Despite a fresh wave of rising tariffs, Wall Street appears unfazed, with stock indexes reaching new peaks last week. A robust start to the earnings season saw 83% of S&P 500 companies surpassing forecasts, fueling market optimism.

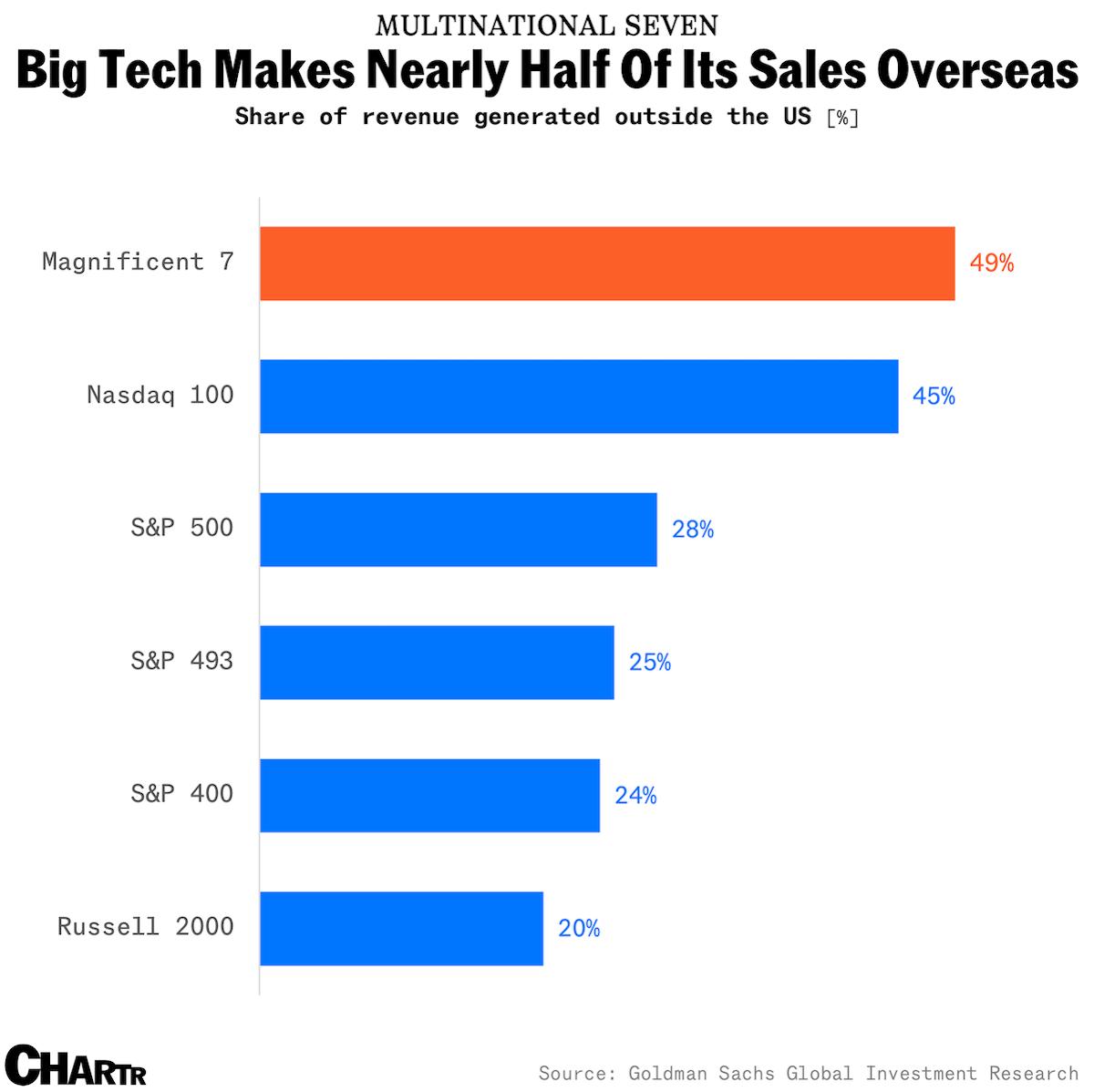

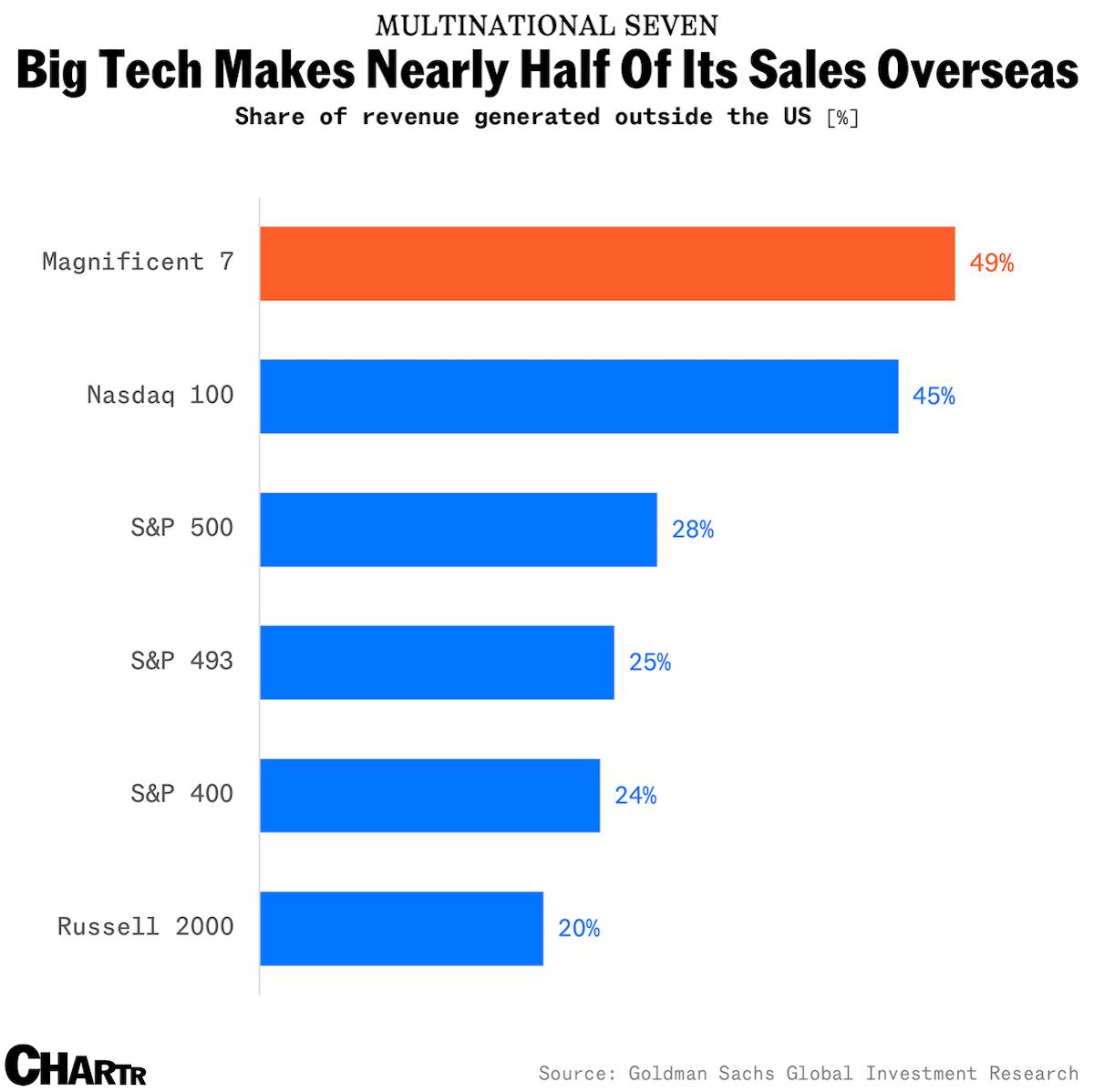

One key driver behind this growth is the weakening dollar, with the DXY index dropping 7% since the start of the year due to declining demand. This currency decline boosts the profitability of companies with international operations, with each 10% drop in the dollar adding 2-3% to S&P 500 earnings per share.

One key driver behind this growth is the weakening dollar, with the DXY index dropping 7% since the start of the year due to declining demand. This currency decline boosts the profitability of companies with international operations, with each 10% drop in the dollar adding 2-3% to S&P 500 earnings per share.

Also read:

- Pika Labs Launches TikTok-Style Social Network for AI-Generated Videos

- “Best Marvel Movie in Years”: The Fantastic Four Shines as a Masterpiece

- X Faces Mounting Tensions with French Authorities as Paris Prosecutors Demand Access to Platform Data

Multinational corporations like 3M, PepsiCo, and Netflix have credited their strong second-quarter results to favorable exchange rates, highlighting the currency’s tailwind. However, the biggest beneficiaries are the tech giants of the “Magnificent Seven,” which derive 49% of their revenue from abroad — well above the S&P 500 average of 28%.

This foreign revenue cushion has helped these companies thrive, even as tariff pressures loom. While the market seems to shrug off the tariff threat for now, the long-term impact on global supply chains and inflation remains a wildcard worth watching.

Author: Slava Vasipenok

Founder and CEO of QUASA (quasa.io) - Daily insights on Web3, AI, Crypto, and Freelance. Stay updated on finance, technology trends, and creator tools - with sources and real value.

Innovative entrepreneur with over 20 years of experience in IT, fintech, and blockchain. Specializes in decentralized solutions for freelancing, helping to overcome the barriers of traditional finance, especially in developing regions.

This is not financial or investment advice. Always do your own research (DYOR).