Friends!

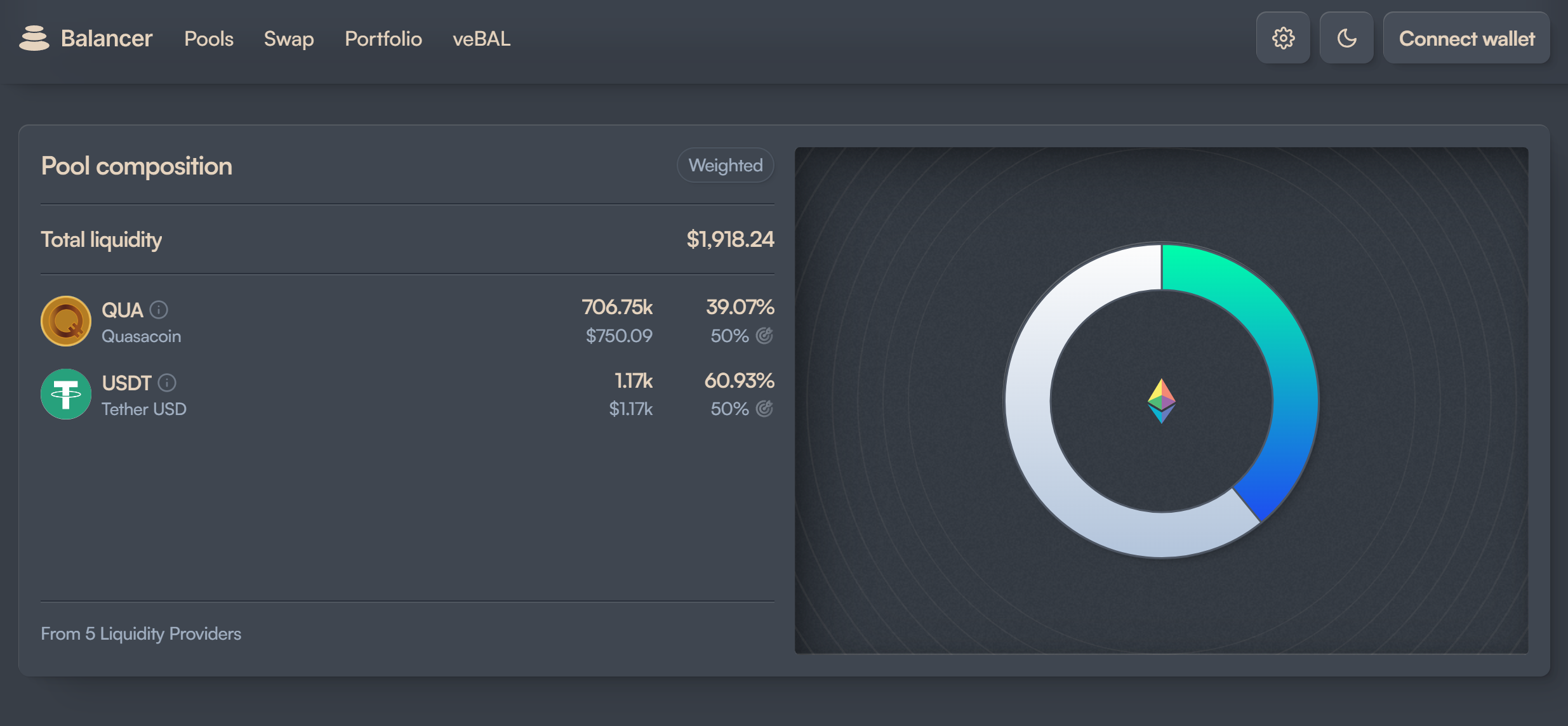

Together with the Balancer DEX team, we have completed the migration of the QUASA pool (50QUA-50USDT) to the new Balancer V3 architecture.

The long history of developing relationships between the QUASA and Balancer teams allowed us to be among the first to migrate to a more advanced platform without delays:

The long history of developing relationships between the QUASA and Balancer teams allowed us to be among the first to migrate to a more advanced platform without delays:

- The QUASA pool (50QUA-50USDT) was originally built on Balancer v1.

- Three years ago, the QUASA pool was migrated to the DEFI infrastructure, Balancer v2.

- In November 2024, the QUASA pool was introduced to Balancer v3

Balancer was a first-of-its-kind platform that created a launchpad for teams to innovate with various AMM strategies, using the security of the vault to manage low-level token transfers, balance accounting, and security auditing.

While v2's versatility proved successful, the developers went further and proposed the Balancer v3 architecture in November 2024, which is based on simplicity, flexibility, and extensibility.

While v2's versatility proved successful, the developers went further and proposed the Balancer v3 architecture in November 2024, which is based on simplicity, flexibility, and extensibility.

Balancer's long-term success is inextricably linked to the balance of protocols and products like QUASA on the DEFI platform.

With a new bull market on the horizon, countless new projects are expected to launch in the near to mid-term. These projects will need a reliable DEX for their token liquidity, and Balancer is well-positioned to meet this demand.

Yield-Bearing Liquidity. Become a liquidity provider in the QUASA pool

Liquidity providers (LPs) are increasingly aware of the hidden costs of holding non-yield-bearing stablecoins like DAI or USDC. With macroeconomic conditions suggesting that interest rates will remain significantly above 0% for the foreseeable future, LPs are actively seeking ways to ensure their liquidity can capture yield — the rapid rise of liquid staking and, more recently, restaking projects highlights this trend.

Liquidity providers (LPs) are increasingly aware of the hidden costs of holding non-yield-bearing stablecoins like DAI or USDC. With macroeconomic conditions suggesting that interest rates will remain significantly above 0% for the foreseeable future, LPs are actively seeking ways to ensure their liquidity can capture yield — the rapid rise of liquid staking and, more recently, restaking projects highlights this trend.

Balancer’s unique and modular design allows rate providers to adjust the price of yield-bearing assets in pools, enabling LPs to earn both swap fees and maintain exposure to yield.

While concentrated liquidity has proven to be one mechanism for increasing LP capital efficiency, Balancer v3 reimplements an optimized version of boosted pools that directs 100% of LP liquidity to on-chain yield markets. In v3, boosted pools will provide 100% exposure to yield-bearing assets (like aDAI) while abstracting the wrap/unwrap complexity for external users.

To improve gas efficiency, an innovative buffer will be introduced at the vault level. This buffer will hold a small reserve of both yield-bearing tokens and their underlying assets, facilitating most trades within the buffer. By minimizing the need for costly on-chain operations, this approach saves on gas fees and simplifies the functionality of boosted pools for users compared to Balancer v2.

Thank you!

Join us on social media!

See you!