In a pair of announcements that landed like a one-two punch to the streaming wars, Warner Bros. Discovery (WBD) is raising prices on its flagship service HBO Max - effective immediately - while simultaneously signaling to Wall Street that it's open for business. Literally.

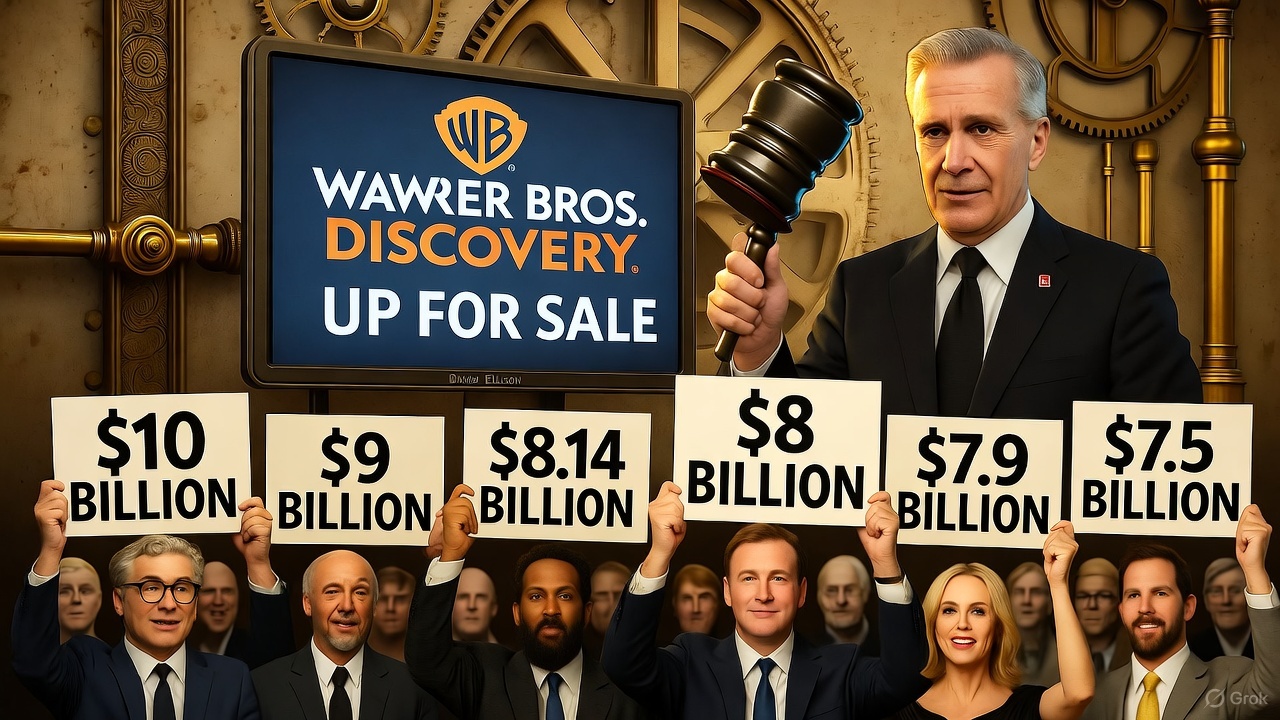

The media giant's board revealed it's reviewing "strategic alternatives," including a full sale, after fielding unsolicited offers for the entire company or just the Warner Bros. assets. Coming hot on the heels of rejecting a lowball bid from Paramount Skydance's David Ellison, these moves paint a picture of a company scrambling to maximize value amid mounting debt and a fracturing industry.

The Price Hike: Paying Premium for Prestige

First, the sting for subscribers: HBO Max, fresh off re-embracing its original name earlier this year after a brief identity crisis as "Max," is getting pricier across the board. The changes, announced on October 21, 2025, and kicking in right away for new sign-ups, represent the streamer's second hike in just 12 months.

First, the sting for subscribers: HBO Max, fresh off re-embracing its original name earlier this year after a brief identity crisis as "Max," is getting pricier across the board. The changes, announced on October 21, 2025, and kicking in right away for new sign-ups, represent the streamer's second hike in just 12 months.

