In an era dominated by bloated smart rings packed with health trackers, haptic feedback, and endless subscription traps, Eric Migicovsky - the visionary behind the groundbreaking Pebble smartwatch - has stripped things back to basics.

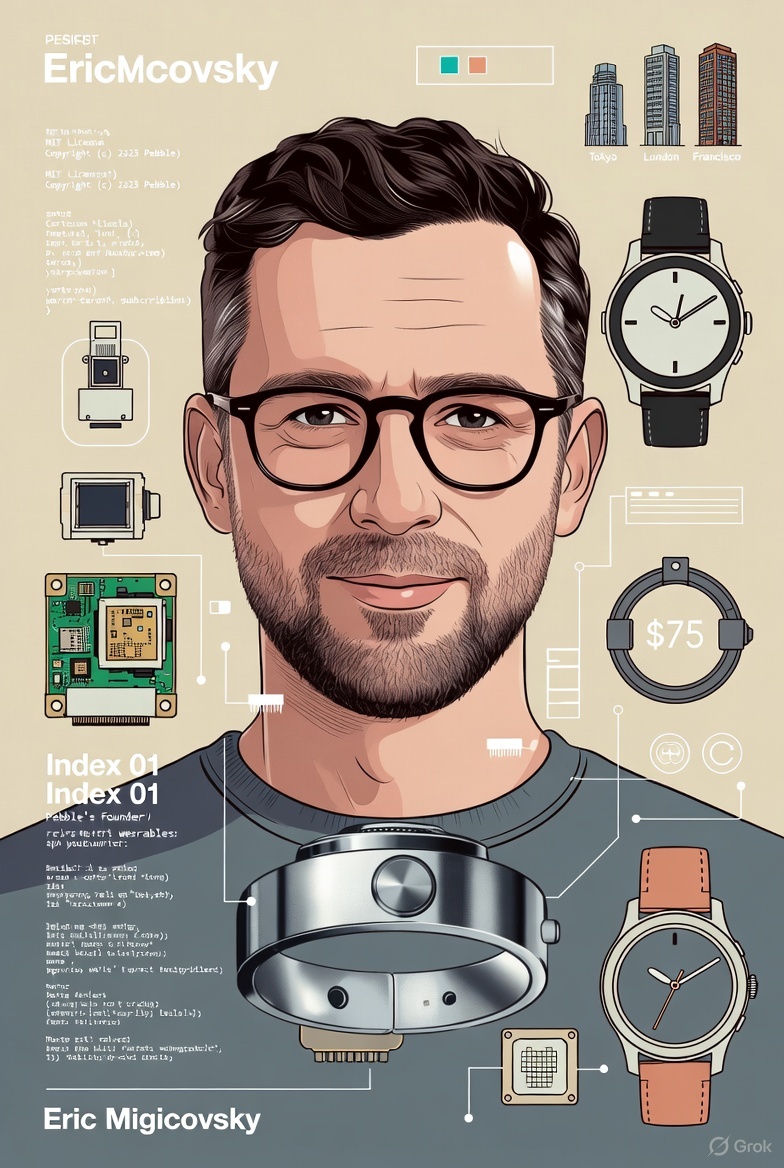

On December 9, 2025, Migicovsky unveiled the Index 01 through his revived Pebble brand under Core Devices: a sleek steel ring that captures fleeting thoughts with a button press and whisper. Priced at $75 on pre-order (rising to $99 post-launch), it ships in March 2026 and embodies a hardware startup ethos that's refreshingly pragmatic: solve one problem brilliantly, keep it open-source, and price it for the masses.

On December 9, 2025, Migicovsky unveiled the Index 01 through his revived Pebble brand under Core Devices: a sleek steel ring that captures fleeting thoughts with a button press and whisper. Priced at $75 on pre-order (rising to $99 post-launch), it ships in March 2026 and embodies a hardware startup ethos that's refreshingly pragmatic: solve one problem brilliantly, keep it open-source, and price it for the masses.

This isn't Migicovsky's first rodeo. The Canadian entrepreneur kickstarted the modern smartwatch category in 2012 with Pebble, raising over $10 million on Kickstarter in record time and selling more than 2 million units.

