Hello!

In African countries, where Quasa is actively establishing connections, the cryptocurrency market is developing rapidly. On the one hand, bitcoins have become a means of storing money for citizens of some countries during financial crises, on the other hand, authorities are looking for ways to gain access to these assets and are trying to regulate them. We tell you how they do this and what digital tools can be used to trade with African countries.

QUASA destroys the unspoken ban on interaction between developed and developing countries during remote work. In many countries, payments in dollars are prohibited or difficult, which limits and prohibits remote work between continents, but there are no problems with cryptocurrencies and cannot be.

QUASA is the world's first application for remote work with payments in crypto-currencies. The new crypto-settlement tools in QUASA democratize access to services traditionally tied to fiat money and banks, and open up opportunities for hundreds of millions of people.

No intermediaries, only the customer and the contractor, no banks, payment systems, no conversion fees, no taxes, no "big brother". By connecting your crypto-wallet, a freelancer or customer instantly settles among themselves using the Quasacoin (QUA) cryptocurrency.

How developed is trade in digital currencies of different categories in Africa and what is the continent’s cryptocurrency landscape?

Digital Money For Everyone

In recent years, Africa has been the region with the fastest adoption of cryptocurrencies in the world.

In recent years, Africa has been the region with the fastest adoption of cryptocurrencies in the world.

In June 2021, the annual growth in cryptocurrency penetration was 1200% amid government bans. According to blockchain research company Chainalysis, from June 2022 to June 2023, the volume of cryptocurrency payments in the sub-Saharan continent was $117.1 billion.

