Introduction

In the dynamic landscape of decentralized finance (DeFi), Maverick Protocol has emerged as a significant player, offering advanced liquidity solutions and trading opportunities on Ethereum and zkSync Era.

In the dynamic landscape of decentralized finance (DeFi), Maverick Protocol has emerged as a significant player, offering advanced liquidity solutions and trading opportunities on Ethereum and zkSync Era.

This article explores the process and implications of adding liquidity and listing QuasaCoin (QUA) on Maverick Protocol.

Maverick Protocol is DeFi’s Liquidity Operating System, offering one-stop liquidity solutions for token projects, liquidity providers, and blockchain ecosystems to bootstrap efficient markets with optimized liquidity and reduced budget spending.

The protocol supports four liquidity movement modes:

- Mode Right: For bullish sentiment on an asset.

- Mode Left: For bearish sentiment.

- Mode Both: A combination for mixed expectations.

- Mode Static: For stable or uncertain price scenarios.

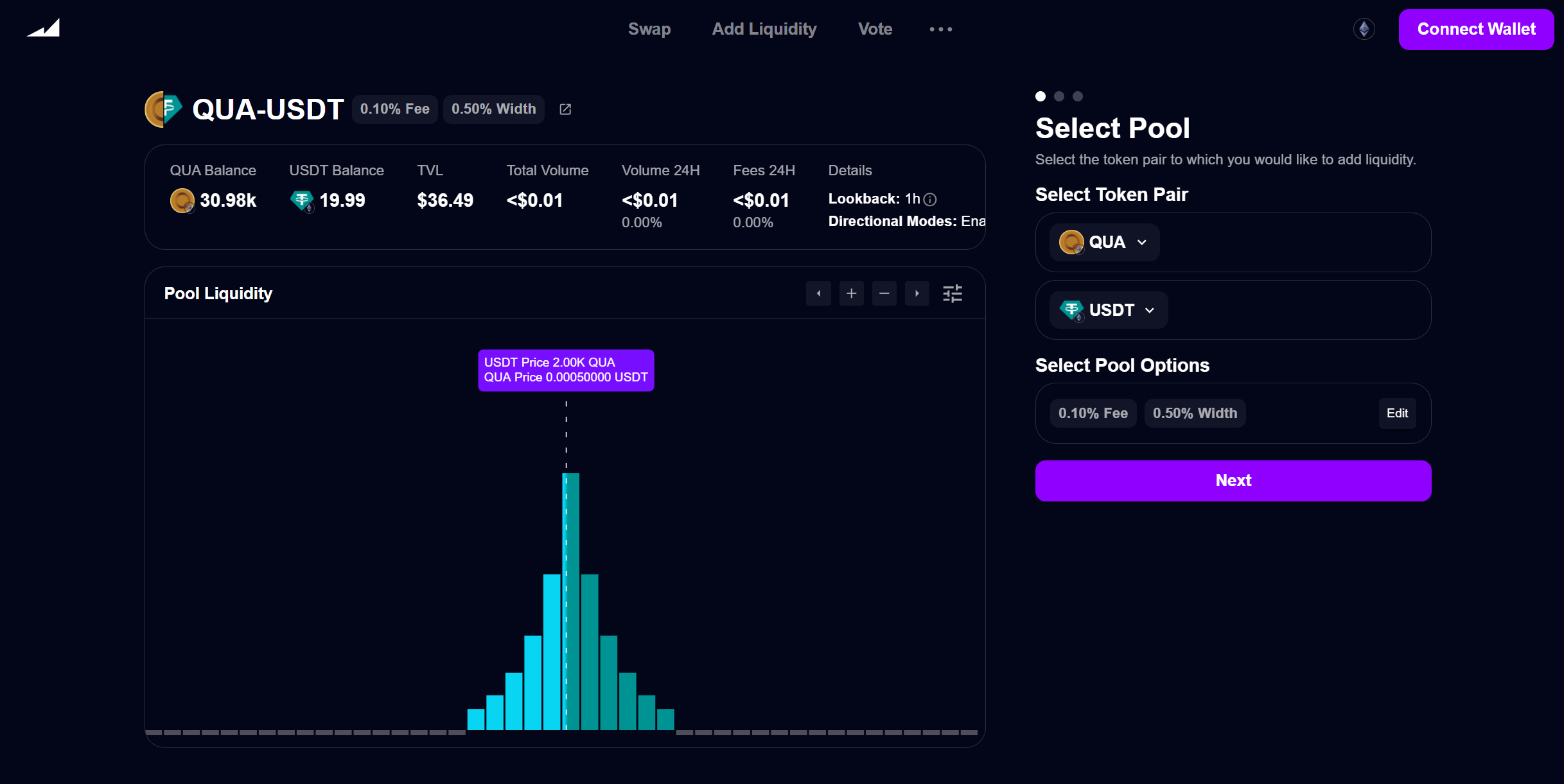

QUA/USDT liquidity pool on Maverick Protocol crypto exchange

QuasaCoin (QUA) Overview

QuasaCoin (QUA) is an ERC-20 token on the Ethereum blockchain, aimed at solving unemployment by connecting freelancers with clients through a decentralized platform known as QUASA Metaverse.

QuasaCoin (QUA) is an ERC-20 token on the Ethereum blockchain, aimed at solving unemployment by connecting freelancers with clients through a decentralized platform known as QUASA Metaverse.

QUA serves as both a governance and utility token within this ecosystem, increasing its demand as services are rendered and tasks completed.

Benefits of Listing on Maverick Protocol

- Enhanced Liquidity: Maverick's AMM model ensures high liquidity with lower slippage, improving trading conditions for QUA.

- Capital Efficiency: By using concentrated liquidity strategies, LPs can earn higher fees with less capital locked, assuming the price stays within the chosen range.

- Community Growth: Listing on Maverick can increase QUA's visibility and attract more traders and liquidity providers, fostering community growth.

- Incentives: Maverick Protocol might offer incentives like additional rewards or tokens to attract initial liquidity providers for new tokens like QUA.

Challenges and Considerations

- Price Volatility: Given QUA's mission to tackle unemployment, its price might be more volatile due to its utility-driven demand.

- Impermanent Loss: Despite Maverick's innovative approach, there's still a risk of impermanent loss if the price moves significantly outside the chosen liquidity range.

- Adoption: The success of QUA on Maverick would largely depend on its adoption within the DeFi space and the effectiveness of the QUASA platform.

Conclusion

Adding liquidity and listing QuasaCoin on Maverick Protocol could significantly enhance QUA's market presence by leveraging Maverick's advanced liquidity management and trading infrastructure.

Adding liquidity and listing QuasaCoin on Maverick Protocol could significantly enhance QUA's market presence by leveraging Maverick's advanced liquidity management and trading infrastructure.

For LPs, this represents an opportunity to engage with a token that has both a utility and governance aspect, potentially leading to more stable returns if the QUASA ecosystem thrives.

However, participants should be cautious of market risks and actively manage their liquidity positions to maximize benefits and minimize losses.

As the DeFi sector continues to evolve, such strategic partnerships between innovative protocols and utility-driven tokens like QUA might set new standards for what decentralized exchanges can achieve in terms of user engagement and economic efficiency.