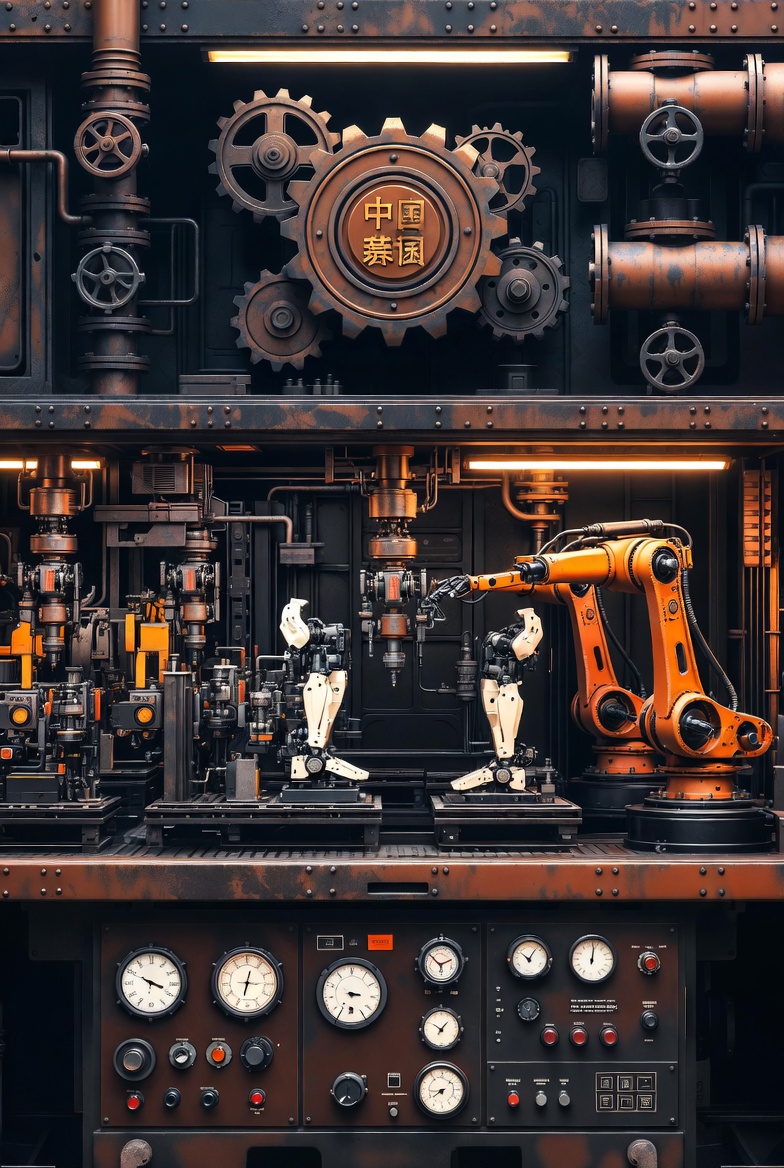

In a milestone for the burgeoning humanoid robotics industry, Chinese firm Eyou Robot Technology has unveiled the world's first automated production line dedicated to manufacturing joints for humanoid robots. Located in Shanghai's Pudong district, this facility marks a pivotal step toward scaling up production and addressing long-standing bottlenecks in the sector.

As global demand for advanced robotics surges, Eyou's initiative could catalyze a more standardized, cost-effective supply chain — potentially deflating fears of an overhyped "bubble" in China's robot market and transforming experimental prototypes into everyday realities.

The Launch: From Prototypes to Production Scale

Eyou's new line, operational since last Wednesday, boasts an initial annual capacity of 100,000 units, with the potential to triple output as demand ramps up. These joints — critical components that enable fluid movement in humanoid robots — represent nearly half the total cost of such machines, making efficient production a game-changer.

Eyou's new line, operational since last Wednesday, boasts an initial annual capacity of 100,000 units, with the potential to triple output as demand ramps up. These joints — critical components that enable fluid movement in humanoid robots — represent nearly half the total cost of such machines, making efficient production a game-changer.

