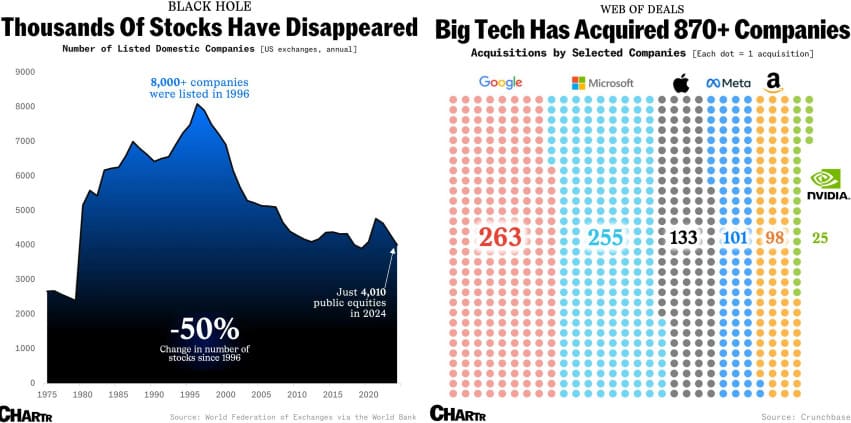

The once-vibrant landscape of US public markets is looking increasingly barren. In 1996, at the height of the dot-com boom, over 8,000 companies were listed on major American stock exchanges like the NYSE and Nasdaq, offering investors a smorgasbord of opportunities from scrappy startups to established players.

Fast-forward to 2025, and that number has plummeted to around 4,000 – a roughly 50% decline that has reshaped the investment world. This isn't just a story of fewer IPOs or economic headwinds; it's a tale of consolidation driven by private equity's allure, regulatory hurdles, and – most aggressively – a feeding frenzy among tech titans.

