Hello!

Illness and Income protection are two major issues in developing and developed countries. As there is always a risk attached to human life like sickness or accidental injury that can lead you and your family into finance and lifestyle trouble.

Illness and Income protection are two major issues in developing and developed countries. As there is always a risk attached to human life like sickness or accidental injury that can lead you and your family into finance and lifestyle trouble.

Therefore, taking illness cover or income protection policy is a good deal. But which policy is right between illness and income protection, is a serious matter of concern. Hence, this write-up is designed to put flashlights.

Let’s know both the policies and how these differ from each other.

What Is Income Protection?

Income protection policy covers both accidental and sickness cover. This policy helps you to recover income that could be lost due to sickness. This policy provides you with the biggest sign of relief when illness affects your regular income.

Once your policy period is over, you will start receiving almost 70% of the monthly income. In addition, it’s tax-free policy is like icing on the cake. Income from insurance companies helps you to focus on recovery rather than worrying about the hospital or medical bills.

Once your policy period is over, you will start receiving almost 70% of the monthly income. In addition, it’s tax-free policy is like icing on the cake. Income from insurance companies helps you to focus on recovery rather than worrying about the hospital or medical bills.

This policy is the best, as you never fall with any hard situation, the regular income from policy helps you to get back. You can generate a regular source of income after retirement.

As this is a long term policy, therefore you can claim as many times you need, or say until the end of policy life. Most covered claims covered under this policy are bad backs and mental health problems.

What Is Critical Illness Insurance?

As the name suggests critical illness insurance cover critical problems enlisted in the insurance company’s policy book. Only if the person is suffering from a particular problem, is able to claim policy. But the insurance company pays out the insured full amount.

Some of the major policies covering claims are:

- Cancer

- Heart Attack

- Stroke

There is no need to wait for a specific period to over. You can avail this policy as soon as you meet with a critical illness. The best part if this policy is that it will cover 100% of the illness cost. But this policy is not designed to cover income loss when you are in bed.

