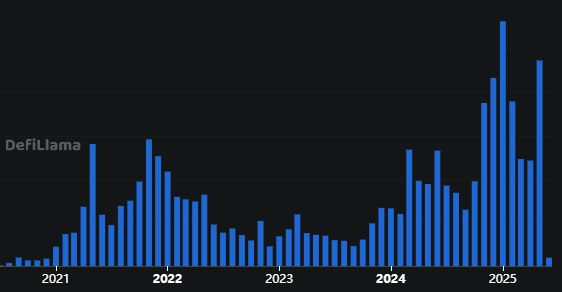

In May 2025, decentralized exchanges (DEXs) recorded a staggering $474.14 billion in total trading volume, securing the second-highest monthly figure in their history. This surge underscores the growing adoption and resilience of decentralized finance (DeFi) platforms, as users increasingly turn to trustless, blockchain-based trading solutions.

Breaking down the numbers by blockchain, BNB Chain led the pack with an impressive $178.23 billion in trading volume, solidifying its position as a dominant force in the DeFi ecosystem.

Breaking down the numbers by blockchain, BNB Chain led the pack with an impressive $178.23 billion in trading volume, solidifying its position as a dominant force in the DeFi ecosystem.

Within BNB Chain, PancakeSwap emerged as the standout performer, outpacing its closest rival, Uniswap. PancakeSwap recorded a remarkable $171.6 billion in trading volume, significantly surpassing Uniswap’s $92.1 billion.

PancakeSwap’s dominance highlights the efficiency and appeal of BNB Chain’s low-cost, high-speed infrastructure, which continues to attract both retail and institutional traders.

While Uniswap remains a cornerstone of the Ethereum-based DeFi landscape, PancakeSwap’s performance signals a shift in market dynamics, with BNB Chain capturing a larger share of the DEX trading market.

Also read:

Also read:

- QUASA Report: The State of the Cryptocurrency Market (April 2025) – Part 2: Rated Projects and the Illusion of Trust

- Crypto Liquidity Vanished: 90% Fake Trading Across Exchanges, 95% Useless or Scam Projects—Reckoning Looms

- Lost Fortunes in Crypto Crashes: Money Laundering, Scams, Collusion, and a Horde of Fraudsters

This milestone reflects the broader maturation of DeFi, as decentralized exchanges continue to challenge traditional finance by offering transparent, accessible, and efficient trading platforms.

As the sector evolves, the competition between leading DEXs like PancakeSwap and Uniswap will likely drive further innovation, benefiting users worldwide.

Author: Slava Vasipenok

Founder and CEO of QUASA (quasa.io) - Daily insights on Web3, AI, Crypto, and Freelance. Stay updated on finance, technology trends, and creator tools - with sources and real value.

Innovative entrepreneur with over 20 years of experience in IT, fintech, and blockchain. Specializes in decentralized solutions for freelancing, helping to overcome the barriers of traditional finance, especially in developing regions.

This is not financial or investment advice. Always do your own research (DYOR).