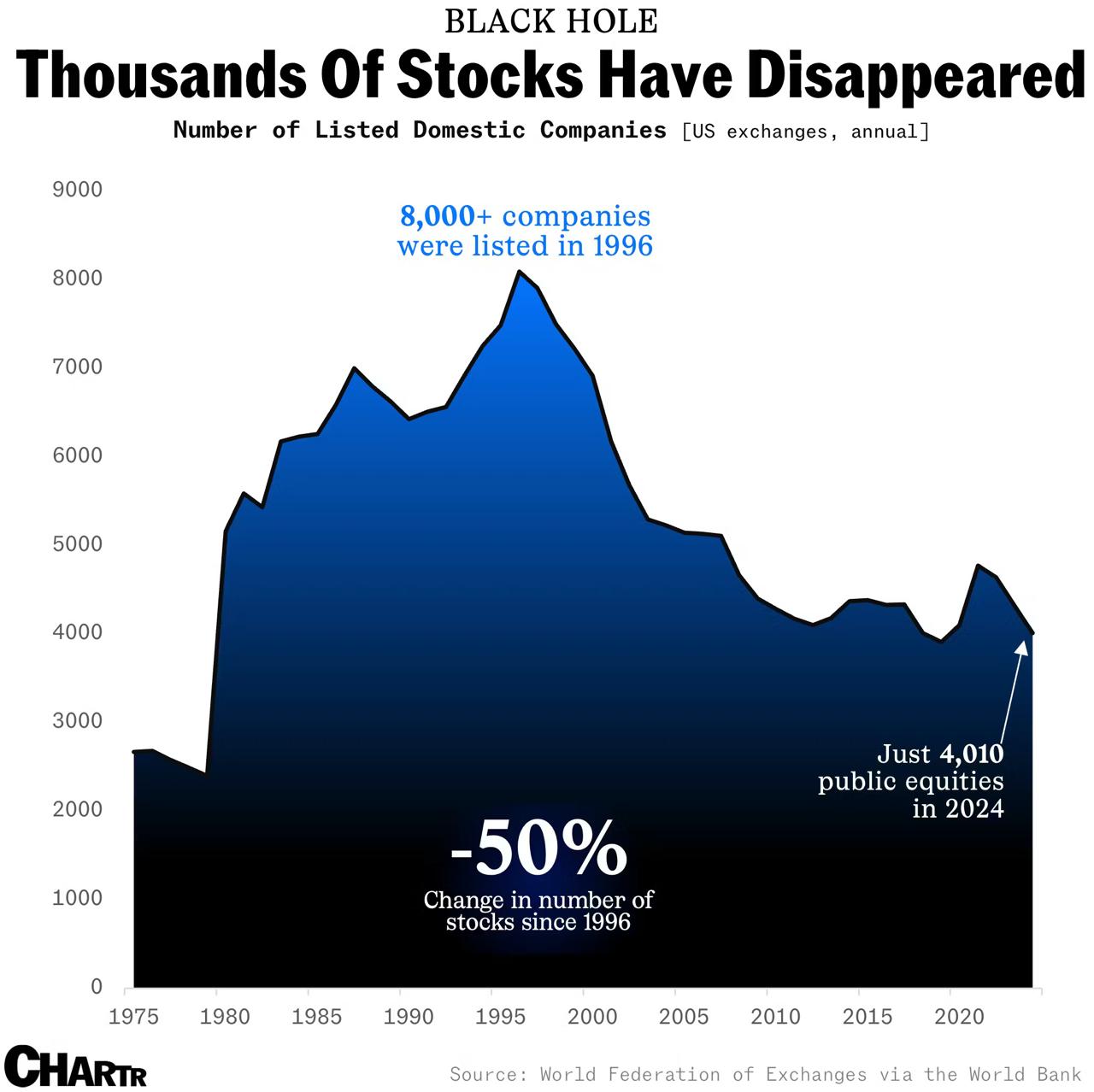

Giants like Google (Alphabet), Microsoft, Apple, Meta, and Amazon have snapped up over 800 companies since the 1990s, swallowing potential public market stars before they could even dream of an IPO. The result? A thinner roster of public stocks, fewer innovation hotspots, and a creeping oligopoly that's now echoing even in the wild west of cryptocurrencies.

The Vanishing Act: Why Fewer Companies Are Going Public

The shrinkage of public listings isn't a sudden 2025 phenomenon; it's decades in the making. Post-dot-com crash, mergers, delistings, and a surge in private funding siphoned off smaller firms that might have otherwise hit the exchanges.

The shrinkage of public listings isn't a sudden 2025 phenomenon; it's decades in the making. Post-dot-com crash, mergers, delistings, and a surge in private funding siphoned off smaller firms that might have otherwise hit the exchanges.

Private equity and venture capital have exploded, allowing companies to stay private longer – raising billions without the scrutiny of quarterly earnings calls or Sarbanes-Oxley compliance costs. In 1996 alone, 848 companies went public, raising $78.6 billion; by contrast, 2024 saw just 72 operating companies IPO (excluding SPACs and the like).

But the real culprit? Big Tech's acquisition spree. Since the late 1990s, these five behemoths – often dubbed the "Magnificent Five" or FAMGA – have collectively acquired more than 800 firms, a number that balloons when including unreported "killer acquisitions" designed to neutralize nascent threats.

Not content with organic growth, they've vacuumed up innovators that could have become independent public entities, diversifying the market and sparking competition. Instead, these gems get folded into sprawling ecosystems, bolstering the giants' moats while starving the public markets of fresh listings.

Big Tech's Shopping Spree: Snuffing Out Tomorrow's IPO Stars

Consider the heavy hitters. Google's parent Alphabet has made over 200 acquisitions since 2000, including the $1.65 billion YouTube buyout in 2006 – a fledgling video platform that exploded into a cultural juggernaut but never got its own ticker.

Consider the heavy hitters. Google's parent Alphabet has made over 200 acquisitions since 2000, including the $1.65 billion YouTube buyout in 2006 – a fledgling video platform that exploded into a cultural juggernaut but never got its own ticker.

