The global energy landscape is undergoing a seismic shift, with investment flows redirecting decisively toward sustainability.

In 2025, worldwide investments in renewable energy are projected to reach a staggering $780 billion — surpassing fossil fuel allocations by $237 billion.

In 2025, worldwide investments in renewable energy are projected to reach a staggering $780 billion — surpassing fossil fuel allocations by $237 billion.

This milestone underscores a decade-long pivot: over the past 10 years, "green" energy funding has surged by 109%, flipping the script on traditional powerhouses like oil and gas.

What began as a trickle in 2015 has become a torrent, driven by technological advancements, policy incentives, and the urgent imperative to combat climate change. As investors chase returns in a decarbonizing world, the question isn't if renewables will dominate—it's how quickly they will reshape our energy future.

A Decade of Divergence: From Fossil Dominance to Green Ascendancy

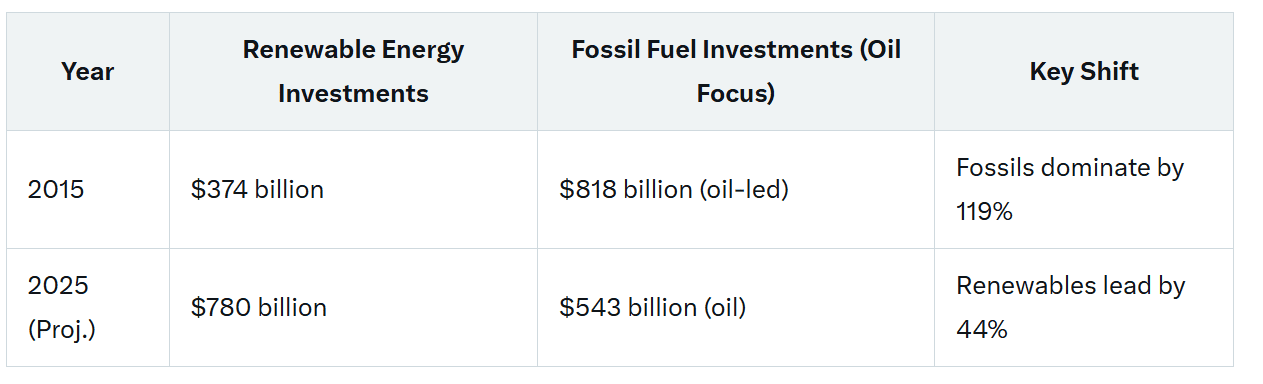

Rewind to 2015: Fossil fuels, led by oil, commanded the investment throne with $818 billion poured into exploration, production, and infrastructure. Renewables, by contrast, lagged at $374 billion—a respectable sum, but dwarfed by the entrenched might of hydrocarbons. Fast-forward to 2025, and the tables have turned dramatically.

Oil investments are forecasted to plummet to $543 billion, a 34% contraction from their 2015 peak, reflecting maturing fields, volatile prices, and waning appetite for carbon-intensive assets. Natural gas, while more resilient, faces a 19% dip over the same period, squeezed by cheaper alternatives and stricter emissions regulations.

Renewables, however, are on a tear. Solar photovoltaic (PV) and wind projects alone are expected to draw $450 billion in 2025, making solar the single largest slice of global energy spending. This growth isn't isolated; it's part of a broader clean energy surge totaling $2.2 trillion across renewables, nuclear, grids, storage, low-emissions fuels, efficiency, and electrification — twice the $1.1 trillion earmarked for oil, gas, and coal combined.

The International Energy Agency (IEA) highlights this reversal: a decade ago, fossil supply investments outpaced electricity generation, grids, and storage by 30%. Today, the electricity sector's $1.5 trillion haul is 50% higher than fossil fuels'.

This table illustrates the stark trajectory: renewables' 109% growth versus oil's 34% decline signals not just a reallocation of capital, but a fundamental reconfiguration of risk and reward in energy markets.

Electrifying Momentum: The Rise of Electrification and Low-Carbon Fuels

At the heart of this green boom is electrification, forecasted to hit $344 billion in 2025. From sprawling data centers powering AI revolutions to the electric vehicle (EV) fleets revolutionizing transport, electrification is bridging the gap between surging demand and clean supply.

At the heart of this green boom is electrification, forecasted to hit $344 billion in 2025. From sprawling data centers powering AI revolutions to the electric vehicle (EV) fleets revolutionizing transport, electrification is bridging the gap between surging demand and clean supply.

BloombergNEF (BNEF) reports that electrified transport investments reached new highs in 2024, with EV sales projected at nearly 22 million units in 2025 — up 25% from the prior year. China, the undisputed leader, captured 44% of global renewable investments in the first half of 2025 alone, funneling billions into battery production and grid upgrades.

Yet, the real story of innovation lies in smaller but explosive categories: low-carbon fuels like biofuels, hydrogen, and synthetic variants. These niche players ballooned from a mere $6 billion in 2015 to $28 billion in 2025 — a blistering 367% increase. Hydrogen, in particular, is gaining traction as a versatile decarbonizer for hard-to-abate sectors like steel and shipping, with investments buoyed by government subsidies and corporate net-zero pledges.

While these figures pale against solar's scale, they spotlight the directional arrow: capital is flowing toward scalable, emissions-free solutions that promise long-term resilience amid geopolitical volatility and energy security concerns.

Why Now? Policy, Profit, and Planetary Imperatives

Several tailwinds are accelerating this pivot. First, cost parity: Over 90% of new wind and solar projects worldwide now generate power cheaper than the cheapest fossil alternatives, thanks to plummeting prices (down 60-90% since 2010, largely due to Chinese manufacturing dominance).

Second, policy firepower: Industrial strategies in the EU, US Inflation Reduction Act, and China's clean tech push have unlocked trillions, with 70% of recent clean energy gains from fossil-importing nations like India and Europe. Third, investor pragmatism: Amid economic uncertainty, renewables offer stable returns — global energy transition investments hit a record $2.1 trillion in 2024, up 11% year-over-year, outpacing fossil fuels despite headwinds.

Fossil incumbents aren't vanishing overnight; coal supply investments are even ticking up 4% in 2025, driven by Asian demand. But the trend is clear: as emissions peak in 2024 and begin a structural decline in 2025, capital is voting with its wallet for a low-carbon future.

Also read:

- Firefox Introduces AI Page Summaries with iPhone Shake Feature

- Apple Unveils AirPods Pro 3 with Groundbreaking Features

- Signal Introduces Secure Backup Feature to Restore Messages After Device Loss

The Road Ahead: Opportunities and Hurdles

By 2030, BNEF warns that annual energy transition investments must average $5.6 trillion to align with Paris Agreement goals—current levels cover just 37%. Challenges loom: Utility-scale solar and onshore wind financing dipped 13% in early 2025 due to policy tweaks in key markets, and emerging tech like carbon capture struggles for funding. Yet, the momentum is undeniable. For investors, this shift isn't a gamble—it's the new gravity.

As 2025 unfolds, the message is unequivocal: Investment flows are no longer trickling; they're flooding toward renewables, electrifying economies and sidelining fossils. In this green tide, the winners will be those who surf the wave—pioneering low-carbon fuels today for a sustainable tomorrow.

---

*Target audience: Investors, policymakers, and sustainability professionals tracking energy markets.*