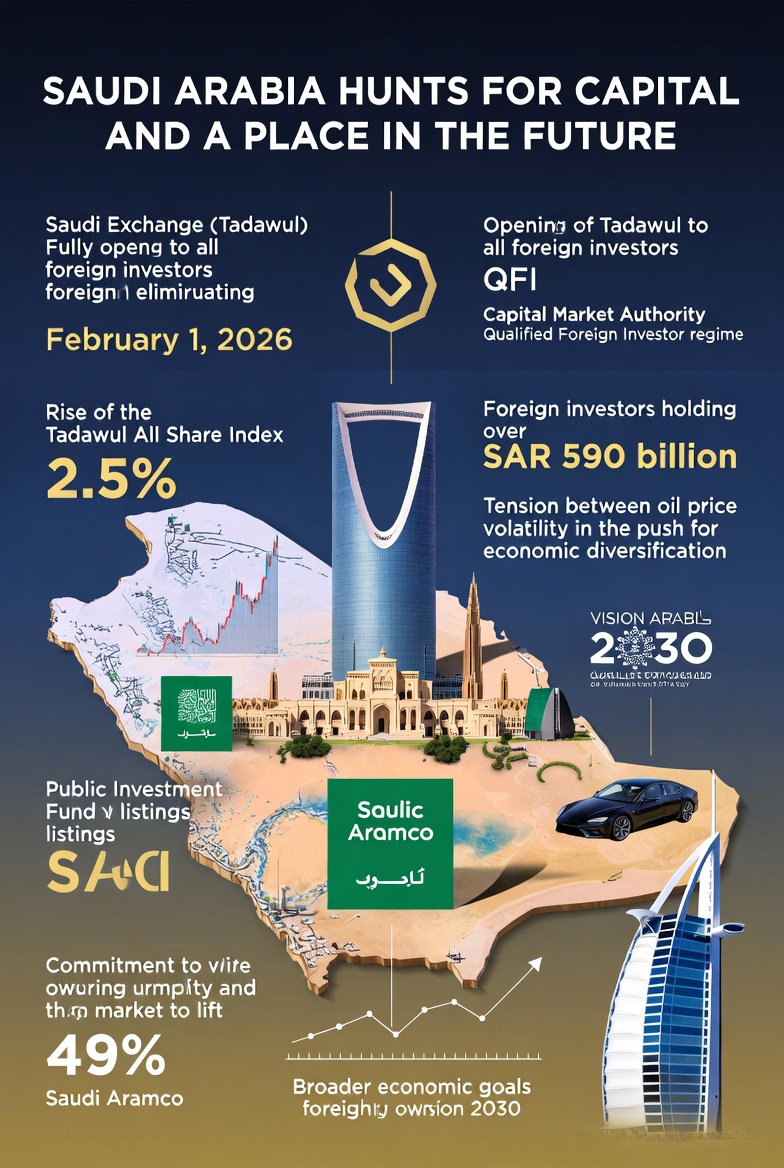

On February 1, 2026, Saudi Arabia took a significant step in its ongoing economic transformation by fully opening its stock market, the Saudi Exchange (Tadawul), to all categories of foreign investors. The Capital Market Authority (CMA) eliminated the Qualified Foreign Investor (QFI) regime, allowing direct access to the Main Market without qualification requirements or special status.

This landmark reform, effective immediately, removes long-standing barriers that previously restricted most foreign participation to large institutional investors meeting strict criteria, such as minimum assets under management of around $500 million.

This landmark reform, effective immediately, removes long-standing barriers that previously restricted most foreign participation to large institutional investors meeting strict criteria, such as minimum assets under management of around $500 million.

The move is part of Saudi Arabia's broader Vision 2030 strategy to diversify the economy away from oil dependence, attract foreign capital, and position the Kingdom as a regional financial hub. The announcement boosted market sentiment: the Tadawul All Share Index (TASI) rose as much as 2.5% in early trading on February 1, though gains later moderated.

