Hello!

Budgeting is a vital component of living a financially healthy life. Rather than being limiting, these budgeting suggestions will assist you in developing a clear image of the money you have to spend. Can assist you in discovering more cash that you can utilize more effectively.

Budgeting is a vital component of living a financially healthy life. Rather than being limiting, these budgeting suggestions will assist you in developing a clear image of the money you have to spend. Can assist you in discovering more cash that you can utilize more effectively.

People who budget set themselves up to get out of debt quicker, save more money over time, and spend wisely.

The greatest thing is that effective budgeting habits may be implemented with only a few simple changes to your money routine.

Make a Budget Before the Month Starts

To stay on top of your finances, plan ahead of time. Plan your next month’s activities and costs a week before the new month begins. You could have a road trip or a vet appointment one month but not the following. Set a reasonable budget once you’ve planned your month.

Include a Category for Contingencies

Sometimes an item may not fit neatly into one of your budget categories. That’s when having a backup plan comes in useful. The caveat is that you must not use it as an excuse to overspend in any of your other categories.

Sometimes an item may not fit neatly into one of your budget categories. That’s when having a backup plan comes in useful. The caveat is that you must not use it as an excuse to overspend in any of your other categories.

If you find yourself constantly going over budget in food, shopping, or any other area, try changing your budget rather than funneling it into your contingency fund.

In the event of an emergency, you may need to get fast cash loans online with a same-day deposit, to survive difficult times.

Experiment with Budgeting to Zero

Budgeting to zero is documenting every dollar you make and allocating it a place in your budget until you have no money left over. Assume you make $4,000 every month, for example. You shouldn’t have any money left over after planning your set costs, savings contributions, investments, and any other extras. Budgeting to zero can help you understand where your money is going and give each dollar you earn a purpose.

Determine Needs vs. Wants

“Needs” are defined as everything essential for your fundamental physical, emotional, and financial well-being – for example, food, rent, and debt repayment. These should always be included in your budget and are available in online budget calculators.

“Needs” are defined as everything essential for your fundamental physical, emotional, and financial well-being – for example, food, rent, and debt repayment. These should always be included in your budget and are available in online budget calculators.

Everything else falls into the category of “wants.” Make sure to budget for these as well! Consider the 50/20/30 rule, which states that you should spend around 30% of your money on non-essentials that will improve your living.

Organize Your Bills And Receipts

Organize your bills and receipts in case you need to go back to one to dispute it. This may also be useful for tax considerations. You have the option of filing physically using hanging files or expanded folders. Sort your papers by month or account, whatever makes the most sense to you. If you get most of your invoices and receipts by email, you may wish to file everything online.

Maintain Separate Accounts

Many people have found that having numerous checking accounts helps them stay organized. Having a separate checking account for set costs like rent and vehicle payments, for example, makes it simple to understand how much money you have to spend each month on more flexible sections of your budget like food.

Make Debt Repayment a Priority

While you may be tempted to make a budget and save for a trip or a vehicle, putting such plans on hold and concentrating on paying off current debt may be a better option.

While you may be tempted to make a budget and save for a trip or a vehicle, putting such plans on hold and concentrating on paying off current debt may be a better option.

Prioritizing debt might help you save money on interest and lessen financial stress. It is critical to maintaining your debt low since it influences your credit usage.

Don’t Forget to Include Some Laughter

Most budgets are effective when enjoyable items are included. When you know you have some wiggle space to watch a movie, spend on a facial, or try a new bar, you’re far more likely to stay to your budget. Consider this a scheduled cheat day for your money!

First, Save, then Spend

Most individuals prefer to spend first and then save what is left over. Saving becomes voluntary as a result, and steady savings contributions are not guaranteed. Consider saving as a fixed item and budget for it appropriately.