Similarly, Meta (Facebook) scooped up Instagram for $1 billion in 2012 and WhatsApp for $19 billion in 2014, both pre-IPO darlings that regulators later questioned as anticompetitive moves. Microsoft's crown jewel? The $26.2 billion LinkedIn acquisition in 2016, the largest tech deal ever at the time, which integrated professional networking into its enterprise suite rather than letting it IPO as a standalone powerhouse.

Amazon, ever the expander, dropped $13.7 billion on Whole Foods in 2017, catapulting into brick-and-mortar groceries and sidelining what could have been a vibrant public food-tech contender.

Apple, more selective with about 100 buys, has focused on services and hardware, but even its spree contributes to the consolidation. These aren't just small fry – hundreds of startups with IPO potential have been absorbed, reducing stock market diversity and innovation pipelines. As one FTC report noted in 2021, many of these deals flew under the radar, evading antitrust scrutiny until it was too late.

The fallout? Public markets are dominated by mega-caps – the S&P 500's top 10 now represent over 35% of its value – leaving retail investors with fewer choices and concentrated risks. Innovation suffers too: Acquired firms lose autonomy, their R&D funneled into parent agendas rather than disruptive standalone ventures.

Also read:

- Has Yanis Varoufakis Lost His Edge—or Is It Just Time’s Toll?

- The Renaissance of Universal Basic Income

- BobDaHacker Strikes Again: Burger King Targeted in Latest Hack

- No News from the US: War Enters Dull Phase, Enemies Identified, Lines Drawn, Artillery Preparation and Reconnaissance Underway

