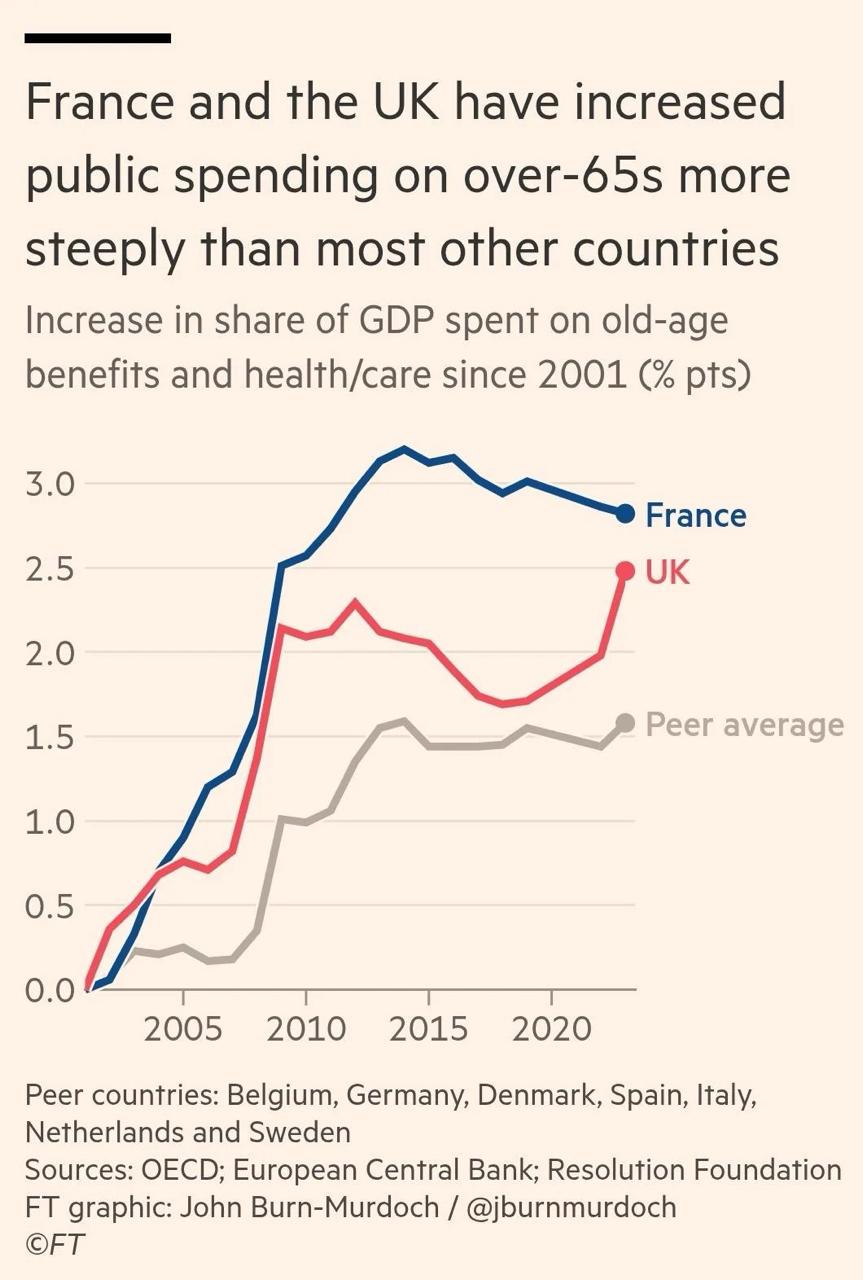

In France and Britain, the escalating costs of supporting pensioners have emerged as the dominant financial challenge over the past two decades.

Politicians’ attempts to transparently address the need for cuts have consistently failed, crushed by public backlash and widespread protests. The narrative of generational fairness has been sidelined, with policymakers bowing to societal pressure rather than tackling the root issue.

In Britain, healthcare and care costs for those over 65 have doubled since 2000, compounded by the “triple lock” policy. This ensures pensions rise by at least 2.5% annually - or more, tied to inflation or wage growth - outpacing the natural increase in the pensioner population. The result? A stark rise in child poverty, with today’s children more likely to live in hardship than their great-grandparents, highlighting a troubling redistribution of resources.

.jpg)

.jpg) Also read:

Also read:

- Proton Mail Suspends Journalist Accounts Amid Controversy

- Elon Musk Accuses Sam Altman of Orchestrating a Murder

- Why You Should Hire a Lawyer After a Car Accident

- For-Profit vs Non-Profit Financial Statements: Key Differences

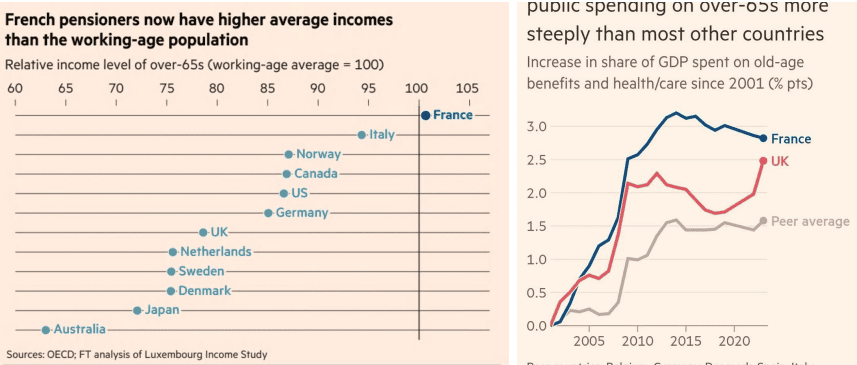

France’s situation is even more extreme.

With one of the lowest retirement ages in the West and the most generous payouts, pensioners there enjoy an average income surpassing that of working adults - a global anomaly.

This lavish system, funded by hefty public spending, fuels discontent when reforms are proposed. Any effort to trim costs triggers massive protests, often toppling governments, as seen in recent years. The underlying question lingers: are these nations prioritizing an aging elite at the expense of future generations, or is the protest-driven resistance masking deeper economic mismanagement?

Author: Slava Vasipenok

Founder and CEO of QUASA (quasa.io) - Daily insights on Web3, AI, Crypto, and Freelance. Stay updated on finance, technology trends, and creator tools - with sources and real value.

Innovative entrepreneur with over 20 years of experience in IT, fintech, and blockchain. Specializes in decentralized solutions for freelancing, helping to overcome the barriers of traditional finance, especially in developing regions.

This is not financial or investment advice. Always do your own research (DYOR).