Hello!

The banking industry has been revolutionized by wearable devices and contactless payments. Soon, intelligent objects will be able to conduct trade independently.

Many bankers might have dismissed the “IoT” as a fad at first. The hype is now a reality. Probably because of staff shortages.

The New Business Models

According to the Digital Banking Report, IoT growth will be a major future prediction for banking.

According to the Digital Banking Report, IoT growth will be a major future prediction for banking.

Experts at Citibank predict that the “Thing Economy”, will provide new business models and ecosystems as well as opportunities for many sectors, including financial services.

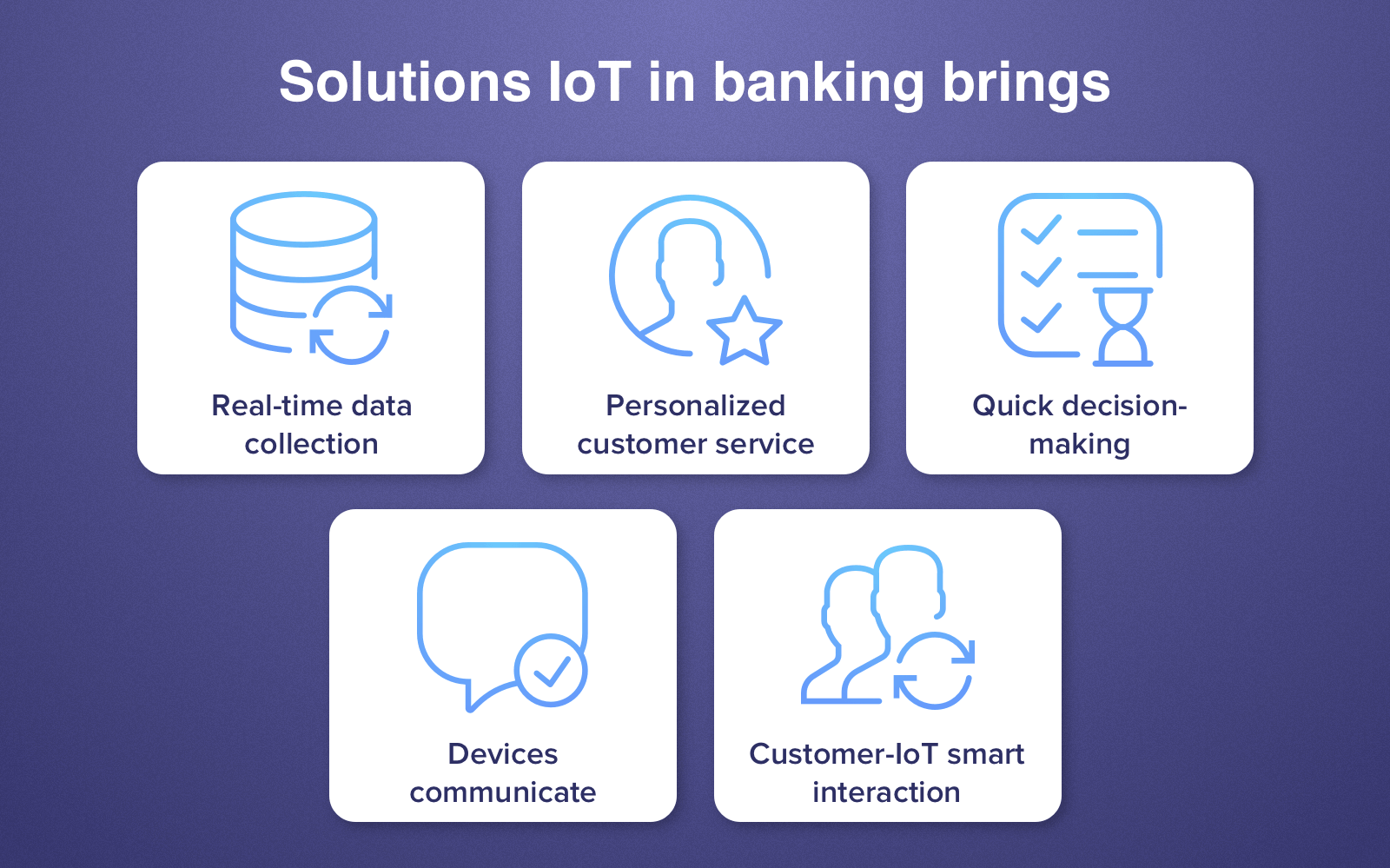

IoT commerce is a reality right now. It is experiencing unprecedented growth, and it is obvious to most people. The fusion of digital and real worlds offers tremendous opportunities to work with partners and create new products and businesses.

