In the high-stakes game of global supply chains, the escalating rivalry between the United States and China over critical minerals has turned into a gold rush - literally and figuratively - for certain players.

.png) Just days ago, on October 20, 2025, U.S. President Donald Trump and Australian Prime Minister Anthony Albanese inked a landmark $8.5 billion deal to bolster mining and processing projects for rare earths and other essential materials.

Just days ago, on October 20, 2025, U.S. President Donald Trump and Australian Prime Minister Anthony Albanese inked a landmark $8.5 billion deal to bolster mining and processing projects for rare earths and other essential materials.

The immediate aftermath? A whirlwind of stock surges on the Australian Securities Exchange (ASX), as investors bet big on Australia's role as America's strategic mineral lifeline. This isn't just market noise; it's a clear signal that some nations and firms are poised to reap massive rewards from the West's push to decouple from China's dominance.

The Deal That Lit the Fuse

.png) The Trump-Albanese agreement commits at least $1 billion from each country over the next six months to fund a pipeline of projects across Australia, targeting minerals vital for defense tech, semiconductors, and renewable energy - like rare earths, lithium, gallium, and antimony. Dubbed a framework for "critical mineral and energy dominance," it includes U.S. Export-Import Bank (EXIM) financing and even equity stakes in key ventures, derisking investments in a sector plagued by volatile prices and small markets.

The Trump-Albanese agreement commits at least $1 billion from each country over the next six months to fund a pipeline of projects across Australia, targeting minerals vital for defense tech, semiconductors, and renewable energy - like rare earths, lithium, gallium, and antimony. Dubbed a framework for "critical mineral and energy dominance," it includes U.S. Export-Import Bank (EXIM) financing and even equity stakes in key ventures, derisking investments in a sector plagued by volatile prices and small markets.

What happened next was textbook market euphoria. Australian shares hit a record high on October 21, with critical minerals stocks leading the charge. Early surges saw some companies double or triple in value, only to cool slightly as profit-taking kicked in. But the momentum is undeniable: This deal isn't a one-off; it's part of a broader U.S. strategy to secure allies' resources amid Trump's aggressive trade posture toward Beijing.

Australia's Mining Titans Ride the Wave

Australia, sitting on vast reserves of these "green gold" minerals, emerges as the undisputed winner. With China controlling over 80% of global rare earth processing, the U.S. has turned to its Pacific ally for diversification. Over a dozen Aussie firms have already been approached by the U.S. administration for potential equity buys, sparking a frenzy.

.png) Standout performers include:

Standout performers include:

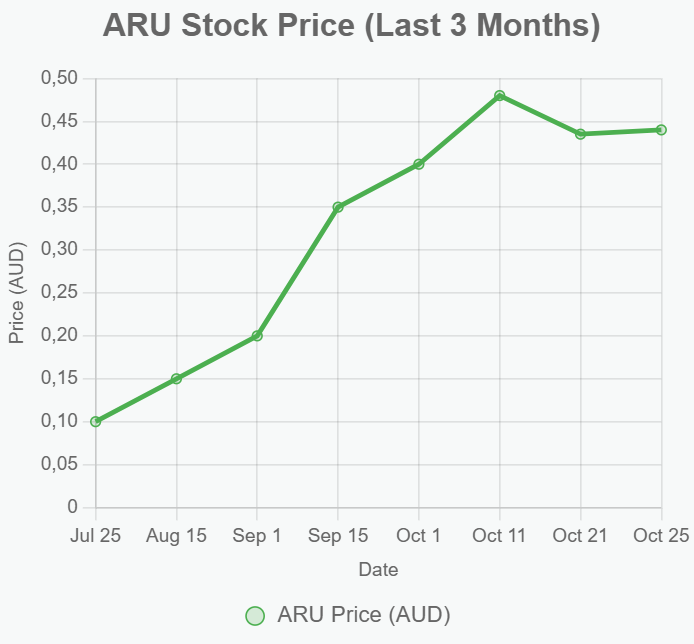

- Arafura Rare Earths (ASX: ARU): Backed by billionaire Gina Rinehart, shares rocketed up to 29% in a single day, capping a 300% gain since September. The company's Nolans project in the Northern Territory is now in line for U.S. funding, positioning it as a cornerstone of non-Chinese rare earth supply.

