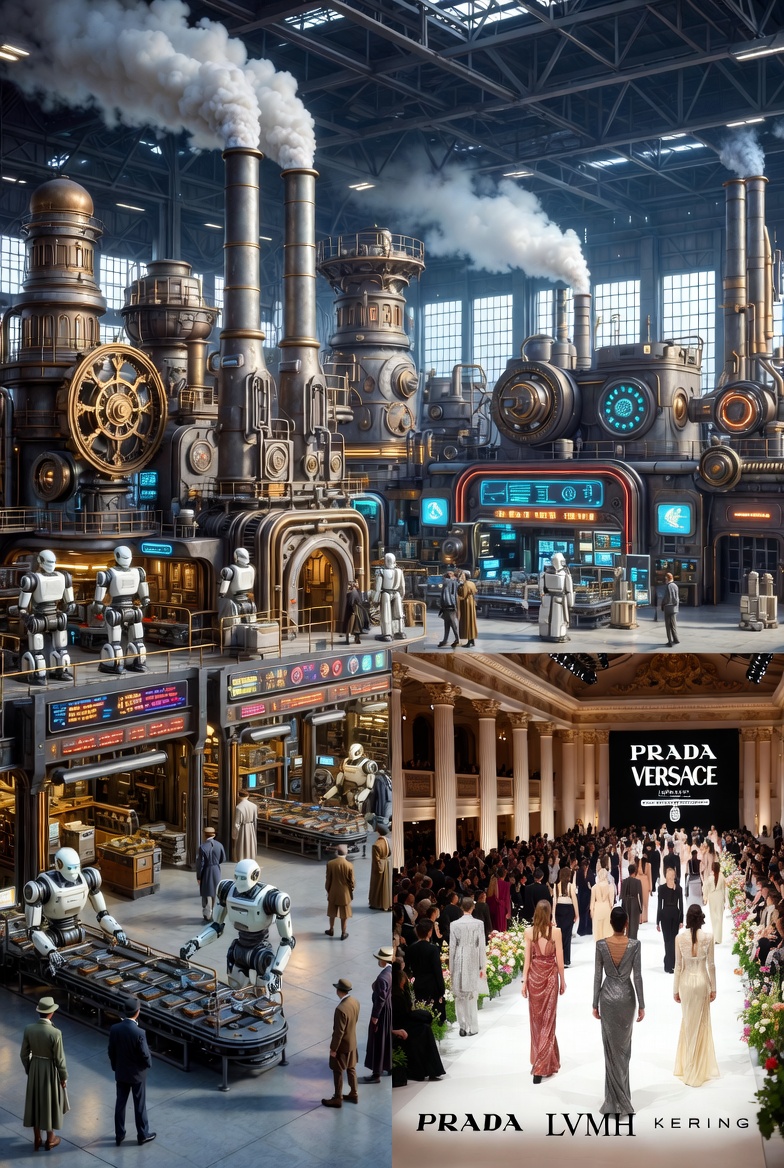

In a landmark deal that underscores the ongoing consolidation in the luxury fashion sector, Prada has finalized its acquisition of Versace from Capri Holdings for approximately $1.38 billion, announced on December 2, 2025. This move elevates Prada to a new tier, creating a trio of dominant conglomerates alongside LVMH and Kering.

No longer just a powerhouse in handbags and ready-to-wear, Prada now controls a portfolio that includes its namesake brand, Miu Miu, and the bold, maximalist Versace - signaling a strategic push to compete in a market where scale is king.

No longer just a powerhouse in handbags and ready-to-wear, Prada now controls a portfolio that includes its namesake brand, Miu Miu, and the bold, maximalist Versace - signaling a strategic push to compete in a market where scale is king.

As the global luxury industry grapples with slowing growth and shifting consumer preferences, this acquisition highlights how mergers are becoming essential for survival and innovation.

The New Luxury Landscape: LVMH, Kering, and Prada

The luxury fashion world has long been dominated by two behemoths: LVMH and Kering. LVMH, led by Bernard Arnault, oversees an empire of over 75 brands, spanning fashion (Louis Vuitton, Dior), jewelry (Tiffany & Co.), watches (TAG Heuer), and even spirits (Moët & Chandon).

The luxury fashion world has long been dominated by two behemoths: LVMH and Kering. LVMH, led by Bernard Arnault, oversees an empire of over 75 brands, spanning fashion (Louis Vuitton, Dior), jewelry (Tiffany & Co.), watches (TAG Heuer), and even spirits (Moët & Chandon).

In 2024, LVMH reported revenues of €86.2 billion, making it the largest luxury conglomerate by far. Kering, meanwhile, focuses on high-fashion icons like Gucci, Bottega Veneta, Yves Saint Laurent, Alexander McQueen, Balenciaga, and Brioni. Its 2024 revenue stood at around €19.6 billion, driven by Gucci's resurgence.