The Tip Of The Spear: Embedded Commerce to Pays

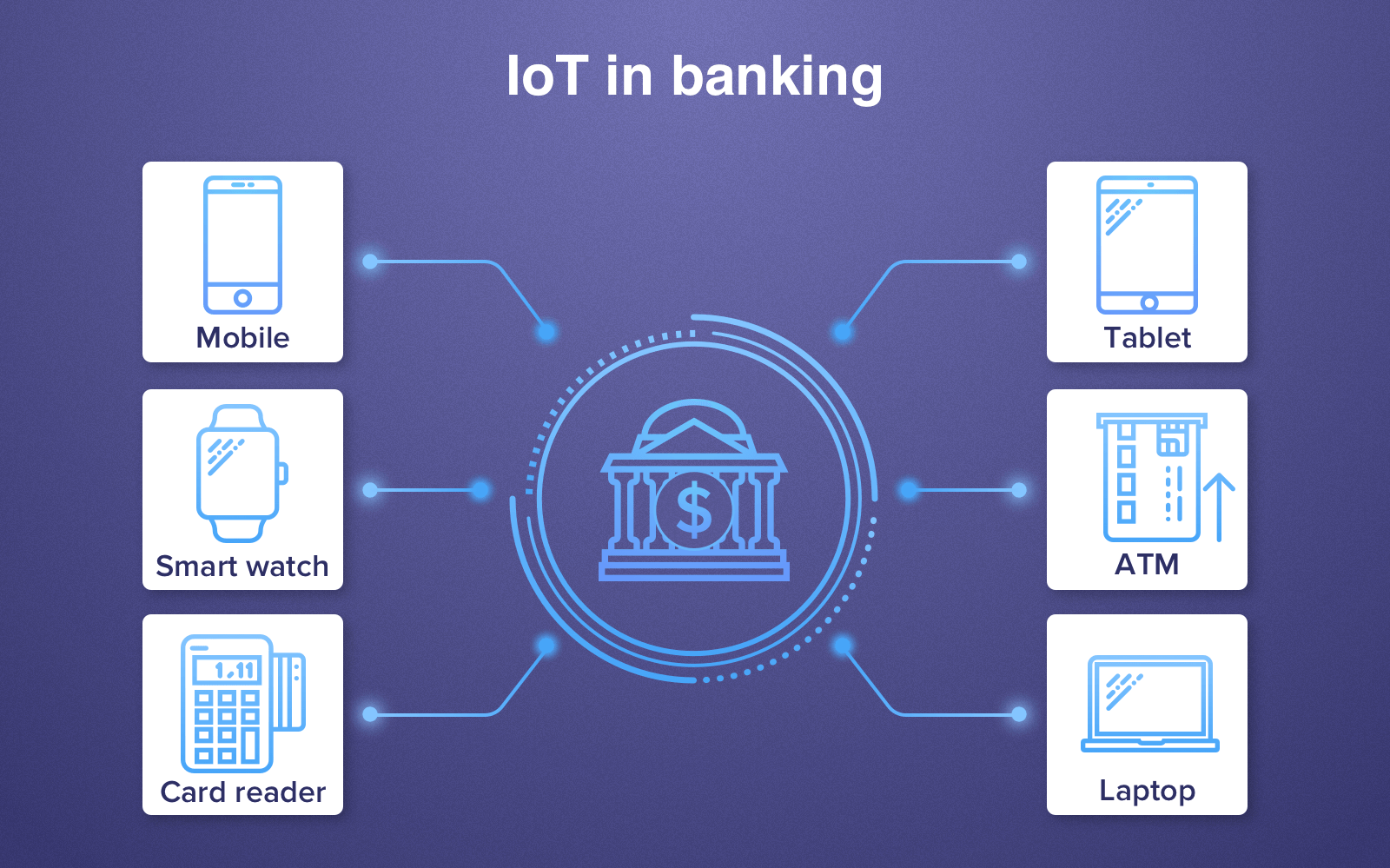

Many financial institutions are aware of the potential IoT has for consumer banking. Mobile applications and contactless payment are part of the bigger picture.

Many financial institutions are aware of the potential IoT has for consumer banking. Mobile applications and contactless payment are part of the bigger picture.

