Well, I just sold my Bored Ape #3707, for $37,000. I bought it once for $425,000. That’s nearly a $400,000 loss, and honestly, I feel like I deserved it.

These are the opening words of a tweet from a crypto enthusiast who bought into the hype, the community, the promises, and the so-called “future of the internet.” But what’s the story behind this bitter farewell?

These are the opening words of a tweet from a crypto enthusiast who bought into the hype, the community, the promises, and the so-called “future of the internet.” But what’s the story behind this bitter farewell?

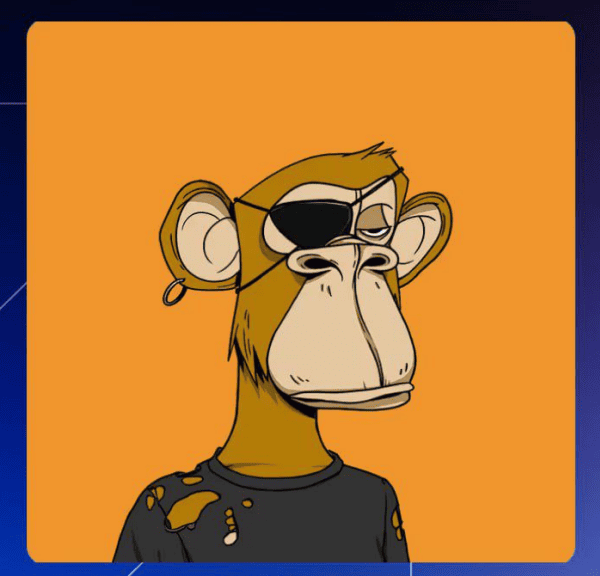

Three years ago, Ryder, a digital artist with a penchant for bold moves, purchased one of the most coveted Bored Ape Yacht Club (BAYC) NFTs, a collection that had skyrocketed to fame. Back then, his Ape #3707 carried a price tag of $425,000 — enough to buy a decent house in New Jersey.

It wasn’t just a JPEG to him; it was a cultural artifact, a status symbol, and a gateway to an exclusive digital club. The Bored Ape craze was at its peak, with collectors and influencers touting the NFTs as the next big thing in the crypto revolution.

But the end of this saga came with a stark realization and a decision to sell. Here’s how Ryder described it: “I was sitting in a diner with three grown men in faded BAYC hoodies, staring at a phone playing some boring nonsense none of us cared about.

One guy showed off his latest gem — a Polygon frog with laser eyes he swore was ‘the next BAYC.’ He’d bought 7,000 of them. They’re worth $19 now. Another guy went into detail about why his girlfriend ‘doesn’t get NFTs’ and actually lives in a different apartment. That was the moment I knew it was over.”

This personal anecdote isn’t just a tale of one man’s financial misstep — it’s a microcosm of a shifting market. The glory days of hoarding monkey JPEGs with the hope of striking it rich are fading. The NFT space, once dominated by profile picture (PFP) collections like BAYC, is evolving.

This personal anecdote isn’t just a tale of one man’s financial misstep — it’s a microcosm of a shifting market. The glory days of hoarding monkey JPEGs with the hope of striking it rich are fading. The NFT space, once dominated by profile picture (PFP) collections like BAYC, is evolving.

The transaction history of Ape #3707 tells the story: purchased for $222 four years ago, flipped for $4,713 the next year, then soared to $425,513 three years ago, only to crash to $37,157 in its latest sale. The market has moved on, and those who clung to the old narrative paid the price.

Also read:

- Atlas of Vulnerable Worlds: Renting Memories in the Age of Loneliness

- Could a Life Expectancy Rating App Reshape Society?

- The Tale of a Criminal Mastermind: The Elizabeth Holmes Story

So, what’s the takeaway from this cautionary tale? The crypto and NFT landscape is no longer about holding onto a single asset with blind faith. It’s about constant change, new trends, and the ability to adapt. The winners are the swift — those who learn, experiment, and seek out fresh opportunities. Easy money hasn’t vanished; it’s just scattered across the sprawling corners of the crypto world, from gaming assets to tokenized real-world items.

Ryder’s experience serves as a stark reminder: don’t trust the apes — or any hype — without keeping your eyes on the horizon. The “future of the internet” might still be out there, but it’s not waiting for you in a faded hoodie at a diner. It’s time to evolve or get left behind.

Author: Slava Vasipenok

Founder and CEO of QUASA (quasa.io) - Daily insights on Web3, AI, Crypto, and Freelance. Stay updated on finance, technology trends, and creator tools - with sources and real value.

Innovative entrepreneur with over 20 years of experience in IT, fintech, and blockchain. Specializes in decentralized solutions for freelancing, helping to overcome the barriers of traditional finance, especially in developing regions.

This is not financial or investment advice. Always do your own research (DYOR).