Hello!

People are now more comfortable making payments to different vendors thanks to the availability of various apps and mobile phones. To increase sales and enhance the user experience of your eCommerce financial application, you will need to integrate a payment gateway. According to statistics, 73% of mobile phone users have made a purchase or paid for something through their mobile phones.

People are now more comfortable making payments to different vendors thanks to the availability of various apps and mobile phones. To increase sales and enhance the user experience of your eCommerce financial application, you will need to integrate a payment gateway. According to statistics, 73% of mobile phone users have made a purchase or paid for something through their mobile phones.

If the checkout process is too complex, 1 in 5 customers will not spend long on the app to make a purchase. However, in order to integrate a mobile payment portal into your app, you must ensure it works correctly and follow certain guidelines. You will find important points in this blog.

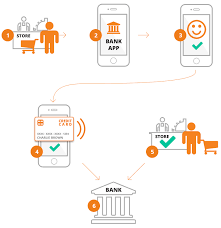

What’s A Mobile Payment Gateway?

Mobile payment gateway integration software allows buyers and merchants to seamlessly integrate their mobile applications. A mobile gateway is a way for users to accept online payments.

The following are some of the key players in the payment processing through the payment gateway:

The issuing bank checks if the buyer has sufficient funds to purchase a product.

The issuing bank checks if the buyer has sufficient funds to purchase a product.

Checks if the merchant has received payment

A system for international payments that verifies if an individual is able to make valid international transactions. It accepts or rejects transactions based on these criteria.

Enable the payment gateway to allow your customers to make payments via debit cards, credit cards, or bank transfers.

These are Some of The Most Popular Payment Gateway Providers:

PayPal

It is one of the most well-known payment services, and it is easy to integrate. It is available in over 200 countries. PayPal records all transactions and helps you monitor invoices to make sure your payments are received on time.

Stripe

Only 46 countries currently have Stripe. It can be used to manage online payments as well as make international payments. According to the official documentation, it supports more than 135 currencies as well as multiple payment methods, including subscription billing, one-click checkout, and mobile payments.

Only 46 countries currently have Stripe. It can be used to manage online payments as well as make international payments. According to the official documentation, it supports more than 135 currencies as well as multiple payment methods, including subscription billing, one-click checkout, and mobile payments.

Authorise.net

It is the oldest payment gateway. It has over 430k merchants listed in various countries, including the UK, Canada, the USA, and Europe. According to statistics, it handles over 1,000,000 transactions each year. It has also partnered with some of the most well-known companies to offer merchant accounts that allow you to accept credit and debit cards payments.

Top 9 Important Points to Remember When Integrating the Payment Gateway in Your Application

1. Understanding Your Market

It is important to understand the needs of your market and how mobile payment works in certain areas. In the USA, people prefer to use their debit or credit cards on payment gateways, while Canadians use their bank accounts or card to make payments. It all depends on where you live and what their financial regulations are. These two factors can help you research the right payment gateway and make your decision.

It is important to understand the needs of your market and how mobile payment works in certain areas. In the USA, people prefer to use their debit or credit cards on payment gateways, while Canadians use their bank accounts or card to make payments. It all depends on where you live and what their financial regulations are. These two factors can help you research the right payment gateway and make your decision.