By the end of Q3 2025, international investors already held over SAR 590 billion in the capital market, with SAR 519 billion in the Main Market — up from SAR 498 billion at the end of 2024 — indicating steady foreign interest even before the full opening.

Why Now? Weak Performance and Funding Needs

The decision comes amid challenges for the Saudi economy and capital markets. In 2025, lower oil prices, reduced government spending, and uncertainty around mega-projects like NEOM contributed to muted investor enthusiasm. International fund managers paused new investments in Saudi equities late last year, citing competition from higher-yielding markets elsewhere and concerns over the pace of diversification initiatives.

The decision comes amid challenges for the Saudi economy and capital markets. In 2025, lower oil prices, reduced government spending, and uncertainty around mega-projects like NEOM contributed to muted investor enthusiasm. International fund managers paused new investments in Saudi equities late last year, citing competition from higher-yielding markets elsewhere and concerns over the pace of diversification initiatives.

Saudi Arabia has been one of the world's most active IPO markets in recent years, driven by listings from state-owned giant Saudi Aramco and assets from the Public Investment Fund (PIF), the sovereign wealth vehicle. These sales have raised significant capital, but sustained foreign inflows are needed to support future privatizations and infrastructure projects.

Limited Immediate Impact — But a Signal for Bigger Changes

While the opening is historic, its immediate effect on capital inflows is expected to be modest. Major global funds already access Saudi stocks through the QFI framework (introduced in 2015) or via passive exposure through MSCI Emerging Markets Index inclusion since 2019. The removal of QFI status primarily benefits smaller institutions, family offices, retail investors, and those previously deterred by administrative hurdles.

Current foreign ownership limits remain in place: non-resident investors are capped at 10% in any single company, and aggregate foreign ownership cannot exceed 49% (excluding strategic investors). These restrictions prevent majority control by foreigners. However, CMA officials have confirmed that foreign ownership limits are under active review in 2026.

Current foreign ownership limits remain in place: non-resident investors are capped at 10% in any single company, and aggregate foreign ownership cannot exceed 49% (excluding strategic investors). These restrictions prevent majority control by foreigners. However, CMA officials have confirmed that foreign ownership limits are under active review in 2026.

Board member Abdulaziz Abdulmohsen Bin Hassan stated that the regulator is committed to lifting the 49% cap, potentially this year, either fully or in phases.

Such a change would be a game-changer, signaling Saudi Arabia's serious intent to become a truly global financial center and likely triggering substantial new capital inflows.

Also read:

- O-Ring Automation: Why AI Might Not Destroy Jobs Gradually — But Could End Them Suddenly

- Alexa Plus Goes Web: Amazon's AI Assistant Breaks Free from Devices, Ushering in a New Era of Seamless Integration

- The Vast, Invisible Web: How Google's Crawler Dominance Shapes the Future of AI

Investor Caution and Broader Context

Despite the reforms, enthusiasm among foreign investors remains tempered. Oil price volatility, fiscal consolidation, and execution risks around ambitious non-oil projects continue to weigh on sentiment. No rush of capital has materialized, and traders are watching closely for concrete action on ownership caps. If the 49% limit is removed or significantly raised, it could unlock billions in new investment and enhance Tadawul's status among emerging markets.

Saudi Arabia's push reflects a broader strategy: attract foreign capital to fund diversification while maintaining strategic control over key assets. The opening of Tadawul is one piece of a larger puzzle that includes real estate liberalization for foreigners, tourism expansion, and PIF-led investments abroad. Whether these measures succeed in securing the Kingdom's place in the global economic future depends on execution, oil prices, and the ability to convince skeptical international investors that the rewards outweigh the risks.

As one analyst noted, "One step is welcome, but the real prize is removing the ownership ceiling — that's when the floodgates could open." For now, Saudi Arabia is signaling openness, but the market awaits proof that it can deliver on its promises.