The GenAI boom is no longer a localized "gold rush" — it is an industrial-scale transformation. To track this, CB Insights has launched its GenAI Signal Tracker, an interactive dashboard that provides a real-time pulse of the industry. For anyone trying to navigate the noise, this dashboard is the "command center" for the generative revolution.

In late 2025, the data suggests that while the hype has cooled into reality, the capital commitment has only intensified.

1. The Numbers: $145 Billion and Counting

The sheer scale of investment in 2025 is staggering. Despite fears of a "bubble," the financial commitment to GenAI infrastructure and applications remains vertical.

- Total Equity Funding (2025 YTD): $145.1 billion (+127% YoY).

- Total Deals: 1,354 (+14% YoY).

- Unicorn Count: There are now 123 GenAI unicorns globally, making it the fastest-growing sector for billion-dollar valuations in history.

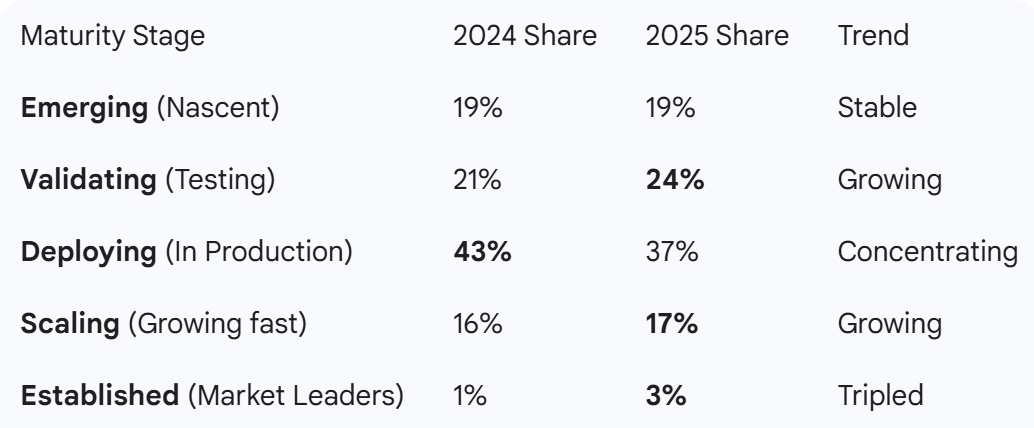

2. Commercial Maturity: The Shift to "Deploying"

CB Insights uses a Commercial Maturity breakdown to show how close these startups are to actual revenue and market stability. Comparing 2024 to late 2025 shows a clear "upward migration":

The increase in "Established" and "Validating" companies suggests the market is maturing. We are moving away from purely experimental "Deploying" phases into companies that have either found a solid product-market fit or are in the process of proving it.

3. The Mosaic Score: Who has the Most Momentum?

The Mosaic Score is CB Insights' proprietary metric that measures a private company’s health, growth potential, and management strength. Looking at the Top GenAI Verticals by Average Mosaic, we see where the highest quality companies are emerging:

The Mosaic Score is CB Insights' proprietary metric that measures a private company’s health, growth potential, and management strength. Looking at the Top GenAI Verticals by Average Mosaic, we see where the highest quality companies are emerging:

- Image Model Developers (Score: 832): Still the most robust sector as visual AI reaches professional creative standards.

- Defense & National Security Copilots (Score: 815): A massive jump in 2025 as sovereign AI and battlefield tech become top priorities for governments.

- Model Deployment & Serving (Score: 806): The "pick and shovel" companies that help enterprises actually run these massive models efficiently.

4. The Investor Power Rankings

The dashboard also tracks who is funding this future. The rankings reveal a mix of established VC giants and strategic corporate arms.

The dashboard also tracks who is funding this future. The rankings reveal a mix of established VC giants and strategic corporate arms.

Top Investors (Last 12 Months):

- Y Combinator: The undisputed factory for early-stage AI talent.

- General Catalyst: Aggressively betting on the Series A/B "middle class."

- a16z (Andreessen Horowitz): Continues its "Software is Eating the World" mission with an AI-first lens.

The "Weekly" Hot List:

Currently, NVentures (Nvidia’s venture arm) is moving the needle most aggressively, alongside Lightspeed Venture Partners, signaling a massive push toward hardware-aware software startups.

5 Fast Facts from the Tracker

- OpenAI's Dominance: Even with dozens of new unicorns, OpenAI still commands the largest share of total funding, recently hitting a $500 billion valuation in secondary markets.

- The "Agentic" Era: Over 21% of the most innovative AI companies (the AI 100) are now focused on AI Agents — systems that don't just chat, but actually execute tasks.

- Security is Table Stakes: 46% of enterprise leaders cite security as the biggest barrier to adoption, leading to a surge in funding for "AI Observability" and "LLM Firewalls."

- Synthetic Data Demand: As the internet "runs out" of human-made data, startups focusing on Synthetic Data Generation are seeing 30%+ higher Mosaic scores than general app developers.

- M&A Heat: Established players like Salesforce and Microsoft are on an acquisition tear, buying up "Scaling" startups to prevent them from becoming competitors.

Also read:

Also read:

- The "Normal" Business Apocalypse: Why AI’s Biggest Impact is in Boring Industries

- The End of the "Gig" Economy: Why Robots, Not Humanoids, are Replacing Your Courier

- The Holodeck in Your Browser: Tencent’s HY World 1.5 and the Dawn of Real-Time Generative Worlds

Author: Slava Vasipenok

Founder and CEO of QUASA (quasa.io) - Daily insights on Web3, AI, Crypto, and Freelance. Stay updated on finance, technology trends, and creator tools - with sources and real value.

Innovative entrepreneur with over 20 years of experience in IT, fintech, and blockchain. Specializes in decentralized solutions for freelancing, helping to overcome the barriers of traditional finance, especially in developing regions.