In the ever-volatile world of cryptocurrency, Ethereum (ETH) is scripting a narrative of scarcity that could redefine market dynamics. As of December 9, 2025, ETH reserves on centralized exchanges have dwindled to just 8.7% of the total circulating supply - translating to roughly 10.5 million ETH out of 120.7 million in circulation.

This marks the lowest level since mid-2015, eclipsing even the depths of previous bear markets and signaling a profound shift in investor behavior. With single-day outflows peaking at 400,000 ETH in recent weeks, the network's lifeblood is being siphoned away faster than ever, potentially setting the stage for a supply-demand imbalance that history has shown can propel prices skyward.

This marks the lowest level since mid-2015, eclipsing even the depths of previous bear markets and signaling a profound shift in investor behavior. With single-day outflows peaking at 400,000 ETH in recent weeks, the network's lifeblood is being siphoned away faster than ever, potentially setting the stage for a supply-demand imbalance that history has shown can propel prices skyward.

This isn't mere speculation; on-chain data from CryptoQuant paints a stark picture. Since July 2025, exchange reserves have eroded by a staggering 43%, driven by a surge in staking participation and a pivot to self-custody solutions. Today, over 36 million ETH—nearly 30% of the supply—is locked in staking contracts, yielding steady returns for holders while bolstering network security.

Add to that the explosive growth of tokenized real-world assets (RWAs) on Ethereum, which ballooned to $11.5 billion in 2025 from $1.5 billion a year prior—a 680% leap - and it's clear why institutions are hoarding rather than trading. BlackRock's BUIDL fund alone commands $2.4 billion in tokenized assets, underscoring Ethereum's unchallenged 56% dominance in this burgeoning sector.

The Fusaka Catalyst: Upgrades Fueling the Exodus

Ethereum's recent Fusaka upgrade, activated on December 3, 2025, has supercharged this trend. By introducing PeerDAS (Peer Data Availability Sampling), Fusaka slashes Layer 2 costs by up to 8x, enabling rollups like Optimism and Arbitrum to handle unprecedented throughput.

Ethereum's recent Fusaka upgrade, activated on December 3, 2025, has supercharged this trend. By introducing PeerDAS (Peer Data Availability Sampling), Fusaka slashes Layer 2 costs by up to 8x, enabling rollups like Optimism and Arbitrum to handle unprecedented throughput.

Post-upgrade, reserves dipped further to 16.8 million ETH in early readings, but the real-time figure of 10.5 million reflects accelerated withdrawals as developers and users flock to cheaper, scalable operations. Staking inflows, meanwhile, have locked away another 73,000 ETH in the past 30 days, with validator counts climbing to 927,966.

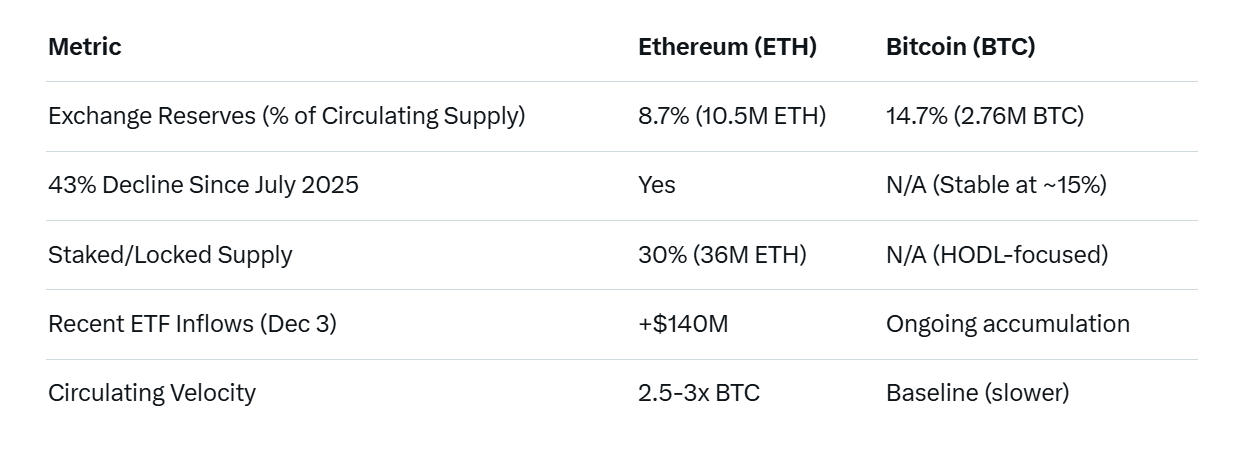

Contrast this with Bitcoin, where exchange reserves hover at a comparatively cushy 14.7% - or about 2.76 million BTC out of 19.96 million circulating. BTC's "digital gold" status lends it a slower circulation velocity, with 61% of supply unmoved for over a year.

