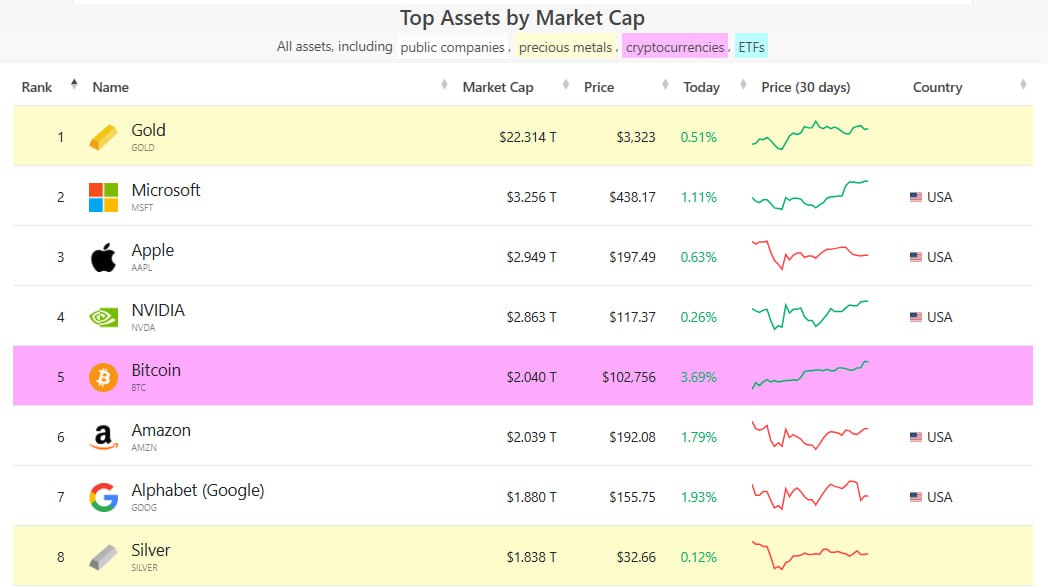

As of May 9, 2025, Bitcoin (BTC) has solidified its position as the world’s fifth-largest asset by market capitalization, overtaking tech giants Google (Alphabet) and Amazon.

With Bitcoin’s price at $102,900 and a circulating supply of approximately 19.7 million coins, its market cap stands at roughly $2.03 trillion. This surpasses Alphabet’s $1.859 trillion and Amazon’s $1.837 trillion, according to CompaniesMarketCap, marking a historic milestone for the cryptocurrency.

A Remarkable Climb

Bitcoin’s ascent to the top five global assets follows a sustained rally, with its price stabilizing around $102,900 after peaking at $108,786 in January 2025. The cryptocurrency has outperformed silver ($1.853 trillion) and tech indices like the Nasdaq, decoupling from its historical correlation with U.S. tech stocks.

This surge has been driven by institutional adoption, macroeconomic shifts, and renewed market optimism, positioning Bitcoin as a formidable competitor to traditional assets.

This surge has been driven by institutional adoption, macroeconomic shifts, and renewed market optimism, positioning Bitcoin as a formidable competitor to traditional assets.

The top four assets by market cap—gold ($22.5 trillion), Apple ($3.00 trillion), Microsoft ($2.72 trillion), and Nvidia ($2.41 trillion) — remain ahead, but Bitcoin’s $2.03 trillion valuation puts it within reach of Nvidia’s $2.41 trillion, sparking speculation about its next target.

Key Drivers of Bitcoin’s Surge

Several factors have fueled Bitcoin’s rise to its current valuation:

Several factors have fueled Bitcoin’s rise to its current valuation:

- Institutional Investment: Corporations and investment firms continue to embrace Bitcoin as a reserve asset. MicroStrategy, a prominent Bitcoin holder, reported over $5.1 billion in profits from its BTC holdings in 2025. The launch of funds like 21 Capital, a $3 billion Bitcoin-focused investment vehicle, underscores growing institutional confidence.