But after a rocky pivot to fitness wearables led to its 2016 sale to Fitbit for a fraction of its peak valuation, Pebble faded into obsolescence—until a community uprising and Google's open-sourcing of PebbleOS in January 2025 gave Migicovsky a second shot. Now, with the Index 01, he's proving that in 2025, launching hardware doesn't require VC millions or viral crowdfunding; it just needs laser focus on user pain points.

The Index 01: Whisper Your Ideas, Ditch the Phone

At its core, the Index 01 is deceptively simple: a 10mm-wide stainless steel band housing a single button, omnidirectional microphone, Bluetooth Low Energy chip, and a non-rechargeable silver-oxide battery akin to those in hearing aids.

Press the button, speak a quick note (up to 6 seconds), and it beams the audio to your phone via Bluetooth for on-device transcription using open-source speech-to-text models like Whisper.cpp - no cloud servers, no data hoarding, no monthly fees. "It's external memory for your brain," Migicovsky wrote in the announcement blog, emphasizing its role in offloading mental clutter without the distractions of always-listening devices like Humane's AI Pin or Rabbit R1.

Press the button, speak a quick note (up to 6 seconds), and it beams the audio to your phone via Bluetooth for on-device transcription using open-source speech-to-text models like Whisper.cpp - no cloud servers, no data hoarding, no monthly fees. "It's external memory for your brain," Migicovsky wrote in the announcement blog, emphasizing its role in offloading mental clutter without the distractions of always-listening devices like Humane's AI Pin or Rabbit R1.

The battery choice is audacious: It promises 2-3 years of life for 10-20 daily recordings, or about 12-15 hours of continuous use before the ring hits the recycler. Migicovsky opted against rechargeable lithium-ion cells to keep the design slim and affordable—avoiding the bulkier profiles of competitors like Oura Ring Gen 3, which starts at $299 plus subscriptions.

Early testers in a closed beta reported seamless integration with iOS and Android, where transcribed notes can auto-sort into apps like Notes or Todoist. Customization shines too: Remap the button for smart home controls (e.g., toggling lights via HomeKit), starting timers, or invoking AI assistants through the Model Context Protocol - an open standard for chaining local models.

Future-proofing is baked in. Migicovsky envisions pairing the Index with upcoming Pebble watches: Whisper a query like "What's the weather?" and get the response on your wrist's e-ink display, bypassing phone screens entirely. Pre-orders hit 10,000 within 24 hours of launch, per Core Devices' dashboard, signaling strong nostalgia-fueled demand from the original Pebble faithful.

From Kickstarter Glory to Fitbit Fire Sale: Pebble's Rollercoaster Ride

Migicovsky's journey began in 2008 as a University of Waterloo student hacking e-paper displays into wristwatch prototypes. By 2012, Pebble's Kickstarter campaign shattered records, funding $10.3 million against a $100,000 goal and birthing the first Bluetooth-connected smartwatch for iOS and Android.

Migicovsky's journey began in 2008 as a University of Waterloo student hacking e-paper displays into wristwatch prototypes. By 2012, Pebble's Kickstarter campaign shattered records, funding $10.3 million against a $100,000 goal and birthing the first Bluetooth-connected smartwatch for iOS and Android.

It featured a crisp e-ink screen, week-long battery life, and an app store that peaked at 1,000+ third-party apps. Over four years, Pebble shipped 2.8 million units, influencing giants like Apple Watch.

Hubris hit in 2015 with Pebble Time: Aiming for $100 million in sales with color e-ink and a mic, it fell short at $82 million amid rising costs from a fitness pivot.

Expenses doubled on marketing and R&D, cash burn accelerated, and by December 2016, Fitbit acquired Pebble's assets for $23 million in cash and $40 million in stock - peanuts compared to its $1 billion valuation hype.

In a candid 2017 Medium post, Migicovsky dissected the failure: overexpansion, ignoring core users, and chasing trends like heart-rate monitoring that diluted the "always-on glanceable info" magic.

