The creator economy has exploded into a $250 billion industry as of 2025, with projections estimating it could nearly double to $480 billion by 2027.

Yet, beneath this impressive growth lies a stark reality: success is unevenly distributed, with a small elite capturing the lion's share of earnings while most creators struggle to break even.

Yet, beneath this impressive growth lies a stark reality: success is unevenly distributed, with a small elite capturing the lion's share of earnings while most creators struggle to break even.

A recent survey by Creator Spotlight, detailed in their 2025 Monetization Report, sheds light on these dynamics through responses from 427 full- and part-time creators in the U.S., all aged 18 or older and spanning diverse backgrounds, niches, and experience levels.

This report, based on a 28-question form distributed to nearly 300,000 subscribers, highlights key trends in revenue, platforms, mediums, and challenges.

Complementing this, broader industry data reveals ongoing shifts toward AI integration, diversified income, and platform independence. Here's a deep dive into the findings, enriched with contextual statistics from across the sector.

Participant Demographics: A Diverse but Unequal Field

The survey captured a balanced gender split overall - 51% male and 46% female (with 3% unspecified) - but disparities emerge when income enters the picture.

The survey captured a balanced gender split overall - 51% male and 46% female (with 3% unspecified) - but disparities emerge when income enters the picture.

Creators ranged from novices to veterans, primarily in North America, including newsletter writers, video producers, podcasters, and social media influencers.

This mirrors the global creator base, now exceeding 200 million individuals, where women make up about 70% of influencers but face systemic barriers. Notably, only 37 participants (8.7%) achieved six-figure earnings ($101,000+), aligning with industry-wide figures where roughly 4% of creators surpass $100,000 annually.

