Hello!

In this era, every bank is facing two big challenges

First Challenge

- New Entrances – Banks every day, have new people stepping up to their landscape. The payment and banking space are being fundamentally transformed. It is said that “People need banking but they do not need banks.” And as banks are dealing with these new entrances, every day they feel that the role they played for so long and was holding a certain upright future is no longer holding at the same place. And this is the reason that traditional banks need to think differently.

Second Challenge

Second Challenge

- Client expectations – The client expectations are rising every day, and this is not because what banks are currently delivering. Banks no longer look to their competitors to determine where they lack in their innovation. They look at organizations like Uber, Nest, and Fitbit that have nothing to do with banking but are setting their client expectations

And if banks fail to address these challenges, they are going to lose customers in millions.

Digital Banking – Its evolution and disruption

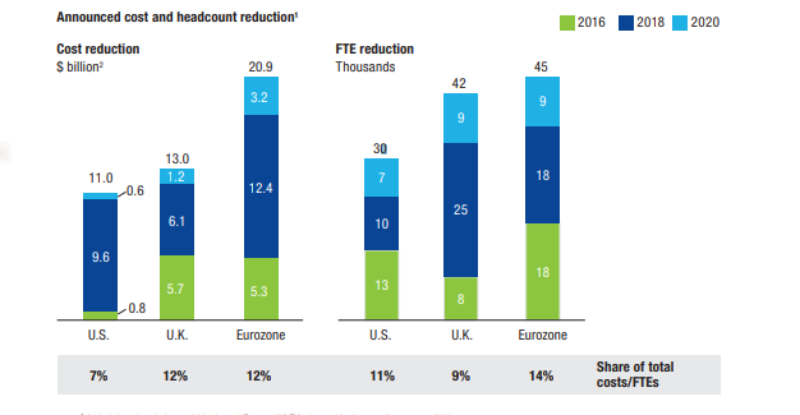

Digital banking is fundamentally affecting existing banks in a lot of ways. It is significantly reducing the cost by automating various processes, but it is also shifting revenue pools to those players who are offering superior customer services.

Source: McKinsey

Digital banking has the power to fully transform the existing banks, from frontend and backend, and everything in between – for both customers and the employees. A bank is considered a digital bank only when all its function – from products to customer service are digitized.

5 Main Reasons Why Digital Banking Is Becoming Necessary

5 Main Reasons Why Digital Banking Is Becoming Necessary

- Reduced Costs – If banks do not switch to digital banking they will have to continue supporting expensive hardware and software for their functionality.

- Increased Revenue – Existing banks lack an intelligent system that promotes poor CX, leading to a lower market share.

- Retain Customers – Fintechs and other newcomers have shaken up the banking landscape by providing improved customer experience and personalized services.

- Remain Compliant – Legacy systems make embracing legislation difficult, reducing the return on expenditure

- Benefits of new technologies – Data analytics, open APIs, blockchain and cognitive banking are predicted to impact banking business models.

Disruptive Approaches To Build A Seamless Digital Banking ExperienceCustomer expectations are rising, new regulations are being created, and the competition from the tech giants are increasing. These fast-paced changes are forcing banks to analyze their core existence and pay a new path to put their step for in the new digital world.

- Developing a multichannel experience

The banking industry needs to find the optimal channel mix to determine what works best for providing personalized CX. This is being referred to as “Optichannel Experience”.

Approach –

Seamlessness also depends on addressing various ouch points. Only a few organizations have the capability to support the customer’s journey from the starting point to the finishing line on one channel. This becomes apparent during the onboarding stage of engagement at credit unions and banks.

Seamlessness also depends on addressing various ouch points. Only a few organizations have the capability to support the customer’s journey from the starting point to the finishing line on one channel. This becomes apparent during the onboarding stage of engagement at credit unions and banks.

- Digital On-boarding

Onboarding experience starts with the application for a new service or product and continues until the customer is highly engaged with the communication. While most organizations have some part of the application process digitized, the majority requires some level of engagement with the physical channels, even with the mobile application process.

Approach –

It is becoming an unacceptable process for the customers to work with a broken process. The customer wants easy and smooth processes, packed with security, authentication, and digital documentation capabilities. One simple is to adapt the video identification option for the process of documentation.

- Analysis

The utilization and delivery of Personal Financial Management tools have usually under-performed expectations. Only a few Personal Financial Management tools provide a great graphic representation of the financial position and also deliver the level of trusted advice in person.

Approach –

The integration of advanced analytics, account aggregation, and improved recommendation and application engines can result in a value-added service for the consumer. With new regulations and approaches, digital banking APIs is a step towards advance selling.

- Offering Next-Gen Customer Support

To meet the expectation of the digital consumer, banks will have to move beyond FAQs to interactive content and chatbots. Both of these technologies, when integrated with AI and machine learning, will significantly improve the delivery of the services while reducing the costs.

To meet the expectation of the digital consumer, banks will have to move beyond FAQs to interactive content and chatbots. Both of these technologies, when integrated with AI and machine learning, will significantly improve the delivery of the services while reducing the costs.

Approach –

Soon chatbots are going to become a core component of digital banking propositions. While some big banks have already started using chatbots for progressive customer experience, integration of voice banking may also be one of the most exciting growth in the industry.

- Enhance Mobile Selling

As millennials are switching from physical banks to mobile banks, so are F2F sales opportunities. The sales pitches that were done on the teller’s window or bank managers desk are now being delivered as a personalized product sales message.

Approach –

Mobile Selling has made it possible for prospects and customers to purchase on a digital channel. Banks are taking a more contextual strategy for sales rather than pushing a product on a device. In other words, they are taking on a need-based selling approach powered by advanced analytics.

Mobile Selling has made it possible for prospects and customers to purchase on a digital channel. Banks are taking a more contextual strategy for sales rather than pushing a product on a device. In other words, they are taking on a need-based selling approach powered by advanced analytics.

Digital Banking if done correctly by the banks can get the best possible digital experience for their consumers. Not only in terms of reduced costs but a significant improvement in revenues. This is the implementation gap that most of the fintech firms are filling for the past several years. They are using data, analytics, digital technology and agility to deliver what the consumer is asking for.

To make it certain for the future, banks need to ensure that they future-proof their business in terms of digital proposition and organizational structure.

Also read:

- What does Account Information Disputed by Consumer Meets FCRA Requirements Mean?

- Guarding Your Rights After a Car Accident in Cocoa beach

- Decaf Coffee Contains a Horrifying Poison, Experts Say

- Here’s How to Start a Content Marketing Agency

Thank you!

Subscribe to our newsletter! Join us on social networks!

See you!