Starting a business in America embodies the American Dream — innovation, independence, and potential riches. Yet, the road is littered with failures.

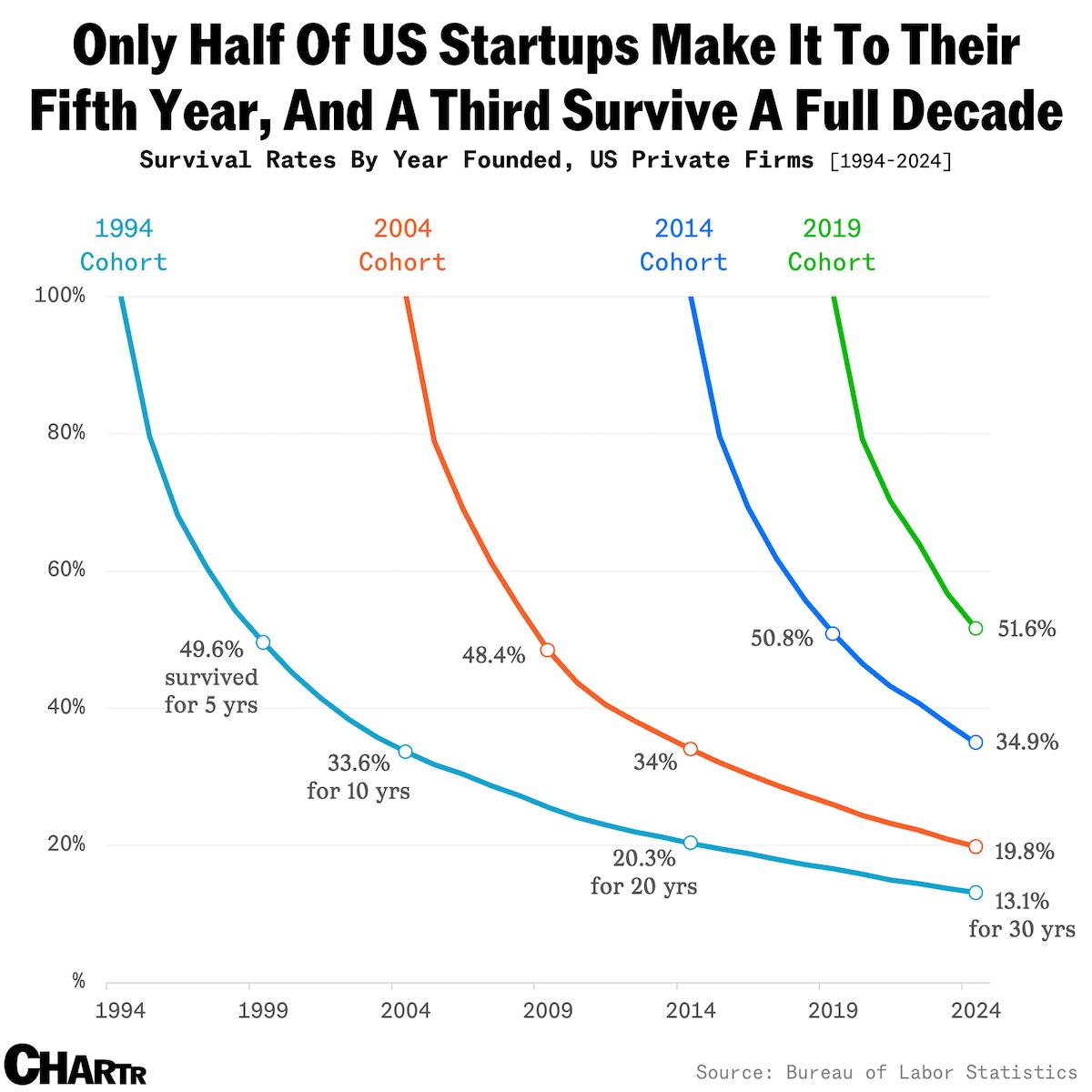

According to the U.S. Bureau of Labor Statistics (BLS), roughly 50% of new U.S. companies survive their first five years, while just one in three makes it to the decade mark. This sobering statistic underscores a fundamental truth: entrepreneurship is a high-stakes gamble, where location, industry, and timing can mean the difference between thriving and shuttering.

