Hello!

Many people find managing finances to be one of their most challenging tasks, especially if it has to be done manually. There is a solution. Use a finance management app to keep track of expenses, monitor your budget, and manage your bank account.

This post will list the top Android apps that can be used to help you manage your finances. These apps can help you track your expenses, manage your monthly budget, and invest your money well.

These apps can also be downloaded free of charge. Let’s get to it.

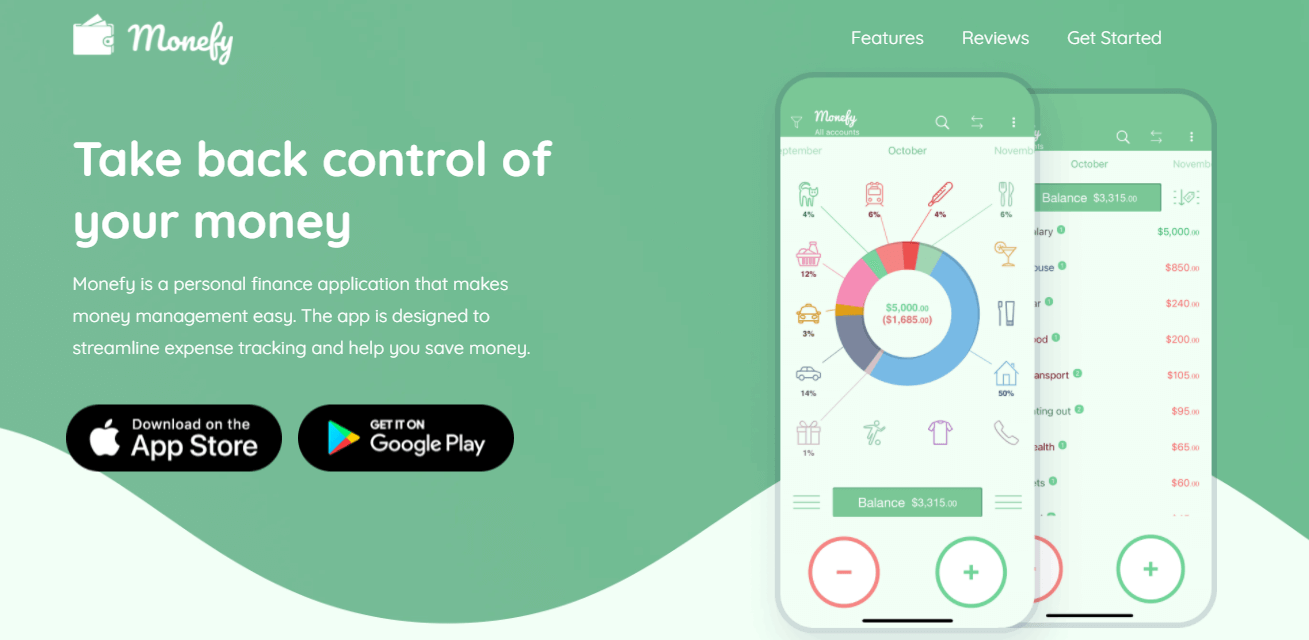

Monefy

Monefy, an Android app that tracks your income, expenses, and savings, is free. You can sync data with your Google Drive and Dropbox accounts. Monefy allows you to export and backup all of your personal financial data with just one click. If you wish, you can also track your finances in multiple currencies.

Key features

- Set financial goals and track your income.

- You can customize the categories to meet your needs.

- Simple interface for simple navigation.

- Keep a close eye on your expenses.

- Take control of recurring payments.

- Stay secure with password protection.

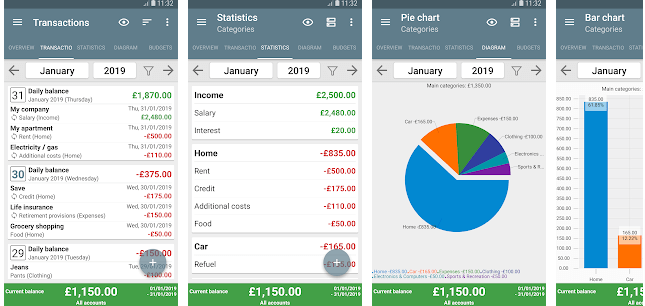

My Finances

My Finances is an excellent android app to manage your home budget. You can also use the planned function to help you plan your expenses. To simplify your home budget management, you can use repeated operations. You can also use the chart option in my finances app to analyze your past and current transactions.