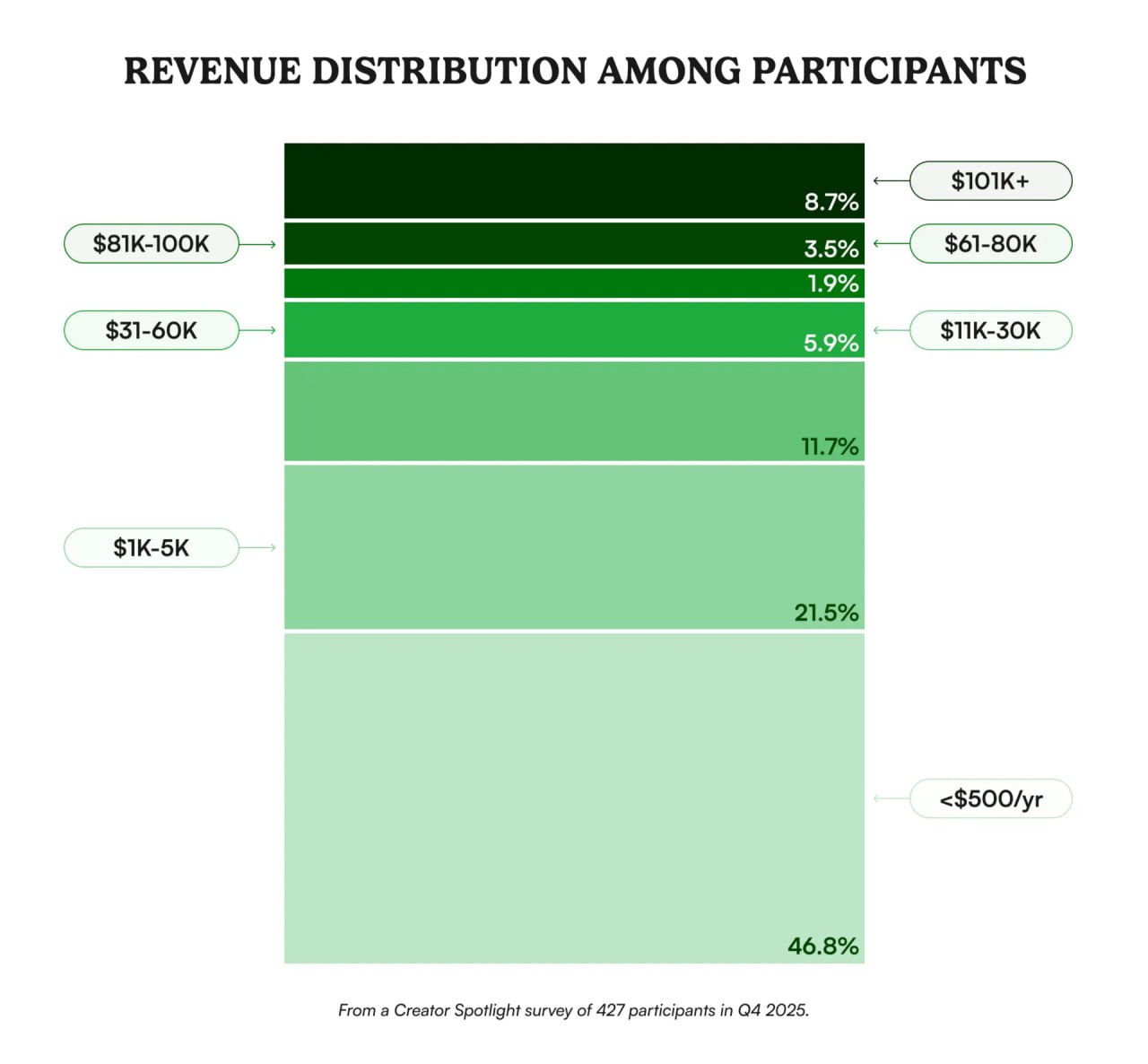

Revenue Distribution: The Long Tail of Earnings

Income inequality is a defining feature of the creator economy. In the Creator Spotlight survey, nearly half (46.8%) of respondents earned less than $500 in 2025, while 21.5% made between $1,000 and $5,000. Mid-tier earners were scarcer: 11.7% hit $5,000 –$10,000, and just 5.9% reached $11,000–$30,000. At the upper end, 3.5% earned $31,000–$60,000, 1.9% made $61,000–$80,000, and 3.5% achieved $81,000–$100,000.

Income inequality is a defining feature of the creator economy. In the Creator Spotlight survey, nearly half (46.8%) of respondents earned less than $500 in 2025, while 21.5% made between $1,000 and $5,000. Mid-tier earners were scarcer: 11.7% hit $5,000 –$10,000, and just 5.9% reached $11,000–$30,000. At the upper end, 3.5% earned $31,000–$60,000, 1.9% made $61,000–$80,000, and 3.5% achieved $81,000–$100,000.

This distribution underscores a common trend: over 50% of creators globally earn under $15,000 per year, with financial rewards heavily skewed toward the top.

Earning $30,000 annually places a creator ahead of 80% of the pack, a threshold that separates aspiring hobbyists from those building sustainable careers.

Broader data supports this pyramid structure; for instance, only 12% of full-time creators average around $50,000 yearly, highlighting the challenges of scaling from side hustle to primary income.