Here's the breakdown:

- Basic with Ads: Up $1 to $10.99/month (or $109.99/year, a $10 bump).

- Standard (ad-free, two streams): Up $1.50 to $18.49/month (or $184.99/year, up $15).

- Premium (ad-free, four streams, 4K): Up $2 to $22.99/month (or $229.99/year, up $20).

Existing monthly subscribers won't feel the pinch until their next billing cycle on or after November 20, 2025, giving them a 30-day heads-up. WBD isn't saying much about the rationale beyond the usual "investing in premium content," but CEO David Zaslav telegraphed this back in September, hinting at higher costs to fund growth and curb password-sharing.

With hits like the upcoming DC Universe expansions, Peacemaker Season 2, and Warner Bros. blockbusters such as Superman and A Minecraft Movie flowing in, the company is betting viewers will pony up for the prestige library of HBO originals, DC comics, and studio tentpoles.

With hits like the upcoming DC Universe expansions, Peacemaker Season 2, and Warner Bros. blockbusters such as Superman and A Minecraft Movie flowing in, the company is betting viewers will pony up for the prestige library of HBO originals, DC comics, and studio tentpoles.

But in a crowded market where Netflix's standard plan sits at $15.49 and Disney+ bundles for less, this positions HBO Max as the priciest ad-free option around - over 20% more than the competition.

Critics are already grumbling: Is elite content worth elite pricing when cord-cutting fatigue is real? WBD's 125 million global subscribers might test that theory soon.

The Sale Signal: Inviting Bidders to the Banquet

If the price hikes feel like squeezing subscribers to fund the party, the second announcement clarifies who's really footing the bill: potential buyers. In a press release that sent WBD shares surging nearly 10% to around $20 in early trading, the company disclosed it's evaluating offers after rejecting multiple bids - including several from Paramount Skydance and one even higher.

If the price hikes feel like squeezing subscribers to fund the party, the second announcement clarifies who's really footing the bill: potential buyers. In a press release that sent WBD shares surging nearly 10% to around $20 in early trading, the company disclosed it's evaluating offers after rejecting multiple bids - including several from Paramount Skydance and one even higher.

Ellison's consortium, fresh off sealing its $8 billion Paramount deal, reportedly floated about $20 per share for Warner Bros. - deemed "chump change" by insiders, given the conglomerate's $40 billion debt load from the 2022 WarnerMedia-Discovery merger.

Now, the board is casting a wide net: full-company takeovers, carve-outs of Warner Bros. (streaming and studios), or even tweaks to its planned mid-2026 split into separate Warner Bros. and Discovery entities. Zaslav framed it optimistically: "We're advancing strategic initiatives... and scaling HBO Max globally," but the subtext is clear - this is a fire sale disguised as prudence.

Potential suitors? Tech titans like Netflix, Amazon, Apple, or Comcast could swoop in for the streaming goldmine, while private equity might eye the distressed assets. A full merger with Ellison's empire isn't off the table, potentially reshaping Hollywood into fewer, fatter conglomerates.

Also read:

- The Trump Effect: Paramount-Skydance Merger Adds Conservative Voices in Political Shift

- Duffer Brothers Bid Farewell to Netflix for Paramount: Theatrical Dreams Trump Streaming Comfort

- Paramount+ Releases Documentary Thirst Trap on One of the Wildest Fandoms: The Cult of TikToker William White

- Spotify Boasts Subscriber Growth but Reports Losses

Symbolic Timing: A Company at the Crossroads

These twin revelations, dropping on the same October morning, aren't coincidental - they're symbiotic. The price bumps juice short-term revenue to make WBD more appetizing to bidders, while the sale buzz validates the hikes as part of a "value-maximizing" pivot. It's a classic Zaslav gambit: the exec who once preached merger synergies now admits the experiment flopped, saddling the firm with legacy cable woes and streaming wars attrition.

For Hollywood, this could spark a bidding frenzy, echoing the Paramount saga. But for consumers? Brace for more nickel-and-diming as media giants consolidate power. If WBD fetches a premium, great - subscribers might get stability. If not, expect deeper cuts, more ads, and perhaps the ironic fate of HBO's crown jewels getting bundled into someone else's empire. Either way, the banquet's on, and we're all buying the tickets.