According to the U.S. Bureau of Labor Statistics (BLS), roughly 50% of new U.S. companies survive their first five years, while just one in three makes it to the decade mark. This sobering statistic underscores a fundamental truth: entrepreneurship is a high-stakes gamble, where location, industry, and timing can mean the difference between thriving and shuttering.

Recent data paints an even starker picture. Of private firms launched in March 2019 — right before the COVID-19 pandemic upended global economies — only 51.6% were still operational by March 2024, a five-year survival rate that barely edges out the national average.

Zooming out to long-term trends since 1994, the BLS reveals remarkable stability: about 33% of startups endure 10 years, one in five reaches 20 years, and a mere 13% celebrate their 30th anniversary.

These cohorts, tracked meticulously over decades, show that while the entrepreneurial spirit persists, the odds of longevity remain stubbornly low.

A Tale of Geography: Where Startups Thrive or Falter

Survival isn't uniform across the U.S.; geography plays a pivotal role, influenced by local economies, regulations, and support ecosystems. In 2024, states like West Virginia boasted the highest five-year survival rate at 57.6%, edging out Connecticut's 57.5%. Alaska and Pennsylvania followed closely at 56%, benefiting from stable industries like energy and manufacturing that buffer against volatility.

Contrast this with the laggards: Washington's dismal 41.1% rate reflects intense competition in tech-heavy Seattle, where startups face cutthroat funding battles and rapid obsolescence. Missouri (43.2%) and the District of Columbia (44.7%) trail due to regulatory hurdles and urban market saturation. Nationally, the 51.6% benchmark highlights a divided landscape — rural heartlands often outpace coastal innovation hubs, where high costs and talent wars accelerate churn.

.jpg)

These disparities underscore the need for location-specific strategies: bootstrapping in low-cost Appalachia versus scaling with venture capital in Silicon Valley.