Top Income Streams: Diversification is Key

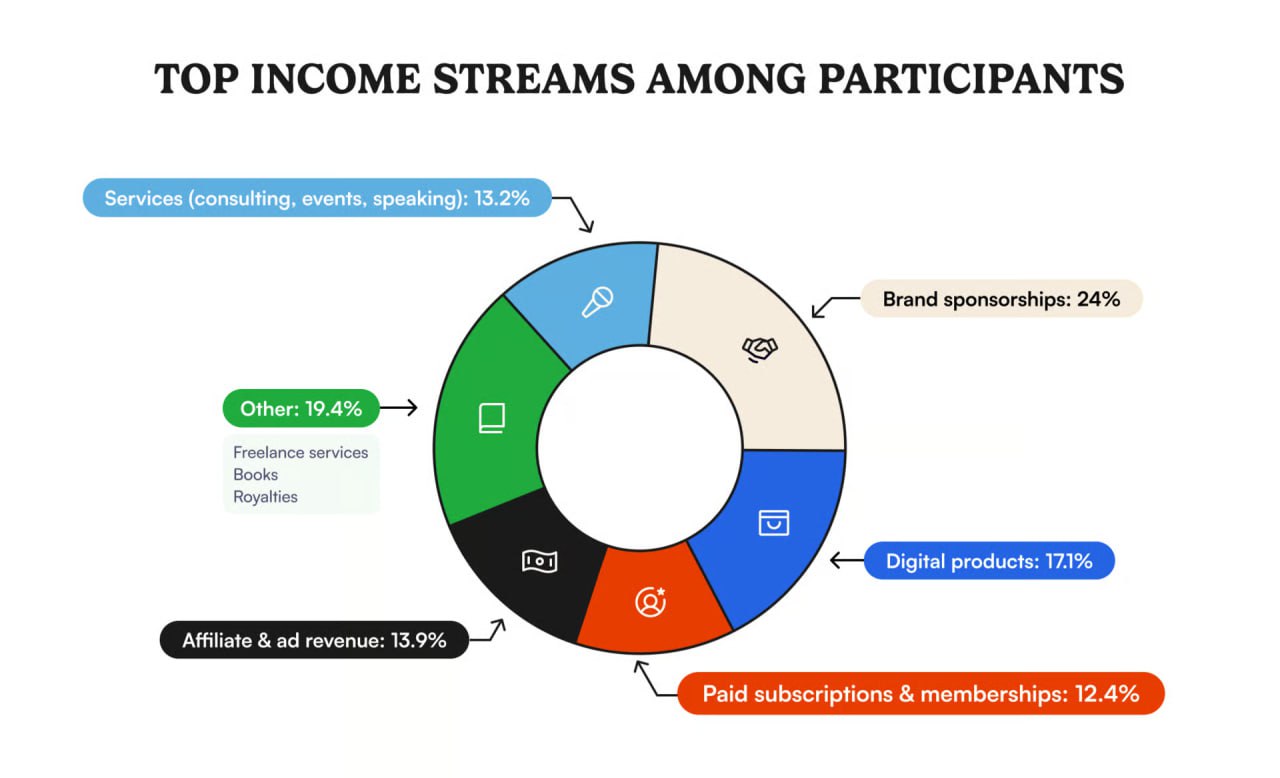

Successful creators don't rely on a single revenue source. The report identifies brand sponsorships as the leading stream at 24%, followed by "other" (including freelance, books, and royalties) at 19.4%, digital products at 17.1%, affiliate and ad revenue at 13.9%, services (like consulting or speaking) at 13.2%, and paid subscriptions/memberships at 12.4%.

Successful creators don't rely on a single revenue source. The report identifies brand sponsorships as the leading stream at 24%, followed by "other" (including freelance, books, and royalties) at 19.4%, digital products at 17.1%, affiliate and ad revenue at 13.9%, services (like consulting or speaking) at 13.2%, and paid subscriptions/memberships at 12.4%.

Top earners ($101,000+) average 3.3 streams, compared to 2.2 for those under $500, emphasizing diversification's role in risk reduction and income growth.

Industry-wide, monetization is evolving: 40% of creators who monetize report higher earnings than in previous years, driven by tools like AI for content optimization and new platforms for direct fan support. Early monetization is also crucial — 49% of top earners generated their first dollar within three months, versus 38% overall—suggesting that quick validation of audience value accelerates long-term success.