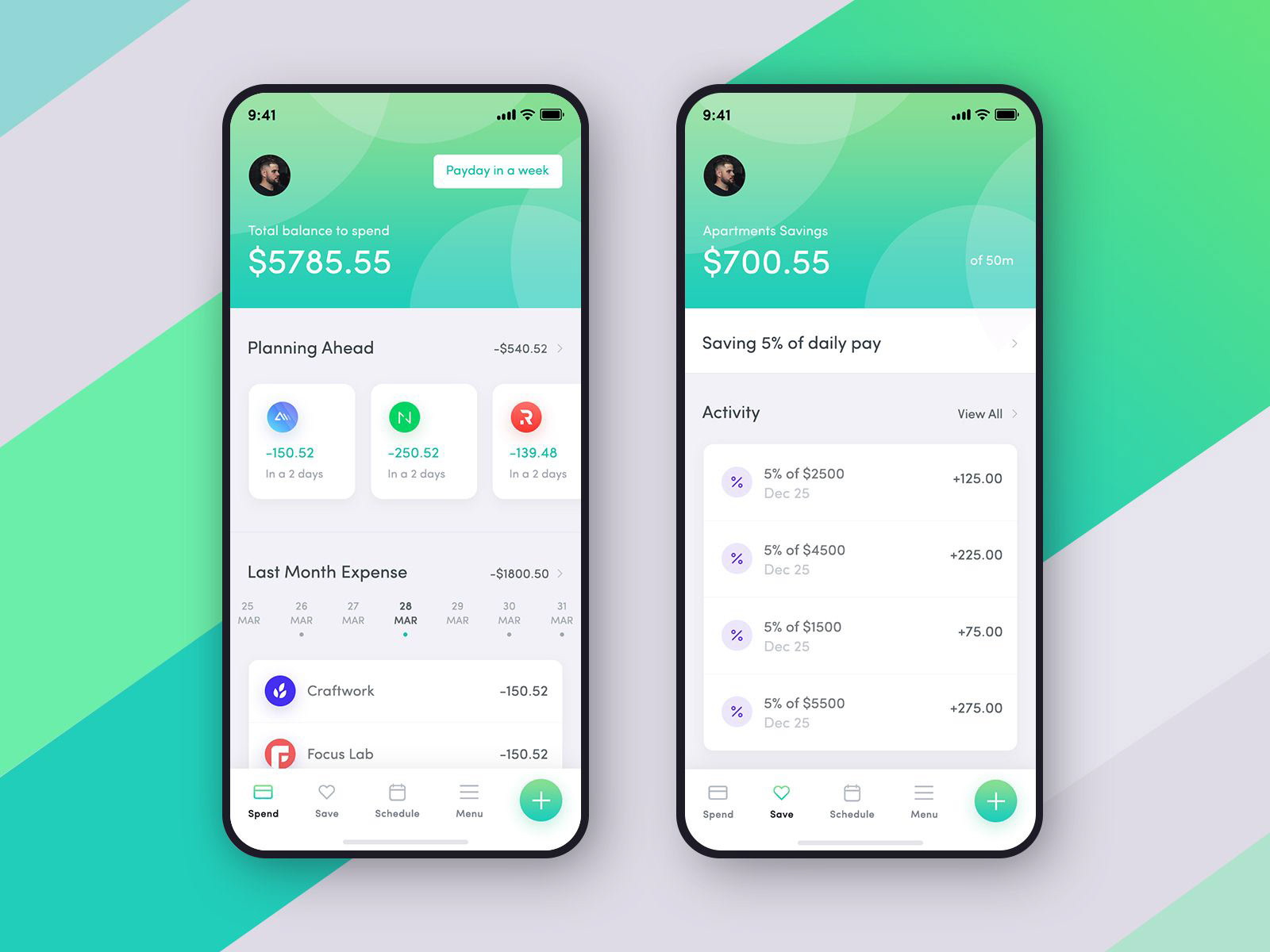

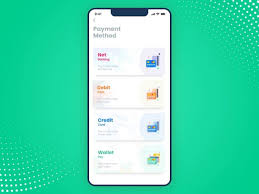

2. Customization of the User Interface

You can change the interface based on the payment tool you wish to integrate. You should ensure that the user interface is simple to use when designing the payment service interface. It should also look natural and harmonious. You need to find a payment gateway that allows for improvements. You can, for example, re-design payment forms to make them more user-friendly.

3. Seek out the Additional Features

You might be able to add additional features to your application. You could also add additional features such as payment via cryptocurrency. To avoid any legal issues, it is important to consider all legal aspects.

