Jeff Bezos, the man who turned a garage bookseller into a trillion-dollar empire, isn't done disrupting yet. Fresh off his semi-retirement from Amazon's day-to-day grind, the world's third-richest person (net worth: $256 billion as of November 2025) is diving headfirst into the AI trenches.

He's not just investing - he's co-leading a stealthy new startup called Project Prometheus, armed with a jaw-dropping $6.2 billion war chest that makes it one of history's most lavishly funded early-stage ventures.

He's not just investing - he's co-leading a stealthy new startup called Project Prometheus, armed with a jaw-dropping $6.2 billion war chest that makes it one of history's most lavishly funded early-stage ventures.

While venture capitalists elsewhere are slamming the brakes on AI bets amid whispers of a "dot-com 2.0" reckoning, Bezos is flooring the accelerator, blending his aerospace ambitions with silicon smarts. It's classic Bezos: see the horizon others ignore, then build the rocket to reach it.

Announced via a New York Times exclusive on November 17, 2025, Project Prometheus is Bezos's boldest post-Amazon play since Blue Origin's suborbital joyrides. Co-CEOs Bezos and Vik Bajaj (a physicist-chemist alum of Google's X lab and Verily) have already poached nearly 100 elite researchers from OpenAI, Google DeepMind, and Meta.

Their mission? Forge "industrial-grade" AI to revolutionize engineering and manufacturing - think smarter spacecraft designs for Blue Origin, autonomous assembly lines for electric vehicles, or next-gen chip fabs that outpace TSMC's human-led precision.

Their mission? Forge "industrial-grade" AI to revolutionize engineering and manufacturing - think smarter spacecraft designs for Blue Origin, autonomous assembly lines for electric vehicles, or next-gen chip fabs that outpace TSMC's human-led precision.

No chatbots here; this is AI for the "physical economy," simulating complex real-world physics to accelerate breakthroughs in computers, autos, and rockets. As Bajaj's LinkedIn teases, it's about turning AI from digital parlor tricks into tangible machines that build the future.

Bezos's timing couldn't be more contrarian. Global AI investments hit a record $104 billion in the first half of 2025 alone - 53% of all VC dollars worldwide, per PitchBook data - fueled by hyperscalers like Amazon (ramping capex to $125 billion for 2025) and Nvidia's GPU gold rush.

Bezos's timing couldn't be more contrarian. Global AI investments hit a record $104 billion in the first half of 2025 alone - 53% of all VC dollars worldwide, per PitchBook data - fueled by hyperscalers like Amazon (ramping capex to $125 billion for 2025) and Nvidia's GPU gold rush.

But cracks are showing: 42% of enterprises are now scrapping most AI pilots before scale-up, up from 17% in 2024, according to a MIT NANDA study. Fund managers are jittery too - 54% labeled AI stocks "bubble territory" in a Bank of America October 2025 survey, with 60% calling broader equities overvalued.