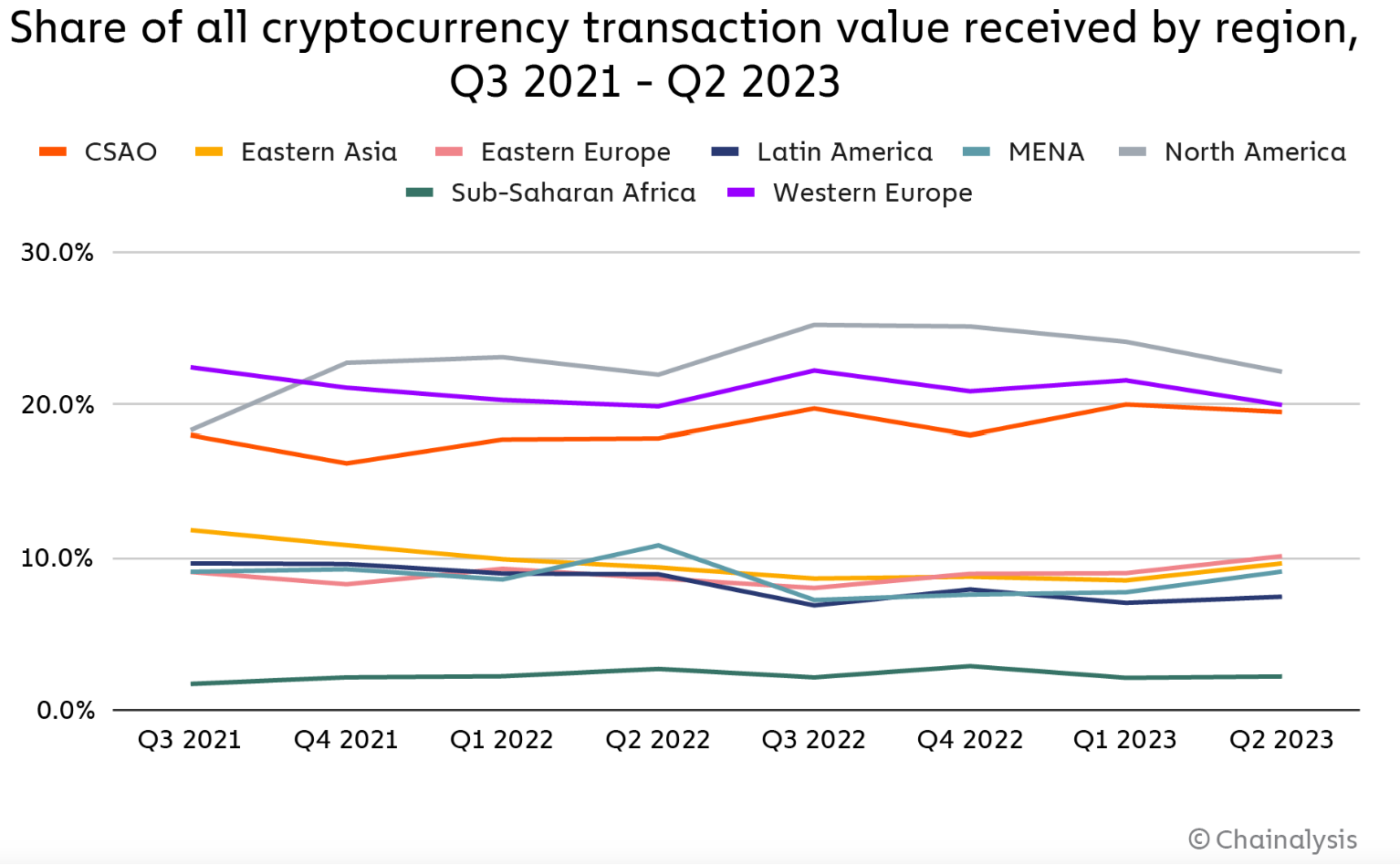

However, compared to other regions, Africa accounts for only 2.3% of the cryptocurrency traded in the world . According to CVVC's 2023 report, Africa currently accounts for 1.8% of all global blockchain funding.

However, as Chainalysis notes, in African countries, the main driver of cryptocurrency market growth is household payments from citizens - a large share of transaction volume in the region comes from transactions worth less than $1 million, as well as the use of local cryptocurrencies.

Africa has long been developing its own cryptocurrencies, and payment systems such as M-Pesa (mobile money), launched by Kenyan telecommunications company Safaricom in 2007, are used for everyday transactions. Thanks to this service, in a fairly short time, Kenya has become one of the world leaders in digital financial innovation. By 2022, the service's customer base already numbered more than 50 million people, of which less than half lived outside of Kenya. M-Pesa revenue grew 38.3% in 2021 to $927 million annually.

Another equivalent of M-Pesa in Africa is the South African company Vodacom, which provides services through its subsidiaries in Tanzania, Democratic Republic of Congo, Mozambique, Lesotho, Ghana and Egypt. Safaricom and Vodacom operate M-Pesa Africa as a joint venture after purchasing the brand and platform from its UK parent Vodafone Plc in 2020. In 2022, they, together with the Visa payment system, launched a virtual card for international digital payments.

British cryptocurrency exchange Binance is also successfully operating in Kenya, even holding educational events for students and participating in discussions with regulators about measures to control the cryptocurrency market. However, another exchange, Worldcoin, founded by OpenAI CEO Sam Altman, has run into trouble over its data policies. Last August, the Kenyan Ministry of Internal Affairs suspended the activities of the crypto project in the country so that government authorities could assess its potential risks to public safety.

Interest in cryptocurrencies in Africa is due to several reasons. The first is the limited availability of banking services: in 2010, according to the African Development Bank, only 20% of Africans had a bank account. This number has now risen to 48%, but more than half of Africans still do not have an account. But if the user has a mobile phone number, a virtual account can be linked to it and funds can be withdrawn from cryptocurrency exchanges to it. Secondly, the system of bank transfers between African countries is poorly developed, in addition, many African emigrants transfer money from abroad to their homeland in this way.

According to Theo Mwangi, founder of blockchain-based money transfer app BitLipa, the increased adoption of stablecoins and Bitcoin as a means of payment is due to the fact that most people are frustrated with the tools offered by traditional financial service providers. In addition, some African countries are under international sanctions, and cryptocurrencies often allow citizens to solve their problems in this regard.

As Slava Vasipenok, CEO of QUASA, said, the cryptocurrency market in African countries is focused on retail trade. “Residents of these countries can turn to digital gold as an alternative tool for saving and achieving greater financial freedom,” suggests the CEO of QUASA.

In Ghana, for example, inflation reached 29.8% in June 2022 after 13 consecutive months of growth—the highest level in two decades. Many Ghanaians have turned to Bitcoin. Nigeria, Kenya and South Africa have faced similar challenges in recent years, and all demonstrate widespread adoption of cryptocurrency at the grassroots level.