Ethereum, ever the workhorse for DeFi and smart contracts, circulates 2.5-3x faster, amplifying the impact of its reserve drain. While BTC ETFs have amassed 1 million coins, ETH spot ETFs saw a rebound with $140 million in inflows on December 3 alone, led by BlackRock ($53 million) and Fidelity ($34 million)—a stark reversal from November's $1.4 billion outflows.

This table highlights Ethereum's sharper scarcity profile, positioning it for outsized volatility.

Price Tease: Hovering at $3,000 Amid Hidden Bull Signals

Despite the bullish supply backdrop, ETH's price tells a tale of frustration. Over the last five days (December 4-9, 2025), it has oscillated tightly around $3,000, with intraday swings from $3,075 to $3,220 but failing to breach the $3,200 resistance. As of today, ETH trades at $3,123.38, down 1% in the past 24 hours but up 10.31% over the week - a modest recovery from November's 43% plunge to $2,623 lows. Trading volume sits at $12.75 billion daily, with open interest deleveraging from $63 billion to $39 billion, reflecting caution amid a short-biased futures market (51.6% shorts).

Despite the bullish supply backdrop, ETH's price tells a tale of frustration. Over the last five days (December 4-9, 2025), it has oscillated tightly around $3,000, with intraday swings from $3,075 to $3,220 but failing to breach the $3,200 resistance. As of today, ETH trades at $3,123.38, down 1% in the past 24 hours but up 10.31% over the week - a modest recovery from November's 43% plunge to $2,623 lows. Trading volume sits at $12.75 billion daily, with open interest deleveraging from $63 billion to $39 billion, reflecting caution amid a short-biased futures market (51.6% shorts).

Yet, beneath the surface, signs of latent demand flicker. Whale wallets like 0x7458 added 1,400 ETH, while fresh addresses poured in $920 million. Smart money on platforms like Hyperliquid is net long, with $31.1 million in 20x longs, and institutions like Bitmine (Tom Lee) scooped up 96,798 ETH for $272 million.

Analysts from Black Triangle and beyond note this "hidden demand" as a precursor to upside, especially with EIP-1559 burns outpacing issuance by 80%, rendering ETH deflationary at times.

The broader market sentiment? Pessimistic, with the Fear & Greed Index at 20 (Extreme Fear). But history favors the contrarian: Past reserve lows in 2016 and 2020 preceded rallies of 475% and beyond. If Fusaka's scalability draws more DeFi volume - stablecoin transactions hit $2.82 trillion in October—ETH could eye $3,900 by month-end, per CoinDCX forecasts. Longer-term, targets stretch to $7,000-$9,000 by Q1 2026.

A Market on the Brink: Supply Shock or Stagnation?

Ethereum's reserve rout isn't just a statistic - it's a manifesto for maturation. As staking yields lure holders (currently ~4-5% APY) and upgrades like Fusaka cement its DeFi throne, the path to a "supply squeeze" is paved. Bitcoin's steadier reserves underscore ETH's unique volatility premium, but also its reward potential. With whales accumulating amid the fear, one spark - be it ETF inflows or RWA breakthroughs - could ignite the powder keg.

Ethereum's reserve rout isn't just a statistic - it's a manifesto for maturation. As staking yields lure holders (currently ~4-5% APY) and upgrades like Fusaka cement its DeFi throne, the path to a "supply squeeze" is paved. Bitcoin's steadier reserves underscore ETH's unique volatility premium, but also its reward potential. With whales accumulating amid the fear, one spark - be it ETF inflows or RWA breakthroughs - could ignite the powder keg.

For traders, the $2,800-$2,960 support is sacrosanct; a break invites $1,500 chaos. But for the patient, this 8.7% low whispers of abundance in disguise. Ethereum isn't vanishing - it's evolving, and those who stake their claim now may reap the harvest of scarcity. In crypto's grand theater, the curtain's rising on Act II.

Also read:

- QUA Сrypto Buyback - December 2025

- Why Seattle’s Food Entrepreneurs Choose Custom Trailers: Reliable Builds, Smart Layouts, and Full Licensing Support

- Why You Should Benchmark Your R&D Spending Against Industry Peers

Author: Slava Vasipenok

Founder and CEO of QUASA (quasa.io) - Daily insights on Web3, AI, Crypto, and Freelance. Stay updated on finance, technology trends, and creator tools - with sources and real value.

Innovative entrepreneur with over 20 years of experience in IT, fintech, and blockchain. Specializes in decentralized solutions for freelancing, helping to overcome the barriers of traditional finance, especially in developing regions.

This is not financial or investment advice. Always do your own research (DYOR).