- Macroeconomic Trends: Bitcoin has benefited from capital outflows from U.S. assets amid concerns over the dollar’s declining appeal as a safe-haven investment. Unlike tech stocks, Bitcoin’s immunity to tariffs makes it an attractive high-beta asset for diversified portfolios.

- Policy Optimism: The “Trump bump,” fueled by expectations of pro-cryptocurrency policies following Donald Trump’s re-inauguration in January 2025, has bolstered Bitcoin’s appeal. Easing U.S.-China trade tensions have further supported its rally.

- Market Momentum: Bitcoin’s technical breakout above key resistance levels has validated its bullish trend. Despite a 5–6% dip from its all-time high, its current price of $102,900 reflects strong market support and investor confidence.

Also read:

- Riot Platforms Sells Mined Bitcoin for First Time in 15 Months, Signals Strategic Shift

- At What Bitcoin Level Will Whales Trigger Forced Liquidations?

- It’s Time to Shear the Wool from the Bitcoin Whales

A New Financial Paradigm

Bitcoin’s rise above Google and Amazon highlights its transformation from a speculative asset to a global financial powerhouse. As a decentralized, non-sovereign asset, BTC challenges traditional financial systems and competes with safe-haven assets like silver.

Bitcoin’s rise above Google and Amazon highlights its transformation from a speculative asset to a global financial powerhouse. As a decentralized, non-sovereign asset, BTC challenges traditional financial systems and competes with safe-haven assets like silver.

Industry leaders, such as Cathie Wood of ARK Invest, argue that Bitcoin’s adoption is still in its early stages, with potential to rival gold’s $22.5 trillion market cap in the long term.

The concept of “hyperbitcoinization,” where Bitcoin surpasses fiat currencies as a global medium of exchange, is gaining traction. Adam Back, CEO of Blockstream, suggests Bitcoin’s market value could reach $200 trillion in such a scenario, driven by its fixed supply and growing distrust in fiat systems.

Volatility and Challenges

Despite its gains, Bitcoin remains volatile. Its current price of $102,900 is 5.4% below its January 2025 peak, and analysts warn of potential corrections. CoinCodex projects a possible dip below $100,000 by mid-June 2025, reflecting the speculative nature of the market.

Critics also question Bitcoin’s intrinsic value and long-term stability, though its resilience during economic uncertainty counters these concerns.

Looking Ahead

With a market cap of $2.03 trillion, Bitcoin is closing in on Nvidia’s $2.41 trillion valuation.

With a market cap of $2.03 trillion, Bitcoin is closing in on Nvidia’s $2.41 trillion valuation.

Posts on X reflect growing enthusiasm, with users touting a “Bitcoin supercycle” and celebrating its role as “digital gold.”

As institutional adoption accelerates and macroeconomic conditions favor alternative assets, Bitcoin’s trajectory suggests it could climb higher in the global asset rankings.

Bitcoin’s surpassing of Google and Amazon is a landmark achievement, signaling the rise of decentralized finance. Whether it maintains its fifth-place ranking or challenges the top four assets, Bitcoin’s influence on the global financial system is undeniable.

Sources:

- CompaniesMarketCap, CoinDesk, TradingView, Business Today, Cointelegraph, and posts on X.

- Bitcoin price and supply data based on user-provided price of $102,900 and standard circulating supply estimates.

Author: Slava Vasipenok

Founder and CEO of QUASA (quasa.io) - Daily insights on Web3, AI, Crypto, and Freelance. Stay updated on finance, technology trends, and creator tools - with sources and real value.

Innovative entrepreneur with over 20 years of experience in IT, fintech, and blockchain. Specializes in decentralized solutions for freelancing, helping to overcome the barriers of traditional finance, especially in developing regions.

This is not financial or investment advice. Always do your own research (DYOR).