In a significant move that has caught the attention of the crypto community, Arthur Hayes, the prominent trader and co-founder of 100x, has offloaded 2,373 ETH (worth approximately $8.32 million), 7.76 million ENA tokens ($4.62 million), and nearly 3.9 billion PEPE tokens ($414,700) in recent transactions. The sales, tracked by on-chain analytics from Lookonchain, signal a strategic shift as Hayes navigates a turbulent market landscape.

Rationale Behind the Sell-Off

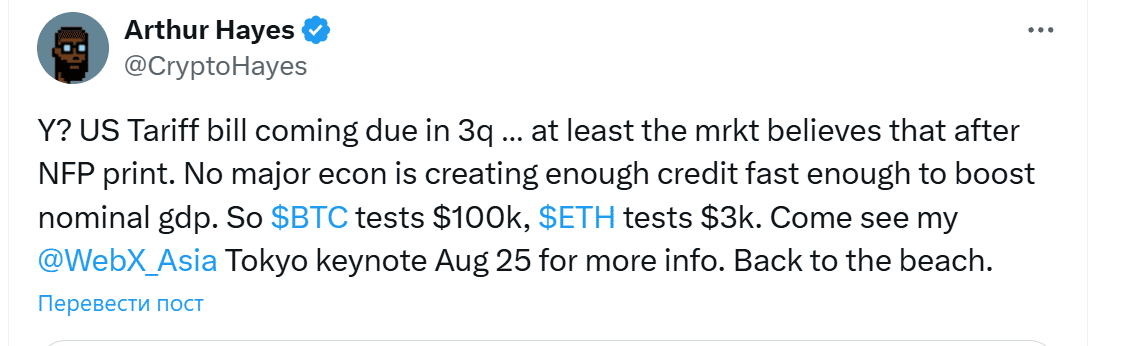

.png) Hayes provided insight into his decision via a post on X, citing weakening economic signals and geopolitical developments as key drivers. He pointed to recent weak employment data and a proposal by former President Donald Trump to introduce new tariffs, suggesting that these factors are exerting increasing pressure on financial markets.

Hayes provided insight into his decision via a post on X, citing weakening economic signals and geopolitical developments as key drivers. He pointed to recent weak employment data and a proposal by former President Donald Trump to introduce new tariffs, suggesting that these factors are exerting increasing pressure on financial markets.

Anticipating a potential downturn, Hayes predicts that Bitcoin could test the $100,000 level, while Ethereum might drop to $3,000. This bearish short-term outlook reflects his assessment of macroeconomic headwinds impacting risk assets.

A Long-Term Optimist

Despite the sell-off, Hayes remains optimistic about the long-term prospects of the crypto market. He frames the current dip as a temporary adjustment, driven by external economic conditions rather than a fundamental flaw in the asset class.

Despite the sell-off, Hayes remains optimistic about the long-term prospects of the crypto market. He frames the current dip as a temporary adjustment, driven by external economic conditions rather than a fundamental flaw in the asset class.

In his view, the pressure from tariff proposals and sluggish job growth—indicators often linked to reduced consumer spending and economic contraction — could create a buying opportunity for those with a longer horizon.

His strategy appears to involve cashing out now to reposition for a potential rebound, a tactic consistent with his history of navigating market cycles.

Market Reactions and Implications

The sales have sparked varied reactions within the crypto community. Some interpret it as a signal to brace for a correction, with traders like @hybridstriker on X suggesting that Hayes’ moves often precede market shifts. Others, however, see it as a calculated move by a seasoned player, with @schizobullpost humorously advising to “buy when Arthur sells.” The timing aligns with broader market uncertainty, as investors digest the implications of U.S. economic policy and its ripple effects on global markets.

Also read:

- X Platform to Integrate AI-Powered Video Generation with "Imagine"

- Pika Labs Launches TikTok-Style Social Network for AI-Generated Videos

- “Best Marvel Movie in Years”: The Fantastic Four Shines as a Masterpiece

- Shoppable Images: What are They and How They can Increase Brand Sales and Trust

Conclusion

Arthur Hayes’ recent liquidation of ETH, ENA, and PEPE underscores his cautious stance amid mounting macroeconomic pressures, including weak employment figures and proposed tariffs. While his short-term forecast points to a potential decline, his long-term optimism suggests confidence in crypto’s resilience. As the market watches closely, Hayes’ actions could serve as a barometer for future trends, reminding investors that even in turbulent times, strategic timing remains key to navigating the volatile world of digital assets.

Author: Slava Vasipenok

Founder and CEO of QUASA (quasa.io) - Daily insights on Web3, AI, Crypto, and Freelance. Stay updated on finance, technology trends, and creator tools - with sources and real value.

Innovative entrepreneur with over 20 years of experience in IT, fintech, and blockchain. Specializes in decentralized solutions for freelancing, helping to overcome the barriers of traditional finance, especially in developing regions.

This is not financial or investment advice. Always do your own research (DYOR).