Some market participants have switched to stablecoins because they have less price volatility than Bitcoin, whose price has now set another record but has previously experienced record drops several times. According to Moyo Sodipo, co-founder of the Nigerian cryptocurrency exchange Busha, in 2019-2020 there was “some kind of madness” around Bitcoin in Nigeria. “A lot of people weren’t initially interested in stablecoins. But as Bitcoin lost value, there was a desire to diversify into stablecoins. However, market shifts do not dampen activity. People are constantly looking for opportunities to hedge against the devaluation of the naira (Nigerian currency) and the ongoing economic downturn post-Covid,” he noted.

The State Intervenes

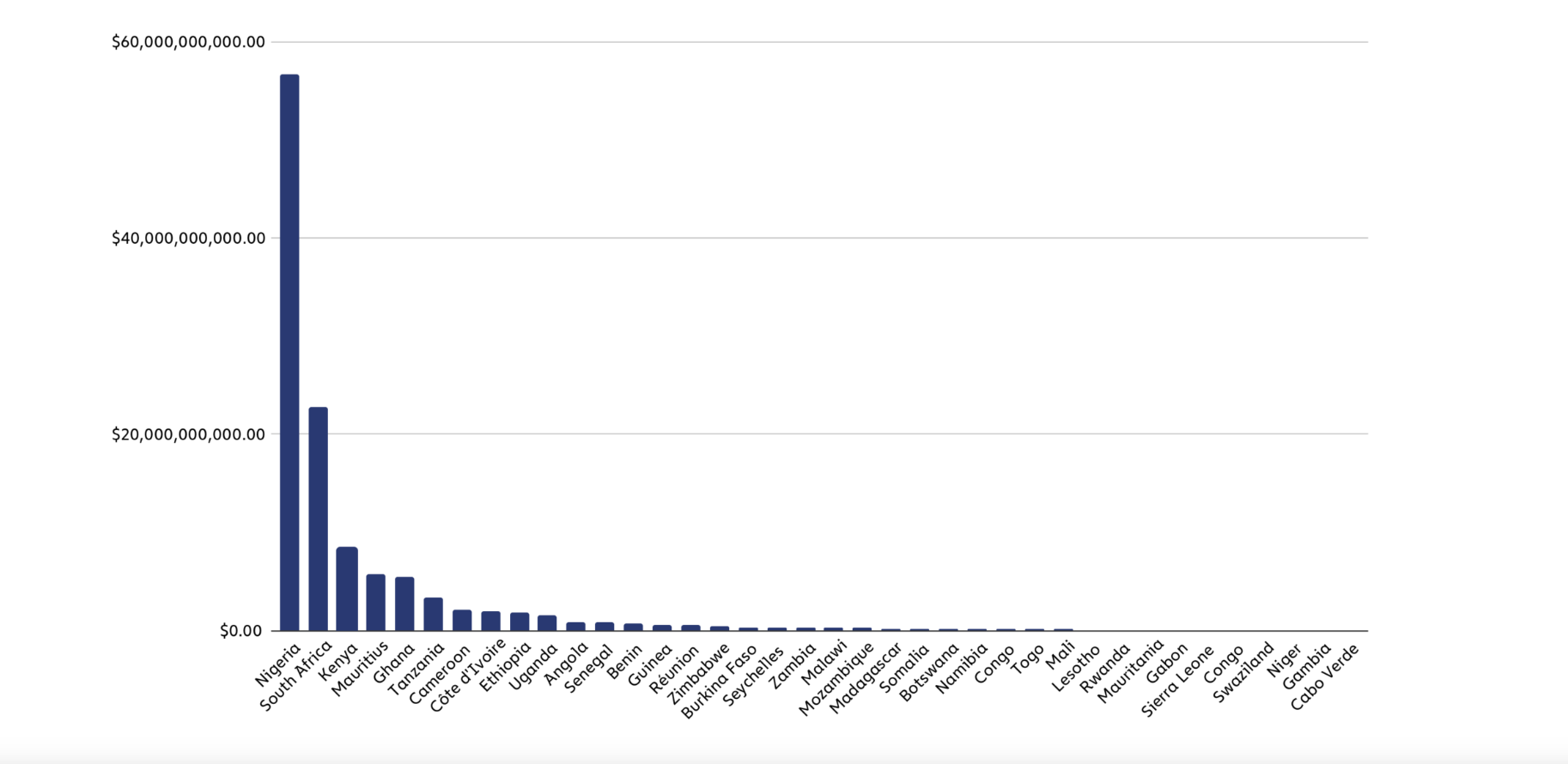

Nigeria ranks first in the use of cryptocurrencies in Africa; it also ranks second in the world after India in terms of cryptocurrency transactions. Nigeria's crypto economy continues to grow despite market turmoil. In fact, Nigeria is one of six countries in the top 50 largest in the world whose cryptocurrency transaction volume is growing year on year (Saudi Arabia, Vietnam, Nigeria, Spain, Taiwan, Indonesia). A growth rate of 9% places Nigeria third among the six countries.