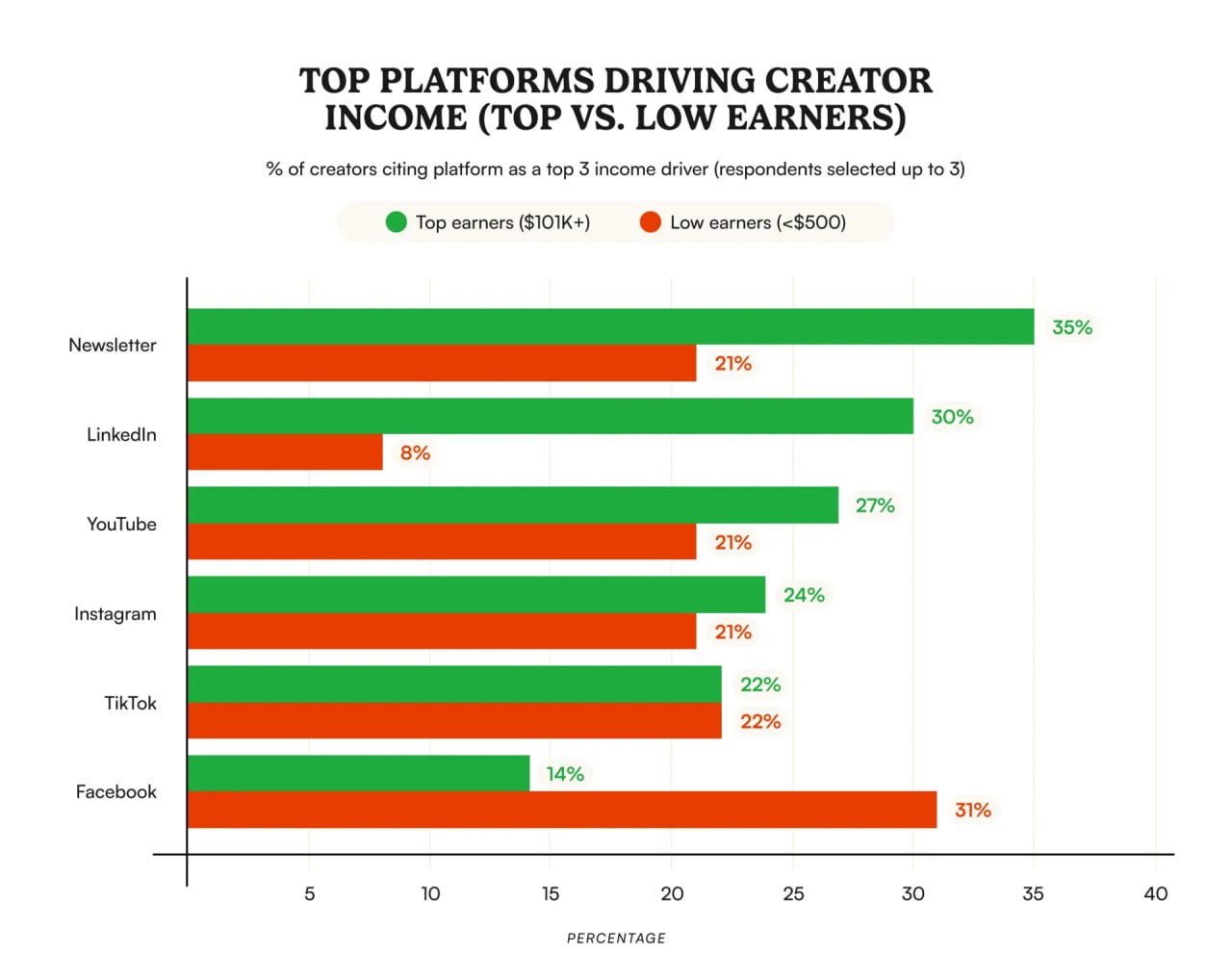

Platforms and Mediums Driving Success

Platform choice significantly impacts earnings. Among top earners, newsletters lead at 35%, followed by LinkedIn (30%), YouTube (27%), Instagram (24%), TikTok (22%), and Facebook (14%). In contrast, low earners (<$500) favor Facebook (31%), with newsletters and TikTok tied at 22-21%, and LinkedIn lagging at 8%.

Platform choice significantly impacts earnings. Among top earners, newsletters lead at 35%, followed by LinkedIn (30%), YouTube (27%), Instagram (24%), TikTok (22%), and Facebook (14%). In contrast, low earners (<$500) favor Facebook (31%), with newsletters and TikTok tied at 22-21%, and LinkedIn lagging at 8%.

This "plot twist" highlights LinkedIn's edge for B2B niches, where audiences have higher spending power; one creator cited in the report scaled from $40,000 in 2024 LinkedIn deals to a projected $250,000 in 2025.

On mediums, podcasts dominate as the primary choice for 31.8% of participants, outperforming YouTube (27%), newsletters (19.2%), streaming (16.7%), and short-form content (9.5%). Podcasters are over three times more likely to earn $31,000+ than short-form creators, thanks to deeper audience engagement enabling premium ads and sponsorships.

This aligns with trends where long-form content fosters loyalty, while short-form offers viral reach but struggles with conversion. Notably, X (formerly Twitter) was rarely mentioned as a revenue driver, reflecting its limited role in monetization compared to platforms like YouTube, which hosts over 50 million creators globally.

