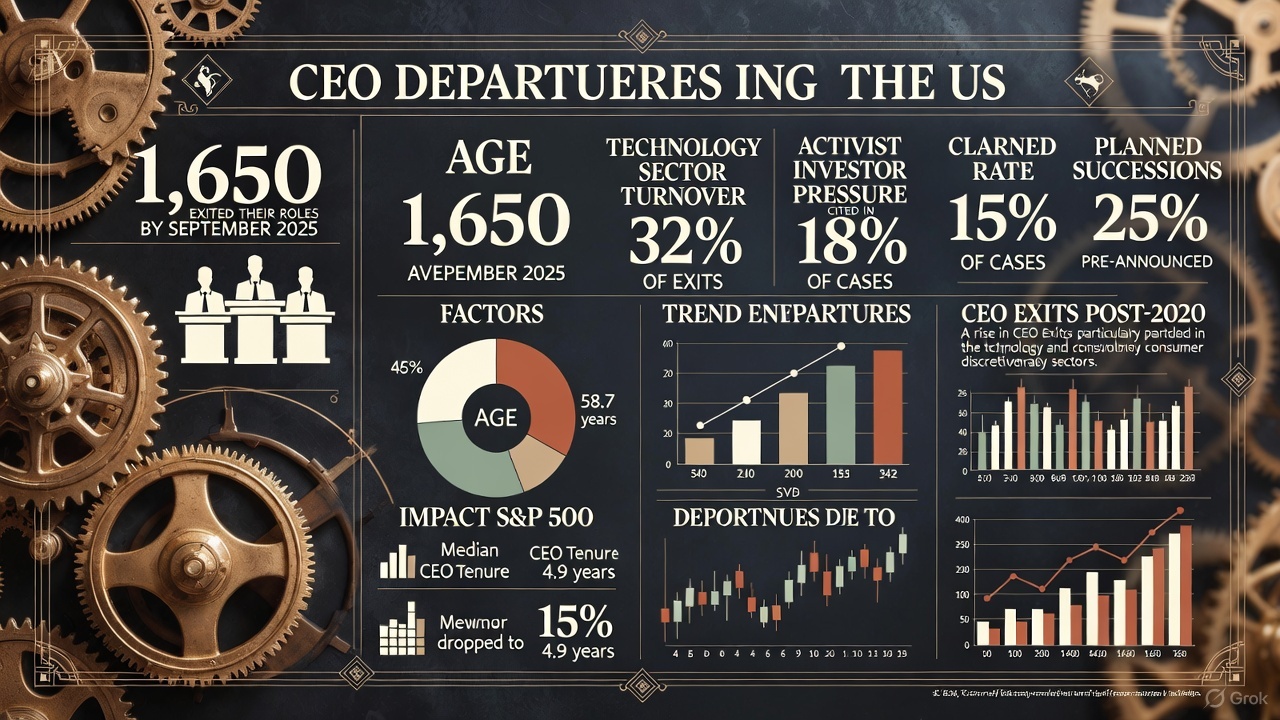

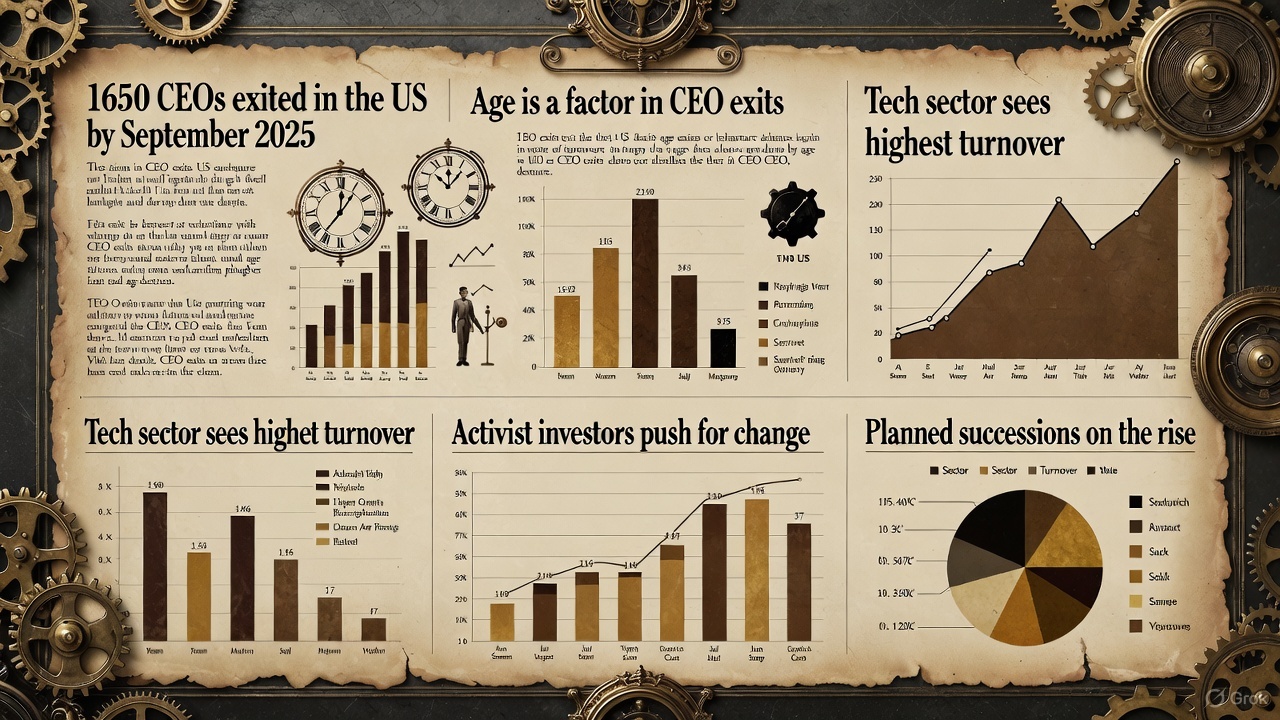

The American C-suite has turned into a revolving door on steroids. According to the latest data from outplacement firm Challenger, Gray & Christmas, 2024 delivered the highest number of CEO departures since the tracker began in 2002, and 2025 is on pace to match or exceed it. By the end of September 2025, 1,650 chief executives had already walked away, virtually identical to the same nine-month period in 2024 that ended the year with a record-shattering total.

This is no ordinary turnover. Something structural is happening at the very top of corporate America.

Age finally catches up

For the first time in history, more than half of the CEOs in the S&P 1500 are now over 60 years old. The post-financial-crisis cohort that took the helm in 2009–2012 is collectively hitting traditional retirement age. Many are choosing to cash out while their stock-based compensation packages are at all-time highs: the S&P 500 has more than quadrupled since 2016, turning paper wealth into life-changing liquidity events.

But retirement is only part of the story

The technology sector alone accounted for nearly one in four departures in 2024, a rate roughly ten times higher than in more mature industries. In an era where generative AI is rewriting competitive moats overnight, boards and investors have zero patience for leaders perceived as slow on the uptake.

The technology sector alone accounted for nearly one in four departures in 2024, a rate roughly ten times higher than in more mature industries. In an era where generative AI is rewriting competitive moats overnight, boards and investors have zero patience for leaders perceived as slow on the uptake.

Companies that were digital darlings five years ago are now dumping founders and long-tenured CEOs for executives with explicit AI transformation credentials. The message is brutal but clear: adapt instantly or be replaced.

Activist investors have smelled blood. Campaign volume hit new peaks in 2024, with funds such as Elliott, Third Point, and smaller “constructivist” players forcing boardroom coups at an unprecedented clip. Last year alone, activist campaigns directly led to 27 CEO ousters, more than double the average of the previous decade.