Nigeria was the first in Africa to create its own cryptocurrency, eNaira, in 2021, developed by Barbadian fintech company Bitt. All transactions with this cryptocurrency are controlled by Nigerian regulators, and its rate is pegged to the national currency of Nigeria to reduce the risk of abuse by speculators.

Other African countries have also expressed potential willingness to launch their own digital currencies. In particular, similar plans are known in Kenya, Ghana, Morocco, Tunisia and Madagascar. The first in Africa to legalize Bitcoin was the Central African Republic, where more than 90% of the country's citizens do not even have access to the Internet.

“Each African country has its own legislation regarding cryptocurrencies. Somewhere it’s prohibited, somewhere it’s allowed, and somewhere in the gray zone,” notes QUASA CEO Slava Vasipenok.

“Each African country has its own legislation regarding cryptocurrencies. Somewhere it’s prohibited, somewhere it’s allowed, and somewhere in the gray zone,” notes QUASA CEO Slava Vasipenok.

In Nigeria, cryptocurrency is enshrined in law; There are completely legal crypto exchangers that have a license to operate from the Central Bank of Nigeria.

Cryptocurrency transaction volume in Nigeria grew 9% year-on-year to $56.7 billion between July 2022 and June 2023, according to Chainalysis.

The state is trying to regulate the cryptocurrency sector, which it considers too suspicious in terms of sources of financing and movement of funds. In 2021, Nigeria introduced a ban on cryptocurrency transactions due to the risks of money laundering and terrorist financing. At the end of December 2023, the country’s Central Bank officially lifted the ban on transactions with cryptocurrencies, emphasizing the need to regulate this area. To do this, he gave instructions to banks and other financial institutions on how to register current accounts in cryptocurrency and provide services to customers. In addition, such virtual service providers must obtain a license from the Securities and Exchange Commission to operate in the cryptocurrency trading industry.

The process of regulating cryptocurrencies in Nigeria did not stop there. In February of this year, the country's authorities announced that they would begin to block access to cryptocurrency trading platforms. A corresponding order was issued to telecommunications companies and other Internet providers with the requirement to block access to cryptocurrency trading platforms. Access to the Binance, Coinbase and Kraken platforms is blocked. This is due to the uncontrolled process of devaluation of the local currency, the naira. According to the government, one of the reasons for the devaluation lies in the fact that most financial transactions of Nigerians go through cryptocurrency exchanges, including exchange for dollars, and the country's banks do not make a profit. As stated by the head of the Central Bank of Nigeria, Olayemi Cardoso, $26 billion passed through Binance in the country from sources that could not be verified.

The other day, Cardoso said that the country was losing taxes due to unregistered cryptocurrency exchanges, after which Nigerian authorities detained two employees of the Binance cryptocurrency exchange. They may now face charges of currency manipulation, tax evasion and illegal transactions. Binance has already announced that it will cease operations in Nigeria effective March 8 due to government policies. However, according to Vasipenok, this is a temporary measure related to the government's intention to stabilize the exchange rate. Considering how actively the cryptocurrency market is developing in Nigeria, he believes, one can expect that the authorities will look for compromise solutions. Meanwhile, Binance suspended all Nigerian naira transactions amid pressure from authorities.

This is not the only scandal involving Binance in Nigeria. In June last year, Nigeria's securities regulator issued an order to shut down Binance Nigeria, after which it was revealed that Binance Nigeria, which operates in the country, has no connection with Binance and is a fraudulent organization. Binance demanded that the Nigerian company stop fraudulent activities under brand, and Binance CEO Changpeng Zhao urged his followers to “not believe everything they read in the newspapers.”

Mining Prospects

African countries have opportunities for cryptocurrency mining, but this area is also subject to government regulation. A few days ago, Angola decided to ban cryptocurrency mining. The proposed law on mining cryptocurrencies and other virtual assets, which was put to a final vote at the plenary session of the National Assembly, carries a prison sentence of one to five years. This happens because mining overloads distribution networks.