Amazon Go Stores are retail applications that allow customers to “Just Walk Out” and make payments using RFID tags or AI. These devices are already teaching people how to make semi-automatic mobile payments.

Jim Marous, co-publisher of The Financial Brand, and CEO of Digital Banking Report, believes these are the “low hanging fruits” of IoT. He predicts that embedded banking prospects will increase as financial institutions realize the importance of engagement over transactional banks.

The Bigger Prize

Although in-car payments remain a possibility, integrated finance is the real promise of IoT. IoT will soon include wearables, speech devices, as well as in-car apps. Marous adds that IoT can also be used for financial engagement, such as cash transfers and content distribution. It can also be used to combine healthcare information with financial gaming.

The Digital Vehicle Fingerprint

Next is automating minor, repetitive payments and transactions. Citi Ventures portfolio company Car IQ is currently developing new ways for automobiles to connect with banks and pay services. Car IQ uses sensor data to create a digital vehicle fingerprint that can be used to authenticate and interact with banks.

Next is automating minor, repetitive payments and transactions. Citi Ventures portfolio company Car IQ is currently developing new ways for automobiles to connect with banks and pay services. Car IQ uses sensor data to create a digital vehicle fingerprint that can be used to authenticate and interact with banks.

Banks and credit unions have the best prospects in B2B and commercial, where smart labels can be integrated into the supply chain.

Your clothing with an Embed or Microprocessor Identifier

These labels contain a microprocessor and an identifying module. An antenna and a beacon are also included. Intelligent labels in goods could create a new economy that allows corporations to embed financial services into products capable of conducting commerce directly between one another.

Citi says that financial institutions are well-positioned for leadership and expansion into the Thing Economy. This could dramatically increase payment volumes.

The IoT Banking Onslaught Prepared

Financial institutions need to overcome challenges such as poor management, expense, and finding the right talent to manage the details — and, of course, cybersecurity — in order to benefit from Thing Economy.

Financial institutions need to overcome challenges such as poor management, expense, and finding the right talent to manage the details — and, of course, cybersecurity — in order to benefit from Thing Economy.

These challenges can be overcome and consumers and IoT users could see an increase in value from $5.5 trillion to $12.6 trillion.

According to Citibank, in order to verify and provide confidence for micropayments, new infrastructure will be required, including technology and partnerships.

Know Your Customer

When infrastructure has been in place, all devices, from postage stamps and electric cars, will be able to perform unattended, programmatic transactions seamlessly end to end. Trust, security, and a unique digital identification system for each device are essential to autonomous transactions.

Financial institutions will need to improve on existing Know Your Customer (KYC), processes in order to verify the identities of users and devices.

Financial institutions will need to improve on existing Know Your Customer (KYC), processes in order to verify the identities of users and devices.

Inaction is the real danger. These KYM procedures can be used to understand and enforce permissions, as well as verify unplanned, autonomous machine interactions. Biometrics and IoT devices provide a higher level of KYC verification than traditional transactions. Yes, there is more tracking.

A Chance, not a Threat — Say, Bankers

Analysts are unsure whether IoT can replace traditional banks. Mercator Advisory Group disagrees. Some think that traditional banks will still be fine, even if third parties offer new payment options.

Jim Marous believes acceptance and integration should start at the top. When considering change, leadership and procedures must be changed. With the traditional bank, both will be required. Marous points out that financial institutions need to adapt to changing consumer (and business) needs.

Banks and credit unions need to respond quickly or partner with third-party IoT solutions providers in order to be part of the future evolution.

The IoT banking industry isn’t rocket science, and we all can see it coming. This IS the Internet of Things. It’s not a secret.

The IoT banking industry isn’t rocket science, and we all can see it coming. This IS the Internet of Things. It’s not a secret.

It is not easy to change, and it will be difficult to integrate a bank business model into a banking system.

This means that if the traditional banking system is to continue functioning, they will have to take charge and demand what they want.

For years, people have longed for the banking system’s transformation. The bankers’ work hours are a dated way of doing business. But have you noticed how difficult they try to make the digital world fit into this outdated system?

The future of banking will require that traditional banks stop dreaming and get busy. You can’t deposit money or get enough cash before midnight, but your bank will be able to take your funds out of your account at midnight by purchasing Amazon products.

Every day your bank or credit union hesitates to upgrade to IoT, they lose ground.

Thank you!

Subscribe to our newsletter! Join us on social networks!

See you!