- Northern Minerals (ASX: NTU): Up 11.1% post-deal, with tentative U.S. support for its Browns Range heavy rare earths venture in Western Australia.

- Lynas Rare Earths (ASX: LYC): Australia's largest rare earth producer saw an initial 8% pop before dipping 7.6% on profit-taking, but executives hail the pact as a "game-changer."

- Australian Strategic Materials (ASX: ASM): Exploded 66% in recent trading, fueled by U.S. interest in its antimony and tungsten assets.

- Smaller fry like Resolution Minerals (ASX: RML) (up 55-56%) and Nova Minerals (ASX: NVA) (up 16%) also briefed Aussie officials ahead of the summit, highlighting U.S. plans for stakes in their Idaho and Alaska projects.

.png) Even U.S.-linked firms like Alcoa Corp. surged 7.5% to $59.68, tied to a gallium project now fast-tracked under the deal. Meanwhile, players like Pilbara Minerals (up 2.6%) and Iluka Resources (flat but optimistic) eye lithium and mineral sands expansions.

Even U.S.-linked firms like Alcoa Corp. surged 7.5% to $59.68, tied to a gallium project now fast-tracked under the deal. Meanwhile, players like Pilbara Minerals (up 2.6%) and Iluka Resources (flat but optimistic) eye lithium and mineral sands expansions.

These gains aren't isolated. Earlier in October, U.S. overtures for equity in Aussie firms had already ignited rallies, with Nova and Resolution prepping for Trump-Albanese talks. The total infusion - potentially $4.6 billion initially - promises to "turbocharge" the sector at unprecedented scale.

Beyond Australia: A Ripple Effect for Allies

.png) Australia isn't cashing in alone. The deal extends to joint ventures, like Japan's funding for Sorjitz Corp.'s gallium project (aiming for 10% of global supply), underscoring a broader "friends-shoring" network. Canada and the UK could follow, with Australia even offering shares in its new strategic mineral reserve to reduce allies' China reliance. For the U.S., this is about national security: Trump's administration has already snapped up 5% stakes in Lithium Americas and MP Materials to fortify domestic chains.

Australia isn't cashing in alone. The deal extends to joint ventures, like Japan's funding for Sorjitz Corp.'s gallium project (aiming for 10% of global supply), underscoring a broader "friends-shoring" network. Canada and the UK could follow, with Australia even offering shares in its new strategic mineral reserve to reduce allies' China reliance. For the U.S., this is about national security: Trump's administration has already snapped up 5% stakes in Lithium Americas and MP Materials to fortify domestic chains.

China's countermove - tightening export controls on rare earth tech just weeks ago - only sharpened the urgency, flooding markets with cheap supply to undercut Western miners. But as Trump quipped post-signing, the pact will produce "so much" to outpace Beijing.

Also read:

Also read:

- How Fintech and E-Commerce Software Development Are Reshaping the Global Economy

- When Free Hot Chicken Crushes AI: Dave's Hot Chicken App Dethrones Sora and ChatGPT in App Store Frenzy

- If You Thought the WordPress Family Drama Was Over, So Did I. Guess Again.

The Bigger Payoff: Geopolitics Meets Profits

This bonanza reflects a seismic shift: Critical minerals aren't just commodities; they're the new oil in a tech-driven world. Countries like Australia, with abundant reserves and stable governance, stand to attract billions in foreign direct investment, creating jobs and export booms. Companies, from Rinehart's empire to nimble juniors, gain legitimacy and capital that volatile markets alone couldn't provide.

Yet, it's not without risks - price floors in the deal could stabilize supplies but irk free-marketeers, and overreliance on U.S. funding ties Aussie firms to Washington's whims. Still, as one exec put it, the agreement is "paramount" for derisking projects and building resilient chains.

In the end, while the U.S.-China showdown escalates, it's Australia and its mining powerhouses that are laughing to the bank - proving once again that in geopolitics, the house always wins when it's resource-rich.

Author: Slava Vasipenok

Founder and CEO of QUASA (quasa.io) - Daily insights on Web3, AI, Crypto, and Freelance. Stay updated on finance, technology trends, and creator tools - with sources and real value.

Innovative entrepreneur with over 20 years of experience in IT, fintech, and blockchain. Specializes in decentralized solutions for freelancing, helping to overcome the barriers of traditional finance, especially in developing regions.

This is not financial or investment advice. Always do your own research (DYOR).