Key features

-

- You can manage your income and expenses from one platform.

To manage your spending better, set goals. - Set your monthly/yearly budget.

- Receive reminders to help you keep track of your spending.

- You can manage your income and expenses from one platform.

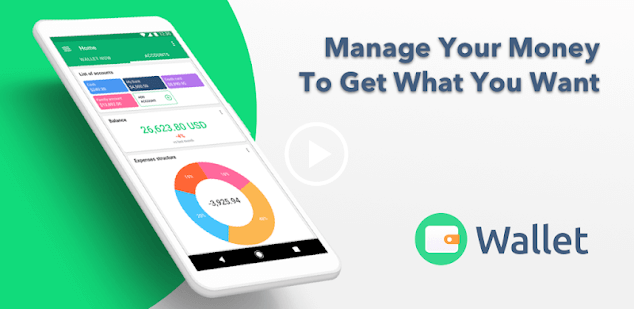

Wallet

A wallet is an excellent finance management app that allows you to plan your budget for the month and track your spending. You can also get detailed reports about expenses. The app also provides easy-to-understand financial overviews, graphs, and charts about your bank accounts and credit & debit card, as well as cash. When you make transactions, they are automatically synced with all your bank accounts.

Key features

- Automatic bank updates.

- You can track your financial progress by tracking your spending trends over time.

- Offer Insightful Reports.

- Use widgets for quick status checks.

- The Income vs. To track your cash flow, use the Income vs.

