The Magic Kingdom is learning a hard lesson: flexing muscle in carriage-fee negotiations can bleed cash faster than a leaky turnstile at Disneyland.

Morgan Stanley estimates that Disney’s ongoing blackout on YouTube TV – triggered by a failure to renew a distribution deal – is costing the entertainment giant $4.3 million in lost daily affiliate revenue. That’s $60.2 million already vanished since the channels went dark, with no new agreement in sight and the next quarterly earnings report looming like storm clouds over Cinderella Castle.

Morgan Stanley estimates that Disney’s ongoing blackout on YouTube TV – triggered by a failure to renew a distribution deal – is costing the entertainment giant $4.3 million in lost daily affiliate revenue. That’s $60.2 million already vanished since the channels went dark, with no new agreement in sight and the next quarterly earnings report looming like storm clouds over Cinderella Castle.

The dispute centers on per-subscriber fees for Disney’s portfolio of 22 networks, including ESPN, ABC-owned stations, FX, Freeform, and the Disney Channel. YouTube TV, Google’s live-TV streaming service with 6.8 million subscribers (per Leichtman Research Group), dropped the channels after Disney demanded a 15–18% rate hike – roughly $2.50–$3.00 more per subscriber per month – to offset cord-cutting losses and fund Disney+ expansion.

Google refused, citing margin pressure and the need to keep its $82.99 base price competitive against Hulu + Live TV ($83.99) and Fubo ($84.99).

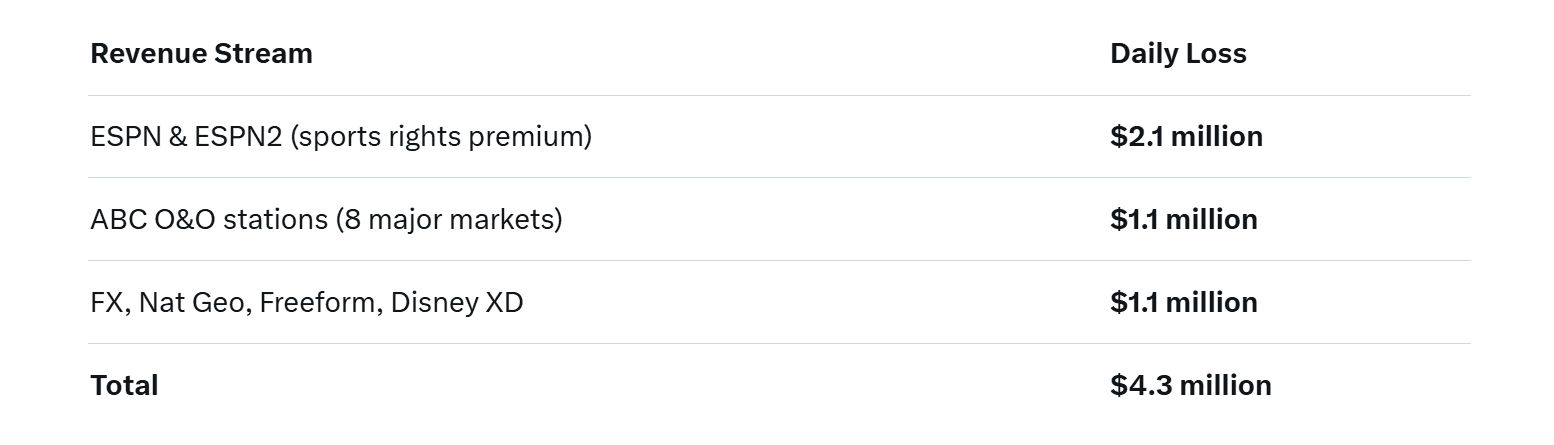

The Math Behind the $4.3 Million Daily Hit

Morgan Stanley’s model breaks it down:

The figure assumes an average blended affiliate fee of $13.80 per YouTube TV subscriber for Disney’s full suite – a rate confirmed by SNL Kagan’s Carriage Fee Database. With 6.8 million subs, that’s $93.8 million in monthly revenue at stake. Every 24 hours without a deal adds another $4.3 million to Disney’s tab.

YouTube TV’s Churn Nightmare

Google isn’t walking away unscathed. Internal data leaked to The Information shows daily net churn spiked 340% in the first week of the blackout, with 42,000 subscribers canceling in the first 72 hours alone.

A YouTube TV subscriber survey conducted by CivicScience found:

A YouTube TV subscriber survey conducted by CivicScience found:

- 61% cited the Disney blackout as their primary reason for considering cancellation.

- 37% of sports viewers said they’d switch to Hulu + Live TV to regain ESPN.

- 19% planned to return to cable.

YouTube TV’s ARPU (average revenue per user) is $89.40, meaning each lost subscriber costs Google $1,073 annually. At the current churn rate, the platform could lose $450 million in annualized revenue by mid-quarter if the standoff drags on.

The Sports Clock Is Ticking

The real pressure cooker? College football playoffs and the NFL. The blackout hit just as the College Football Playoff expanded to 12 teams, with first-round games airing on ESPN and ABC. YouTube TV subscribers in eight Disney-owned ABC markets (New York, Los Angeles, Chicago, etc.) also lost local news and primetime programming.

The real pressure cooker? College football playoffs and the NFL. The blackout hit just as the College Football Playoff expanded to 12 teams, with first-round games airing on ESPN and ABC. YouTube TV subscribers in eight Disney-owned ABC markets (New York, Los Angeles, Chicago, etc.) also lost local news and primetime programming.

One viral Reddit thread on r/YouTubeTV titled “No ESPN for the CFP – I’m out” garnered 14,000 upvotes and 2,100 comments, many from cord-cutters who vowed to re-subscribe to cable for bowl season.

Disney, meanwhile, is banking on fan outrage to force Google’s hand. CEO Bob Iger called the rate increase “non-negotiable,” citing ESPN’s $9.2 billion in sports rights commitments (up 12% YoY). But Wall Street isn’t buying the bravado: Disney shares dipped 3.1% on the first trading day after the blackout as analysts downgraded guidance.

Also read:

- Warner Bros. Discovery Sinking Fast: Someone, Please Just Buy It Already!

- Jack Conte's Latest Patreon Updates: Discovery Feeds, Quips, and the Social Media Paradox

- Disney's $1 Billion Content Spending Surge in 2026: A Sports-Fueled Bet on Streaming Supremacy

A Deal by Christmas?

Morgan Stanley predicts a resolution within the next week, just in time to restore channels for the CFP. The likely compromise: a 10–12% rate hike (≈$1.80–$2.20 extra per sub) with tiered bundling – YouTube TV could offer a $12 “Disney Sports Add-On” (ESPN + ABC) and a $6 “Family Pack” (Disney Channel, Freeform). Google would eat part of the increase via reduced ad revenue share on Disney inventory, while Disney concedes **flexible packaging** to curb churn.

Until then, the daily $4.3 million hemorrhage continues. As one YouTube TV subscriber tweeted:

> “Disney and Google fighting over my $3 while I miss the Army-Navy game. Congrats, billionaires – you played yourselves.”

Corporate America’s new anthem: Let the viewers eat static.