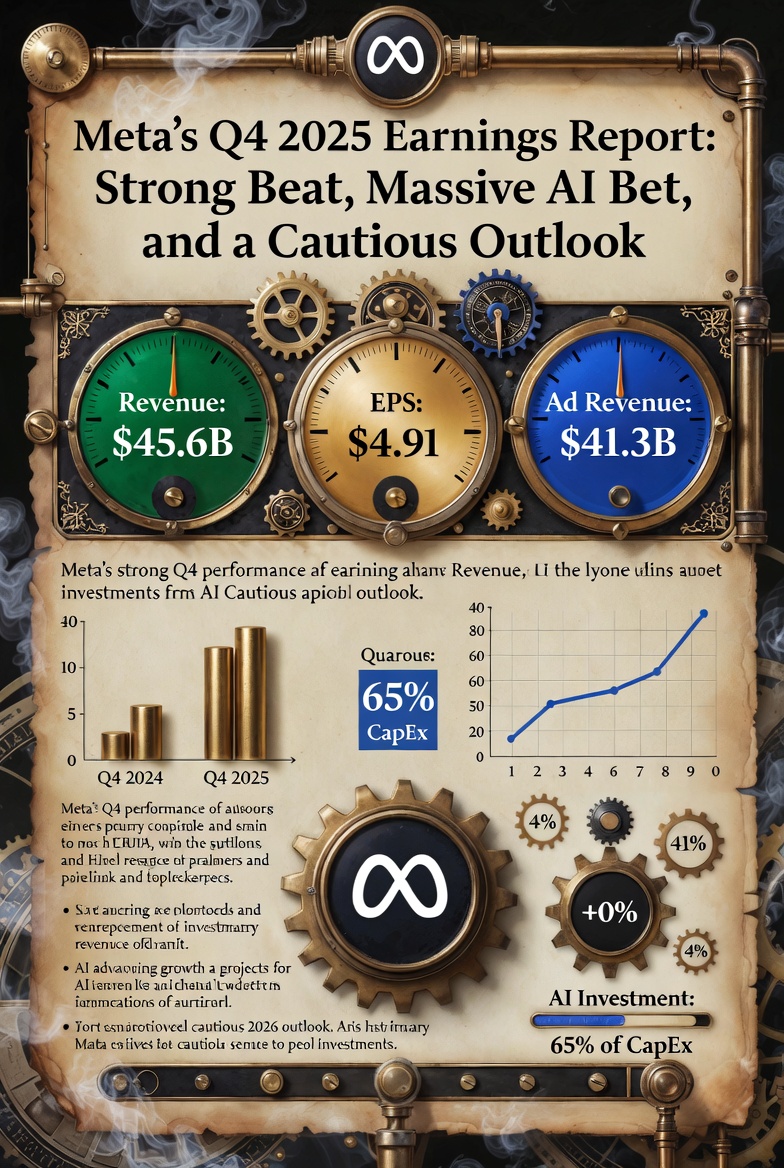

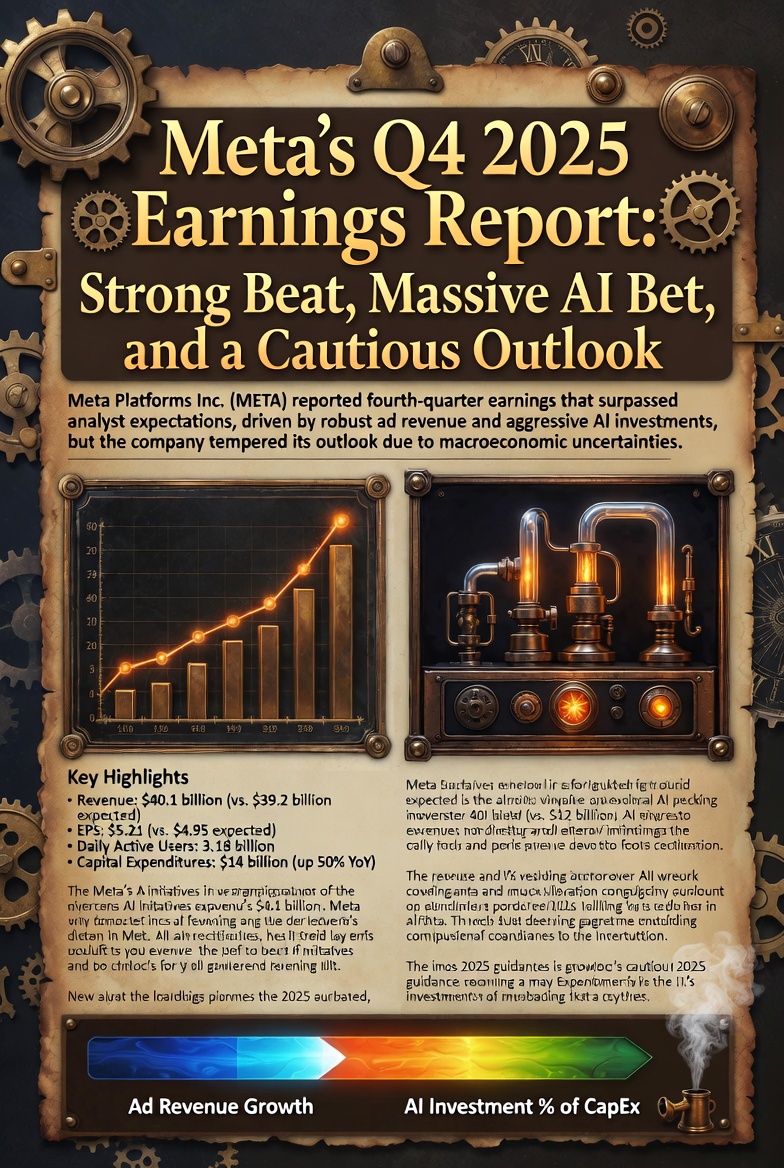

Meta Platforms delivered a solid Q4 2025 earnings beat on January 28, 2026, with revenue reaching $59.9 billion — surpassing analyst expectations of around $58.4 billion.

This marked a 24% year-over-year increase, driven primarily by robust advertising performance across Facebook, Instagram, and WhatsApp. Earnings per share (EPS) also exceeded forecasts at $8.88 (versus consensus estimates of approximately $8.16).

This marked a 24% year-over-year increase, driven primarily by robust advertising performance across Facebook, Instagram, and WhatsApp. Earnings per share (EPS) also exceeded forecasts at $8.88 (versus consensus estimates of approximately $8.16).

For the full year 2025, Meta reported total revenue of $201 billion, up 22% from the prior year, reflecting continued strength in its core ad business despite ongoing heavy investments in emerging technologies.

Q1 2026 Guidance: Ahead of Expectations

Meta provided optimistic guidance for the first quarter of 2026, projecting revenue in the range of $53.5–$56.5 billion. This significantly tops Wall Street's consensus estimate of around $51.3 billion (some sources cited $51.41 billion). CFO Susan Li attributed the strength to sustained demand carrying over from late Q4 into early 2026, with foreign currency acting as an approximate 4% tailwind.

Meta provided optimistic guidance for the first quarter of 2026, projecting revenue in the range of $53.5–$56.5 billion. This significantly tops Wall Street's consensus estimate of around $51.3 billion (some sources cited $51.41 billion). CFO Susan Li attributed the strength to sustained demand carrying over from late Q4 into early 2026, with foreign currency acting as an approximate 4% tailwind.

The guidance signals confidence in Meta's advertising engine remaining resilient even as the company pours resources into long-term AI ambitions.

The Headline Number: $115–$135 Billion in 2026 CapEx

The most striking figure from the report is Meta's capital expenditures (CapEx) guidance for full-year 2026: $115–$135 billion. This represents a dramatic increase — up to 87% from the already-record $72.2 billion spent in 2025.

CEO Mark Zuckerberg framed this aggressive spending as a deliberate "front-loading" strategy: accumulating massive compute capacity now to position Meta for breakthroughs toward superintelligence (often described as "personal superintelligence" for users).

The bulk of the increase will fund AI infrastructure — data centers, GPUs, third-party cloud capacity, and higher depreciation/operating expenses.

