillion. Founded as Google in 1998, it dominates search, advertising, and cloud services.

- Apple (AAPL): Market cap ~$3.98 trillion. Founded in 1976, Apple's consumer electronics empire was built on innovations like the iPhone.

- Microsoft (MSFT): Market cap ~$3.09 trillion. Founded in 1975, it leads in software, cloud, and AI.

- Amazon (AMZN): Market cap ~$2.53 trillion. Founded in 1994 as an online bookstore, it now spans e-commerce, cloud computing, and more.

- Meta Platforms (META): Market cap ~$1.81 trillion. Founded as Facebook in 2004, it rules social media and metaverse tech.

- Tesla (TSLA): Market cap ~$1.62 trillion. Founded in 2003, Tesla pioneered electric vehicles and sustainable energy.

- Broadcom (AVGO): Market cap ~$1.57 trillion. Founded in 1961 (as a semiconductor firm), but its modern form dates to 1991 mergers.

- Berkshire Hathaway (BRK.A): Market cap ~$1.04 trillion. Founded in 1839 as a textile company, but transformed under Warren Buffett since 1965.

- Eli Lilly (LLY): Market cap ~$930 billion. Founded in 1876, it focuses on pharmaceuticals like weight-loss drugs.

Eight of these specialize in technologies that barely existed 20 years ago — AI, cloud computing, social media, and EVs. Six didn't exist before 1991, and two (Meta and Tesla) were founded in the early 2000s. This reflects the US's venture capital ecosystem, which poured over $170 billion into startups in 2025 alone (PitchBook data), enabling rapid scaling. The S&P 500's tech sector has grown at an average annual rate of 15% over the past decade, outpacing traditional industries (S&P Dow Jones Indices).

Europe: Legacy and Stagnation

In contrast, Europe's top 10 by market cap (from CompaniesMarketCap.com and FinanceCharts.com) leans heavily on historical giants:

In contrast, Europe's top 10 by market cap (from CompaniesMarketCap.com and FinanceCharts.com) leans heavily on historical giants:

- ASML Holding (ASML): Market cap ~$535 billion. Founded in 1984 (Netherlands), semiconductor equipment.

- Roche Holding (RHHBY): Market cap ~$324 billion. Founded in 1896 (Switzerland), pharmaceuticals.

- LVMH (LVMUY): Market cap ~$293 billion. Founded in 1987 (France), but roots trace to 1854 (Louis Vuitton).

- Novo Nordisk (NVO): Market cap ~$264 billion. Founded in 1923 (Denmark), diabetes treatments.

- Nestlé (NSRGY): Market cap ~$255 billion. Founded in 1866 (Switzerland), food and beverages.

- SAP (SAP): Market cap ~$238 billion. Founded in 1972 (Germany), enterprise software.

- Hermès (HESAY): Market cap ~$220 billion. Founded in 1837 (France), luxury goods.

- L'Oréal (OR.PA): Market cap ~$252 billion. Founded in 1909 (France), cosmetics.

- Prosus (PRX.AS): Market cap ~$234 billion. Founded in 2019 (Netherlands), tech investments.

- Linde (LIN): Market cap ~$217 billion. Founded in 1879 (Ireland/UK-listed), industrial gases.

Three hail from the 19th century (Roche, Nestlé, Hermès), none from the 21st century except Prosus (a spin-off), and only two (ASML, SAP) are in digital tech. Europe's R&D spending as a GDP percentage lags the US (2.3% vs. 3.5% in 2025, Eurostat/OECD), and venture funding reached just €45 billion in 2025 (Dealroom), a fraction of US levels. This fosters persistence: many top firms are family-controlled or state-influenced, with wealth often tied to aristocratic lineages.

The UK: A Microcosm of European Legacy

The UK's FTSE 100 top 10 (from CMC Markets and CompaniesMarketCap.com) mirrors this:

- AstraZeneca (AZN): Market cap ~£192 billion. Founded 1999 (merger, roots 1913/1926), pharmaceuticals.

- HSBC (HSBA): Market cap ~£131 billion. Founded 1865, banking.

- Shell (SHEL): Market cap ~£188 billion. Founded 1907 (merger, roots 1833), energy.

- Unilever (UL): Market cap ~£103 billion. Founded 1929 (merger, roots 1872), consumer goods.

- Rio Tinto (RIO): Market cap ~£95 billion. Founded 1873, mining.

- British American Tobacco (BATS): Market cap ~£98 billion. Founded 1902, tobacco.

- GSK (GSK): Market cap ~£70 billion. Founded 2000 (merger, roots 1715), pharmaceuticals.

- RELX (REL): Market cap ~£65 billion. Founded 1993 (merger, roots 1880), information services.

- Diageo (DEO): Market cap ~£62 billion. Founded 1997 (merger, roots 1749 Guinness), beverages.

- BAE Systems (BA): Market cap ~£59 billion. Founded 1999 (merger, roots 1560), defense.

Only one tech firm: ARM (founded 1990, owned by SoftBank since 2016, market cap part of broader list but not top in pure UK). Most have 19th-20th century origins, emphasizing legacy sectors like finance, energy, and consumer goods.

Wealth Persistence in Europe: Aristocratic Echoes

European wealth often endures through families and firms from 100-200 years ago. Studies show aristocratic lineages in Sweden held 29% of private wealth in 1750, declining to 5% by 1900 but still privileged (Scandinavian Economic History Review). In Britain, rare surnames linked to 19th-century elites correlate with wealth five generations later (The Guardian, 2015).

In Germany, top fortunes persist over 100 years, with family perpetuation key (Socio-Economic Review, 2023). This contrasts US churn, where self-made billionaires dominate (Forbes).

A Different Picture Without the Ancients

Excluding 19th-century holdouts like Roche, Nestlé, and Hermès shifts Europe's top 10 toward modernity: ASML (1984), LVMH (1987 roots but modern), Novo Nordisk (1923), SAP (1972), L'Oréal (1909), Prosus (2019), Linde (1879 but restructured), etc. The list becomes more tech-oriented, with firms like Siemens Healthineers or Airbus emerging. This suggests Europe's innovation isn't absent — it's overshadowed by entrenched legacies.

Also read:

Also read:

- The Great Switch: LinkedIn Emerges as the World's Top Dating Network, While Dating Apps Turn into Job Hunt Hotspots

- What is the Price of AGI?

- Copying the Uncopyable: Waterloo Scientists Unlock Quantum Data Backups

Lessons for Global Markets

The US model fosters disruption, driving GDP growth (2.5% in 2025 vs. Europe's 1.2%, IMF). Europe risks stagnation without reforms to boost startups (e.g., unified digital market). As Mario Draghi noted in 2024, Europe must enhance competitiveness to counter this inertia. Ultimately, dynamic markets reward the new; static ones preserve the old — at a cost to progress.