Prada's entry as the third major player changes the dynamics. Prior to the deal, Prada Group managed its core brand and Miu Miu, generating €4.7 billion in 2024 sales. Acquiring Versace adds a brand with €1.1 billion in annual revenue and a distinct aesthetic - Versace's opulent, glamorous style contrasts Prada's minimalist elegance, potentially broadening appeal.

This isn't Prada's first expansion; it has been building its portfolio quietly, but Versace marks a bold step toward conglomerate status.

A Wave of Consolidations in Luxury

This acquisition fits a broader pattern of mergers in the affluent luxury segment. LVMH's biggest splash was the $15.8 billion purchase of Tiffany & Co. in 2021, bolstering its jewelry division amid a post-pandemic boom. Kering, while less acquisitive recently, has focused on deepening stakes in existing brands and enhancing production infrastructure.

This acquisition fits a broader pattern of mergers in the affluent luxury segment. LVMH's biggest splash was the $15.8 billion purchase of Tiffany & Co. in 2021, bolstering its jewelry division amid a post-pandemic boom. Kering, while less acquisitive recently, has focused on deepening stakes in existing brands and enhancing production infrastructure.

In Q3 2025, the fashion industry saw aggressive M&A activity, with deals aimed at strategic realignment amid economic pressures. Overall, luxury brand valuations dropped 5% in 2025 due to declining demand, pushing firms toward consolidation for stability.

Why Consolidate? Efficiency, Synergy, and Managed Risk

Beyond survival, consolidation offers tangible benefits. Within a holding company, brands share IT systems, e-commerce platforms, and logistics networks, achieving economies of scale. For instance, centralized production can optimize supply chains, potentially relocating manufacturing from high-cost areas like Italy to more affordable regions, though this risks diluting brand heritage.

Synergies extend to marketing: Cross-promotions "nudge" customers from one brand to another, as seen in LVMH's ecosystem. But a key advantage is "managed creativity." Smaller brands risk collapse from failed experiments, while conglomerates can freeze underperformers, subsidize them with profits from others, and relaunch later. This allows bolder innovations in a volatile market, where 2025 saw a 5% valuation drop across top luxury brands due to economic headwinds.

Shifting Consumer Patterns: Meaning Over Logos

Driving this urgency are profound changes in buyer behavior. Younger consumers prioritize meaning over brands - no more logomania or ostentatious displays for social media.

Driving this urgency are profound changes in buyer behavior. Younger consumers prioritize meaning over brands - no more logomania or ostentatious displays for social media.

Instead, they seek "quiet luxury," minimalism, vintage pieces, and sustainable options like resale. Interest in limited-edition collaborations with influencers often trumps century-old reputations.

Global instability exacerbates this: Economic crises, the end of cheap money, and trade barriers complicate cross-border flows. The luxury market stagnated in 2025, with global consumption at €1.44 trillion, flat from 2024, as per Altagamma forecasts.

Conglomerates like the new Prada-Versace entity are better equipped for this transformation, offering diversified portfolios to test varied strategies without fatal risks.

The Road Ahead: A More Consolidated Future?

Prada's Versace buyout cements a triopoly in luxury fashion, promising efficiency but raising concerns about reduced competition and creativity. As independents like Stella McCartney reclaim autonomy through buybacks, the big three may dominate further. In a world of evolving tastes and economic uncertainty, consolidation isn't just strategy - it's survival. For consumers, it could mean more innovative, meaningful luxury; for the industry, a bolder, risk-managed era.

Prada's Versace buyout cements a triopoly in luxury fashion, promising efficiency but raising concerns about reduced competition and creativity. As independents like Stella McCartney reclaim autonomy through buybacks, the big three may dominate further. In a world of evolving tastes and economic uncertainty, consolidation isn't just strategy - it's survival. For consumers, it could mean more innovative, meaningful luxury; for the industry, a bolder, risk-managed era.

Also read:

- Diagnosing the Digital Cycle: From Megachurch Feeds to Shorting Degeneracy

- QE is Dead, Long Live RMP: Arthur Hayes on the Fed's Stealthy Return to Money Printing

- US Crypto Regulation Reboot: Senate Confirms Pro-Crypto Leaders for CFTC and FDIC

Author: Slava Vasipenok

Founder and CEO of QUASA (quasa.io) - Daily insights on Web3, AI, Crypto, and Freelance. Stay updated on finance, technology trends, and creator tools - with sources and real value.

Innovative entrepreneur with over 20 years of experience in IT, fintech, and blockchain. Specializes in decentralized solutions for freelancing, helping to overcome the barriers of traditional finance, especially in developing regions.