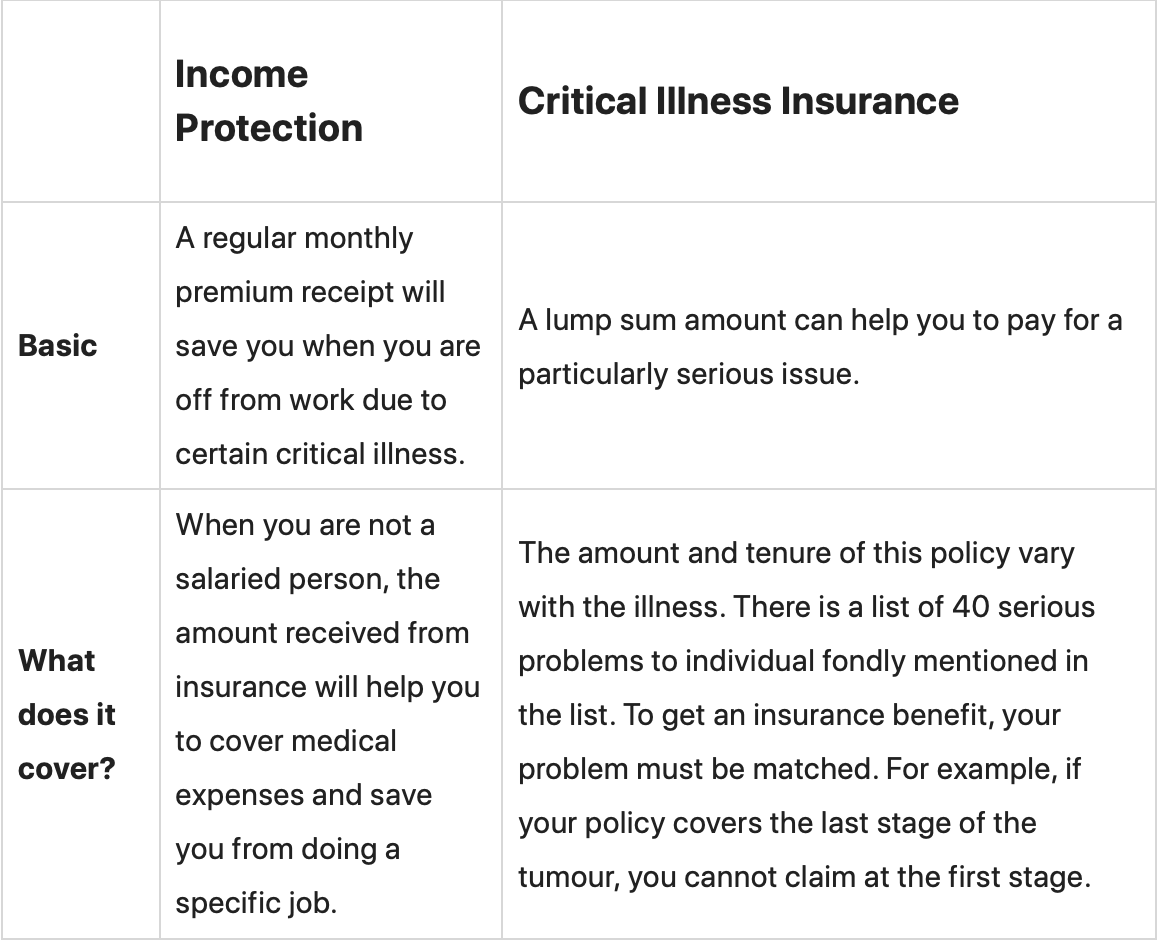

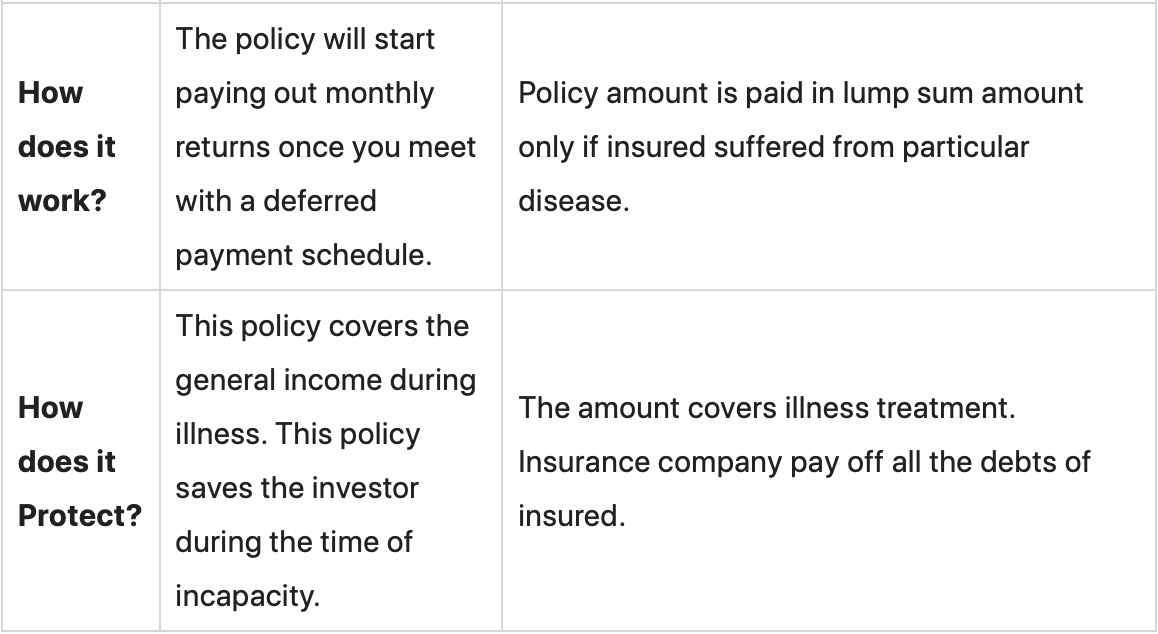

Let’s know how Critical Illness Cover and Income Protection differ from each other. This will help you to make better decision:

Which is the biggest claim?

Income protection claim

Income protection policy aims with protecting insured income when he suffers from musculoskeletal issues and back pain. Neither of both issues seems critical. Therefore, this policy provides you with the best way to come up from financial crises during the disability time period. You can easily cover medical expenses.

Income protection policy aims with protecting insured income when he suffers from musculoskeletal issues and back pain. Neither of both issues seems critical. Therefore, this policy provides you with the best way to come up from financial crises during the disability time period. You can easily cover medical expenses.

Critical Illness Insurance Claims

Cancer is a major issue covered under critical illness insurance. Today, the roots of cancer are spreading at a great pace. And treatment is costly. Therefore taking this policy will help you to save financial crises.

Also read:

How to choose The Perfect Domain Name

Mist: The Free Meal Planner That Counts Calories and Builds Your Daily Menu

Which is Right for You?

As every client is different, their needs and wants also vary. Therefore, it’s really hard to tell which policy is best under a vast array of situations.

As every client is different, their needs and wants also vary. Therefore, it’s really hard to tell which policy is best under a vast array of situations.

If you are working in such a condition, where the chances of serious issues like cancer are high, it’s better to take illness cover policy.

On the other side, if you are in your own business here income protection will help you to generate recurring income.

In addition, paying attention to following also make sense:

- Critical illness covers only once payout. These policies have a certain fixed amount. If your expenditure goes beyond you need to pay the rest amount from pocket.

- Income protection serves you with recurring monthly income. If you get sick or unable to get back to work, your financial and lifestyle won’t be affected.

- Income protection policies are cheaper than critical insurance. But, the insurance amount will also be high.

Thank you!

Subscribe to our newsletter! Join us on social networks!

See you!