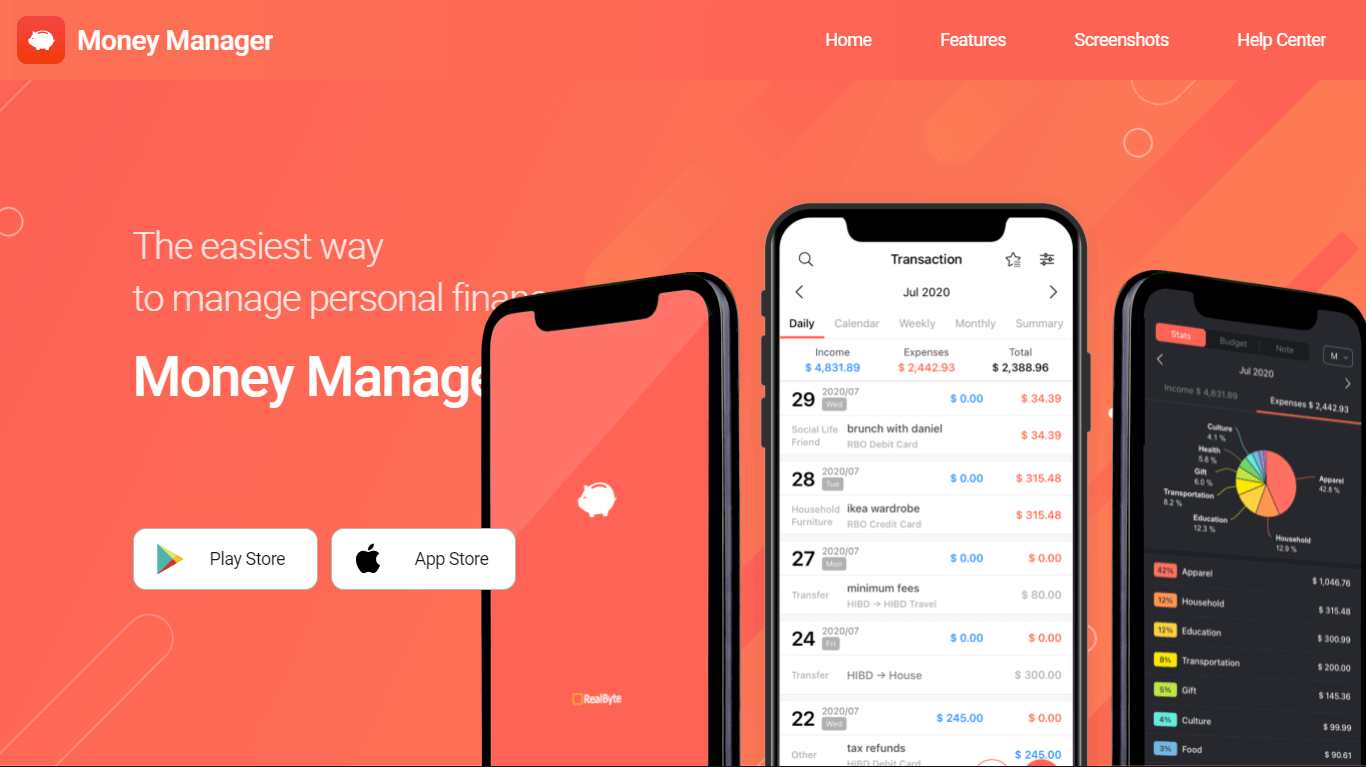

Money Manager

Money Manager makes managing your personal finances simple and easy. With just one click, you can track your transactions and generate spending reports.

This app displays your expenses in a graph. It allows you to quickly view the expense amount and make financial decisions. This app provides a double-entry accounting system that will allow you to efficiently manage your accounting.

Key features

- Budget and expense management functions.

- Management function for credit and debit cards.

- Bookmarking feature.

- You can transfer, debit or recurrence.

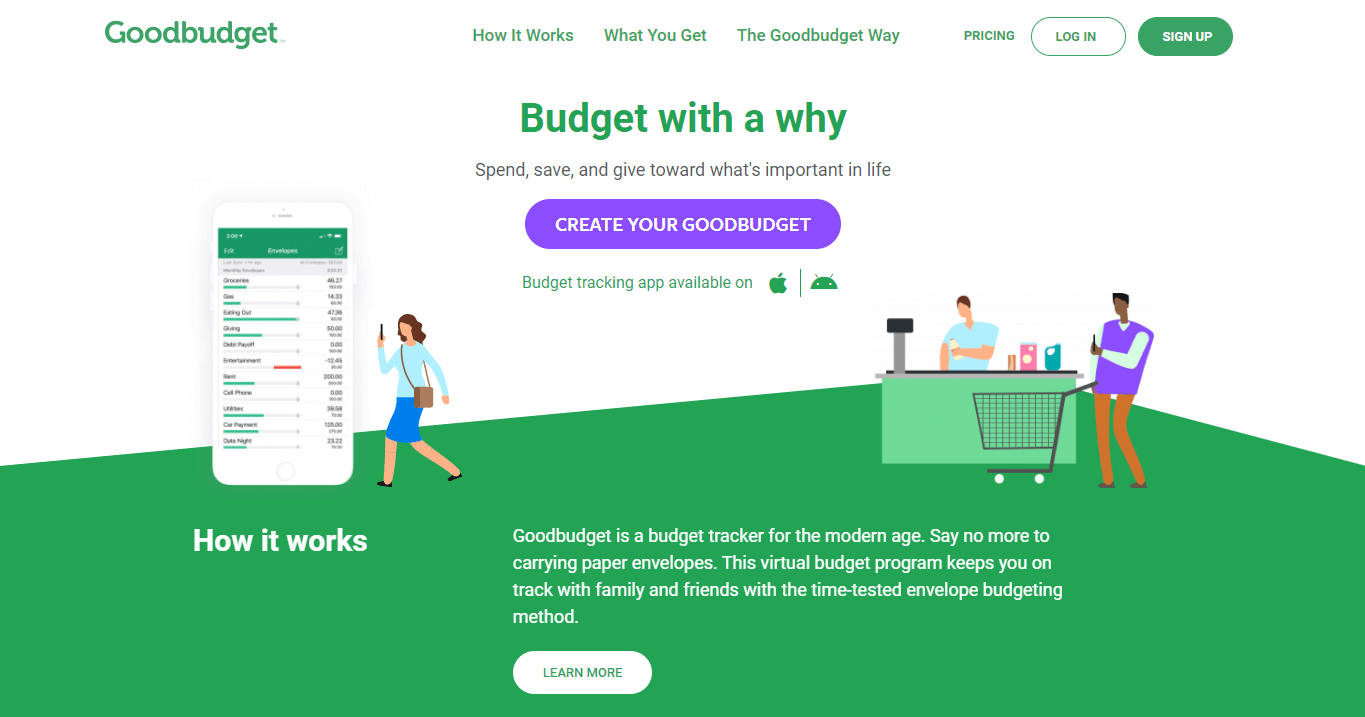

Goodbudget

Goodbudget is the best tool to help manage your money and track all of those pesky expenses. The app is based on the enveloping budgeting system that your grandparents used. To prevent cover spending, the app periodically checks your budget. Goodbudget tracks your cash flow using income vs. expenditure reports. Your data can be automatically synced to multiple devices such as Android, iPhone, and the web.