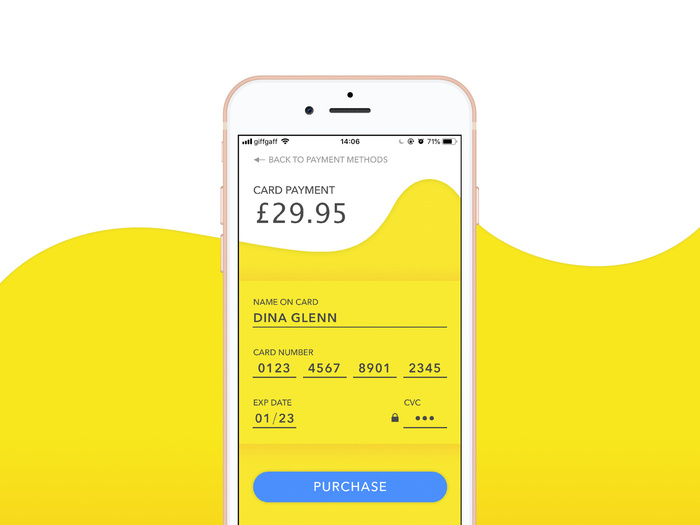

4. Make Sure that You have taken All Security Measures Properly

People would use their debit or credit cards to pay for purchases. Before you approve the payment app, it is important to conduct a thorough security audit. You should follow certain security standards, such as PCI-DSS. This standard was specifically designed to ensure that financial apps are made with security in mind.

People would use their debit or credit cards to pay for purchases. Before you approve the payment app, it is important to conduct a thorough security audit. You should follow certain security standards, such as PCI-DSS. This standard was specifically designed to ensure that financial apps are made with security in mind.

5. All Information About Buyers

It is important to provide complete information about each step. You should also provide all details regarding the authorization and verification, which might take some time. When you are choosing a mobile payment gateway for your application, make sure to search how they share the information with users. You can then integrate contact support and allow users to pay later. If they are unable to pay, you can choose another payment gateway.

6. Take into Account The Reputation of All Payment Gateways Companies

A company’s reputation is very important as it tells you what its product is doing on the market.

These are some of the things you should consider when choosing a company:

These are some of the things you should consider when choosing a company:

- What is the age of the company on the market?

- What are the feedbacks and reviews from clients?

- Do you have any clients who are well-known or large customers of payment gateways that you would like to integrate?

7. Which Products do You want to Sell?

It is a good idea to integrate payment processors such as Stripe, MasterCard, Visa, PayPal, and PayPal if you plan to sell physical products or services. If you are selling digital goods, all transactions can be made through the Google Play Store or the App Store. All transactions will be made using your Apple ID or Gmail. You can discuss the matter with the iOS app development company for more information.

8. It should be Easy to Integrate

Integration of a payment gateway should not be difficult and take developers less time. Consider the SDK size when choosing a payment gateway. It should take up less space on users’ smartphones. They should also support the coding platform as well as the framework used to develop the app.

Integration of a payment gateway should not be difficult and take developers less time. Consider the SDK size when choosing a payment gateway. It should take up less space on users’ smartphones. They should also support the coding platform as well as the framework used to develop the app.

9. Type of Merchant Account

Many merchant accounts are available to help your business. The most popular Merchant accounts are the dedicated seller accounts and aggregated seller accounts. Each has its own advantages and limitations. A dedicated seller account is best for those who want faster funds and greater control over their finances. However, the cost of a dedicated seller account is higher.

How do You Integrate A Mobile Payment Gateway into Your Application?

It is important to read all details about how to connect their payment gateway with your mobile app. Below are some of the steps you should follow.

Step 1 – Understand and Integrate the Client-side and Server-side SDK

SDK stands for the software development kit. It includes a range of software products and tools that can be used to create your application.

SDK stands for the software development kit. It includes a range of software products and tools that can be used to create your application.

Many SDKs can be integrated with data sharing and safe payments. The official documentation contains all details regarding the SDK. Make sure you read the entire document before you begin integrating.

