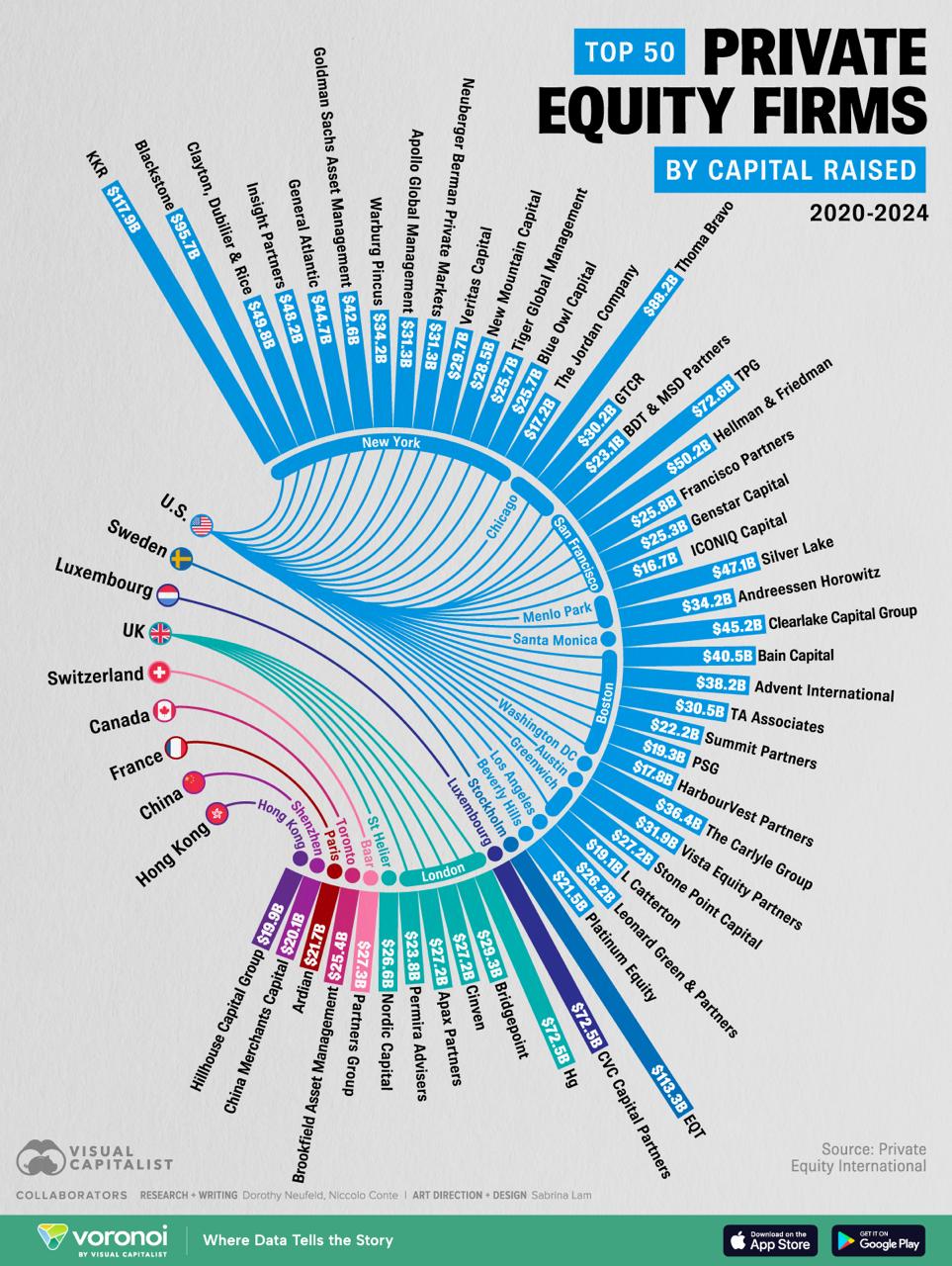

The world’s 300 largest private investment firms have collectively raised a staggering $3.3 trillion over the past five years, cementing their dominance in global finance. However, the industry is becoming increasingly concentrated, with the top six players capturing 60% of all funds raised in the first nine months of 2024. As of July 2025, New York-based KKR has emerged as the world’s leading private investment firm, showcasing remarkable growth and strategic focus. Here’s a breakdown of the key players and trends shaping this dynamic sector.

KKR Takes the Crown

KKR has solidified its position as the largest private investment firm globally, raising an impressive $117.9 billion over the last five years. Managing assets worth $620 billion across a portfolio of 284 companies, KKR is aggressively targeting opportunities in North America and Asia. A recent highlight is its acquisition of a 12% stake in Henry Schein, a major medical supplies provider, signaling its intent to deepen its footprint in healthcare. This move underscores KKR’s strategy of leveraging its vast capital to secure high-growth stakes in resilient sectors.

EQT Climbs to Second Place

Sweden’s EQT has risen to second place, amassing $113.3 billion over the past five years. The firm hit a record high in 2024, with exits surging 72%, driven by standout deals such as the IPO of Galderma and the sale of data center provider EdgeConneX. This performance reflects EQT’s knack for timing lucrative exits, bolstering its reputation as a nimble player in the private investment space.

Blackstone Slips to Third

Blackstone, a global titan and one of the largest owners of commercial real estate, has slipped to third place after raising $95.7 billion in the past five years. Despite the dip, the firm remains a powerhouse, recently investing $300 million in AI platform DDN. This move highlights Blackstone’s pivot toward technology-driven growth, even as it navigates challenges in the real estate market as of 10:37 AM CEST on July 19, 2025.

Also read:

Also read:

- Discover a Massive Library of Cheat Sheets for Every Need: Study, Coding, Design, Business, Marketing, Languages, and Even Gaming

- Using Shelf Companies for Real Estate Investments

- Animate ANY Data in Minutes: Dora Turns Boring Numbers into Wow-Worthy Presentations

Industry Concentration and Future Outlook

The concentration of capital among the top six firms — KKR, EQT, Blackstone, and others—signals a maturing industry where scale and expertise are king. The $3.3 trillion raised over five years underscores the sector’s resilience, even amid global economic shifts.

For investors, this trend suggests opportunities lie in backing established giants with proven track records, though niche players may still carve out space through specialized strategies. As KKR, EQT, and Blackstone continue to innovate — whether through healthcare acquisitions, tech investments, or real estate pivots—the private investment landscape is poised for further evolution in the coming years.

Author: Slava Vasipenok

Founder and CEO of QUASA (quasa.io) - Daily insights on Web3, AI, Crypto, and Freelance. Stay updated on finance, technology trends, and creator tools - with sources and real value.

Innovative entrepreneur with over 20 years of experience in IT, fintech, and blockchain. Specializes in decentralized solutions for freelancing, helping to overcome the barriers of traditional finance, especially in developing regions.

This is not financial or investment advice. Always do your own research (DYOR).