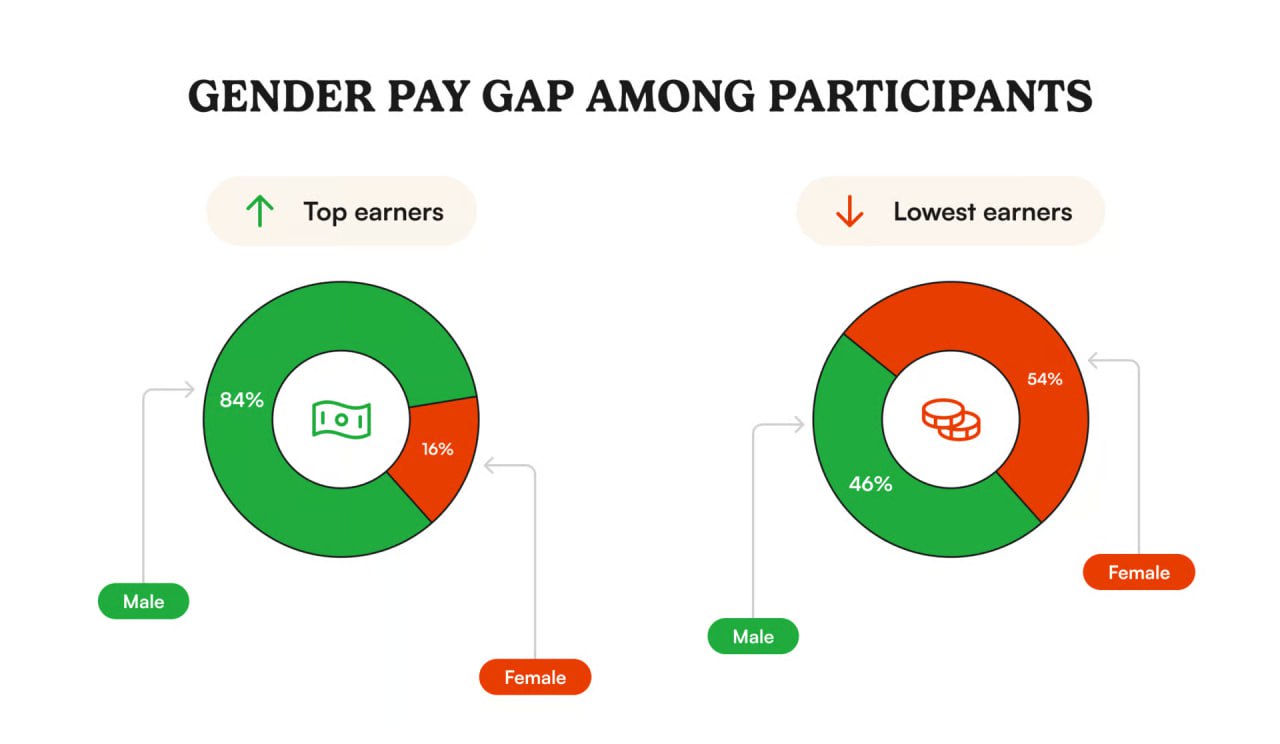

The Persistent Gender Pay Gap

Gender disparities persist, with 84% of top earners being male versus just 16% female, while low earners are more balanced (46% male, 54% female). This gap echoes broader inequalities: male creators earn about 40% more per collaboration, and women, despite dominating the influencer space (77%), are underrepresented in high-paying roles like video editing (only 24%).

Gender disparities persist, with 84% of top earners being male versus just 16% female, while low earners are more balanced (46% male, 54% female). This gap echoes broader inequalities: male creators earn about 40% more per collaboration, and women, despite dominating the influencer space (77%), are underrepresented in high-paying roles like video editing (only 24%).

Female respondents also prioritize transparency in brand pricing more (62% vs. 44% for men), pointing to negotiation challenges and bias in sponsorships.