Key features

- Add and edit Accounts.

- It is easy to visualize your data in tables and graphs. This makes it easier to understand your income and expenses.

- Search for transactions.

- Backup/restore function.

- Smart payee and category suggestions can save you precious time.

My Budget Book

My Budget Book makes it easier than ever to keep track of your money. To track your expenses, you can create subcategories and categories. You can also reconcile your expenses and bank statements with the app. To make transaction entry easier, you can also create your own template.

Key features

- Multiple accounts can be managed and transferred between them.

- Protect sensitive data by using a fingerprint or password.

- To save paper and remember details, add receipts to transactions.

- Consolidate your expenses and your bank statement.

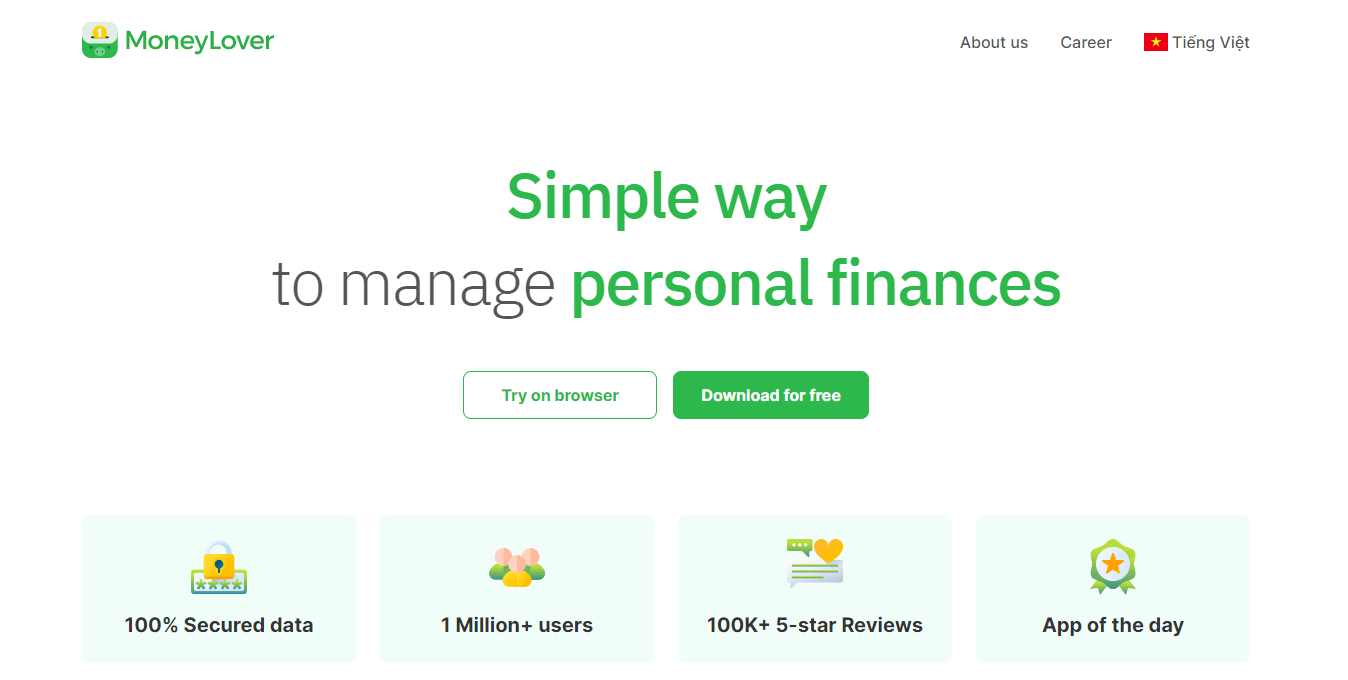

Money Lover

My Budget Book makes it easier than ever to keep track of your money. To track your expenses, you can create subcategories and categories. You can also reconcile your expenses and bank statements with the app. To make transaction entry easier, you can also create your own template.