The company, which relocated to Shanghai's Zhangjiang Robot Valley, secured a 50 million yuan (US$7.2 million) Series A funding round in March 2025, co-led by Pudong Venture Capital Group and Shanghai Zhangjiang Science and Technology Investment Corporation, with additional backing from TCL Venture Capital and others.

Already a key supplier to domestic players like AgiBot, Eyou delivered over 95,000 joints in 2025 alone — a figure that underscores its growing footprint. Globally, humanoid robot installations reached 16,000 units in 2025, with China accounting for over 80% of them, according to Counterpoint Research. Top Chinese firms like AgiBot (5,200 units) and Unitree Robotics (4,200 units) dominated shipments, far outpacing Western counterparts such as Tesla, which captured less than 5% of the market.

This launch aligns with projections of explosive growth: Industry analysts forecast over 100,000 humanoid robot shipments by 2027, driven by advancements in AI and manufacturing. Eyou's move positions it to capture this surge, leveraging economies of scale to reduce costs and accelerate adoption.

Addressing the Bubble: From Hype to Hard Realities

China's robotics sector has exploded in recent years, with over 140 humanoid robot manufacturers releasing more than 330 models in 2025 alone. Globally, 166 new humanoid robots were launched that year, with Chinese firms contributing 127 — or about 75% — establishing a clear scale advantage through complete supply chains and dense application scenarios. However, this proliferation has sparked concerns about an impending bubble. With a zoo of startups and prototypes — over 100,000 in some estimates — the industry risks overhyping without widespread real-world adoption or viable use cases.

Chinese authorities and analysts have voiced worries that without standardization, the market could falter. Many components are still produced in small batches or custom orders, inflating costs by 2-3 times compared to mature industries like automotive or smartphones. This lack of scale hinders broad deployment, limiting robots to niche experiments rather than mass utility.

The Supply Chain Revolution: Building Blocks for the Future

Eyou's automated line is a harbinger of change, fostering a more mature supply chain. By mass-producing joints, the company addresses a key "narrow neck" in humanoid robotics, where low standardization has stifled progress. As supply chains deepen, expect similar scaling for actuators, controllers, force sensors, and balancing modules — creating Tier-1 and Tier-2 suppliers akin to those in autos or electronics.

This evolution complements bubble concerns: The industry will consolidate, with inefficient startups folding while efficient leaders emerge. In 2025, considered the "first year of mass production," firms like UBTECH, Unitree, and AgiBot transitioned from prototypes to small-batch deliveries. By 2026, costs could drop to 200,000-300,000 RMB per unit, driven by localized components and supply chain maturity.

Goldman Sachs anticipates 2026 as a pivotal year, with volume verification and market share shifts. Shipments may multiply, from hundreds to tens of thousands, as chains optimize and applications expand. Globally, humanoid robots are projected to hold 0.2% of the $8.8 billion robot market in 2025, rising to 0.8% in 2026.

China's Strategy: From Chaos to Champions

True to form, China is orchestrating this transformation. Initially fostering a diverse "zoo" of innovations, the government now prunes underperformers while elevating winners as "national champions" through credits, standards, and state orders.

True to form, China is orchestrating this transformation. Initially fostering a diverse "zoo" of innovations, the government now prunes underperformers while elevating winners as "national champions" through credits, standards, and state orders.

Unlike in smartphones or autos — where China caught up—here it leads from the outset, with policies targeting secure supply chains by 2025 and global dominance by 2027.

Regional hubs like Wuhan's Guanggu district, with 85% supply chain coverage, exemplify this focus.

The Middle East emerges as a "blue ocean" market, boosting global exports and shifting from product to technology and standard exports.

Also read:

- OpenAI Strikes Back: The Receipts Musk Didn’t Want You to See

- The Translation Wars: OpenAI’s Stealth UI vs. Google’s Open-Source Might

- The New Oil is Human: Cloudflare and Wikimedia Pivot to AI Licensing

The Road Ahead: Cheaper Robots, Broader Impact

As supply chains standardize, robots will cheapen, unlocking use cases in manufacturing, healthcare, and beyond. From experimental to mass-market, humanoid robotics could become ubiquitous, mirroring the smartphone revolution — but with China at the helm.

Eyou's launch isn't just about joints; it's about jointing an industry together. In a field ripe for disruption, this could flush away the bubble fears and usher in a robotic golden age.