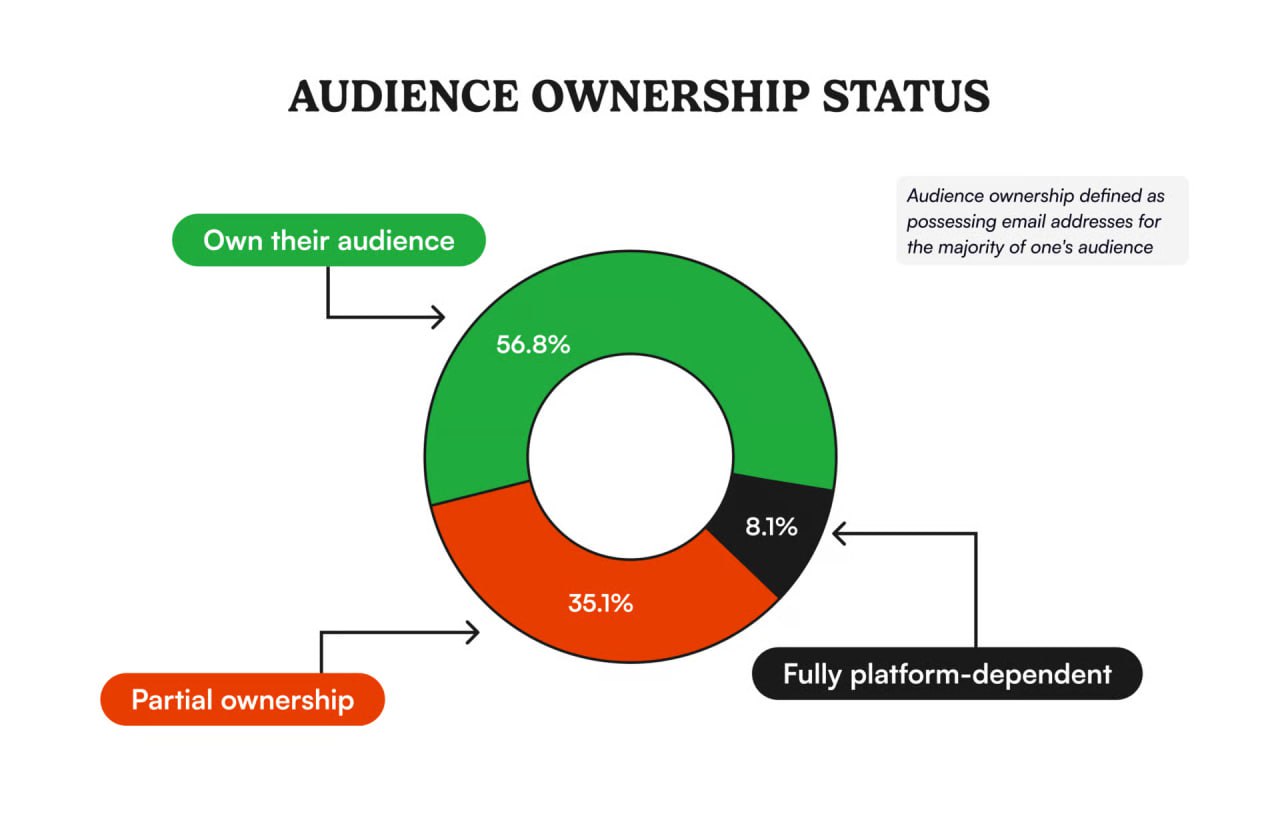

Audience Ownership: The Multiplier for Earnings

Owning an audience via email lists is a game-changer. The survey found 56.8% of creators fully own their audience (email access to the majority), 35.1% have partial ownership, and 8.1% are fully platform-dependent. Those with strong ownership are 2.7 times more likely to earn $31,000+, as emails provide "liquid content capital" immune to algorithm changes.

This resonates with industry advice: in a fragmenting attention economy, direct channels like newsletters (used by 35% of top earners) offer stability amid platform volatility.

Key Insights and Recommendations for Creators

Top performers share traits: 84% work full-time (vs. 35% overall), 68% build teams (vs. 26%), and they tackle advanced challenges like burnout (rising from 66% in early years to 80% after eight+).

Top performers share traits: 84% work full-time (vs. 35% overall), 68% build teams (vs. 26%), and they tackle advanced challenges like burnout (rising from 66% in early years to 80% after eight+).

Low earners focus on basics like audience growth (27%) and sponsorship access (20%). To bridge the gap, the report recommends immediate email list building, shifting to LinkedIn for B2B opportunities, diversifying to three+ streams, and monetizing early.

Looking ahead, the creator economy's compounding growth - projected to reach $1.18 trillion by 2032 - will favor those embracing AI for efficiency and exploring niche communities. While opportunities abound, the data serves as a wake-up call: sustainable success demands strategy, not just creativity. For aspiring creators, starting with owned assets and targeted platforms could be the difference between scraping by and thriving in this $250 billion arena.

Also read:

- The Evolving Landscape of International Trade: Challenges and Implications for Developing Economies

- Stranger Things: Netflix's Supernatural Saga Fuels $1.4 Billion Economic Surge in the US

- Trust Wallet Chrome Extension Compromised: $7 Million Stolen in Sophisticated Supply Chain Attack

Author: Slava Vasipenok

Founder and CEO of QUASA (quasa.io) - Daily insights on Web3, AI, Crypto, and Freelance. Stay updated on finance, technology trends, and creator tools - with sources and real value.

Innovative entrepreneur with over 20 years of experience in IT, fintech, and blockchain. Specializes in decentralized solutions for freelancing, helping to overcome the barriers of traditional finance, especially in developing regions.