Key features

- Split expense transactions.

- To make transactions even easier, create your templates.

- To remind you to make your pending payments on time, send reminders.

- Unlimited financial plans and budgets.

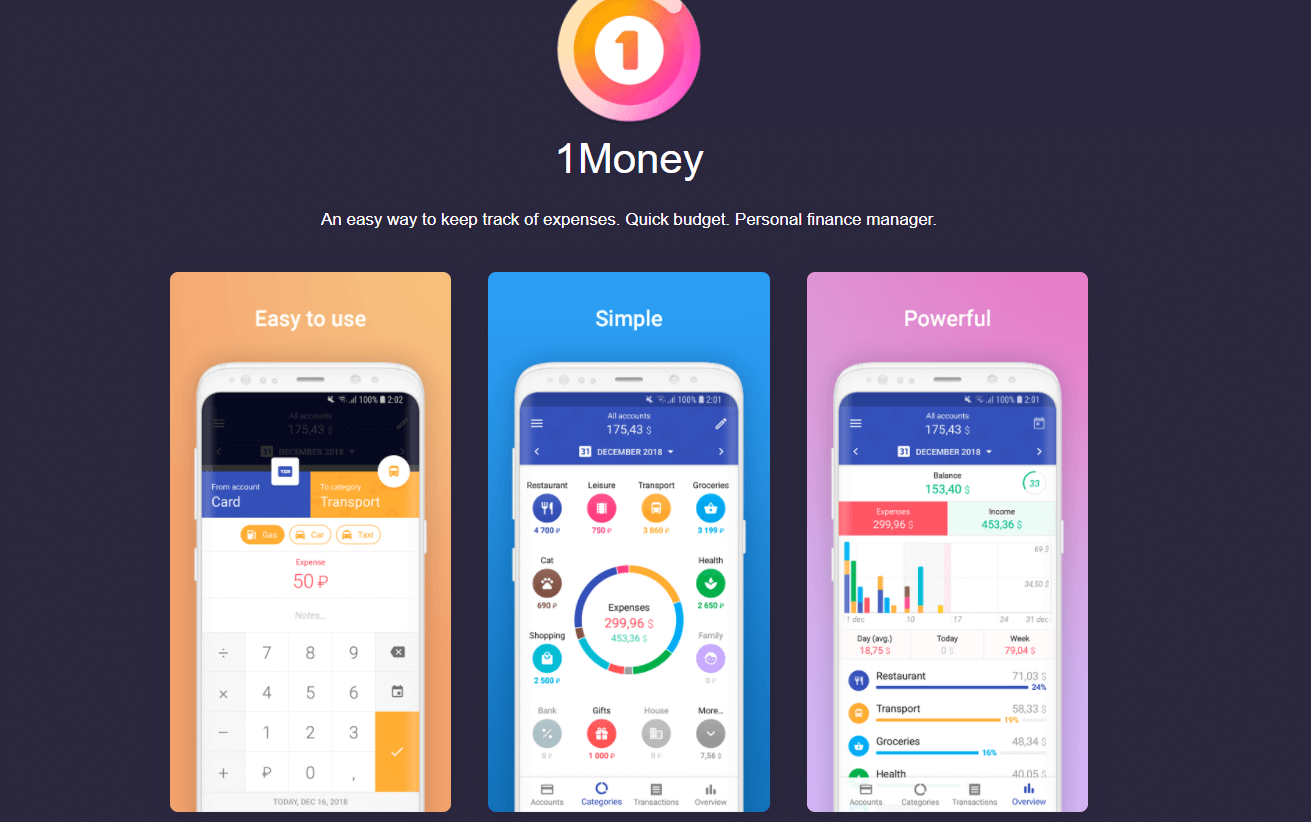

1Money

1Money is a great personal finance management tool with a simple interface. With the advanced transaction feature, you can instantly add any transaction. You can also view an informative chart showing you where your money is going. 1money allows you to quickly track your finances and keep tabs on your balances.

Key features

- CSV import allows you to import bank statements or existing data.

