After more than a year of intense discussion, the Texas Stock Exchange (TXSE) is officially becoming a reality. The exchange announced a major investment from JPMorgan, bringing its total pre-launch funding to over $250 million ahead of its planned launch in 2026.

This funding round has attracted more than 70 investors, including industry heavyweights like BlackRock, Charles Schwab, and Citadel Securities.

Challenging the Duopoly

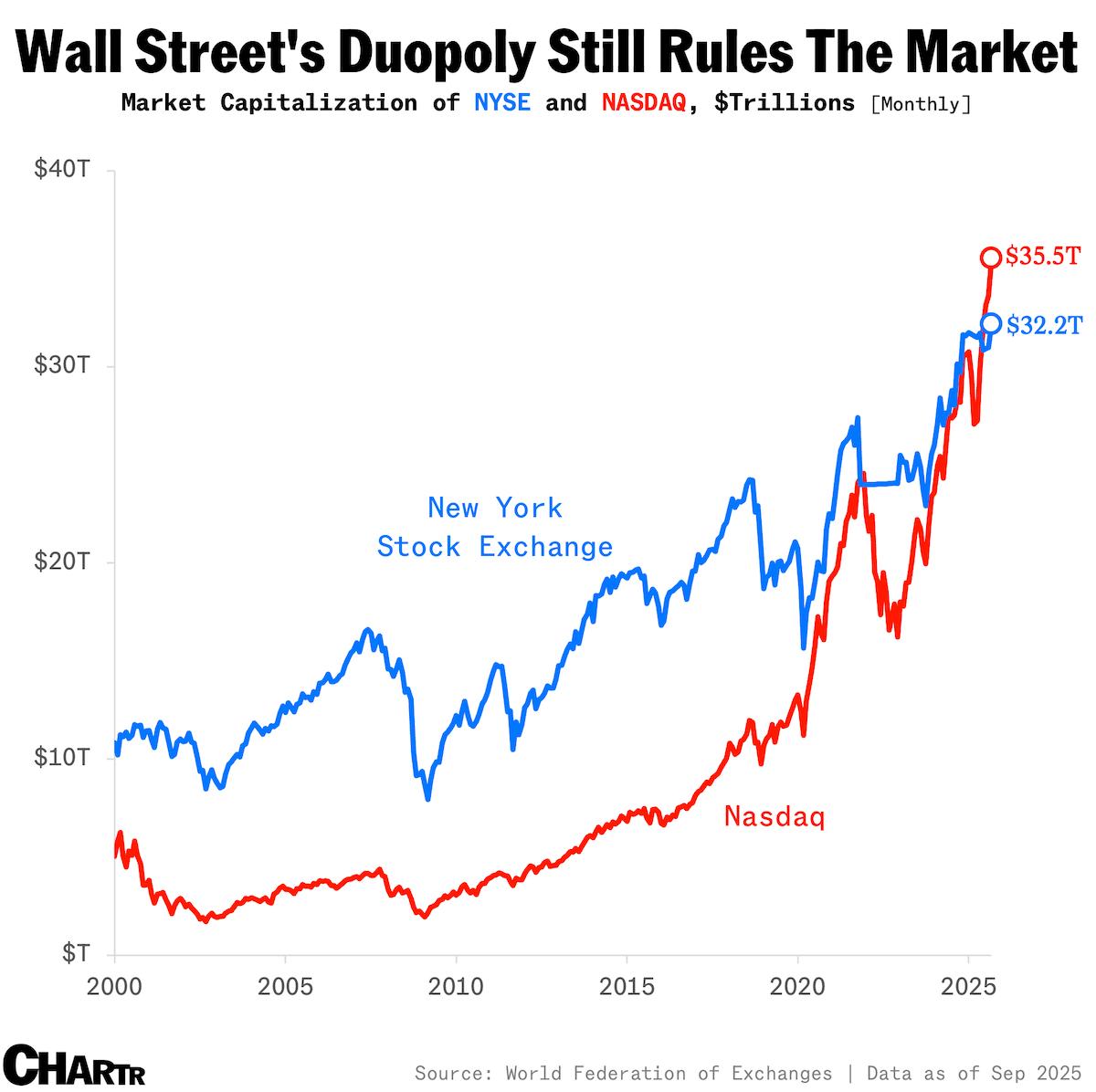

The TXSE is set to become the first exchange in decades to be approved by the SEC with the dual capability of both listing companies and trading their stocks. This positions it as a direct challenger to the entrenched duopoly of the New York Stock Exchange (NYSE) and the Nasdaq.

Since 2008, these two incumbent venues have controlled nearly 100% of the public stock market in the U.S., which boasts a combined value exceeding $67 trillion. The Nasdaq, which held less than a third of the market in 2000, now accounts for 52% thanks to the massive growth of Big Tech.

Since 2008, these two incumbent venues have controlled nearly 100% of the public stock market in the U.S., which boasts a combined value exceeding $67 trillion. The Nasdaq, which held less than a third of the market in 2000, now accounts for 52% thanks to the massive growth of Big Tech.

Texas's Value Proposition

The new exchange promises to significantly lower the "burden of going and staying public" by offering a simpler and cheaper alternative to its competitors. This move is part of a broader push by Texas to increase its appeal to corporations. The state already established a business court in 2023 to directly compete with Delaware, where the majority of S&P 500 companies are currently incorporated.

The TXSE aims to capitalize on the ongoing corporate migration to the Lone Star State by providing a locally based, financially competitive listing venue.

Also read:

Also read:

- The Marketing Strategist’s Competency Map: Julian Cole’s Framework for Building Unbreakable Plans

- How Cognitive Biases Work: Lessons from Classic Halloween Campaigns by IKEA and OREO

- How the Brain Chooses Brands: The Copenhagen Business School Framework

The Battle for Texas is On

The potential threat posed by the TXSE has not gone unnoticed by the incumbents.

Competition is already intensifying on Texas soil:

- NYSE announced plans to launch "NYSE Texas" in Dallas.

- Nasdaq is also opening a major headquarters in the area.

While the TXSE launch is still a year away, the capital raised and the high-profile investors involved signal a serious intent to disrupt the U.S. exchange landscape.

Author: Slava Vasipenok

Founder and CEO of QUASA (quasa.io) - Daily insights on Web3, AI, Crypto, and Freelance. Stay updated on finance, technology trends, and creator tools - with sources and real value.

Innovative entrepreneur with over 20 years of experience in IT, fintech, and blockchain. Specializes in decentralized solutions for freelancing, helping to overcome the barriers of traditional finance, especially in developing regions.

This is not financial or investment advice. Always do your own research (DYOR).