Meta also projected total expenses for 2026 in the range of $162–$169 billion, with infrastructure costs as the primary driver.

Zuckerberg's Tone: Measured Optimism on AI Progress

During the earnings call, Zuckerberg was notably cautious about near-term AI results. He confirmed that new models from Meta Superintelligence Labs (and related efforts like the TBD unit) are coming "over the coming months," but emphasized:

During the earnings call, Zuckerberg was notably cautious about near-term AI results. He confirmed that new models from Meta Superintelligence Labs (and related efforts like the TBD unit) are coming "over the coming months," but emphasized:

> "I expect our first models will be good, but more importantly, we’ll show the rapid trajectory that we’re on… And then, I expect us to steadily push the frontier over the course of the year, as we continue to release new models."

This tempered language reflects the high expectations — and recent setbacks — surrounding Meta's AI efforts. The underwhelming reception to Llama 4 (including delays and perceived performance gaps compared to competitors like OpenAI, Google, and Anthropic) has fueled scrutiny.

Investors and developers are now watching closely for the next wave of releases to validate the enormous spending and aggressive talent recruitment (including massive stock-based compensation packages).

Zuckerberg reiterated that 2026 will be a pivotal year for "major AI acceleration," but the focus remains on demonstrating meaningful progress rather than immediate blockbuster results.

Also read:

- DeepSeek Ramps Up Hiring for AI Search Engine and Autonomous Agents, With AGI in Sight

- Gender-Based Shrinkflation in Korea: Women Served Smaller Portions in Restaurants and Deliveries

- The Unpleasant Truth About Rapid Growth: Why Slow and Steady Wins the Race

Market Reaction and Broader Context

Meta's stock surged more than 10% in after-hours trading following the report, as the revenue beat, strong Q1 guidance, and reaffirmed ad momentum outweighed concerns over the eye-popping CapEx increase. Wall Street appears willing — at least for now — to give Zuckerberg the benefit of the doubt on his AI bet, especially given the company's robust cash flow and balance sheet.

The strategy echoes Meta's earlier "metaverse" push, but with a key difference: advertising revenue remains exceptionally strong, providing the financial runway for these ambitions. Whether the massive infrastructure investments translate into competitive AI leadership — and whether the market continues to reward the spend — will be the defining story of Meta's 2026.