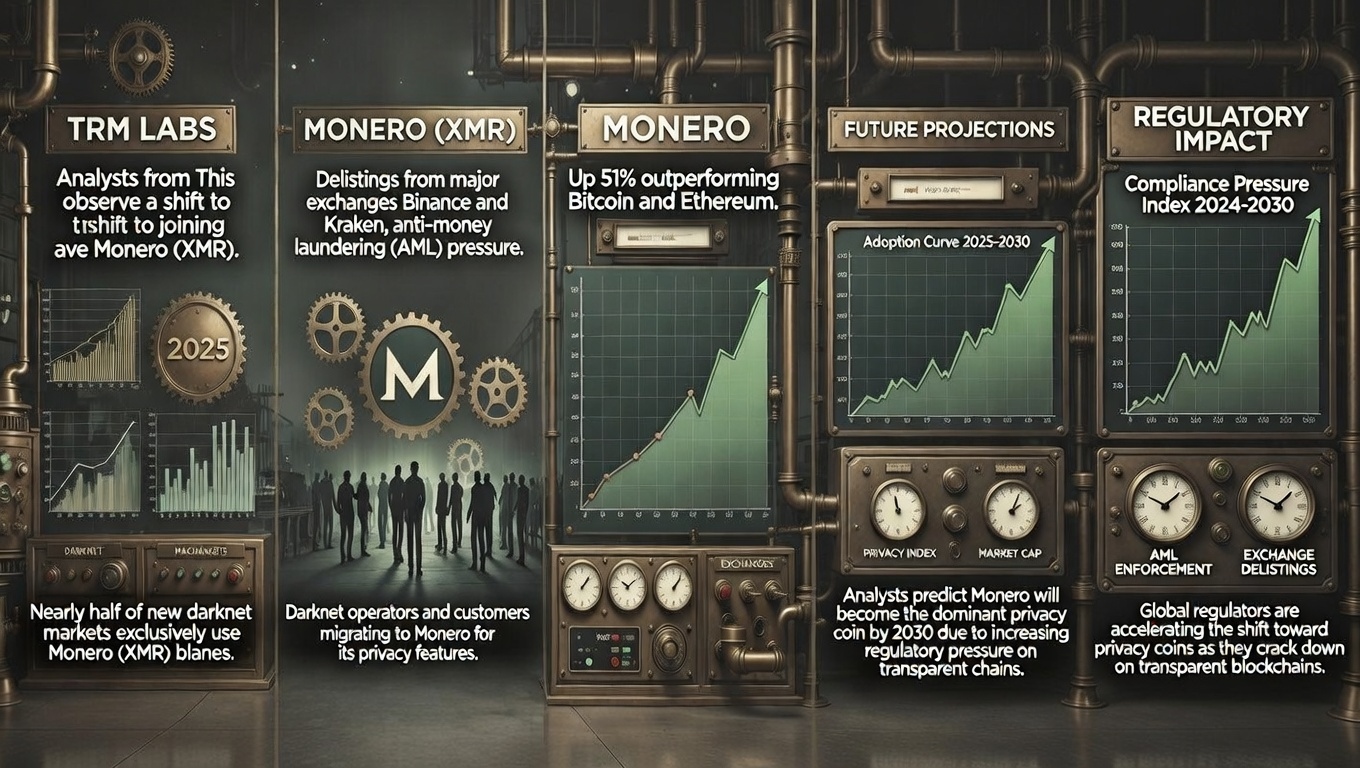

Monero is rapidly becoming the de facto monopoly in the darknet economy. According to analysts at blockchain intelligence firm TRM Labs, a clear structural shift occurred in 2025: nearly half (48%) of all newly launched darknet markets supported exclusively Monero (XMR)* as the payment method. This marks a significant increase compared to previous years and signals that privacy-focused cryptocurrency has effectively pushed out most competitors in the highest-risk segments of the underground web.

Mass Delistings as the Main Catalyst

The primary driver behind Monero's dominance is the wave of delistings from major centralized exchanges.

The primary driver behind Monero's dominance is the wave of delistings from major centralized exchanges.