Industry Matters: Stability vs. Volatility

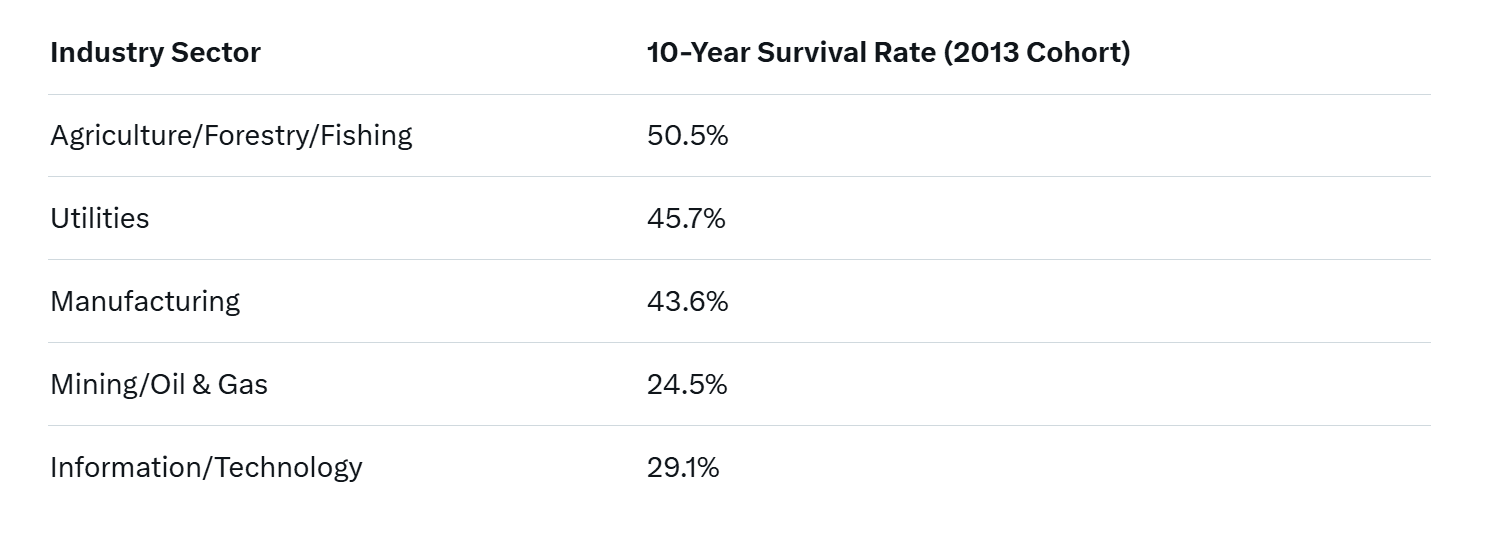

Sector choice amplifies or mitigates risks. Stable, regulated industries like agriculture, forestry, fishing, and hunting lead with a 50.5% 10-year survival rate for the 2013 cohort, buoyed by consistent demand and government subsidies. Utilities follow at 45.7%, their monopolistic structures shielding them from fierce competition.

High-volatility sectors tell a grimmer story. Mining, quarrying, and oil/gas extraction scrape by with just 24.5% surviving a decade, battered by commodity price swings and environmental regulations. Technology and information industries fare little better, with 29.1% longevity, as rapid innovation cycles and disruption (think AI upending software firms) cull the weak. Construction clocks in at around 36.6% after five years, hampered by economic cycles tied to real estate booms and busts.

Entrepreneurs in volatile fields must prioritize adaptability—pivoting quickly to market shifts—while those in stable sectors can focus on efficiency and compliance.

Timing the Launch: The Economic Cycle's Cruel Hand

When a business launches can seal its fate more than strategy alone. Historical BLS data shows cohorts born during recessions suffer disproportionately: 1-year survival plunged for startups in 2001 (dot-com bust) and 2008 (financial crisis), dipping below 78% nationally. Pre-crisis launches fare poorly too, as overhyped booms lead to overleveraged ventures that crumble in downturns.

When a business launches can seal its fate more than strategy alone. Historical BLS data shows cohorts born during recessions suffer disproportionately: 1-year survival plunged for startups in 2001 (dot-com bust) and 2008 (financial crisis), dipping below 78% nationally. Pre-crisis launches fare poorly too, as overhyped booms lead to overleveraged ventures that crumble in downturns.

Conversely, post-recession recoveries breed resilience. Businesses started in 2011 — amid the Great Recession's aftermath — boasted a 51% five-year survival rate, 3% above the prior decade's average, filling market gaps left by failures. The COVID-19 era echoed this: While 2019 starters grappled with lockdowns (51.6% five-year survival), 2021 recovery-era firms showed slightly higher first-year rates despite challenges. Economic tailwinds — low interest rates, stimulus — aid cash flow, but volatility tests mettle.

In 2025's uncertain climate, with inflation cooling but geopolitical risks rising, timing remains key. Aspiring founders should monitor indicators like unemployment (currently at historic lows) and consumer spending before leaping.

Also read:

- Australia's Social Media Ban for Under-16s: A Global Test Case or Regulatory Headache?

- YouTube's AI Upscaling Rollout: A Breath of Fresh Air for Old Videos—or a Risky Gamble?

- NVIDIA Invests $1 Billion in Nokia: Building an AI-Powered Telecom Ecosystem

Beyond the Numbers: Boosting Your Odds

These statistics aren't destiny; they're averages. Cash flow mismanagement dooms 38% of failures, while 35% cite no market need — fixable with rigorous planning. Serial entrepreneurs succeed 30% more often than novices, proving experience counts. Governments and ecosystems help too: Grants in resilient states like West Virginia, or accelerators in tech hubs, can tip scales.

Ultimately, U.S. startup survival demands grit amid geography, sector volatility, and economic tides. As one cohort after another proves, it's not just about starting — it's about outlasting the storm. For the 13% that endure three decades, the rewards are generational. The question for today's founders: Will yours be among them?