Begin Saving for Retirement Immediately

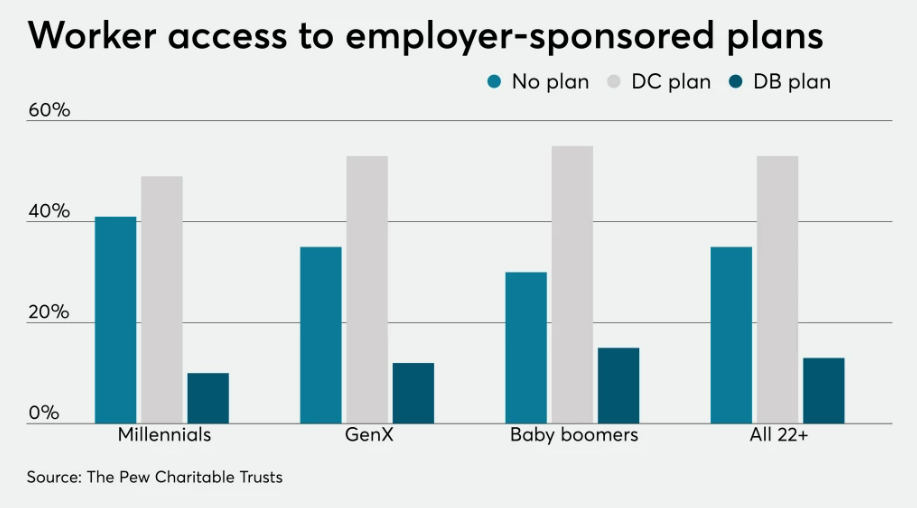

You’ve probably heard it before, but it bears repeating: it’s never too early to start saving for retirement. A recent study found that 70% of employees are saving less for retirement than they would like. This is a troubling statistic, as it indicates that many people are not taking the necessary steps to ensure a comfortable retirement.

There are a number of factors that can contribute to this problem. For example, some people may not have access to a retirement savings plan at work, or they may not be able to afford to contribute as much as they would like.

There are a number of factors that can contribute to this problem. For example, some people may not have access to a retirement savings plan at work, or they may not be able to afford to contribute as much as they would like.

Others may simply not be aware of the importance of saving for retirement. Whatever the cause, it is clear that more needs to be done to help people save for their future.

One way to address this problem is to offer employees educational resources on the importance of retirement savings. Another solution is to make it easier for workers to contribute to a retirement savings plan by offering employer matching or other incentives. Whatever approach is taken, it is essential that we do more to help people save for retirement. Otherwise, we will see an increasingly large number of people struggling in their golden years.

Divide Your Direct Deposit

Consider setting up direct deposit via your job so that a particular amount of your payment goes directly into your savings account. Because automation handles the job for you, you don’t even need to include saving in your budget. That’s one less thing to remember!

Be Prepared for the Unexpected

Even the best preparation cannot always prepare us for unanticipated expenditures. Car repairs and visits to the emergency room are unforeseeable. That is why it is critical to have an emergency reserve in your budget. We recommend saving at least $1,000, but the amount is entirely up to you.

Make Provisions for Large Purchases

The key to obtaining a costly item, such as a new laptop or television, is to prepare ahead of time. Choose a date for the purchase and divide the price by the number of days you have. For example, if you want to buy a $1,500 computer in 300 days, all you have to do is save $5 every day. This prevents you from charging the purchase to a credit card, possibly placing you in considerable debt and requiring you to pay interest until the amount is paid off.

The key to obtaining a costly item, such as a new laptop or television, is to prepare ahead of time. Choose a date for the purchase and divide the price by the number of days you have. For example, if you want to buy a $1,500 computer in 300 days, all you have to do is save $5 every day. This prevents you from charging the purchase to a credit card, possibly placing you in considerable debt and requiring you to pay interest until the amount is paid off.

Make Monthly Budget Adjustments

Needs fluctuate, therefore a budget should not be rigid. Consider re-evaluating your budget every month to see how well you’ve been keeping to it. If you realize that you are frequently overpaying in one area while underspending in another, balance your budget to make it more manageable.

Have a No-Spend Day

Set aside one day every week to spend no money other than what is essential.

Set aside one day every week to spend no money other than what is essential.

This is a simple technique to ensure that your weekly spending remains within your budget. If you’re in desperate need of a spending detox, try an entire no-spend month – yep, you read that correctly — spend a whole month solely on basics.

Thank you!

Join us on social networks!

See you!