Echoes in Crypto: The Meme Party Winds Down as Scams Get the Boot

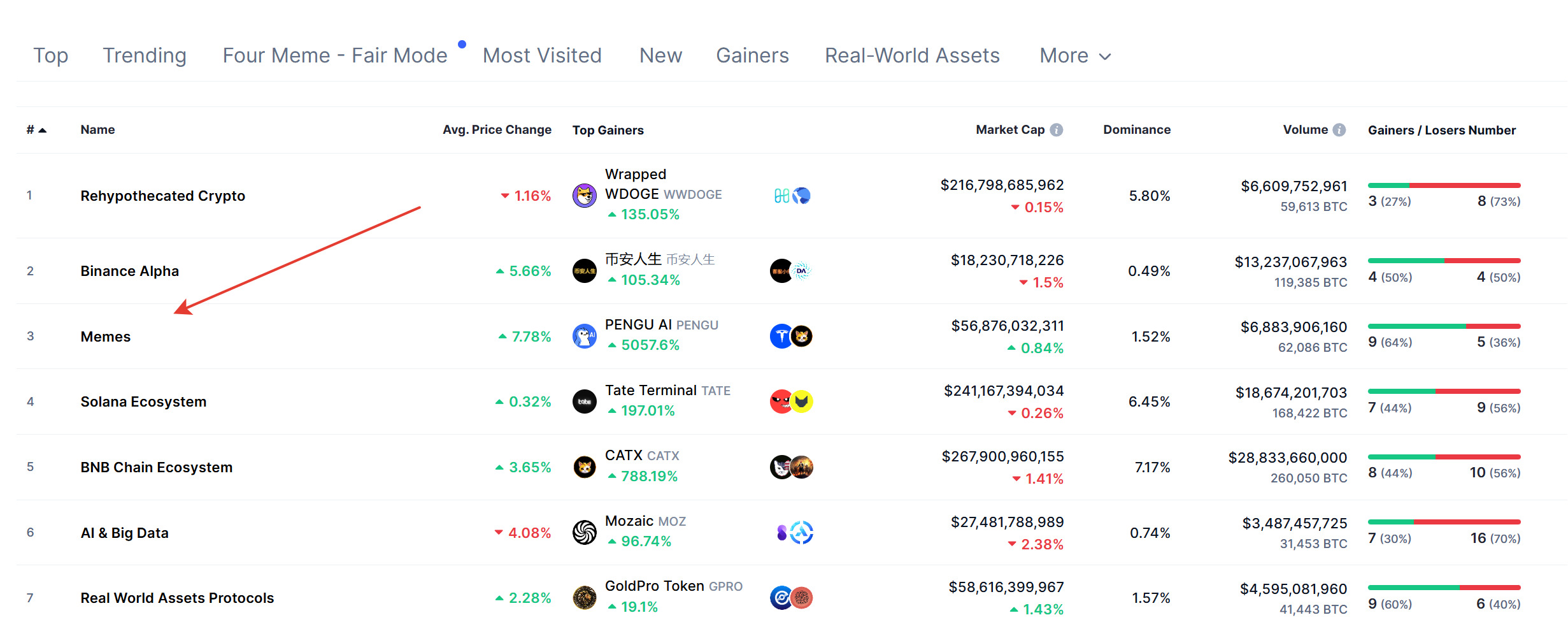

This consolidation fever isn't confined to stocks; it's infiltrating the decentralized dream of cryptocurrencies. The crypto space, once a "wild west" of unchecked experimentation, is witnessing its own purge – and it's hitting hard in 2025. From May to October, the number of active crypto tokens plummeted by about 600, largely low-quality meme coins and outright scams evaporating amid regulatory crackdowns and market fatigue.

This consolidation fever isn't confined to stocks; it's infiltrating the decentralized dream of cryptocurrencies. The crypto space, once a "wild west" of unchecked experimentation, is witnessing its own purge – and it's hitting hard in 2025. From May to October, the number of active crypto tokens plummeted by about 600, largely low-quality meme coins and outright scams evaporating amid regulatory crackdowns and market fatigue.

The meme coin market cap, which peaked at $137 billion in late 2024, cratered 62% to $49 billion by mid-2025, wiping out billions in hype-driven value.

Why now? With over 37 million unique cryptocurrencies created by September 2025 – on pace for 100 million by year-end – the ecosystem is bloated with junk. Of the roughly 10,000 tracked on major platforms like CoinMarketCap, at least 6,000 are memes, per conservative estimates, many lacking websites, socials, or real products. Q1 2025 alone saw 1.8 million project failures, a 49.7% spike from prior years, fueled by rug pulls, low liquidity, and post-hype crashes. Political memes like TRUMP and LIBRA surged on election buzz only to nosedive, exposing the fragility of influencer-backed tokens.

Why now? With over 37 million unique cryptocurrencies created by September 2025 – on pace for 100 million by year-end – the ecosystem is bloated with junk. Of the roughly 10,000 tracked on major platforms like CoinMarketCap, at least 6,000 are memes, per conservative estimates, many lacking websites, socials, or real products. Q1 2025 alone saw 1.8 million project failures, a 49.7% spike from prior years, fueled by rug pulls, low liquidity, and post-hype crashes. Political memes like TRUMP and LIBRA surged on election buzz only to nosedive, exposing the fragility of influencer-backed tokens.

Even in crypto's anarchic realm, "killer acquisitions" loom: Big players are snapping up protocols, and exchanges are delisting duds under pressure from watchdogs. The result mirrors stocks – a leaner, more mature market, but one potentially stifled by fewer wild ideas. As one analyst quipped on Reddit, "Meme coins are the death of the cryptoverse" – dumb money's dried up, and retail's tuning out the noise.

Eat What They Give You: Navigating a Consolidated Future

In both public markets and crypto, the message is stark: Eat what they give you. Big Tech's voracious appetite has culled competition, leaving investors with a narrower menu of opportunities – and risks concentrated in a handful of overlords.

In both public markets and crypto, the message is stark: Eat what they give you. Big Tech's voracious appetite has culled competition, leaving investors with a narrower menu of opportunities – and risks concentrated in a handful of overlords.

While this breeds efficiency and scale, it starves diversity, potentially quashing the next Google before it can bloom. Regulators are waking up – FTC probes into past deals are mounting – but reversing the tide will be tough.

For savvy players, the play is diversification: Hunt for resilient mid-caps in stocks or utility-driven cryptos beyond the memes. The party's not over, but it's getting exclusive. In this shrinking arena, the real winners will be those who spot the consolidators early – or build the tools to pry open their grip.