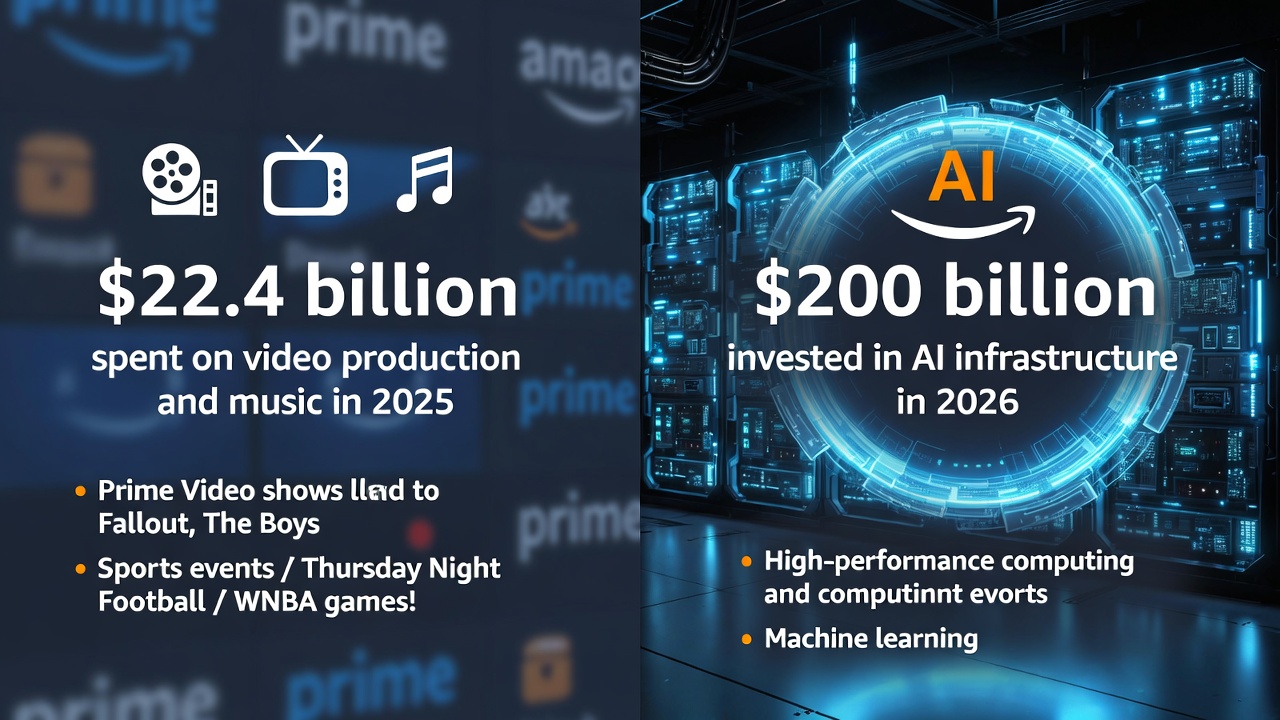

Big Tech rarely opens the books on entertainment spending, but Amazon just gave us a rare peek. In its latest 10-K annual filing (disclosed February 2026), the company revealed it poured $22.4 billion into content across video and music in 2025 — a 10% increase from the previous year's roughly $20.4 billion.

This eye-watering figure covers everything: original productions, licensed films and series, music rights and streaming for Amazon Music, live sports deals (NFL Thursday Night Football, NBA rights share), and even costs tied to digital rentals, subscriptions, and ancillary content. It's not just Prime Video originals like Fallout, Reacher, or The Rings of Power — it's the full entertainment flywheel that keeps Prime members hooked and spending more on e-commerce.

Content as a Prime Membership Booster — Not the Main Profit Driver

For pure-play streamers or traditional media companies, content is often the largest expense and the core value proposition. For Amazon, it's different. The $22.4 billion is a strategic investment in Prime retention and acquisition — content that makes the $139/year (or equivalent) membership feel indispensable. Prime Video alone reportedly reached over 315 million monthly viewers worldwide in 2025, helping drive higher ad revenue (up sharply in recent quarters) and more shopping cart additions.

Comparatively:

Comparatively:

- Netflix spent around $18 billion on content in 2025 (movies, TV, games, podcasts), meaning Amazon outspent it by roughly 25% while serving a broader ecosystem.

- The $22.4 billion also dwarfs many legacy studios' budgets, even as Amazon's content slate mixes high-profile originals with massive sports rights (e.g., $1B+ annually on NFL TNF) and music licensing.

Capitalized content costs (mostly released video and music) stood at $21.3 billion as of December 31, 2025 — up 9% year-over-year — reflecting ongoing heavy investment in assets that deliver value over multiple years.

Meanwhile, the Real 2026 Bet Is on AI — With Capex Jumping ~50% to $200 Billion

While $22.4 billion on entertainment is headline-grabbing, Amazon's bigger story in early 2026 is elsewhere. CEO Andy Jassy confirmed plans to ramp capital expenditures to approximately $200 billion in 2026 — a ~50% increase from 2025's ~$131–132 billion.

While $22.4 billion on entertainment is headline-grabbing, Amazon's bigger story in early 2026 is elsewhere. CEO Andy Jassy confirmed plans to ramp capital expenditures to approximately $200 billion in 2026 — a ~50% increase from 2025's ~$131–132 billion.

The bulk is earmarked for AI infrastructure: data centers, custom chips, compute capacity, robotics, and even low-Earth-orbit satellites.

Jassy emphasized strong demand for AWS AI offerings and expressed confidence in long-term returns, but the sheer scale stunned Wall Street — exceeding expectations by tens of billions and contributing to a sharp post-earnings share drop.

In other words:

- Fallout sequels, Reacher seasons, and NBA games are great for keeping Prime sticky...

- But generative AI, cloud-scale training clusters, and robotics are where Amazon sees the next wave of profit growth.

Content spending will likely stay robust (or grow modestly) to defend Prime's entertainment moat, but the company's capital allocation priorities are shifting hard toward AI dominance alongside Microsoft, Google, and Meta.

Also read:

- OpenAI and Sam Altman Back Merge Labs: A Non-Invasive BCI Startup Challenging Neuralink

- AI Frontier Explodes: Quasa's Top-5 Highlights — Claude 4.6, GPT-5.3-Codex, Kling 3.0 & More

- YouTube Shorts Gets Its Cameo Moment: Google Lets Creators Generate AI Avatars of Themselves

Bottom Line

Amazon's $22.4 billion content splurge in 2025 underscores how seriously it takes entertainment as a loss-leader for Prime loyalty — even as it outspends Netflix and fuels sports/media rights inflation. Yet the real capital tsunami is coming in 2026: $200 billion aimed squarely at winning the AI infrastructure race.

In Amazon's world, blockbuster shows and live games keep customers subscribed today — but massive AI buildout is the bet on tomorrow's profits. The entertainment arms race continues... but the AI capex arms race just went nuclear.