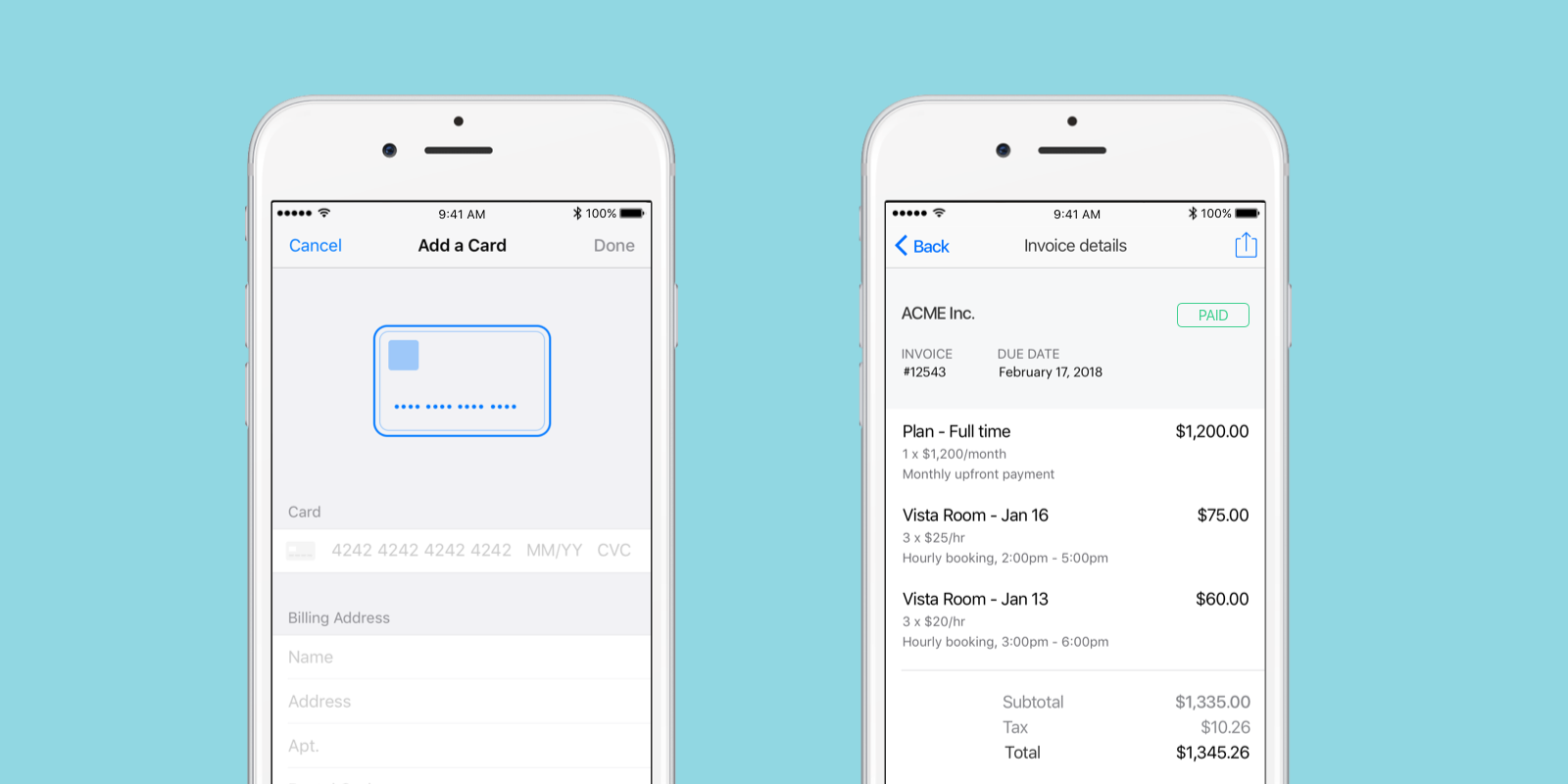

Step 2 – Use the API to Connect to The Payment Gateway

Many of the mobile payment gateway integration services provide an API that can be used to create the checkout system. This system will handle all transactions between buyer and seller. It will perform common tasks such as encrypting card data, authorizing payments, and verifying transactions.

Step 3 – Apply for The Certification

After you have integrated the payment gateway into your mobile app, it will use a special API for all payment requests. You will need to be a certified merchant in order to process the payments and protect all data. You must validate your application security if you are following the PCI DSS standard. To do this, you will need to fill out Assessment forms at Level D.

After you have integrated the payment gateway into your mobile app, it will use a special API for all payment requests. You will need to be a certified merchant in order to process the payments and protect all data. You must validate your application security if you are following the PCI DSS standard. To do this, you will need to fill out Assessment forms at Level D.

Conclusion

There are many payment gateways on the market. This makes it difficult to find the one that suits your needs. Consultation from top iOS app developers is a great way to learn how to choose the best payment gateway. They will help you through every step of integrating a payment gateway.

Thank you!

Join us on social networks!

See you!