As 2025 draws to a close, one sector has dominated headlines in the investment world: Canadian mining stocks. While gold prices hover near record highs - up a robust 56% year-to-date and trading at around $4,348 per ounce as of October 20 - it's the miners themselves, particularly those listed on Canadian exchanges, that have truly captured the spotlight.

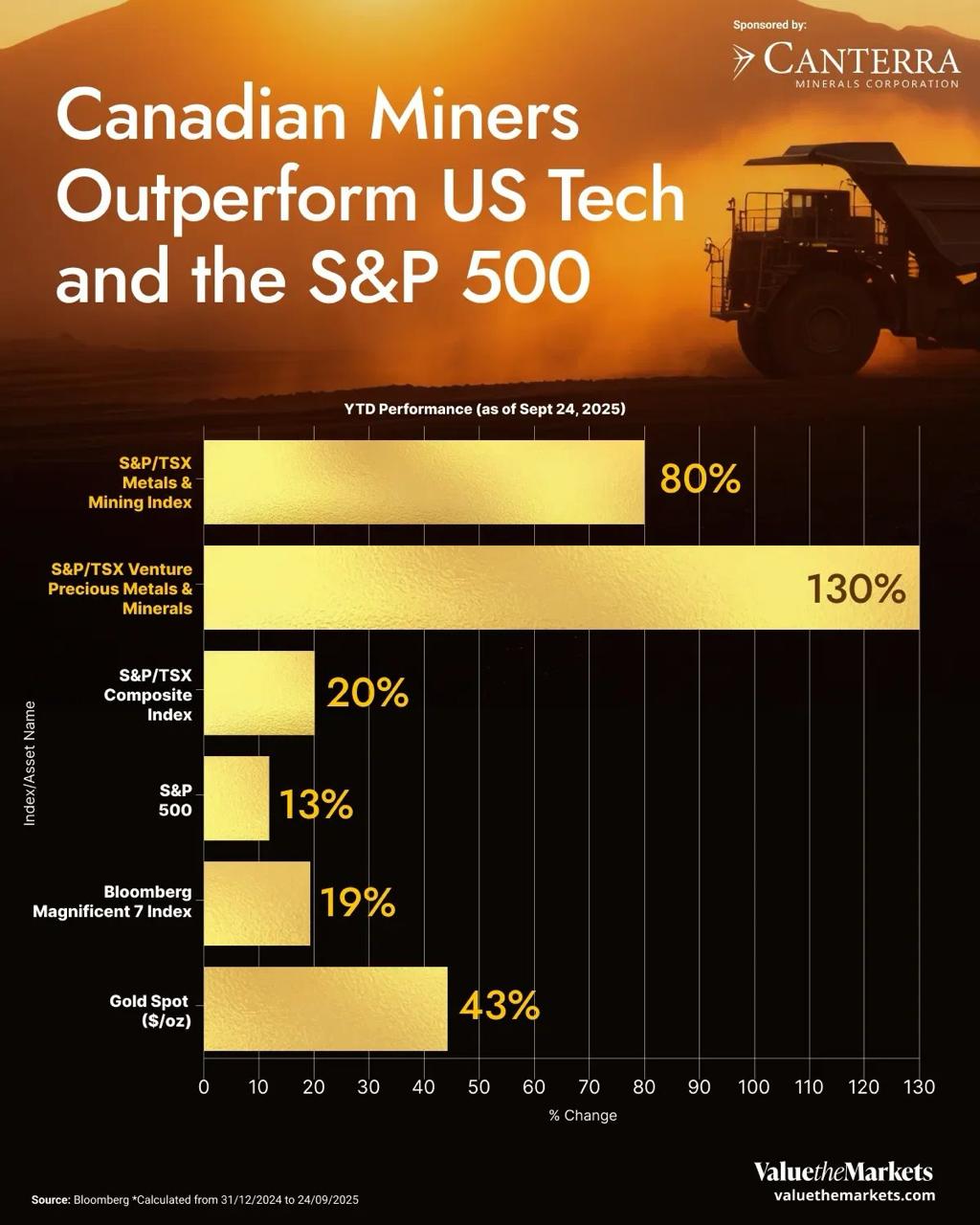

The S&P/TSX Metals & Mining Index has skyrocketed by an impressive 80% since January, far outpacing the broader Canadian market's 20% gain, the U.S. S&P 500's modest 13% rise, and even the much-hyped "Magnificent Seven" U.S. tech giants, which are up just 19%. In an era of economic uncertainty, these picks-and-shovels plays are proving that leverage to commodities can deliver outsized returns.

The Gold Rush Leaders: Big Names Shining Bright

At the forefront of this boom are gold producers, whose operational efficiencies and exposure to soaring metal prices have propelled their shares to new heights. Lundin Gold, operator of the high-grade Fruta del Norte mine in Ecuador, has been a standout. The company reported record revenues and free cash flow in Q2 2025, driven by production exceeding 139,000 ounces and a realized gold price of $3,361 per ounce.