Pebble's corpse lived on through fans. The non-profit Rebble project, launched in 2017, reverse-engineered cloud services and rebuilt the app store, sustaining 400,000+ devices for nine years on volunteer grit and donations. When Google swallowed Fitbit in 2021 (finalized January 2023 for $2.1 billion), Pebble's IP languished until Google's January 2025 open-sourcing of PebbleOS under Apache 2.0 - freeing schematics, firmware, and APIs. Migicovsky seized the moment, reclaiming the lapsed "Pebble" trademark and founding self-funded Core Devices in March 2025.

Revival Drama: Open-Source Triumph Over Community Clashes

The relaunch wasn't smooth. Core Devices kicked off with Pebble 2 Duo - a monochrome e-ink revival at $149 with 30-day battery life - shipping 5,000 units in October 2025 to rave reviews for its minimalist vibe. The pricier Pebble Time 2 ($225, color touch e-ink, metal case) amassed 25,000 pre-orders by December, promising March 2026 delivery.

The relaunch wasn't smooth. Core Devices kicked off with Pebble 2 Duo - a monochrome e-ink revival at $149 with 30-day battery life - shipping 5,000 units in October 2025 to rave reviews for its minimalist vibe. The pricier Pebble Time 2 ($225, color touch e-ink, metal case) amassed 25,000 pre-orders by December, promising March 2026 delivery.

Tensions boiled in November 2025 when Rebble accused Core of "stealing work" by demanding full access to their backend data and apps to build a "closed ecosystem," potentially sidelining the community. Migicovsky fired back in a blog post, claiming Rebble sought exclusivity while he offered $0.20 per user monthly royalties for integration. The feud risked fracturing the Pebble diaspora, with Reddit threads buzzing over fears of vendor lock-in.

Migicovsky blinked first - and big. On November 24, 2025, he open-sourced 100% of Pebble's software stack, including the mobile app, on GitHub under MIT license. Hardware schematics and BOMs for Pebble 2 Duo followed, alongside a swappable battery in Time 2. "This hands control back to the community," he wrote, ensuring Pebble's longevity beyond Core Devices' fate. Rebble, while skeptical, acknowledged the move as a "step forward," and joint firmware updates resumed by month's end.

The 2025 Hardware Playbook: Lean, Local, and Lover's Lane

Index 01 exemplifies Migicovsky's evolved philosophy: Build what you'd use daily, for tinkerers like yourself. No VC pressure means no feature bloat - unlike Oura's $5.99/month premium tier or Ultrahuman's $7.99 analytics. Manufacturing is easier too: Shenzhen fabs now handle 5,000-unit runs affordably, thanks to commoditized chips like Nordic's nRF52840 (under $2/unit) and efficient mics from Knowles. Open-source tools like ESP-IDF slashed dev time, and direct pre-orders via Shopify bypassed Kickstarter's fees.

Migicovsky's candor remains his superpower. That 2017 post-mortem? It humanized failure, earning respect that fueled his comeback. As he told Wired in a December 2025 interview, "We learned: Scale sustainably, listen to superfans, and own your screw-ups publicly." With Index 01's no-frills approach, Pebble isn't chasing Apple Watch dominance—it's carving a niche for thoughtful minimalism in a gadget-glutted world.

In giving Migicovsky a second act, the stars aligned: Community passion, timely open-sourcing, and matured supply chains. If Index 01 succeeds, it won't just revive a brand - it'll redefine indie hardware as viable again. After all, in 2025, the best tech isn't smartest; it's the simplest that sticks.

Also read:

- Pentagon's AI Revolution: 3 Million Troops and Civilians Log Into Google Gemini-Powered GenAI.mil

- Google's Gemini API Free Tier Fiasco: Developers Hit by Silent Rate Limit Purge

- Scribe: Revolutionizing AI Adoption by Mapping the Road to Real ROI

Author: Slava Vasipenok

Founder and CEO of QUASA (quasa.io) - Daily insights on Web3, AI, Crypto, and Freelance. Stay updated on finance, technology trends, and creator tools - with sources and real value.

Innovative entrepreneur with over 20 years of experience in IT, fintech, and blockchain. Specializes in decentralized solutions for freelancing, helping to overcome the barriers of traditional finance, especially in developing regions.