- To pay off your debts, create a financial plan.

- Automatic tracking can be achieved by linking your bank account.

- Transaction & expenditures tracking.

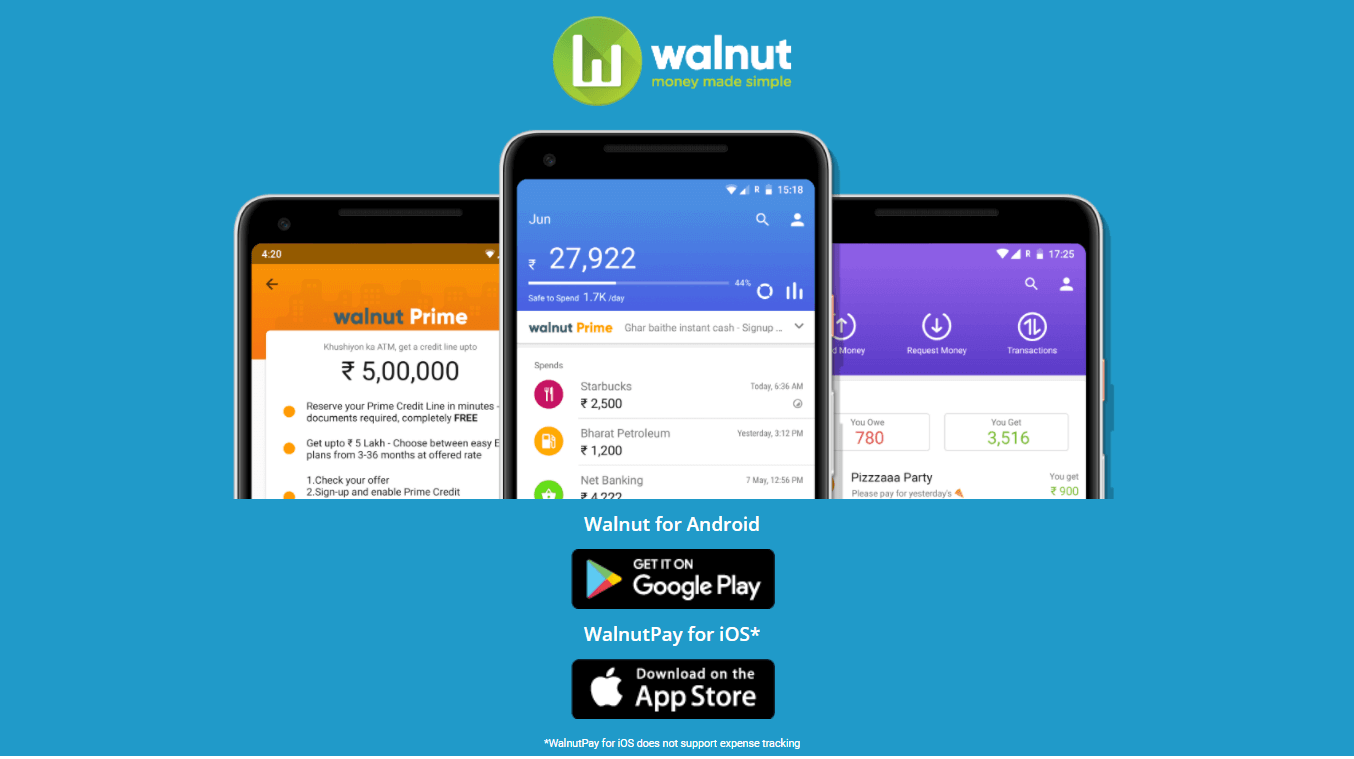

Walnut

Walnut is the ideal money manager and daily expense tracker that will help you keep track of your monthly spending. You can export your data to create expense reports in CSV and PDF formats. The app allows you to shop at any top brand and use Walnut 369 to buy now and pay later.

Key features

- All expenses in one glance – Banks accounts, Credit Cards, and Digital Wallets.

- Keep track of credit card dues.

- Export your data to create expense reports in PDF and CSV formats.

- Easily search for expenses, tags, or notes.

- You can keep track of your cab, movie, and event bookings.