The playbook is now refined: take a stake, publish a glossy “value-unlock” presentation, threaten a proxy fight, and watch the board cave within weeks.

The rise of the orchestrated exit

One of the quietest but most telling shifts is the surge in planned successions. In 2024, 22 % of all departures were announced well in advance with named successors, the highest proportion on record. This is no longer the chaotic, scandal-driven purge of the early 2000s.

One of the quietest but most telling shifts is the surge in planned successions. In 2024, 22 % of all departures were announced well in advance with named successors, the highest proportion on record. This is no longer the chaotic, scandal-driven purge of the early 2000s.

Boards, under pressure from large index funds and governance advisors like ISS and Glass Lewis, are finally doing what they’ve talked about for years: treating CEO succession as a core risk-management process rather than a crisis event.

When the market rewards cashing out

Soaring equity markets have created a perfect storm. A CEO sitting on restricted stock units and performance shares that vested at 300–500 % of grant value faces an obvious calculation: lock in generational wealth now, hand the reins to a hungry successor, and ride off into the private-equity sunset (or onto half a dozen lucrative boards).

The median realized pay for an S&P 500 CEO in 2024 topped $23 million, much of it in exercised options and vested equity. Few are sticking around to see if the next five years can possibly match that windfall.

Also read:

Also read:

- Trump's AI Power Play: Crushing State Regulations to Forge a "Woke-Free" Future

- Waymo Just Unlocked Half of California — And Personal Car Ownership Might Never Recover

- China’s Box Office Just Broke Its Own 2024 Record — in October — Thanks to the “Ticket-Stub Economy”

What comes next

The combination of demographic inevitability, technological disruption, activist aggression, and stock-market euphoria has produced the most concentrated wave of leadership change in modern corporate history. By the time 2025 closes, more than 4,000 CEO transitions will have occurred in just two years across public and large private companies, an effective changing of the guard for an entire generation of American business leadership.

The corner office has never been more precarious, or more lucrative, to leave.