But in Ethiopia, on the contrary, there are no problems with electricity: after the commissioning of the dam and the Revival hydroelectric power station, the price of electricity in the country dropped noticeably, which attracted miners from China to Ethiopia. According to Bloomberg, the country's main competitive advantage is a rare combination of lenient government regulation of the industry and low electricity prices. At the same time, in China itself, a complete ban on cryptocurrency mining has been introduced since 2021.

Ethiopian authorities have allowed cryptocurrency mining in 2022. At the same time, in order to compensate for the current shortage of hard currency in the country, the authorities decided to charge local companies for electricity in foreign currency. Bloomberg estimates that within a few years, Ethiopia will be able to compete with Texas, which is now the leader in the United States in the production of digital currency.

DFA and Сryptocurrencies in Africa

According to Coingecko, if in Nigeria the level of interest in cryptocurrency is 66.8%, then in the next second place is South Africa - only 8.36%. Morocco comes in third with 5.43%, while Ghana is close behind with 5.24%. Inflation-stricken Egypt rounds out the top five with interest in cryptocurrencies at 2.74%.

It was South Africa, where the banking sector was quite well developed, that was one of the leaders in the region in terms of cryptocurrency regulation and the development of supporting trade frameworks. At the end of 2022, the Financial Sector Conduct Authority (FSCA) announced a licensing regime for crypto-currency businesses and stated that crypto-assets are financial products. This, firstly, rooted them in the legal field, and secondly, provided law enforcement officers with the opportunity to better combat illegal activities in this area.

According to Marius Reitz, Africa CEO of South African exchange Luno, the main use case for cryptocurrency in South Africa currently revolves around investment. Over the past three years, the number of clients with significant cryptocurrency balances on Luno has grown by almost 50%. “In markets where there are no regulatory restrictions, the industry develops more responsibly, since there players work openly and there is more productive interaction between regulators and exchanges. But bans do not stop people from wanting to use cryptocurrencies. The cryptocurrency industry will continue to grow with or without regulation. It is in everyone's interest to have pragmatic regulation that protects consumers and creates a safer work environment for everyone,” he added.

The Central Bank of Kenya has issued statements on potential volatility risks.

The Central Bank of Kenya has issued statements on potential volatility risks.

In early 2023, the government proposed legislation calling for a uniform definition of digital currencies as securities and strict record-keeping by licensed crypto traders.

In Mauritius, the Virtual Assets and Initial Token Offering Services Act 2021 provided the legal framework for the issuance of new tokens.

Last week, the Russian State Duma adopted a law on international payments with digital financial assets (DFA), which implies the possibility of foreign trade transactions using such instruments as a means of payment. In addition, it is planned to pay with digital currency with countries in Africa and Asia, in particular with Myanmar, Angola, South Africa and Nigeria. A bill allowing foreign trade settlements in cryptocurrency may be adopted at the current Duma meeting.

According to Slava Vasipenok, it is important to separate the concepts of cryptocurrency, or digital currency, and central bank digital currency (CBDC, Central Bank Digital Currency). “The difference is fundamental. The second is completely centralized and is under the control of financial regulators and governments of the respective countries. Therefore, CBDC is not a cryptocurrency, but refers to digital financial assets (DFA) or tokens, issued and circulated by central/national banks backed by national currencies,” explains the expert.

“Cryptocurrency is a more flexible mechanism for organizing mutual settlements than digital financial assets, which are one way or another controlled by the central banks of countries,” Vasipenok emphasized. According to him, cryptocurrency exchanges between African countries are being developed by Cameroon, Côte d'Ivoire, Ghana, South Africa, Nigeria, Senegal, but not all of them are enshrined at the legislative level. “It is worth noting that a real digital transition is impossible without states adopting new rules of the game in finance. Especially in countries like Algeria, where cryptocurrencies were banned back in 2018 in accordance with the adopted financial law,” he added.

Cryptocurrencies have revolutionized finance and technology, changing the way we think about them. Even though this decentralized revolution is just getting started, it brings with it a multitude of opportunities for professionals who seek flexibility, autonomy and career growth.

QUASA has become the first one-stop marketplace offering cryptocurrency payments for freelancers and those who work remotely!

Quasacoin (QUA) is the governance token of the QUASA.

The Quasa Connect application is placed in the public domain on the Google Store and you can test it both from the side of the contractor and from the side of the customer. And as the world's first mobile crypto app for remote work, it has huge potential in Africa. Read more here.

Thank you!

Join us on social media!

See you!