Over recent years — and especially accelerating in 2024–2025 — platforms such as Binance, Kraken, and others have removed XMR trading pairs due to regulatory pressure concerning anti-money laundering (AML) rules and concerns over traceability.

Paradoxically, these restrictions have strengthened Monero's position in the darknet rather than weakened it:

- Transparent assets (Bitcoin, stablecoins like USDT, Ethereum) have become significantly easier to track using modern blockchain analytics tools.

- Darknet operators and their customers, seeking to minimize the risk of deanonymization and seizure of funds, have logically migrated to the cryptocurrency that — by design — hides sender, receiver, and amount by default.

- After delistings, liquidity and trading volume for XMR simply migrated to decentralized exchanges (DEX), P2P platforms, and atomic swaps, where regulatory pressure is much lower.

As a result, new darknet marketplaces increasingly launch as "Monero-only" from day one, avoiding the technical and security risks associated with supporting multiple currencies.

Monero's Price Performance Amid the Trend

Despite (or perhaps partly because of) the narrative around its "criminal" use, Monero has shown strong price dynamics. Over the past year (from mid-February 2025 to mid-February 2026), XMR has gained approximately 51%, noticeably outperforming both Bitcoin and Ethereum during the same period.

Despite (or perhaps partly because of) the narrative around its "criminal" use, Monero has shown strong price dynamics. Over the past year (from mid-February 2025 to mid-February 2026), XMR has gained approximately 51%, noticeably outperforming both Bitcoin and Ethereum during the same period.

While major cryptocurrencies experienced corrections after the 2024–2025 bull run peaks, Monero demonstrated relative resilience. This growth was supported by steady demand from privacy-conscious users (both legitimate and illicit), as well as periodic large inflows connected to high-profile incidents (for example, hackers converting stolen funds into XMR).

The Core Philosophy vs. Growing Pressure

The Monero development team has consistently emphasized that the project's goal is not to serve criminals, but to protect financial privacy as a fundamental human right. In their view, Monero recreates the properties of physical cash in the digital world — something that Bitcoin and most other cryptocurrencies have lost due to public ledgers.

"Monero exists to allow people to transact privately without needing permission from banks, governments, or corporations," project contributors often state in official communications.

"Monero exists to allow people to transact privately without needing permission from banks, governments, or corporations," project contributors often state in official communications.

Nevertheless, the growing monopoly in the darknet inevitably attracts attention from regulators and law enforcement.

Experts increasingly discuss the possibility of:

- Further exchange delistings and restrictions on on-ramps/off-ramps.

- Attempts to classify Monero as a "high-risk" asset at the legislative level.

- Increased funding for research into potential traceability weaknesses (though so far, Monero's privacy mechanisms remain among the strongest in the industry).

Also read:

- TON Wallet Launches Cross-Chain Deposits in Telegram: Simplifying Crypto Funding Across Blockchains

- Quasa Connect Joins the Global Top 10%: A Triumph of Organic Growth

- Top 5 AI Opportunities This Week from Quasa

Is a True Monopoly Inevitable?

While Monero has become the clear leader among privacy coins on the darknet in 2025–2026, calling it an absolute monopoly would be premature. Some longstanding markets still accept Bitcoin or Litecoin in parallel, and certain niches (especially those tied to ransomware or state-linked actors) continue to prefer stablecoins.

While Monero has become the clear leader among privacy coins on the darknet in 2025–2026, calling it an absolute monopoly would be premature. Some longstanding markets still accept Bitcoin or Litecoin in parallel, and certain niches (especially those tied to ransomware or state-linked actors) continue to prefer stablecoins.

However, the vector is unambiguous: the more successful blockchain analytics become against transparent chains, the stronger the incentive for darknet participants to choose the asset that offers the highest level of privacy by default.

Monero's current trajectory illustrates a classic regulatory paradox — attempts to restrict a privacy tool in the name of fighting crime often lead to its even deeper entrenchment in exactly those environments it was intended to suppress. Whether this trend will continue into 2026–2027, or whether new technical/regulatory countermeasures emerge, remains one of the most intriguing questions in the crypto space today.