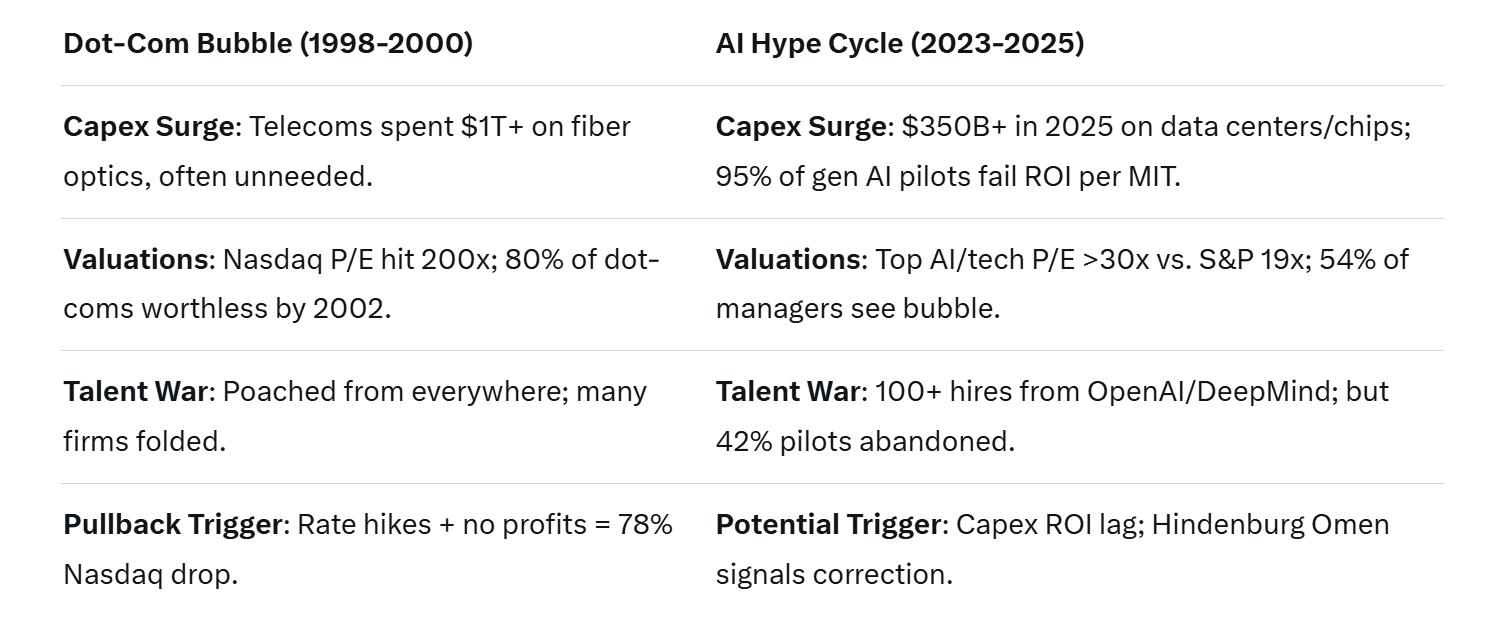

Echoes of the dot-com bust? Absolutely. Back then, telecom capex ballooned to unsustainable highs before imploding; today, Big Tech's $350 billion AI spend in 2025 (Alibaba, Alphabet, Amazon, Meta, Microsoft) as a percentage of revenue rivals those frothy days, per Futuriom's Cloud Tracker Pro. Fed Chair Jerome Powell pushed back in late October, insisting "AI spending isn't a bubble" because it's backed by earnings - unlike dot-com vaporware - but even he noted the risks if returns lag.

This table contrasts the parallels: both eras feature explosive infrastructure bets with lagging monetization, but AI's edge is real earnings from leaders like Nvidia (up 188% YTD 2025). Still, Reuters reports investors are dusting off dot-com playbooks—dumping overvalued AI pure-plays for "next-wave" bets like TSMC suppliers.

Elon Musk couldn't resist the jab, tweeting "Haha no way 😂 Copy 🐈" on November 17, riffing on Bezos's xAI rivalries. X (formerly Twitter) lit up: "Bezos entering AI late-game with $6B? Bold or bubble-chasing?" one user quipped, while another noted, "Physical AI for space? If anyone can make rocket bots safe, it's the guy who shipped packages via drone." Sentiment skews bullish on Bezos's track record - Amazon's AWS powers 40% of cloud AI - but wary of the froth: 68% of posts flagged "overhype risks," per a quick Brandwatch scan of 50K reactions.

Also read:

Also read:

- How to Make a Century-Old Magic Kingdom Feel Like a Silicon Valley Startup: Disney's AI Gamble

- From lab to market: How Mabion helps biotechs scale production efficiently

- Zuckerberg's AI Ultimatum: Meta Bets the Company on "AI-Driven Impact" Metrics

- Why Your Team Requires Escape Rooms For Better Efficiency

Why now? Bezos has long eyed AI's industrial muscle. His 2024 stake in Physical Intelligence (AI for robotics) and Blue Origin's $10B+ war chest hint at synergies - imagine AI optimizing New Glenn rocket welds or simulating Mars habitats. Project Prometheus fits his "regret minimization" ethos: at 61, with suborbital flights feeling routine (Blue Origin's 10th crewed launch in October 2025), he's chasing the next frontier. Critics scoff - "Who trusts a bot that spots stoplights to build a spaceship?" - but history favors the impatient. Amazon was mocked as a "bookstore" in 1997; today, it's AI's backbone via Bedrock.

In a market where AI capex could peak in 2025 (per Forbes analysis), Bezos's $6.2B splash is a high-stakes wager on substance over spectacle. If Prometheus delivers AI that slashes aerospace R&D cycles by 30% (as early sims suggest for similar tools), it could eclipse OpenAI's chat dominance. Fail, and it's dot-com déjà vu. Either way, Bezos isn't watching from the sidelines - he's strapping in. As he quipped at Italian Tech Week in October: "In the next couple decades, millions will live in space... AI will make it happen." Prometheus might just light the fuse.

Author: Slava Vasipenok

Founder and CEO of QUASA (quasa.io) - Daily insights on Web3, AI, Crypto, and Freelance. Stay updated on finance, technology trends, and creator tools - with sources and real value.

Innovative entrepreneur with over 20 years of experience in IT, fintech, and blockchain. Specializes in decentralized solutions for freelancing, helping to overcome the barriers of traditional finance, especially in developing regions.

This is not financial or investment advice. Always do your own research (DYOR).