Deutsche Bank has released a comprehensive study examining asset returns over more than 200 years across 56 global economies.

The report is designed to equip both private and professional investors with the historical data needed to refine their strategic asset allocation and achieve long-term financial goals.

The report is designed to equip both private and professional investors with the historical data needed to refine their strategic asset allocation and achieve long-term financial goals.

The Enduring Power of Risk and Compounding

The historical evidence is unequivocal: investors who embraced risk and maintained a long-term investment horizon were consistently rewarded through the compounding effect of dividends and coupons.

Taking calculated risk and staying invested remains the most reliable strategy for wealth accumulation.

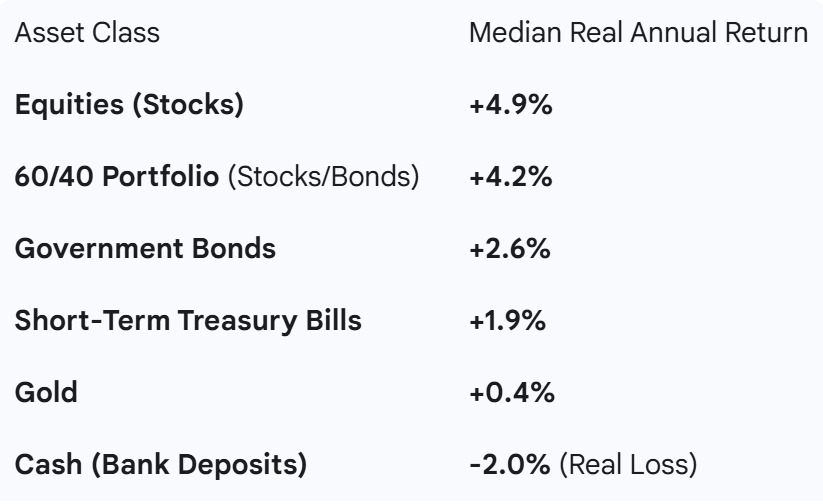

200-Year Median Real Annual Returns

Over the past two centuries, the following assets demonstrated these median annual returns (in U.S. dollar terms, adjusted for inflation—i.e., real returns):

In the long run, gold significantly lagged financial assets that generate income (dividends/coupons). Holding cash resulted in a net loss of purchasing power due to inflation.

The 21st Century Anomaly (Since 2000)

While gold has underperformed over 200 years, the 21st century has been an anomaly:

- Gold has outperformed all other assets, showing a real annual return of +7.45%.

- U.S. Equities returned +5.8% per annum.

- German Equities returned +3.9% per annum.

- UK Equities returned +3.3% per annum.

- Government Bonds have yielded barely any return, averaging only 0.6%–0.9% per year.

Global Investment Leaders and Laggards

Analyzing the last 100 years, the best countries for investment have been the most politically and economically stable:

Analyzing the last 100 years, the best countries for investment have been the most politically and economically stable:

- Best Performers (Stocks):

Sweden: +7.5% per annum.

USA: +7.2% per annum.

- Best Performer (Bonds):

Denmark: +3.5% per annum.

Worst Performers:

- Italy: Equities returned +2.5%, while Bonds returned -1.1%. This poor performance is attributed to frequent political crises and government changes. However, Italian stocks have been the best performers among developed economies over the last five years, returning +12.2% annually.

- Countries with perpetually poor bond returns often struggle with high national debt, including Italy, Japan, and France.

Economic Growth and Investment Returns

Economic growth (GDP) is a direct driver of investment returns. Since 1900, world GDP has grown by approximately 5.7% per year.

Economic growth (GDP) is a direct driver of investment returns. Since 1900, world GDP has grown by approximately 5.7% per year.

- Decelerating Growth: Growth in developed countries has slowed significantly. The 2010s saw growth rates as low as those in the 19th century. By the end of 2024, the return on equities over the preceding 25 years was the lowest it has been since 1877.

- Forecast: International organizations, such as the IMF, project that developed economies will grow around 4% per year over the next five years—a rate below the historical average. This forecast does not account for the additional inflation created by government fiscal and monetary policies. Notably, since 1971, no country has maintained inflation below 2% in the long term.

Key Structural Challenges

The slowing growth rate is compounded by demographic shifts:

- The growth of the real economy in developed countries is now as low as it was in the mid-to-late 19th century and lower than in the second half of the 20th century.

- Population growth is decelerating. It is projected that 32 out of the 56 economies in the sample will face a shrinking working-age population by 2050, posing a serious challenge to sustaining real GDP growth.

Equity Risk Premium and Currency Stability

Equity Risk Premium

The Equity Risk Premium (ERP) — the excess return stocks provide over bonds — is a key metric for measuring the reliability of stock markets over time:

The Equity Risk Premium (ERP) — the excess return stocks provide over bonds — is a key metric for measuring the reliability of stock markets over time:

- The global average ERP over 100+ years is 3.2% per year.

- Germany boasts the highest ERP at 7.0% since 1835.

- Spain has one of the lowest at approximately 0.8%.

- The U.S. shows a reliable ERP of 4.8%, cementing its status as one of the most dependable countries for long-term equity investment.

Also read:

- Emerging Technologies and Approaches in Digital Marketing for 2026

- Truth Social Enters the Prediction Market Arena with Truth Predict, Challenging Polymarket and Kalshi

- French Parliament to Consider Bill on State Bitcoin Reserve

Currency Stability

Over the last 100 years, only three currencies — Switzerland, Singapore, and the Netherlands — have managed to strengthen their currency against the U.S. dollar. Conversely, 25 countries have seen their currencies almost completely depreciate, losing nearly 99% of their value relative to the dollar. This underscores the risk inherent in holding assets in weaker currencies.

Author: Slava Vasipenok

Founder and CEO of QUASA (quasa.io) - Daily insights on Web3, AI, Crypto, and Freelance. Stay updated on finance, technology trends, and creator tools - with sources and real value.

Innovative entrepreneur with over 20 years of experience in IT, fintech, and blockchain. Specializes in decentralized solutions for freelancing, helping to overcome the barriers of traditional finance, especially in developing regions.

This is not financial or investment advice. Always do your own research (DYOR).