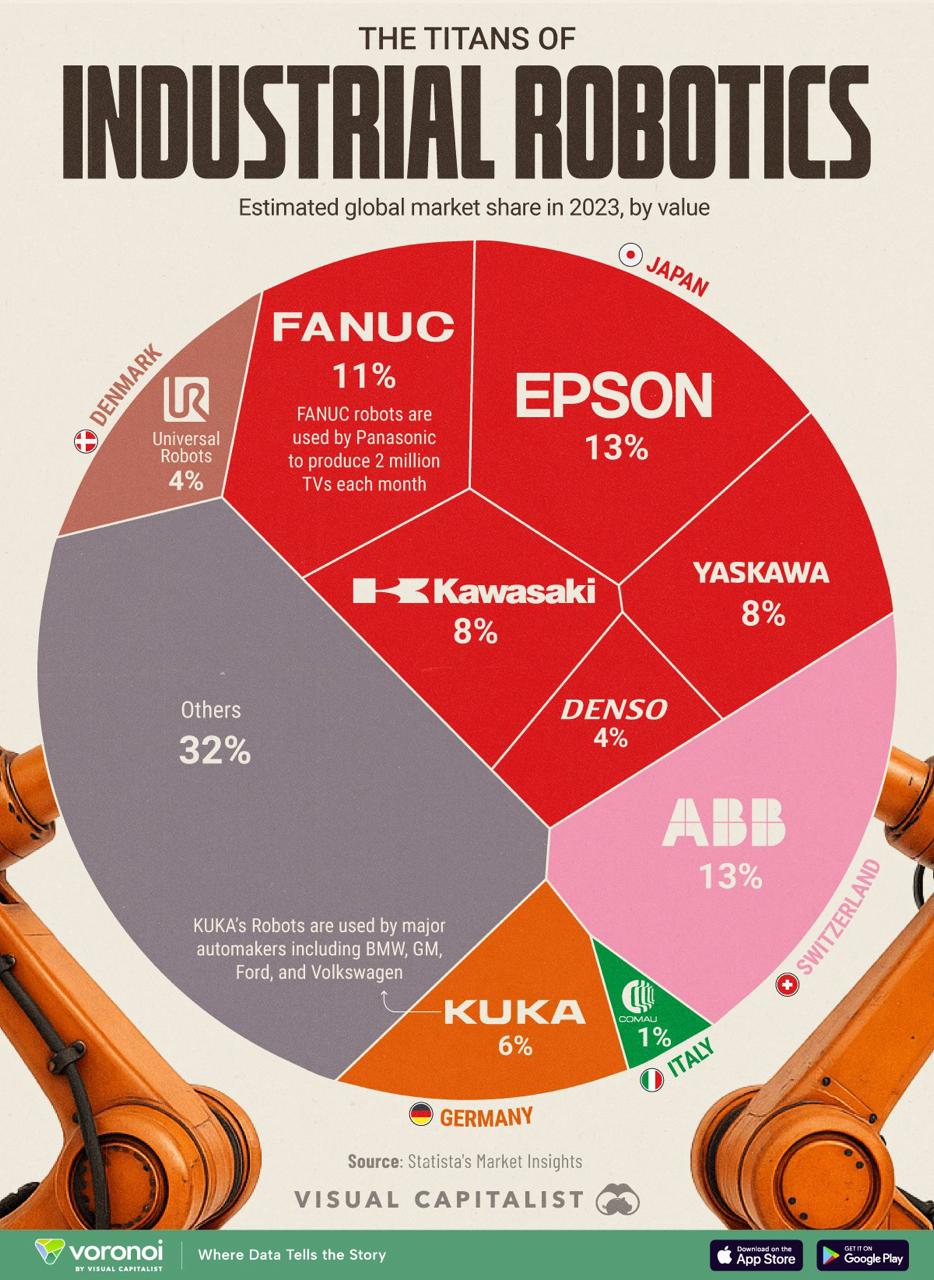

The global industrial robotics market is on a rapid rise, projected to hit $10.2 billion in 2025. Yet, some argue this figure is modest given the sector’s potential.

Leading the charge are Switzerland’s ABB and Japan’s Epson, each commanding a 13% market share. ABB’s versatility spans multiple industries, while Epson excels in precision automation for electronics and small-part assembly, showcasing their distinct strengths.

Leading the charge are Switzerland’s ABB and Japan’s Epson, each commanding a 13% market share. ABB’s versatility spans multiple industries, while Epson excels in precision automation for electronics and small-part assembly, showcasing their distinct strengths.

Japan’s dominance is undeniable, with five of the top ten manufacturers hailing from the country: Epson, Fanuc (11%), Kawasaki (8%), Yaskawa (8%), and Denso (4%).

This success stems from decades of R&D investment and Japan’s export-driven economy, which has honed its robotics expertise. However, the market remains fragmented, with 32% of the share split among smaller players or regionally focused firms, suggesting a competitive yet scattered landscape.

Also read:

- Streaming Giants Pour Over $1 Billion into UK TV—But Not Everyone's Cheering

- Generation Alpha to Rescue Cinemas—But on Their Own Terms

- Vegas Case Study: Sphere Rakes in $2 Million Daily with a 90-Year-Old 'Wizard of Oz' AI Revamp

Among these, Denmark’s Universal Robots, Germany’s KUKA, and Italy’s Comau stand out, each carving out a notable but smaller slice of the pie. While the $10.2 billion milestone reflects growth - driven by automation in automotive and electronics - the total pales in comparison to other tech sectors, raising questions about whether the industry’s true value is being underestimated or if it’s still in an early growth phase.

Among these, Denmark’s Universal Robots, Germany’s KUKA, and Italy’s Comau stand out, each carving out a notable but smaller slice of the pie. While the $10.2 billion milestone reflects growth - driven by automation in automotive and electronics - the total pales in comparison to other tech sectors, raising questions about whether the industry’s true value is being underestimated or if it’s still in an early growth phase.

The mix of giants and niche players hints at a dynamic future, but the market’s full potential may depend on how these forces evolve.

Author: Slava Vasipenok

Founder and CEO of QUASA (quasa.io) - Daily insights on Web3, AI, Crypto, and Freelance. Stay updated on finance, technology trends, and creator tools - with sources and real value.

Innovative entrepreneur with over 20 years of experience in IT, fintech, and blockchain. Specializes in decentralized solutions for freelancing, helping to overcome the barriers of traditional finance, especially in developing regions.

This is not financial or investment advice. Always do your own research (DYOR).