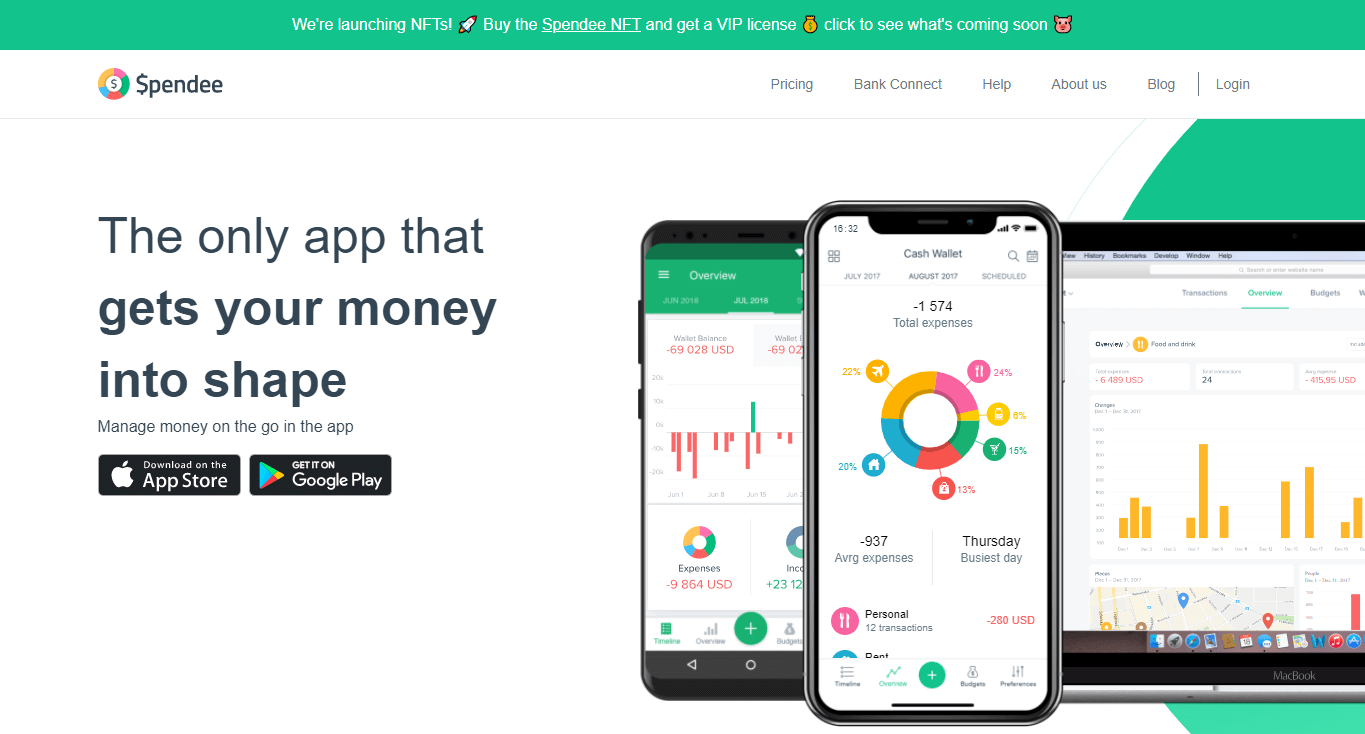

Spendee

Spendee, a popular financial management app, has been loved by more than 3,000,000 people. Connect the app to your e-wallet or crypto wallet and you can view all of your wealth. You can optimize your spending with the app by setting up budgets. The app automatically categorizes your data, which you can view with the help of an infographic or easy-to-understand chart. This allows you to save money in the end.

Key features

- Analyze and organize your expenses.

- Optimize your spending.

- All your money is in one place.

- Use these widgets to quickly access your spending tracker.

- Track in multi-currencies.

Also read:

- What Are Cross-Border Payment Systems?

- Debt Recovery For Small Businesses: Essential Steps To Follow

- What Are the Best Lean Tools?

Conclusion

Each of the android apps listed above offers unique features that make it ideal for managing personal finances. You can choose any one of them depending on your preferences and needs.

Walnut or 1Money are good choices if you’re looking for an app that has a simple UI. Spendee is a better option if you need to keep track of your credit card payments.

You can download any app and keep track of your expenses hassle-free.

Thank you!

Join us on social networks!

See you!