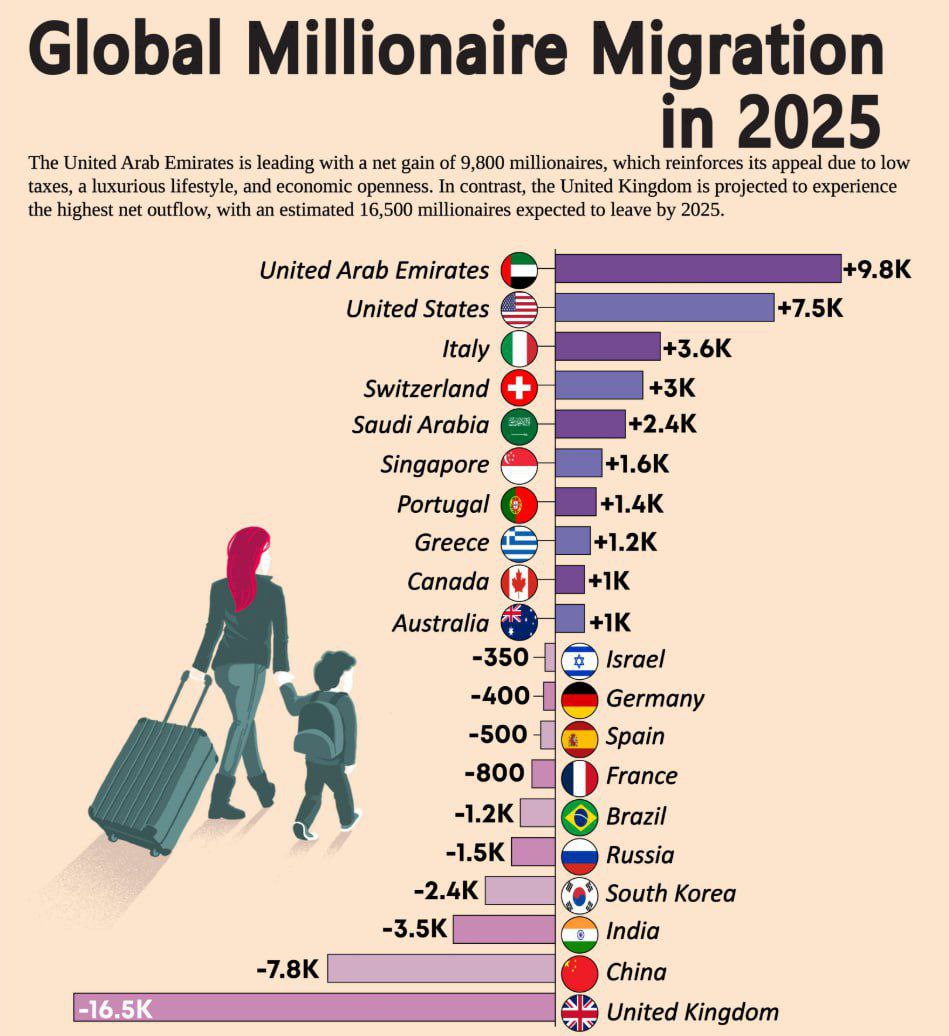

The global migration of millionaires has reached an all-time high, with an estimated 142,000 wealthy individuals relocating to new countries in 2025 — a 16% increase from the previous year.

This surge underscores a dramatic shift in the movement of private wealth, reshaping economic landscapes worldwide. Among the standout destinations, the United Arab Emirates (UAE) has emerged as a leading magnet, attracting 9,800 millionaires. This influx signals the country’s rise as a global financial hub, bolstered by the arrival of new residents bringing a collective $63 billion in investment capital.

UAE: A New Financial Powerhouse

The UAE’s appeal lies in its strategic policies, including zero income tax, world-class infrastructure, and political stability, drawing high-net-worth individuals (HNWIs) seeking both opportunity and security. The country’s Golden Visa program, expanded in recent years, has further fueled this trend, offering long-term residency options that cater to affluent investors.

The UAE’s appeal lies in its strategic policies, including zero income tax, world-class infrastructure, and political stability, drawing high-net-worth individuals (HNWIs) seeking both opportunity and security. The country’s Golden Visa program, expanded in recent years, has further fueled this trend, offering long-term residency options that cater to affluent investors.

With $63 billion in investable wealth flowing in, the UAE is cementing its status as a go-to destination for the global elite, challenging traditional financial centers like London and New York.

UK Faces Historic Wealth Outflow

In stark contrast, the United Kingdom is experiencing the largest single-year exodus of millionaires ever recorded, with a projected net loss of 16,500 HNWIs in 2025. This figure nearly doubles the outflow from China, which ranks second with an estimated 7,800 departures.

The UK’s decline reflects a combination of factors, including post-Brexit uncertainty, changes to tax policies like the non-domicile regime, and a less welcoming climate for foreign capital. Once a net importer of millionaires, the UK now serves as a cautionary tale of how policy shifts can reverse decades of wealth attraction.

Also read:

- Stripe Partners with Paradigm to Launch “Tempo” Blockchain for Next-Gen Payments

- Roblox Content on YouTube Surpasses One Trillion Views: YouTube Throws a Block Party with Top Influencers

- Instagram Launches Location-Sharing Maps, Inspired by Snapchat

A Shifting Global Landscape

This unprecedented migration highlights a broader trend of wealthy individuals seeking jurisdictions that offer tax advantages, lifestyle benefits, and stability amid global uncertainties. While the UAE’s success showcases the power of targeted immigration policies, the UK’s losses raise questions about the long-term impact on its economy and tax base.

This unprecedented migration highlights a broader trend of wealthy individuals seeking jurisdictions that offer tax advantages, lifestyle benefits, and stability amid global uncertainties. While the UAE’s success showcases the power of targeted immigration policies, the UK’s losses raise questions about the long-term impact on its economy and tax base.

With 142,000 millionaires on the move in 2025 alone, the redistribution of wealth is poised to influence investment patterns, real estate markets, and geopolitical dynamics for years to come.

As of 05:31 PM CEST on August 12, 2025, these trends are drawing attention from policymakers and investors alike, with the full implications still unfolding. The migration of such significant capital suggests a redefinition of global economic influence, where adaptability and innovation could determine the winners and losers in this new era of wealth mobility.

Author: Slava Vasipenok

Founder and CEO of QUASA (quasa.io) - Daily insights on Web3, AI, Crypto, and Freelance. Stay updated on finance, technology trends, and creator tools - with sources and real value.

Innovative entrepreneur with over 20 years of experience in IT, fintech, and blockchain. Specializes in decentralized solutions for freelancing, helping to overcome the barriers of traditional finance, especially in developing regions.

This is not financial or investment advice. Always do your own research (DYOR).