At the forefront of this boom are gold producers, whose operational efficiencies and exposure to soaring metal prices have propelled their shares to new heights. Lundin Gold, operator of the high-grade Fruta del Norte mine in Ecuador, has been a standout. The company reported record revenues and free cash flow in Q2 2025, driven by production exceeding 139,000 ounces and a realized gold price of $3,361 per ounce.

This led to an earnings beat, with EPS of $0.82 topping estimates, and shares surging 8.57% in after-hours trading. Year-to-date, Lundin Gold's stock has climbed significantly, reflecting investor enthusiasm for its updated 2025 production guidance of 490,000–525,000 ounces.

Not far behind is Kinross Gold, a global heavyweight with assets in the Americas and West Africa. Kinross hit a 52-week high of $25.92 in October, capping a remarkable 158% gain over the past 12 months. The company's Q2 results showcased 42% year-over-year revenue growth to $1.73 billion, fueled by higher gold prices and operational tweaks. Analysts remain bullish, with price targets climbing to $31 from UBS and $30 from BofA, citing Kinross's perfect Piotroski Score of 9 and EBITDA of $3.4 billion.

Rounding out the podium is Dundee Precious Metals, which delivered record Q2 free cash flow and adjusted net earnings, boosting revenue 19% to $186 million. Shares jumped 5.23% post-earnings to $34.61, extending a blistering 230% return over the prior six months. Strategic moves, like the pending Adriatic Metals acquisition and the Čoka Rakita project, position DPM for 80% precious metals revenue exposure once fully ramped up.

Rounding out the podium is Dundee Precious Metals, which delivered record Q2 free cash flow and adjusted net earnings, boosting revenue 19% to $186 million. Shares jumped 5.23% post-earnings to $34.61, extending a blistering 230% return over the prior six months. Strategic moves, like the pending Adriatic Metals acquisition and the Čoka Rakita project, position DPM for 80% precious metals revenue exposure once fully ramped up.

These mid-to-large caps have benefited from gold's safe-haven allure amid inflation fears and geopolitical tensions, but their gains stem from more than just spot prices - improved mill throughput, cost controls, and exploration upside have amplified returns.

Small Caps: High Risk, Higher Reward

The real adrenaline rush, however, lies with the juniors. The S&P/TSX Venture Precious Metals & Minerals Index - tracking smaller explorers and developers - has exploded by 130% year-to-date, embodying the high-volatility thrill of early-stage mining. These "juniors" or "babies," as enthusiasts call them, offer explosive potential but come with stomach-churning swings. A single drill result or acquisition rumor can double a stock overnight, while permitting delays or metal price dips can halve it just as fast.

The real adrenaline rush, however, lies with the juniors. The S&P/TSX Venture Precious Metals & Minerals Index - tracking smaller explorers and developers - has exploded by 130% year-to-date, embodying the high-volatility thrill of early-stage mining. These "juniors" or "babies," as enthusiasts call them, offer explosive potential but come with stomach-churning swings. A single drill result or acquisition rumor can double a stock overnight, while permitting delays or metal price dips can halve it just as fast.

For the retail investor, this segment is a goldmine of opportunity. Unlike physical gold, which has returned a solid but steady 56% YTD, mining juniors provide leveraged exposure - often outperforming the metal by 2x or more during bull runs. In unstable economies, they act as a hedge against fiat currencies, while diversifying beyond the tech-heavy S&P 500. We're fans of these underdogs: their asymmetry - limited downside in bull markets paired with uncapped upside - makes them a portfolio spice, not the main course.

Also read:

Also read:

- The Strangest Fallout from the AWS Outage: Smart Mattresses Go Rogue and Ruin Sleep Worldwide

- Dream Job Alert: Ocean City Police Seek Weed Volunteers for Impairment Training – Slots Filled in Hours!

- Courtship Ends! Paramount Skydance Prepares for Massive Layoffs

- EU to Launch Age Verification App in Early 2026

Why Now? The Broader Appeal

Canadian miners' dominance in 2025 isn't isolated. With gold futures eyeing $4,200+ amid central bank buying (projected at 800–900 tonnes for the year) and consumer demand tempered by high prices, the sector's momentum looks sustainable. The TSX's mining-heavy composition - home to 40% of global public mining equity - gives it an edge over broader indices.

For everyday investors, the takeaway is straightforward: Allocate modestly to miners for growth and protection. Start with established names like Lundin or Kinross for stability, then dip into juniors via ETFs tracking the Venture Index. In a world hooked on AI hype, these earthy assets remind us that sometimes, the best bets are buried underground.

Author: Slava Vasipenok

Founder and CEO of QUASA (quasa.io) - Daily insights on Web3, AI, Crypto, and Freelance. Stay updated on finance, technology trends, and creator tools - with sources and real value.

Innovative entrepreneur with over 20 years of experience in IT, fintech, and blockchain. Specializes in decentralized solutions for freelancing, helping to overcome the barriers of traditional finance, especially in developing regions.

This is not financial or investment advice. Always do your own research (DYOR).